Revolut Juggernaut: In Search Of A New World Order In Finance

- Sanjeev Kumar and Risav Chakraborty

- 3 mins read

- Digital Finance, Insights

Table of Contents

At a time when firms across industries are reeling under the adverse effects of inflation and geopolitical tension, one of the first neobanks, Revolut, has remained committed to its mission of unlocking the power of a borderless economy for everyone. Be it acquiring licenses in foreign markets or announcing expansions in new regions along with regular updates to its product suite, Revolut has strongly backed up its claim of being a global financial super app. From British Neobank to Global Challenger BankSince its inception, Revolut has operated as an e-money institution in multiple countries. It still continues to operate with an e-money license in the UK and also relies on it to serve business customers in Europe. Revolut obtained a European banking license in 2018 from the Bank of Lithuania and has been relentlessly executing its aggressive expansion strategy. Post-pandemic, the digital bank filed paperwork with the Financial Conduct Authority and the Prudential Regulation Authority in the UK and with the Federal Deposit Insurance Corporation and the California Department of Financial Protection and Innovation in the US, seeking a banking license. These ambitious advancements align with company CEO Nikolay Storonsky’s statement, “generally in each country where we expand, we’re going […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

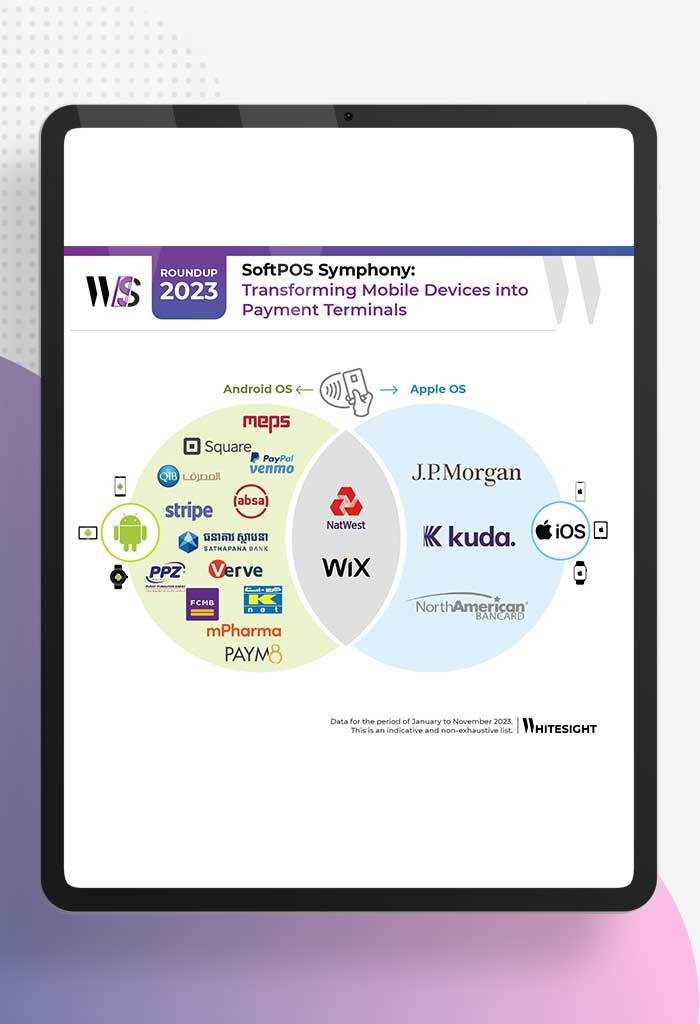

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

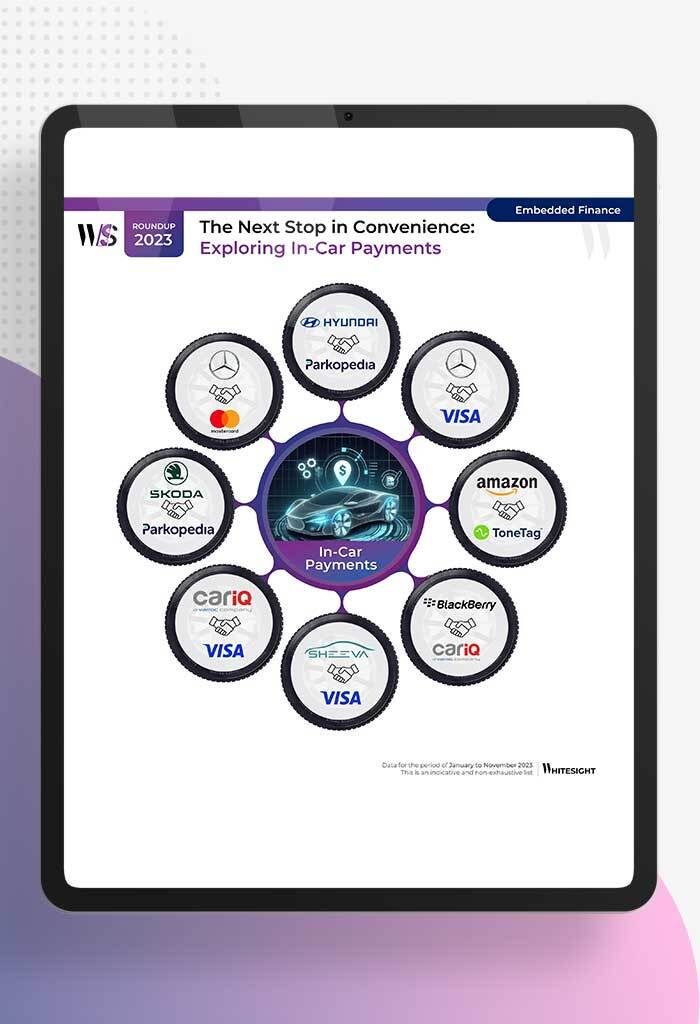

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

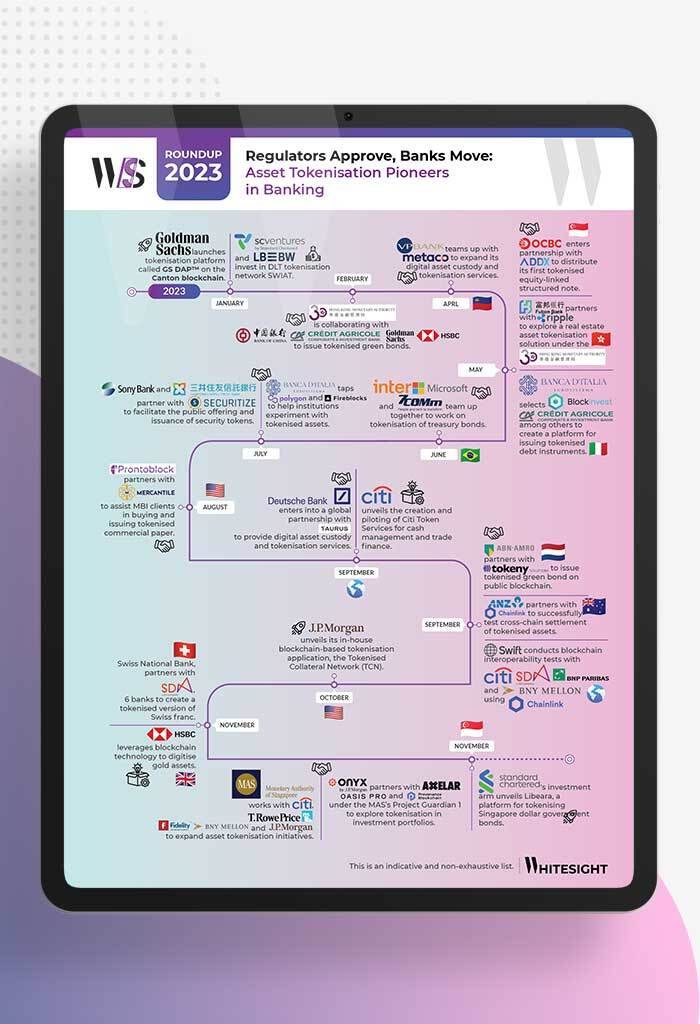

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

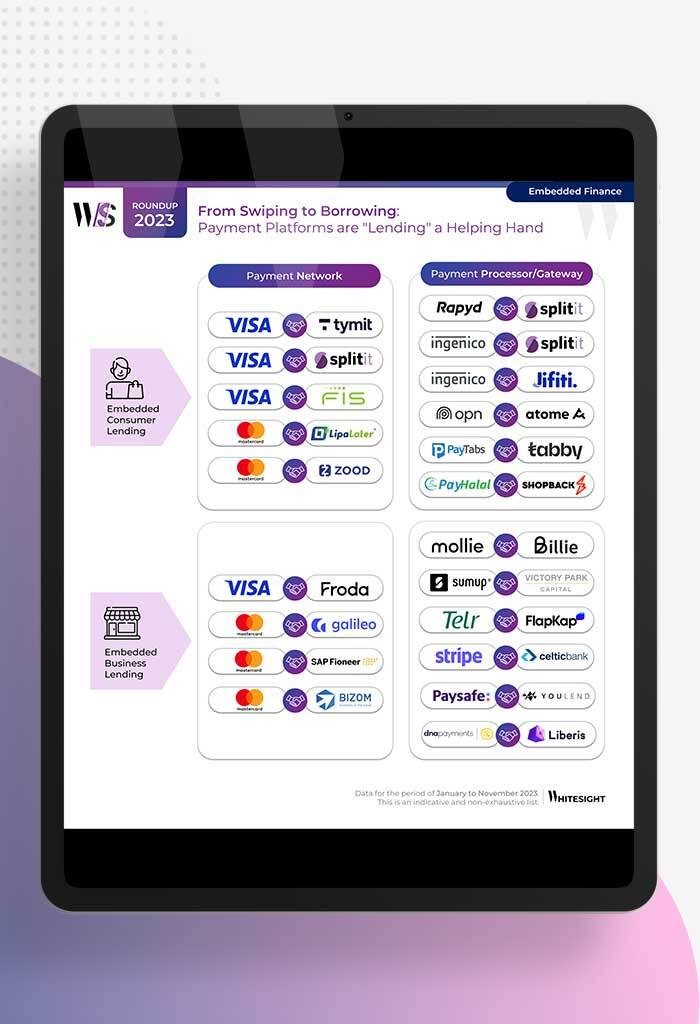

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

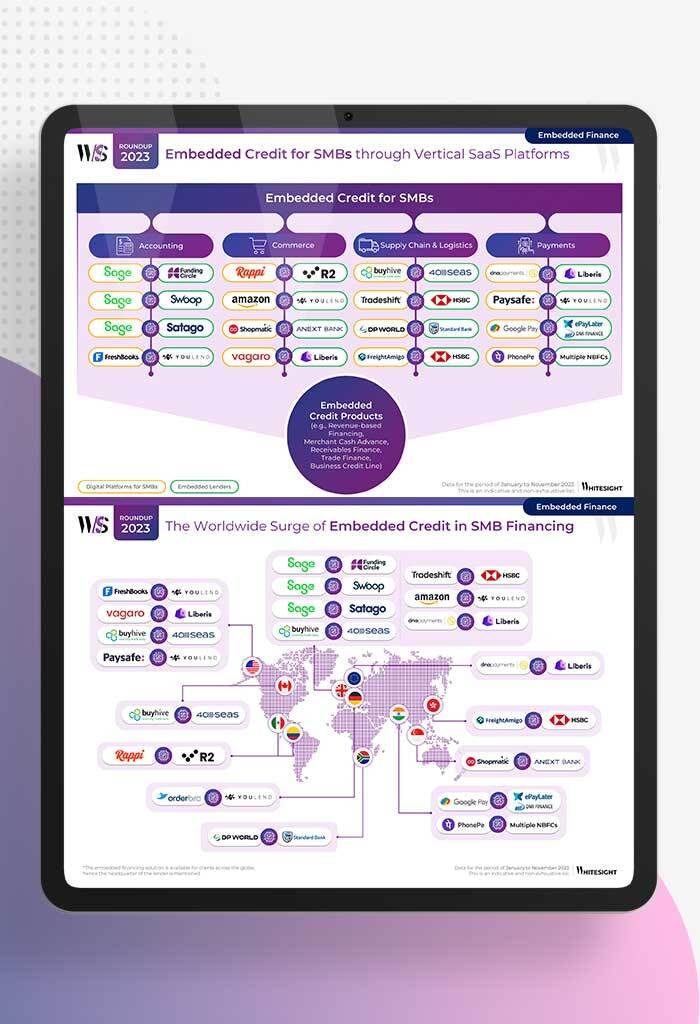

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...