From Z to A: The New Battleground of Neobanks & FinTechs

- Team WhiteSight

- 2 mins read

- Digital Finance, Insights

Table of Contents

Bye Millennials, Hello GenZ & Gen Alpha! Here are the neobanks catering to the vibrant youths of the world and ushering in a new era of digital banking – one that’s a lot more fun and full of learnings. Coming of age in a technological boom makes today’s Z & Alpha generations digitally savvy like no other. It’s only natural that their ‘financial coming of age’ will be a much different experience.From ‘How Much?’ to ‘How?’Bringing in the parental perspective, in a digital age like ours, the concern of ‘How much pocket money should I give my child?’ (amount) has evolved into ‘How should I give it to them?’ (channel).This whitespace was tapped into brilliantly by the early-movers in this segment to target a future generation of customers. ,,GoHenry, and ,,Osper were the first of many that emerged in Europe circa 2012.The FocusOver the years, the segment has seen a bubbling emergence of new fintechs and neobanks globally, that can be broadly classified into two types:Kids & Teen banking as a ‘core-offering’ – GoHenry, Spriggy, Step – Fintechs partnering with a licensed bank or payments provider on the backend.Kids & Teen banking as a ‘sub-offering’ – Tinkoff Junior, Kakao Bank, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

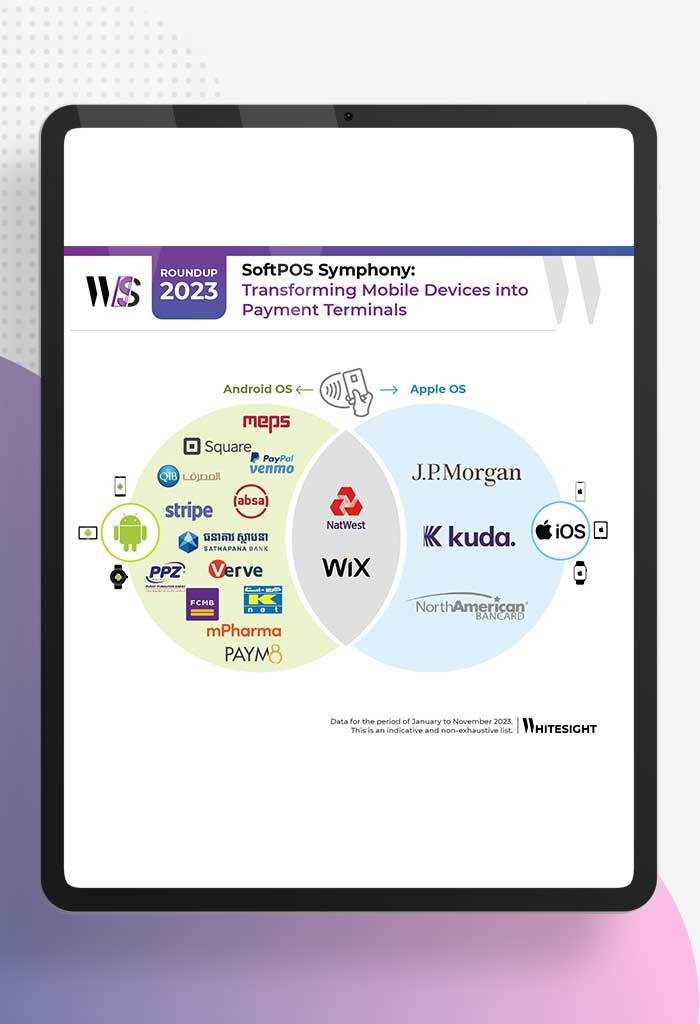

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

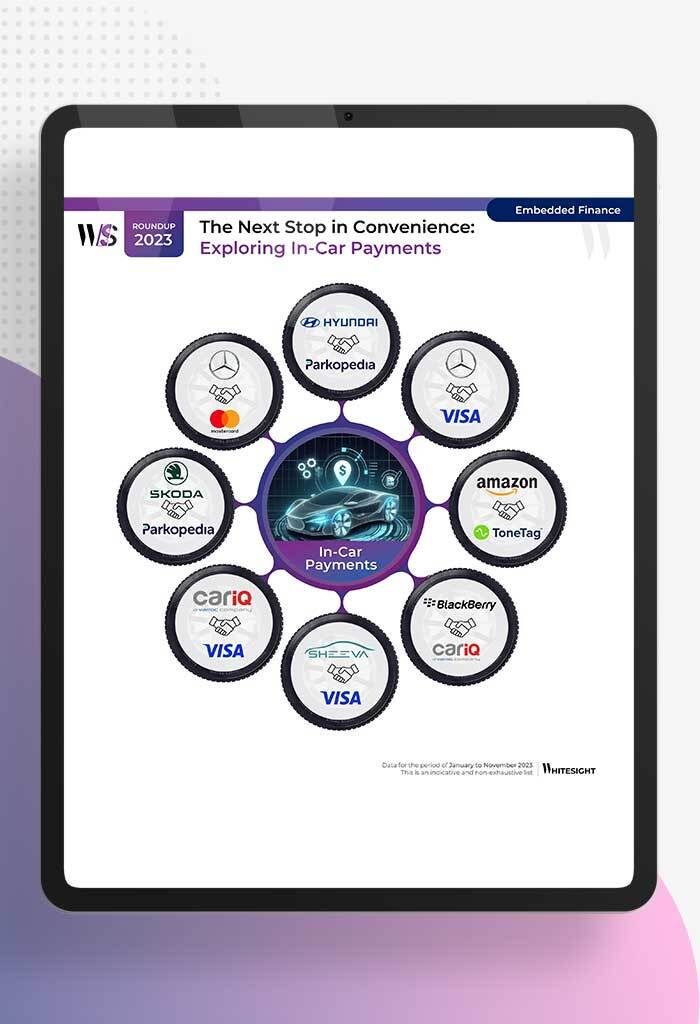

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

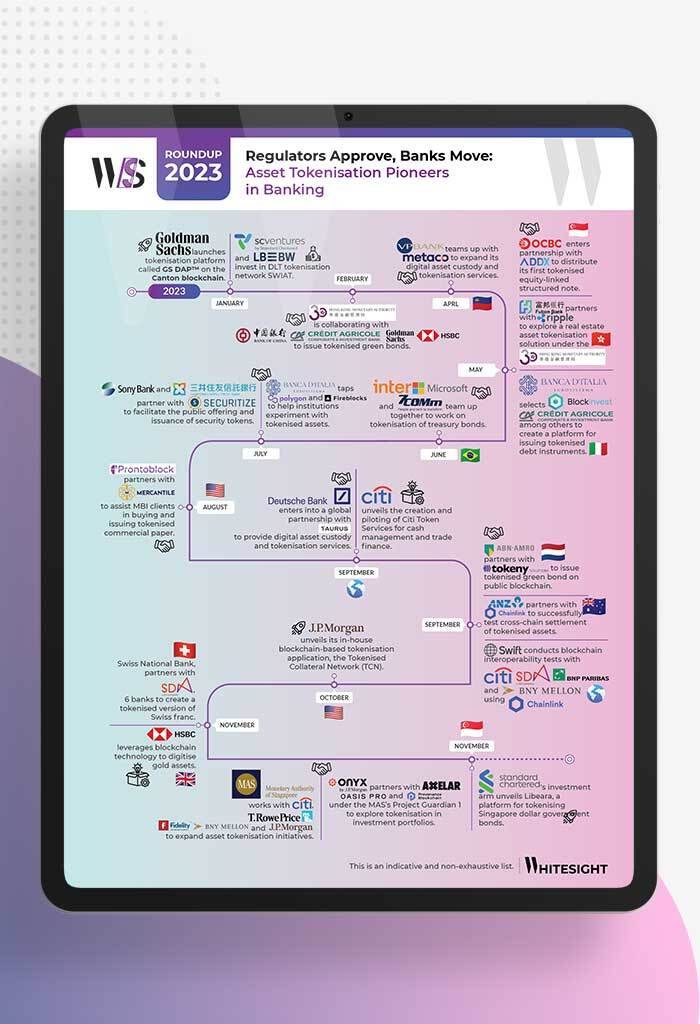

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

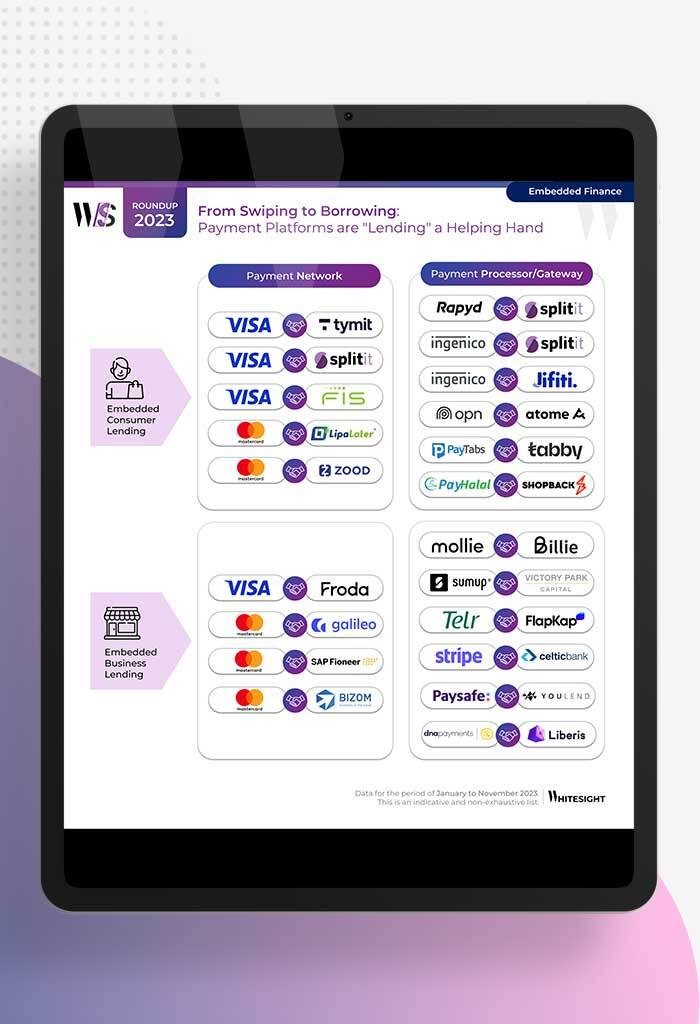

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

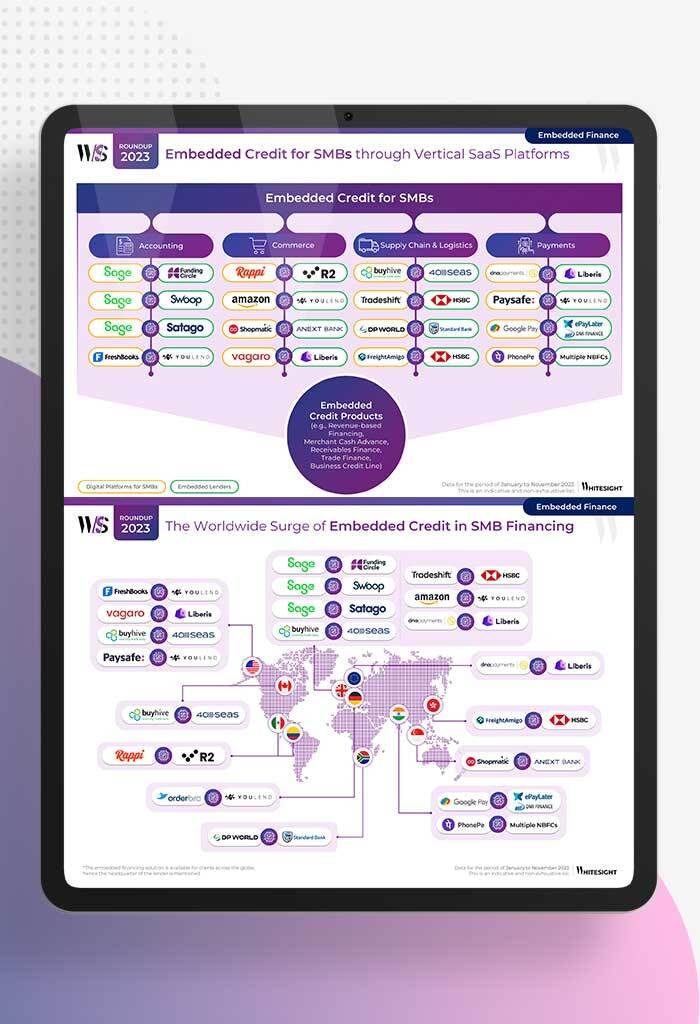

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...