Inside Nubank’s Playbook for Cost-Efficient Hypergrowth

- Kshitija Kaur and Sanjeev Kumar

- 4 mins read

- Digital Finance, Partnerships

Table of Contents

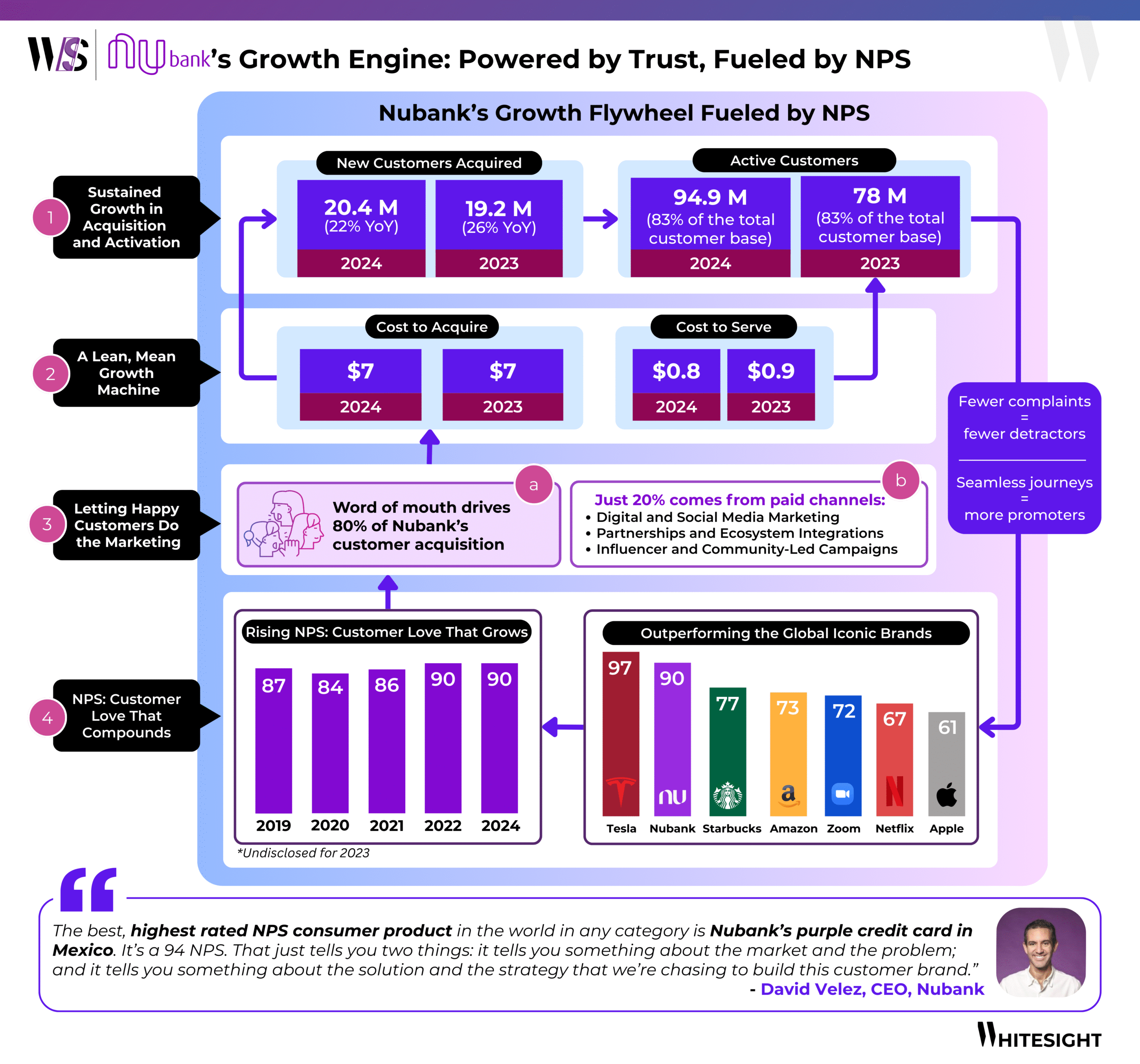

Nubank’s Customer Growth Playbook Is Written in NPS and Word of Mouth

NPS is a widely used customer experience metric that gauges how likely users are to recommend a company to others. Calculated by subtracting the percentage of detractors (unhappy customers) from promoters (loyal enthusiasts), it gives a score between -100 and +100. A higher NPS indicates a strong base of promoters—customers who are not just satisfied, but willing to actively refer others.

More customer-obsessed than Amazon. More beloved than Starbucks. A digital bank with 115M+ users – built with empathy and scaled with trust.

Latin America’s beloved purple giant, Nubank, has achieved what most banks spend billions chasing: sustained, organic growth at scale. Since 2015, it has added nearly 13 million customers every year on average. But here’s what’s remarkable: 80% of that growth comes from word-of-mouth referrals alone.

At the heart of this engine is one number – its Net Promoter Score (NPS). Clocking in at 90, nearly three times higher than incumbents and other major local fintechs, it’s far from a vanity metric. It’s the flywheel fuel behind Nubank’s near-zero customer acquisition cost (CAC) model, where every delighted customer brings in the next, turning experience into exponential scale.

In an industry riddled with churn, marketing bloat, and rising CACs, Nubank has hacked growth through trust and transparency. Here’s how NPS became the foundation of its word-of-mouth engine, turning everyday delighted users into its most effective acquisition channel.

The Foundation Behind Nubank’s Consistent NPS

Nubank’s NPS acts as the entry point to a tightly engineered growth system. For five consecutive years, this score has held steady, underpinned by consistent design decisions rooted in real customer needs that make every interaction feel intentional:

Nubank's Deep Dive Report 📔

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net income, and metrics that legacy and challenger banks would kill for, Nu is proof that fintechs can scale and stay profitable. In a region where high cost-to-serve and low credit access are the norm, Nubank built a lean, digital-first platform that’s low-cost, hyper-scalable, and sticky.

WhiteSight’s latest deep dive distills the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

WhiteSight’s latest deep dive distills the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

Report

- Proactive customer support and education: 94% of customer calls are answered in under 45 seconds. Most are resolved by Nubank’s own trained professionals, “Xpeers”, at the first touchpoint. But Nubank goes further. Its “Nu WOWs” focuses on sending Nu gifts, particularly when a connection stands out between the Xpeers and the customer. The SOS Nu platform adds another layer—a comprehensive hub educating users on scams and thefts through real-time, actionable tips.

Financial education has always been one of our pillars, and it is also present in the design of our products and services to empower consumers to make the best decisions for their lives and have control over their money. Advancing the literacy journey on these topics brings greater and more sustainable benefits not only to individuals, but to the community as a whole

Cristina Junqueira, Co-founder and CGO, Nubank

- Product features that actually serve users: Nubank’s Payments Assistant platform for bills and recurring transactions saved customers 750K+ hours in one year. Open finance-powered overdraft alerts helped avoid R$4M in interest in just a month. And 1.4M users were nudged to act on idle funds via personalized notifications—purposeful nudges that build daily utility.

- Ultra-low complaint rates, high leadership visibility: Nubank received only 1,222 complaints per million users in Q4 2024. That’s far lower than both incumbents (Itau: 4,127; Santander: 3,365) and new-age fintechs like PagBank (7,926) and Inter (7,496). Not just that—even CEO David Vélez personally addresses customer grievances like this one.

This relentless focus on quality compounds customer love, which in turn becomes the bedrock for Nubank’s flywheel.

The NPS Flywheel: How Customer Love Becomes a Scalable Acquisition Engine

When users love the product, they spread it, powering a flywheel that scales at near-zero cost. This system helps Nubank run lean. The customer acquisition cost has held steady at $7 for both 2023 and 2024, up slightly from $6.5 in 2022, but still far below industry averages. These are the payoff of optimizing spend early and building a brand users trust enough to share.

Activity metrics reinforce the health of this base. Nubank grew from 93.9M customers in 2023 to 114.3M in 2024—adding over 20M users (22% YoY). Active users hit 94.9M in 2024, sustaining an 83% activity rate. And despite rising total customer base and sustained active customer base, cost to serve dropped to $0.8 per user, down from $0.9. This reflects the scalability of a digitally-native, automation-led operating model.

From Satisfaction to Scale, the Nubank Way

This virtuous cycle—where exceptional service drives advocacy, growth, and reinvestment—explains why Nubank now outranks Amazon, Apple, and Starbucks in customer centricity. Its model demonstrates that customer satisfaction is not just about good ethics but also a sound business strategy. For digital banks, fintechs, and incumbents alike, Nubank’s model offers a clear lesson: NPS should not be an end in itself but a means to an end. Build products that solve real pain points, deliver consistent value, and turn support into a meaningful experience. When you get that right, a high NPS becomes a byproduct—fueling scalable, efficient growth for banks.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

Authors

Head of Growth

Kshitija is a senior branding associate at WhiteSight, crafting branding strategies and fintech content. When she's not conjuring up new ideas for the company, you can find her dabbling in new hobbies and documenting her experiences through writing and short films.

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

- Kshitija Kaur and Risav Chakraborty

- Kshitija Kaur and Sanjeev Kumar