Testing Waters: Confluence of Neobanks and BNPL

- Sanjeev Kumar

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

Neobanking and Buy Now, Pay Later (BNPL) have surfaced as the biggest fintech megatrends in the post-COVID world, alongside Crypto and Open Banking. While both neobanking and BNPL have individually tasted billion-dollar valuations, fund-raising, and public listings in the last 10-12 months, the confluence of these two megatrends promises to have a gigantic impact on the future course of the fintech phenomenon. We are increasingly witnessing a massive crossover between neobanking and BNPL with neobanks across the world launching BNPL products for their customers.Neobanks in their heyday, having been focused on removing friction in the storage and movement of money, garnered millions of customers. Now, they are attempting to bring the same proposition of convenience and real-time access to funds in the form of instant and contextual credit to their customers in the form of BNPL. Neobanks’ Tryst with BNPLTo better grasp the nitty-gritty of this transpiring shift, a global overview of the many archetypes that neobanks have adopted in launching BNPL offerings is as follows.Credit-first neobanks like Tinkoff and Nubank have launched BNPL offerings in a bid to expand affordability for their customers by allowing them to avail small-ticket credit on their cards, that can be paid back in […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

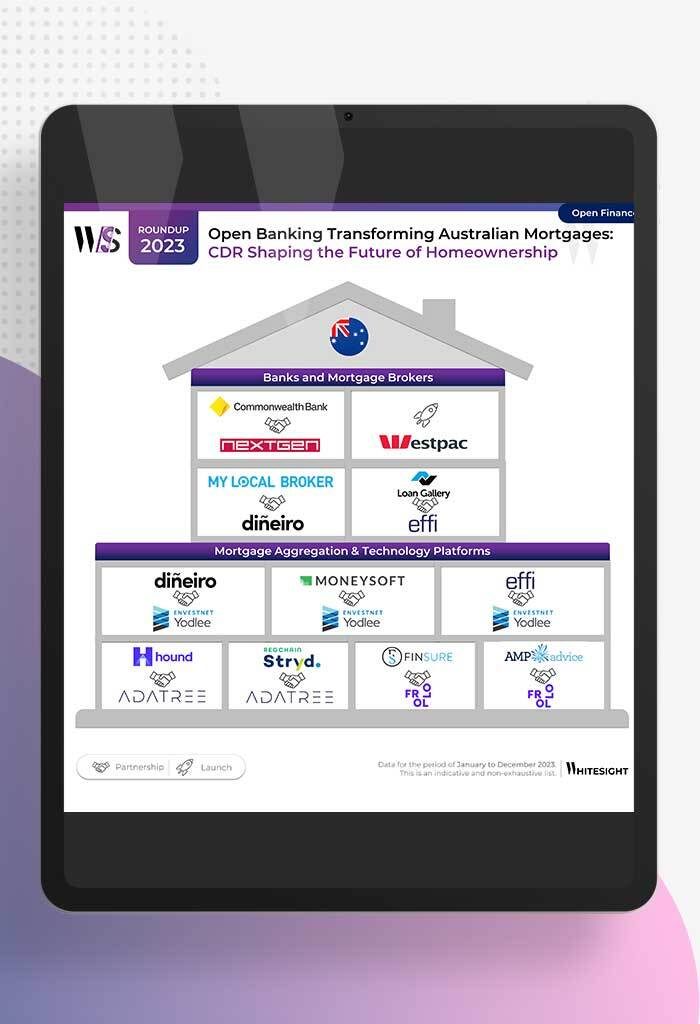

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

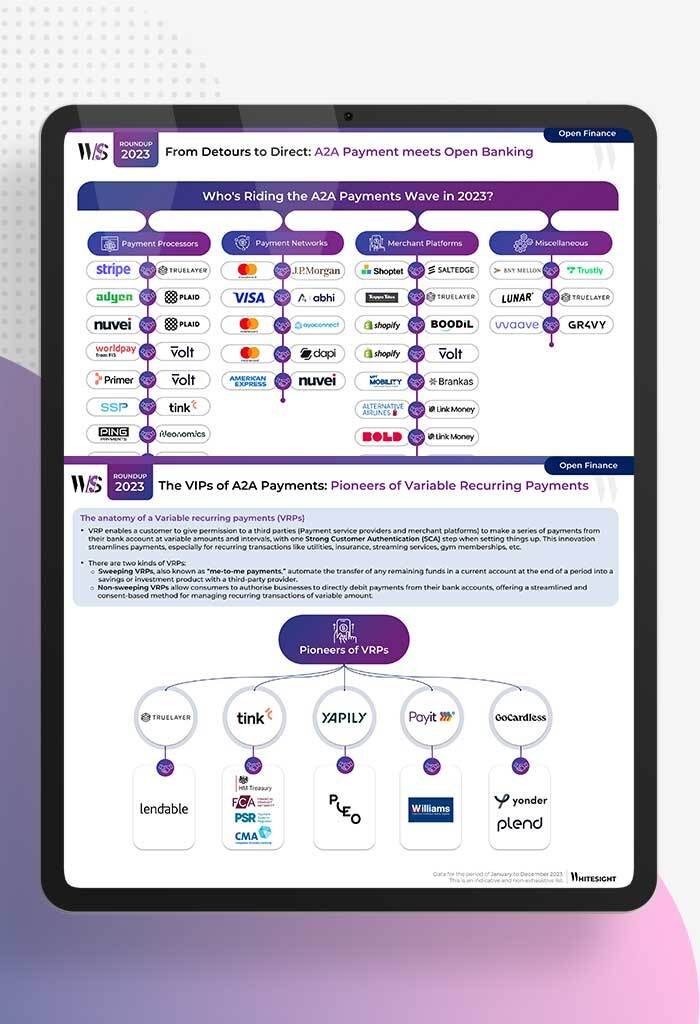

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

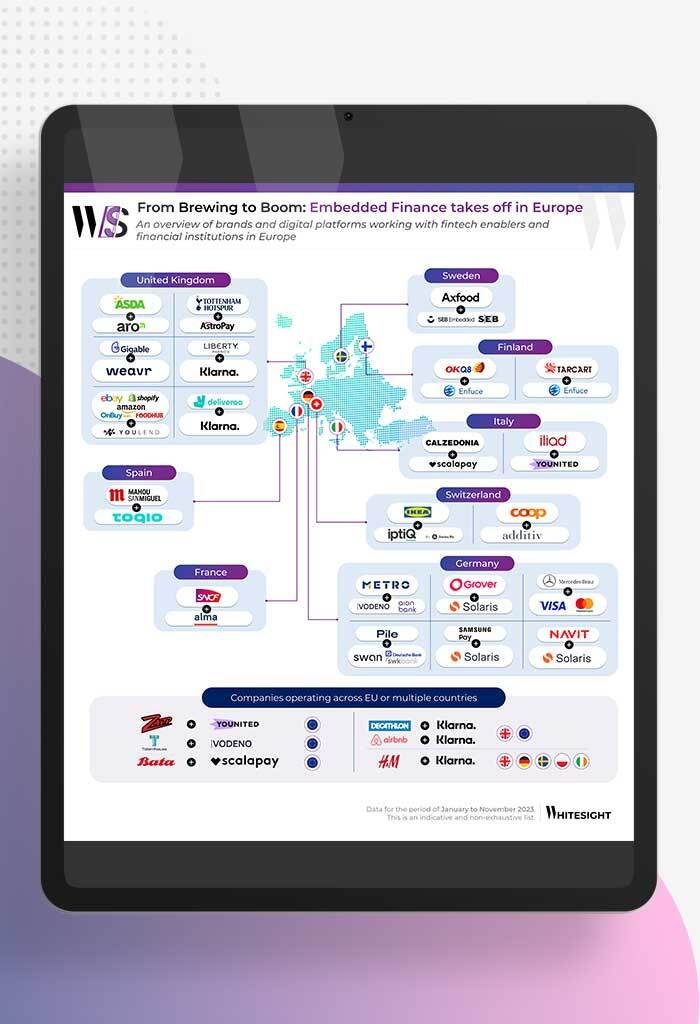

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

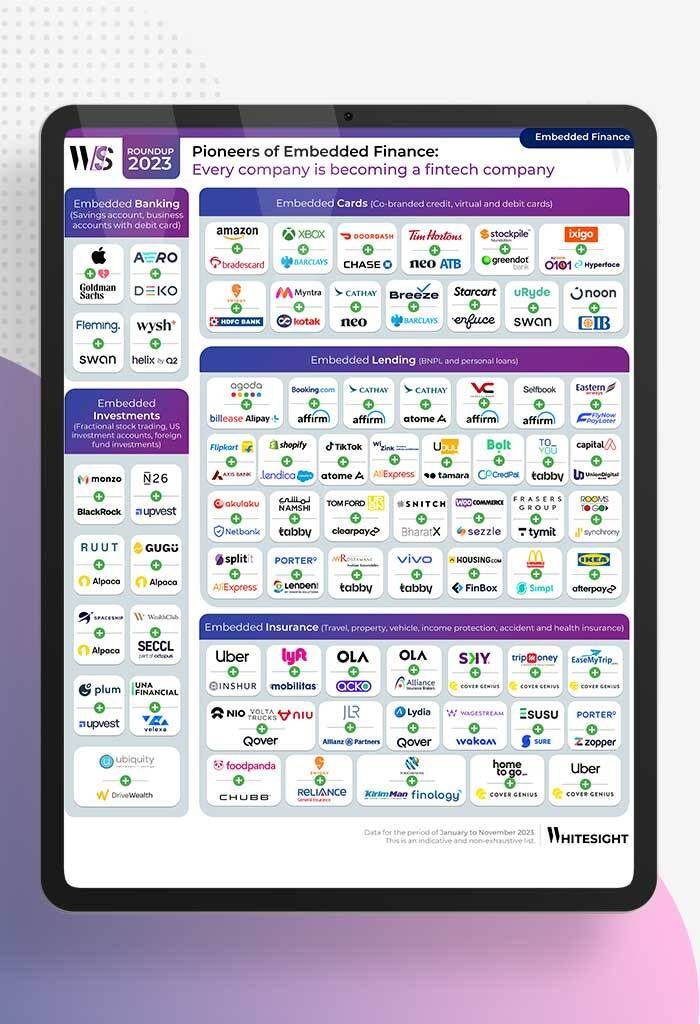

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...