JPMorgan Chase: A Goliath’s Resurgence

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

On the eventful day of the 31st of December, 2021, JPMorgan Chase—a global leader in financial services—created a new milestone for the banking goliath – it disclosed an asset size of $3.11 trillion. The firm’s roots can be traced to 1799 when its earliest predecessor institution The Manhattan Company was founded. In 1871, John Pierpont Morgan – in a partnership with Anthony Drexel – established the Drexel, Morgan and Co. in New York; which was rechristened J.P. Morgan and Co. in 1895. The financial institution acquired its present name of JPMorgan Chase and Co. in 2000 when it merged with Chase Manhattan. In this post, we take a closer look at the banking giant’s unique investment and acquisition strategy through the years in a bid to battle FinTechs at their own game. Tech Deal Making Contours“We have to fight. We have to move quicker. We have got to kill our own bureaucracies.” — Jamie Dimon, JPMorgan ChaseIf we look at the contours of JPMorgan Chase, we can surely see signs of the commandment set by the CEO. The urgency, the swiftness, and the diversity of FinTech investments by the firm signal the desire to engage in a multi-pronged fight with […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

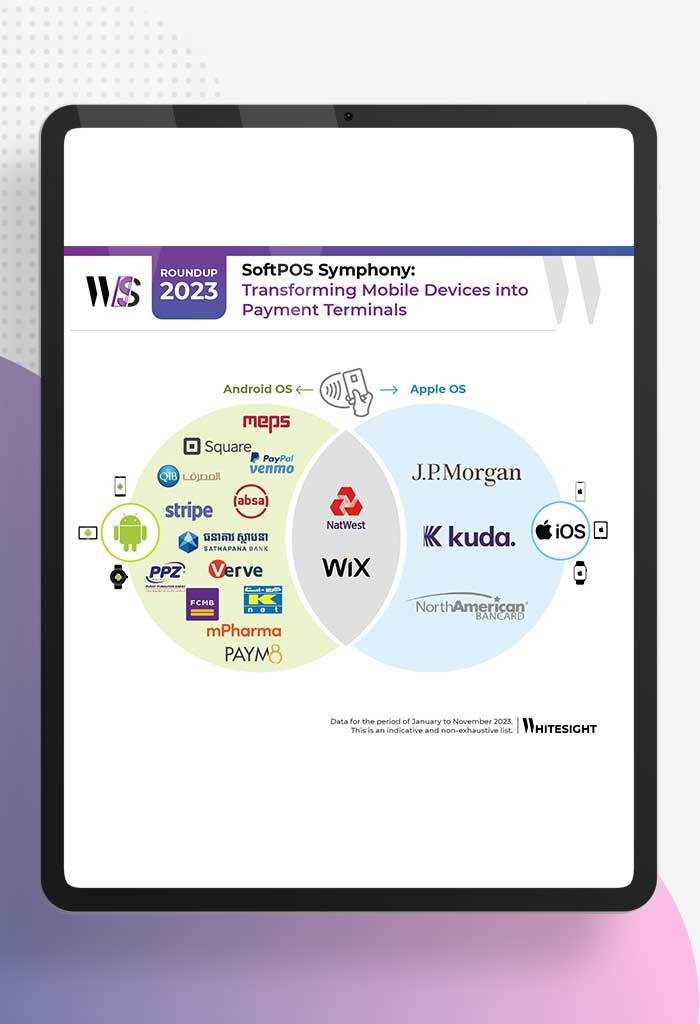

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

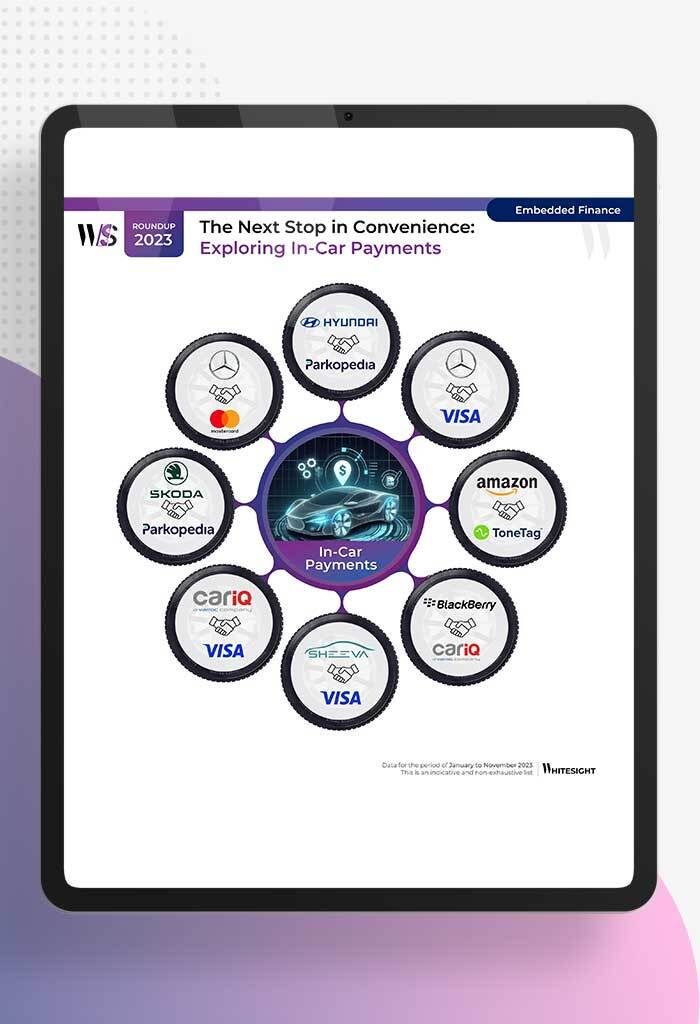

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

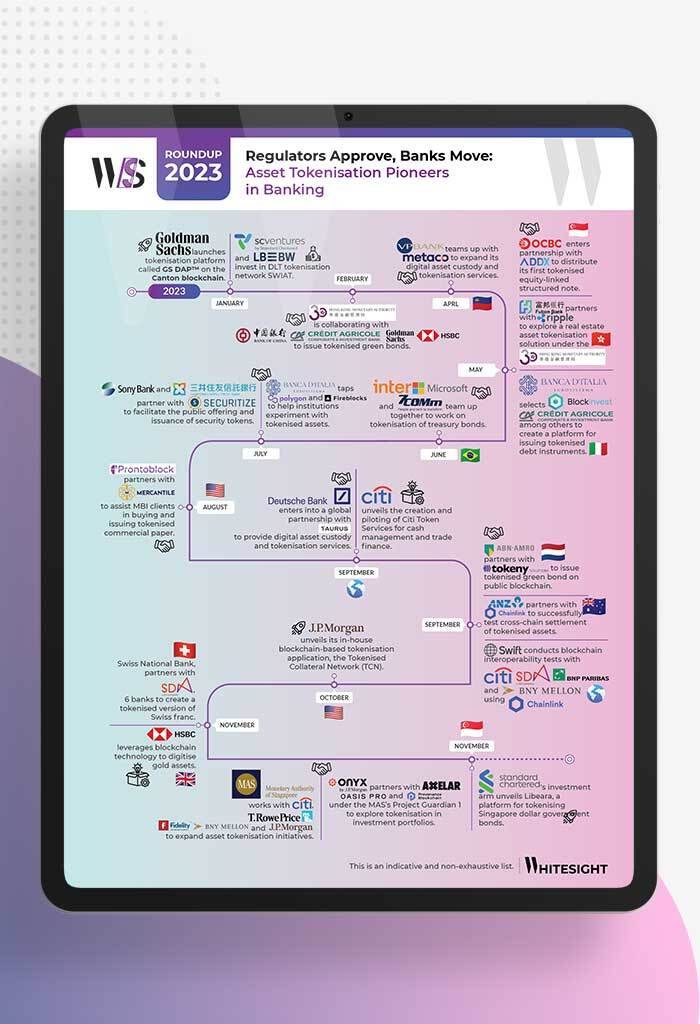

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

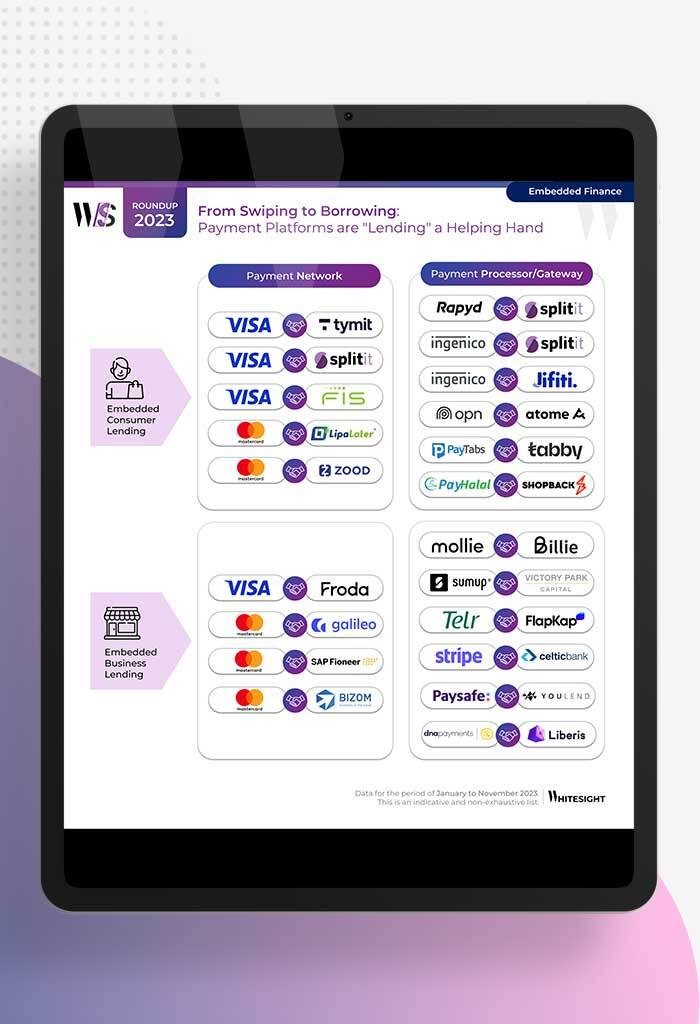

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...