WealthTech’s Wealthy Wins: Mega M&As

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

Innovation and investments have been the key trends in the WealthTech industry over the last decade. Its recent claim to fame with the high value mergers and acquisitions is driven not only by incumbents like Goldman Sachs, JPMorgan Chase, and Charles Schwab, but also by FinTech players such as SoFi, Acorns, and NuBank. While the financial details of most of the deals remain undisclosed, the sheer size of the acquirers has been sufficient to garner attention. In this post, we take a closer look at some of the mega mergers and acquisitions that the sector witnessed in the recent years. Incumbents Flex Their Financial MuscleOne of the biggest transactions in the WealthTech world was unveiled on 26th Jan, 2022 – when Swiss Banking Giant UBS announced its acquisition of robo-advisor Wealthfront in an all cash deal valued at $1.4B. With an asset size of over $1T, UBS will be able to support its growth plans in the US by leveraging Wealthfront’s state-of-the-art digital platform tailored for the next generation of mass affluent investors. In a bid to compete with established retail banking and FinTech rivals, JPMorgan Chase acquired British digital wealth management platform Nutmeg in a blockbuster transaction valued approximately […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

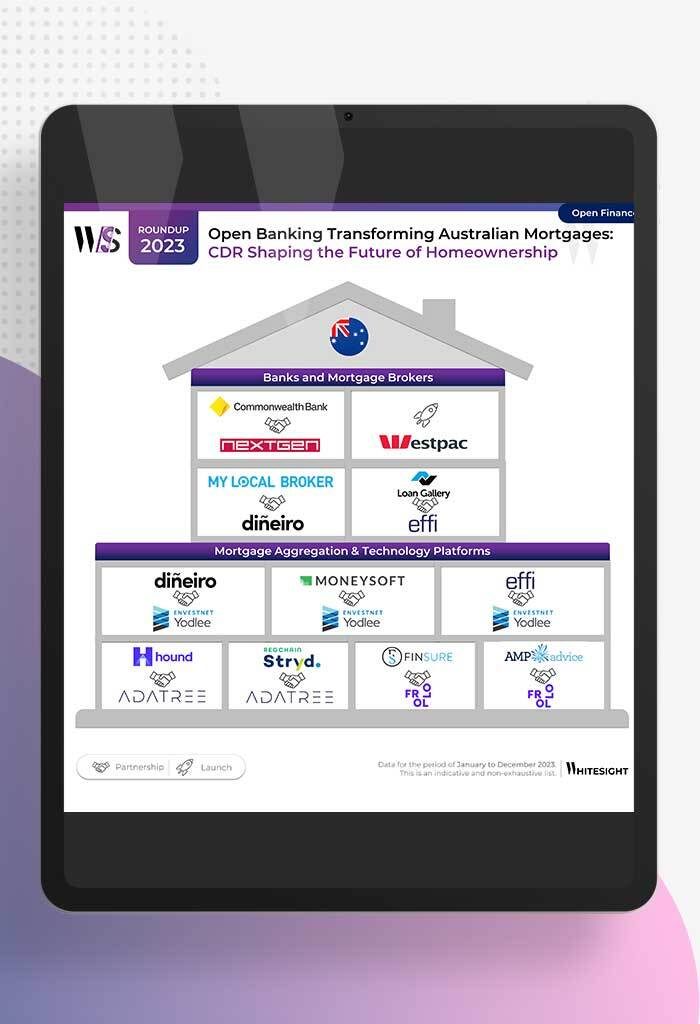

- Sanjeev Kumar and Samridhi Singh

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

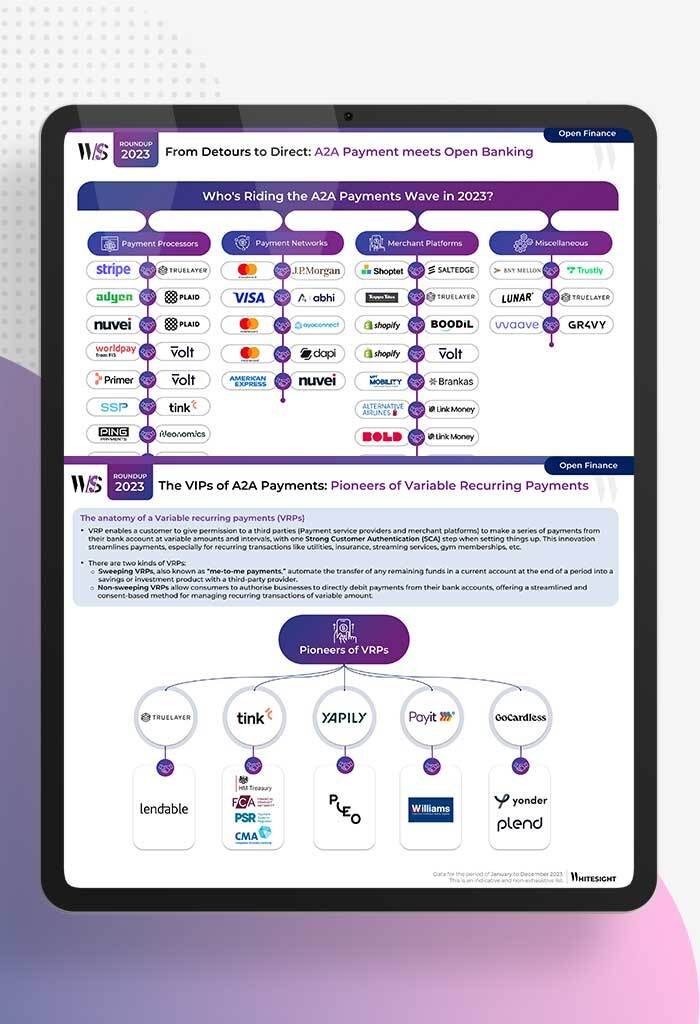

- Kshitija Kaur and Sanjeev Kumar

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

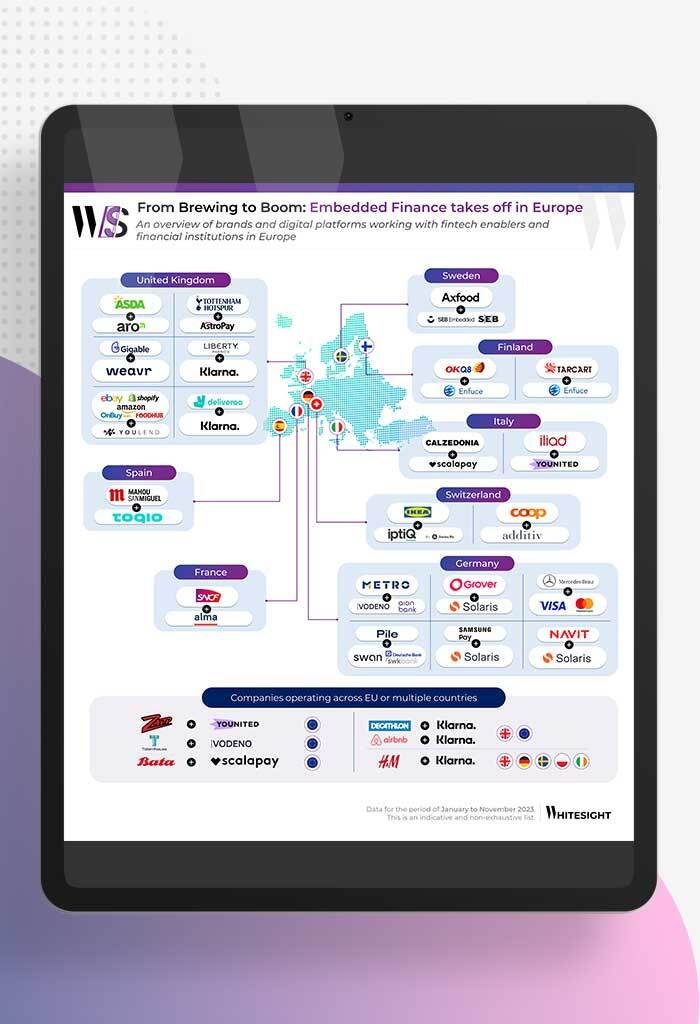

- Afshan Dadan and Sanjeev Kumar

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

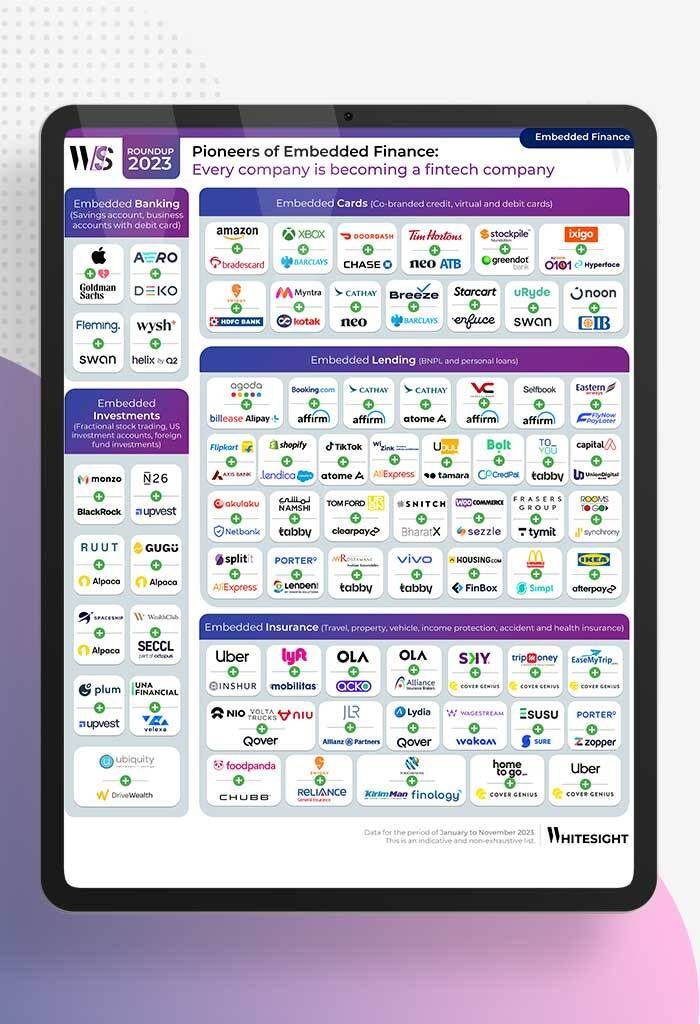

- Sanjeev Kumar and Samridhi Singh

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...