How Nubank Championed Creative Destruction in Brazil

- Sanjeev Kumar

- 4 mins read

- Digital Finance, Partnerships

Table of Contents

Tracing the economic evolution that turned Schumpeter’s theory into Nubank’s reality

When Joseph Schumpeter coined the term creative destruction in 1942, to describe how it is a “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one”. In 2025, the term finds a compelling modern incarnation in Latin America through Nubank. The most valuable digital bank in the world has become the most valuable company in Brazil.

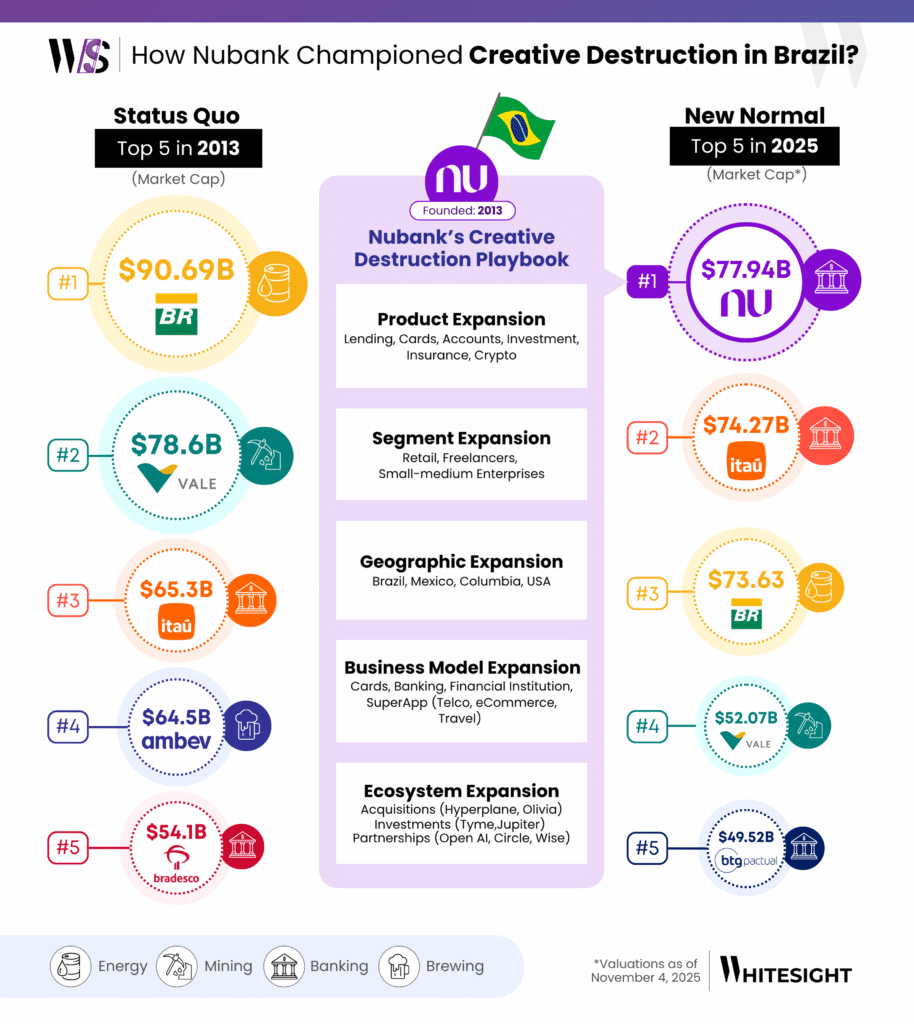

The Scene: Brazil’s 2013 Corporate Order

Back in 2013, Brazil’s most valuable companies were firmly anchored in the extractive and legacy economy such as oil and gas, precious metal mining, and traditional banking. These institutions had thick walls, long histories, a dominant market share and massive profit margins.

The Challenger: Nubank’s Founding and Mission

Founded in 2013 by David Vélez, Cristina Junqueira and Edward Wible, Nubank entered the market with a single credit-card offering (no annual fee, mobile-first interface). From the early days it articulated a radical promise: to simplify banking, remove complexity and fees, and extend access to previously underserved Brazilians.

The Scale: Disruptive Innovation at Play

Here are the key numbers that show how Nubank has transformed the financial industry and the economy in Brazil:

- As of November 2024, Nubank had reached 100 million customers in Brazil alone, representing about 57 % of the country’s adult population.

- The company’s global customer base (Brazil + Mexico + Colombia) exceeds 122 million customers.

- Growth in underserved segments: in Brazil alone, in a single year Nubank promoted financial inclusion by bringing 5.7 million people into the credit-card market.

These figures underscore that Nubank is re-architecting the market. Its reach and scale challenge legacy banks whose networks and cost structures were built for a very different era.

The Mechanics of Creative Destruction

Schumpeter’s concept of creative destruction, the idea that economic progress is driven by entrepreneurs who upend the existing order, maps neatly onto Nubank’s own evolution. The company’s trajectory demonstrates how a digital native can deconstruct entrenched business model components and reassemble them into something fundamentally more inclusive and efficient.

Nubank cracked the code to scale and profitability, in one of the toughest markets in the world. With 114M+ users and a model built for cost-efficiency, it’s setting new standards for fintech success.

WhiteSight’s latest deep dive analyses the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

Report

1. From Product to Platform:

Nubank began with a single, fee-free credit card and gradually expanded into a comprehensive financial platform. Today, its offerings span deposits, savings, personal loans, insurance, investments, and even crypto services. This journey from a single product to a full-stack ecosystem illustrates how innovation can scale from simplicity, using technology as the common denominator.

2. Expanding Financial Inclusion:

What started as a consumer-focused model soon grew to encompass freelancers and small businesses. By targeting segments long overlooked by Brazil’s traditional banks, Nubank redefined the idea of market access, making inclusion a competitive advantage rather than a social obligation.

3. Scaling Beyond Borders:

Having proven its model in Brazil, Nubank exported its formula across Latin America, entering Mexico, Colombia, and lately in the USA. Its regional growth shows that the forces of creative destruction need not be confined by borders; digital infrastructure and unified design principles can scale across vastly different markets.

4. From Bank to Super-App:

Nubank’s evolution from a lean neobank into a multi-product digital ecosystem, effectively a digital lifestyle super-app, represents the most visible phase of creative destruction. The company blurred boundaries between banking, payments, commerce, travel, telecom, and other lifestyle services, transforming the financial relationship into an everyday digital experience.

5. Orchestrating the Ecosystem:

Finally, Nubank’s strategic acquisitions, partnerships, and venture investments have created network effects that deepen its moat. Collaborations with global fintechs, AI partners, and payment innovators have extended its capabilities far beyond traditional banking, reinforcing a self-reinforcing ecosystem that continually compounds its advantage.

Together, these five vectors of expansion demonstrate that Nubank’s rise was not merely about taking market share from incumbents, it was about redefining what banking and customer relationship mean in the digital age. That redefinition is the essence of creative destruction.

The Outcome: A New Corporate Order in Brazil

In 2025, Nubank sits at the top of Brazil’s corporate valuation chart , a company born in 2013 now valued at ~USD 78 billion. It marks a shift away from asset-heavy extractive models (oil, mining) to asset-light, data-driven digital platforms.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Sanjeev Kumar

- Kshitija Kaur and Sanjeev Kumar

- Risav Chakraborty, Kshitija Kaur, Samridhi Singh and Chinmayee Kadam

- Ananya Shetty and Kshitija Kaur

Cash Flow Lifeline: Embedded Finance for SMEs Imagine a burgeoning entrepreneur, their independent bookstore teeming with life. The latest bestsellers...