Winter Is Here For The FinTech Folks

- Risav Chakraborty and Anjali Singh

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

Global FinTech investments reached a record US$210B across 5,684 deals in 2021. The massive investment inflows into the FinTech ecosystem led many players to overestimate their growth potential and focus on scaling fast to exploit the massive digital adoption by consumers and businesses in the wake of the pandemic.Rapid and cheap access to capital coupled with bullish estimates of the market opportunity, and favourable customer behaviour meant aggressive hiring, hopeful investments in new product lines, extravagant marketing campaigns, and accelerated geographic expansion. Riding on the high, few anticipated the gloomy valley of an economic downturn and swift reversals to pre-pandemic behaviours that 2022 had in store.Snap Back to Reality2022 has witnessed a blizzard of tech layoffs, and the FinTech industry was no exception. The reasons for layoffs cited varied, ranging from macroeconomic conditions to industry shifts to company-level factors.Macroeconomic factors cited include a looming recession, rising inflation, reduced consumer spending, and reversion to pre-covid behaviours. These reasons were cited by companies like Klarna and TrueLayer.Industrial factors cited were shrinking venture funding, nosediving valuations in public and private markets and heightened regulatory scrutiny. For example, Blend Labs slashed its payroll amid major mortgage industry turmoil.Company factors mentioned include cost reduction mandates, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

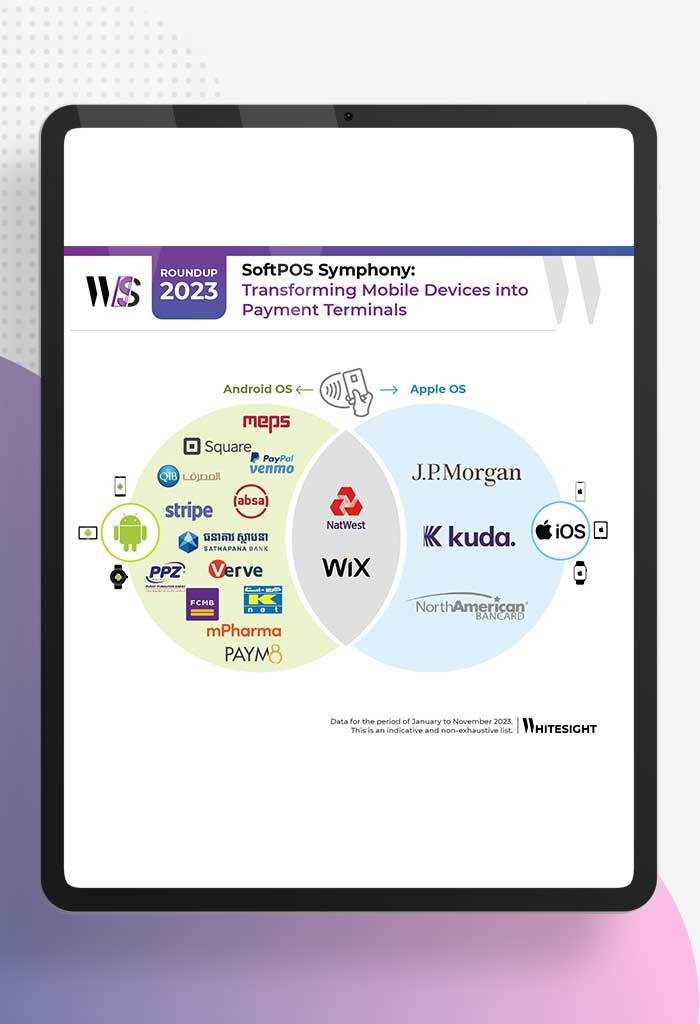

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

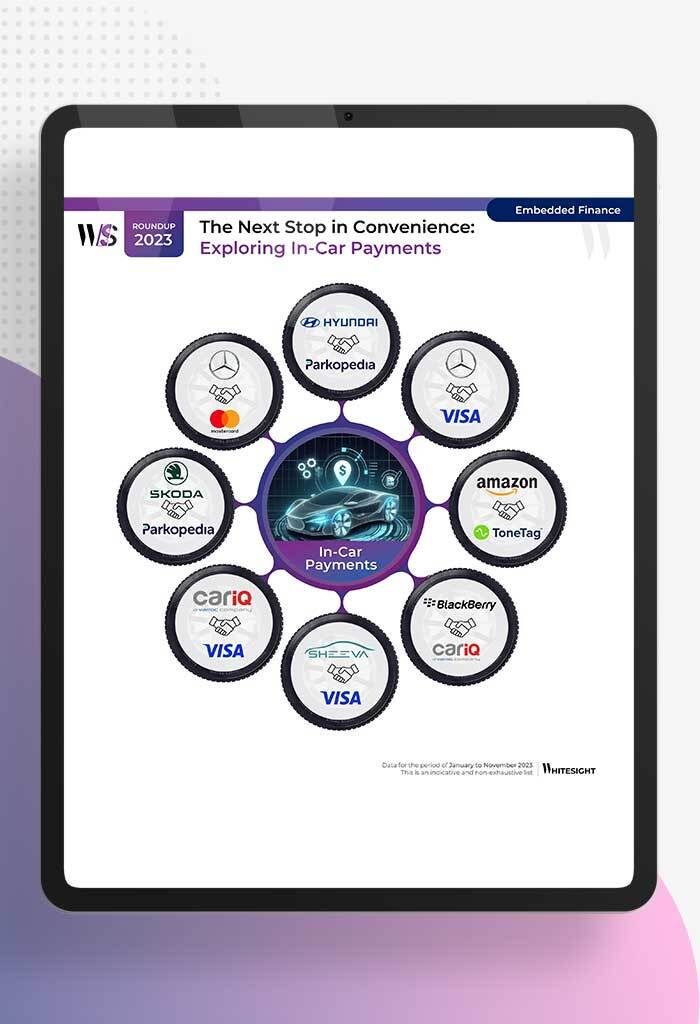

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

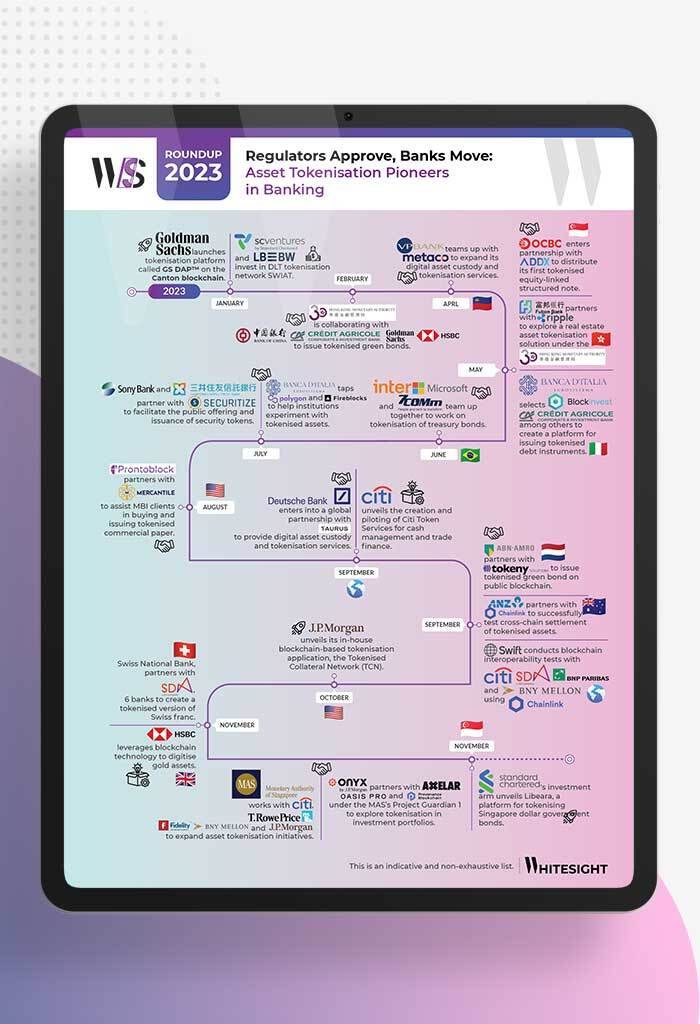

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

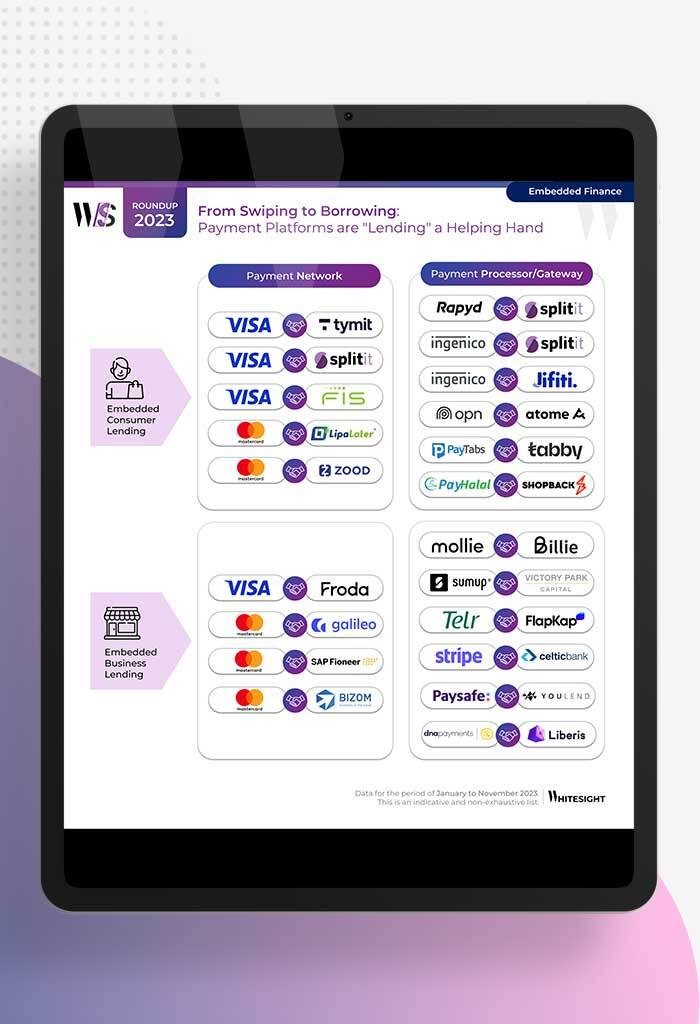

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...