Inside Saudi Arabia’s Open Banking Boom: A 2023 Snapshot

- Kshitija Kaur and Risav Chakraborty

- 4 mins read

- Insights, Open Finance

Table of Contents

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon, the Gulf Cooperation Council (GCC) nations are anchoring their national strategies on the bedrock of an ‘Open Economy’. And open banking is fast becoming a key ingredient in their recipe for innovation and economic diversification. Now, Bahrain might have been the first-mover in making open banking mandatory, but guess what? The UAE and Saudi Arabia are hot on their heels, gearing up to embrace the future of finance. Saudi Arabia, in particular, is witnessing a digital transformation of epic proportions in the banking industry, where open banking initiatives have triggered a phenomenal 30% surge in fintech adoption rates.Previously, we glimpsed the GCC’s overarching venture into open banking, where Saudi Arabia emerges as a heavyweight in driving Open Banking initiatives. Saudi Arabia’s Open Banking landscape is currently experiencing a symbiotic relationship between industry players and regulatory bodies. Market players, including traditional banks, data aggregators, and emerging fintechs, are actively exploring and implementing Open Banking solutions, driven by a growing demand for more integrated, customer-centric financial services. Simultaneously, Saudi regulatory authorities are playing a pivotal role in shaping this transformation by setting up innovation […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Risav Chakraborty and Kshitija Kaur

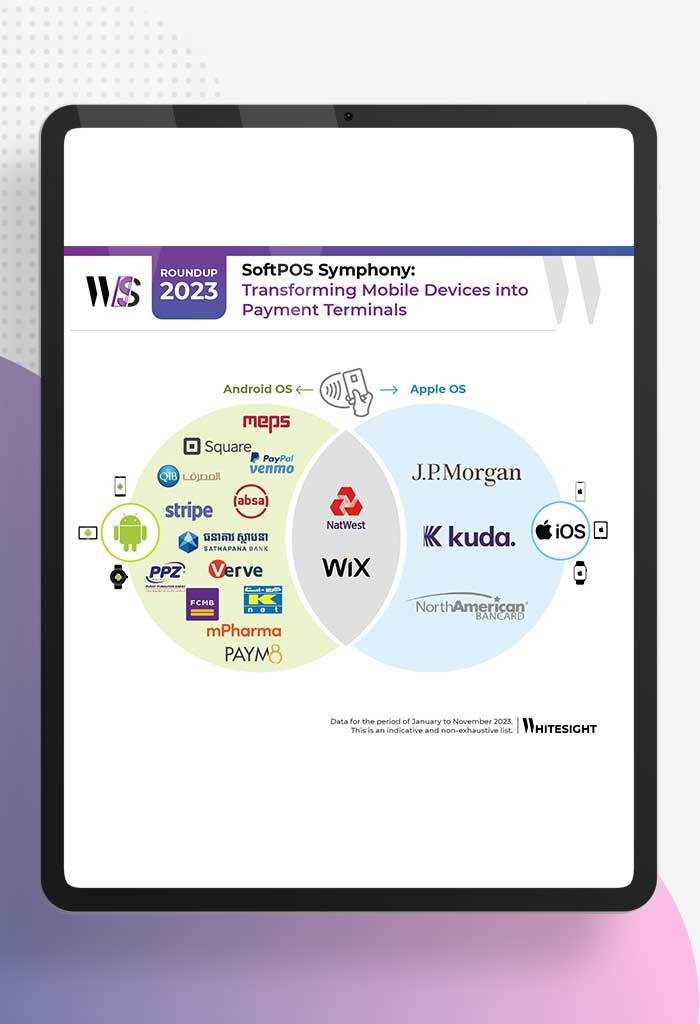

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

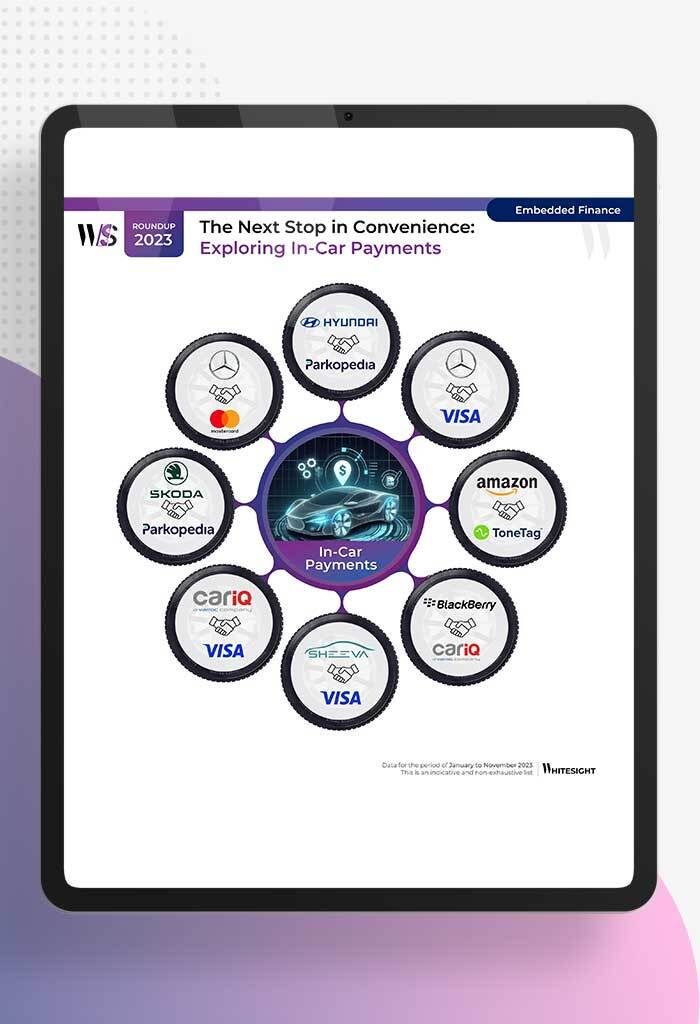

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

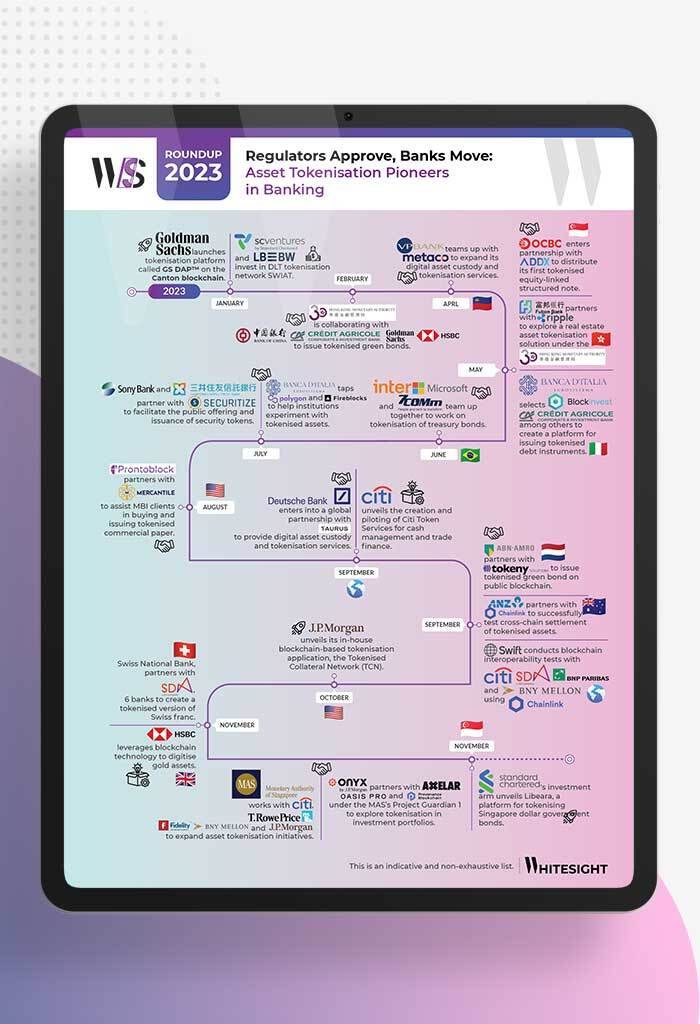

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

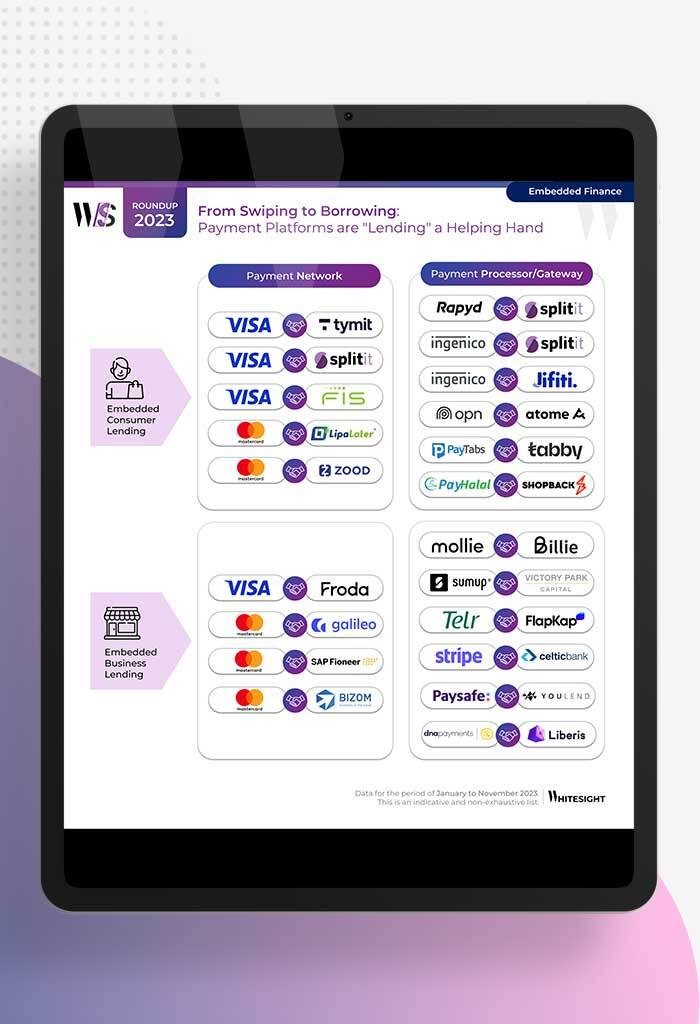

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

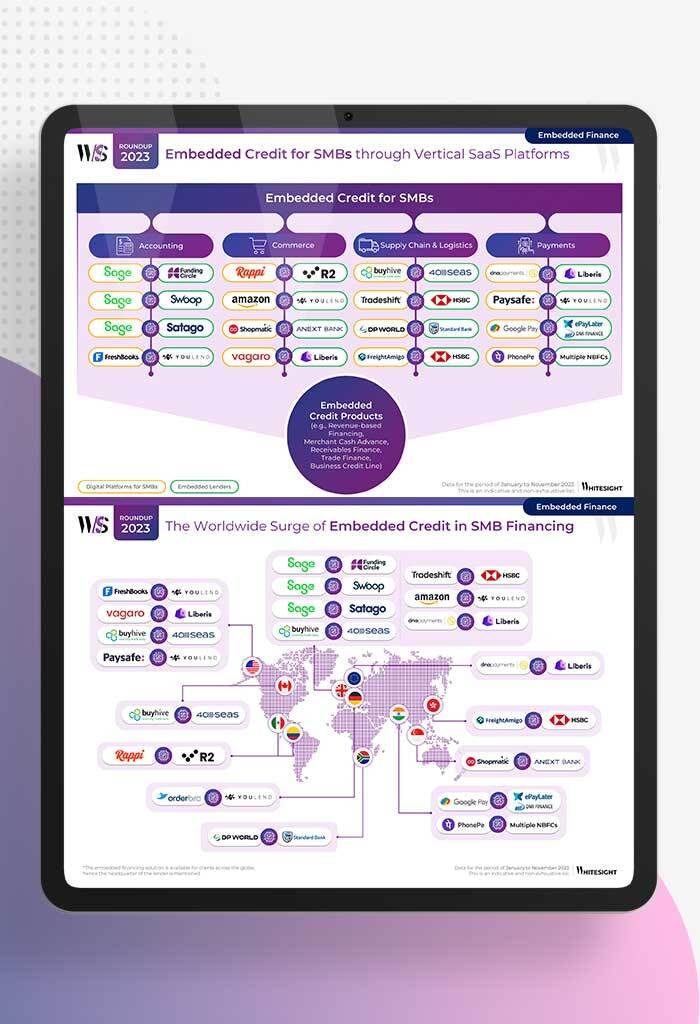

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...

- Samridhi Singh and Kshitija Kaur

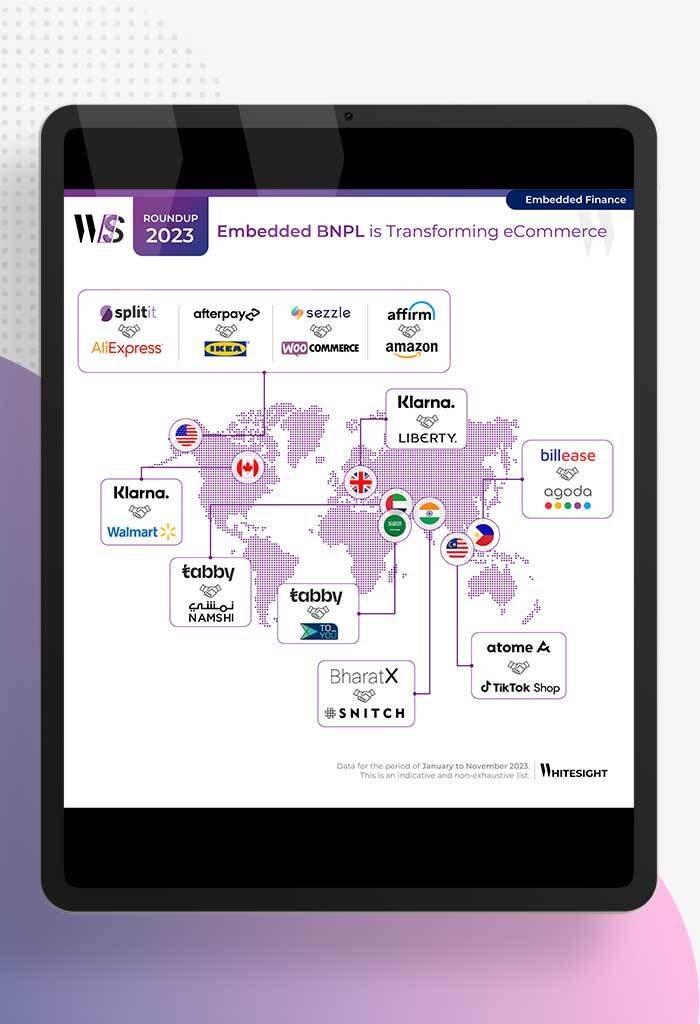

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...