Revolutionary Open Banking Use Cases in North America

- Samridhi Singh and Sanjeev Kumar

- 4 mins read

- Insights, Open Finance

Table of Contents

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years. At Whitesight, we’ve dedicated considerable effort to exploring its intricacies and impact on the financial services sector. Whether it’s examining the ‘Os of Open Banking‘ or delving into the recent open banking boom in Saudi Arabia, we’ve gone far and wide. Now, we’re shifting our focus to open banking in North America, i.e. the US and Canada.In North America, open banking has been predominantly fueled by industry initiatives, with financial institutions and tech companies taking the lead in fostering collaboration and innovation. This stands in stark contrast to Europe and Australia, where regulatory mandates play a more prominent role in shaping the open banking landscape.In 2023, North America experienced an upswing in diverse use cases driven by the accelerated adoption of open banking, thanks to ongoing industry collaborations and the regulatory nod for a better open banking framework. Let’s go down the rabbit hole. Payment Revolution: A2A leads the way! The adoption of open banking-powered account-to-account (A2A) payments (also called pay-by-bank in the US) has stirred up a global storm. A2A payments involve directly transferring funds between accounts, bypassing intermediaries such as cards and […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

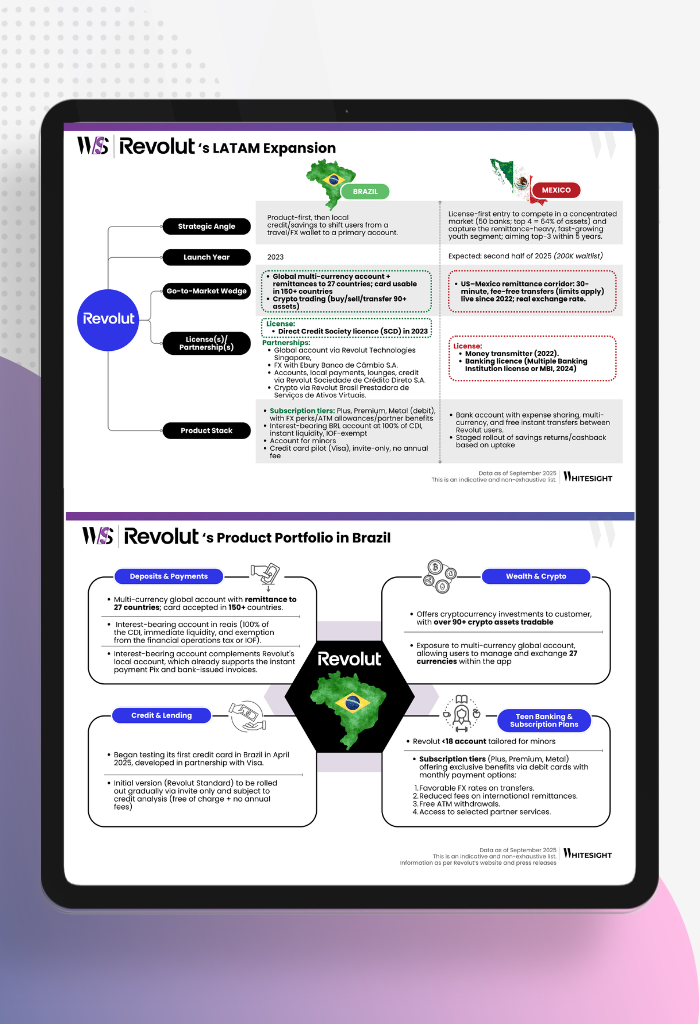

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

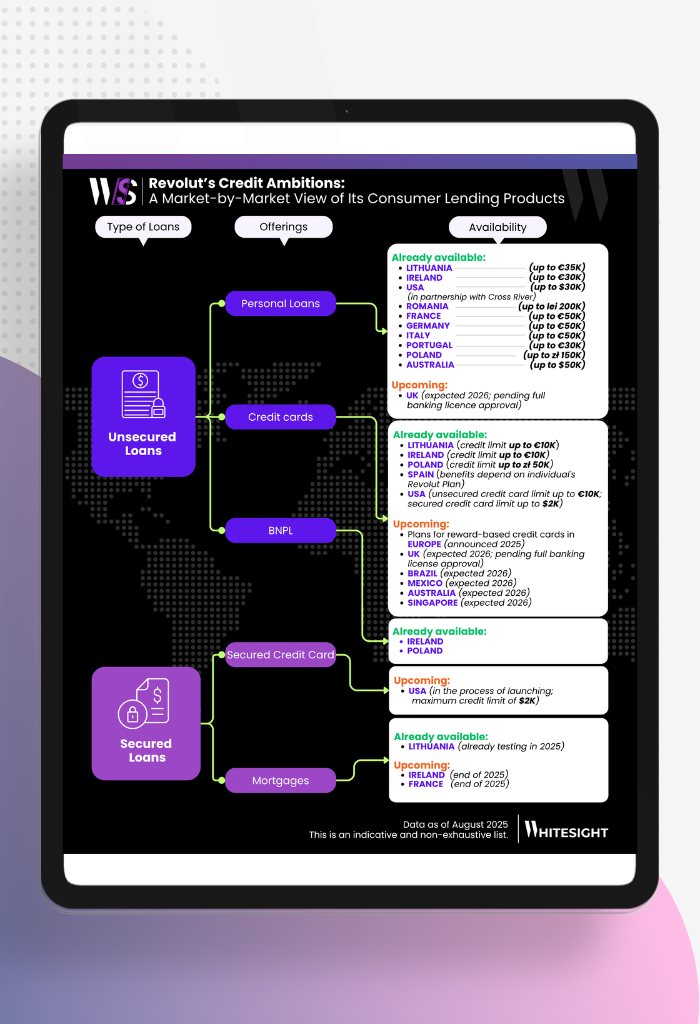

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...