Testing Waters: Confluence of Neobanks and BNPL

- Sanjeev Kumar

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

Neobanking and Buy Now, Pay Later (BNPL) have surfaced as the biggest fintech megatrends in the post-COVID world, alongside Crypto and Open Banking. While both neobanking and BNPL have individually tasted billion-dollar valuations, fund-raising, and public listings in the last 10-12 months, the confluence of these two megatrends promises to have a gigantic impact on the future course of the fintech phenomenon. We are increasingly witnessing a massive crossover between neobanking and BNPL with neobanks across the world launching BNPL products for their customers.Neobanks in their heyday, having been focused on removing friction in the storage and movement of money, garnered millions of customers. Now, they are attempting to bring the same proposition of convenience and real-time access to funds in the form of instant and contextual credit to their customers in the form of BNPL. Neobanks’ Tryst with BNPLTo better grasp the nitty-gritty of this transpiring shift, a global overview of the many archetypes that neobanks have adopted in launching BNPL offerings is as follows.Credit-first neobanks like Tinkoff and Nubank have launched BNPL offerings in a bid to expand affordability for their customers by allowing them to avail small-ticket credit on their cards, that can be paid back in […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Kshitija Kaur

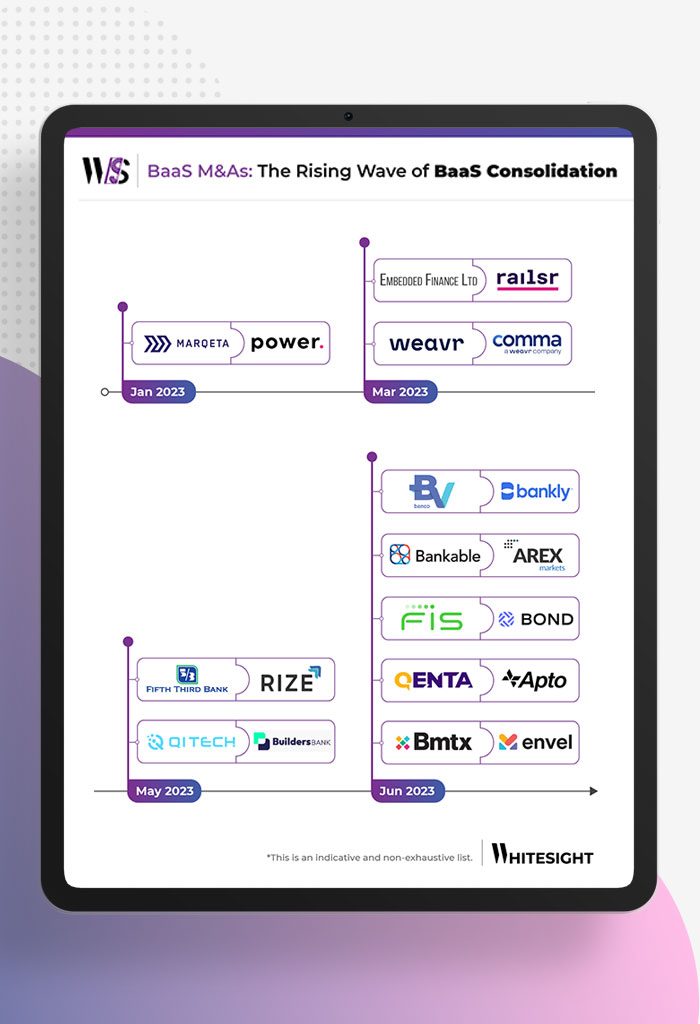

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

- Risav Chakraborty and Kshitija Kaur

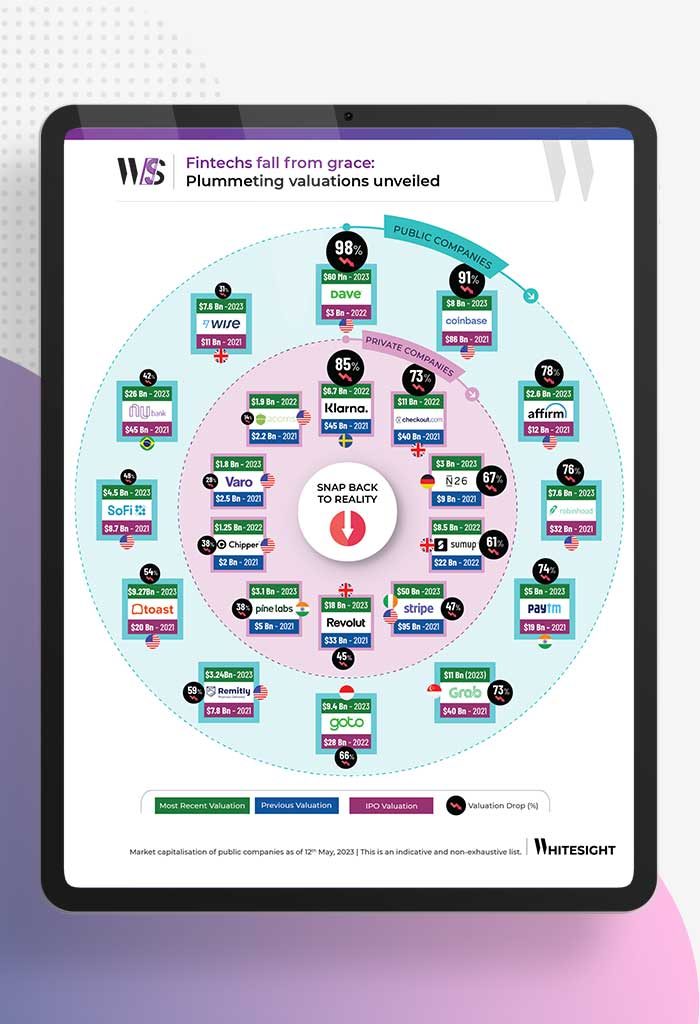

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

- Risav Chakraborty and Sanjeev Kumar

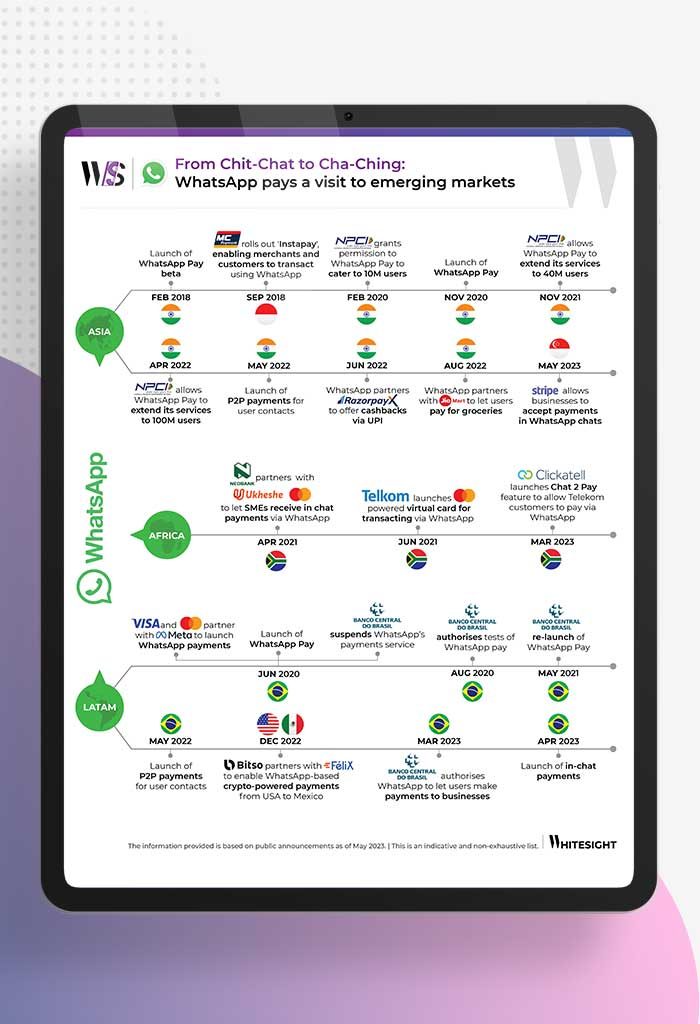

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

- Sanjeev Kumar and Samridhi Singh

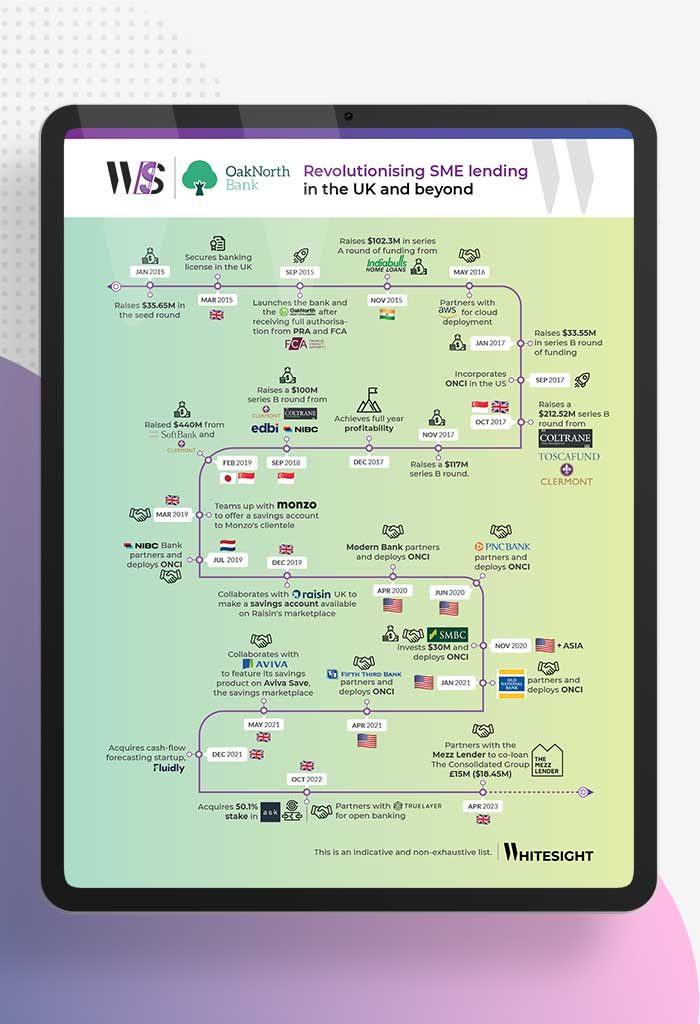

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

- Afshan Dadan and Ananya Shetty

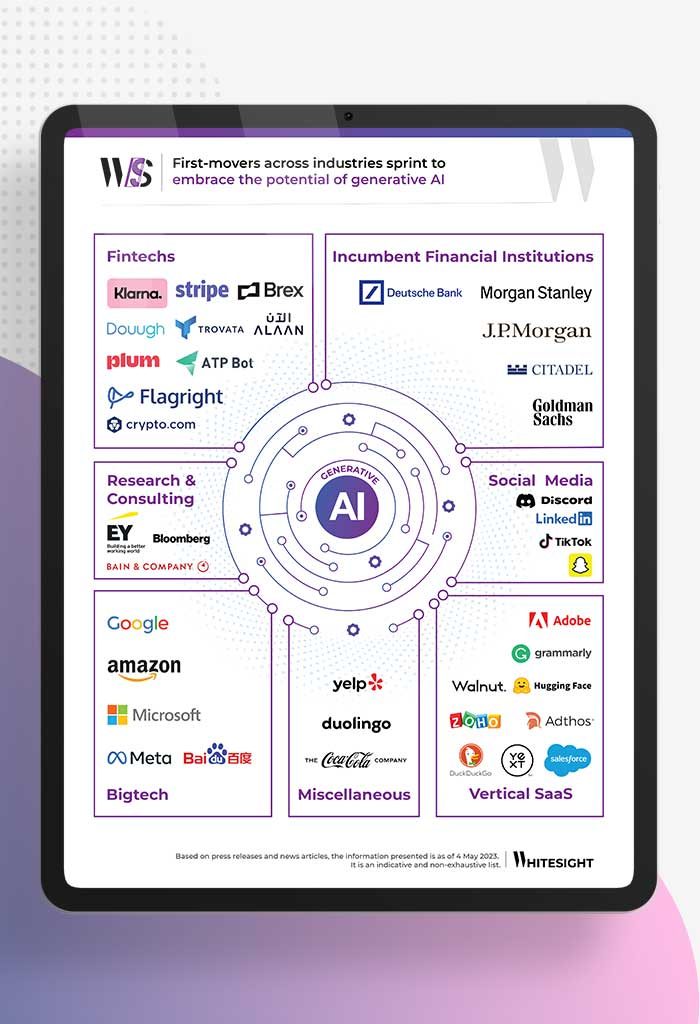

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...