WealthTech’s Wealthy Wins: Mega M&As

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

Innovation and investments have been the key trends in the WealthTech industry over the last decade. Its recent claim to fame with the high value mergers and acquisitions is driven not only by incumbents like Goldman Sachs, JPMorgan Chase, and Charles Schwab, but also by FinTech players such as SoFi, Acorns, and NuBank. While the financial details of most of the deals remain undisclosed, the sheer size of the acquirers has been sufficient to garner attention. In this post, we take a closer look at some of the mega mergers and acquisitions that the sector witnessed in the recent years. Incumbents Flex Their Financial MuscleOne of the biggest transactions in the WealthTech world was unveiled on 26th Jan, 2022 – when Swiss Banking Giant UBS announced its acquisition of robo-advisor Wealthfront in an all cash deal valued at $1.4B. With an asset size of over $1T, UBS will be able to support its growth plans in the US by leveraging Wealthfront’s state-of-the-art digital platform tailored for the next generation of mass affluent investors. In a bid to compete with established retail banking and FinTech rivals, JPMorgan Chase acquired British digital wealth management platform Nutmeg in a blockbuster transaction valued approximately […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

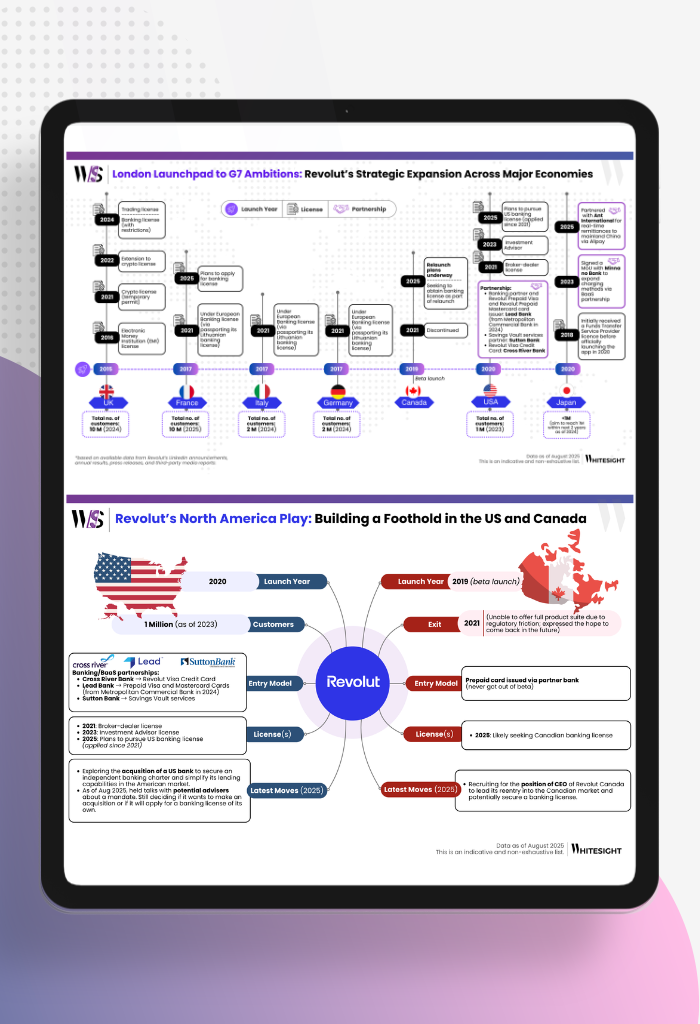

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty