2021 FinTech M&A Roundup: From Crisis to Consolidation

- Sanjeev Kumar and Afshan Dadan

- 5 mins read

- Fintech Strategy, Insights

Table of Contents

2021 has been a high octane year for mergers and acquisitions (M&As) in the FinTech world. The FinTech industry, which initially came to the fore on the promise of competitive disruption, has come through the ranks and has matured towards collaboration and consolidation. 2020 was a real testing time for FinTech when the pandemic put strenuous questions on the new-age business models. The industry as a whole has emerged from the crisis stronger and is aiming to reach new heights in this decade by joining forces with fellow disruptors, as well as the incumbents.2021 was a breakout year for M&As, where we witnessed massive consolidation across key FinTech sectors such as Digital Banking, Payments, Buy Now Pay Later (BNPL), Lending, Wealth Management, Insurance, FinTech Infrastructure, and Decentralized Finance (DeFi). Continuing with the tradition to analyze the most impactful fintech M&As that we started in 2020, we look at the consolidation trend in 2021.(Note: All non-USD deal values have been converted to USD for ease of analysis.) The Mega M&A Deals of 2021 In 2021, we witnessed over 10 billion-dollar deals within the FinTech industry. Square’s acquisition of Afterpay topped the charts with a whopping $29 billion deal. BNPL, being the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

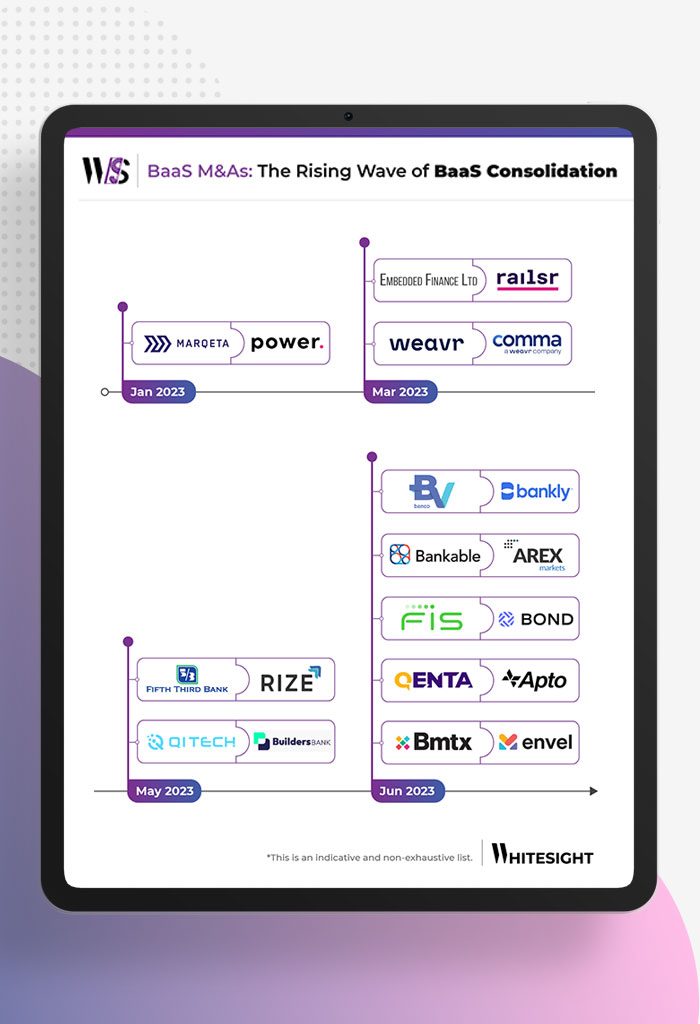

- Sanjeev Kumar and Kshitija Kaur

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

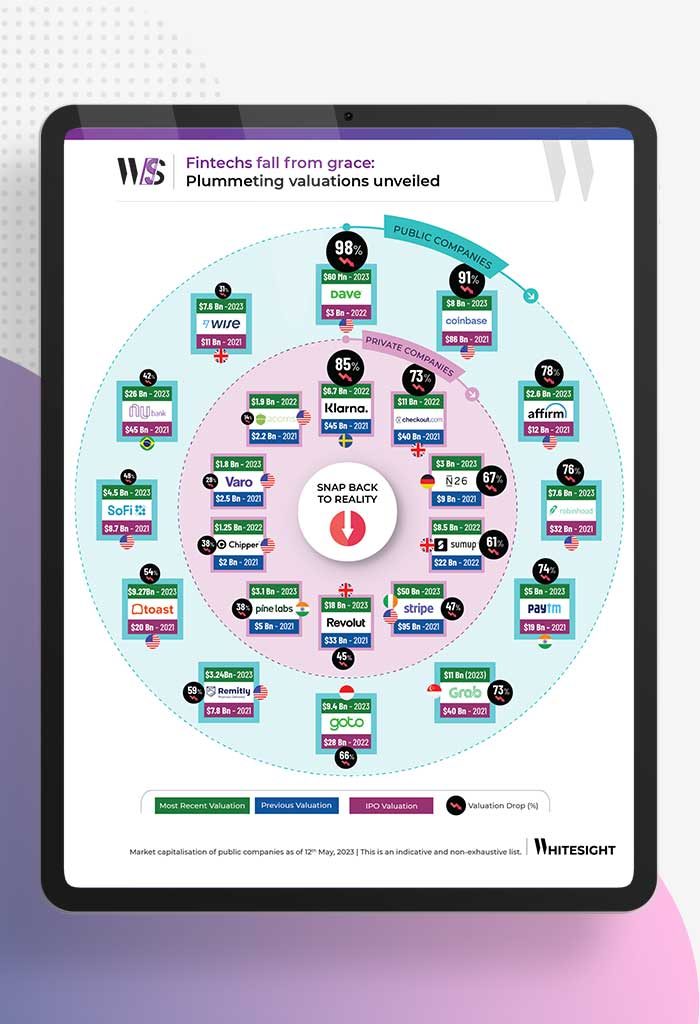

- Risav Chakraborty and Kshitija Kaur

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

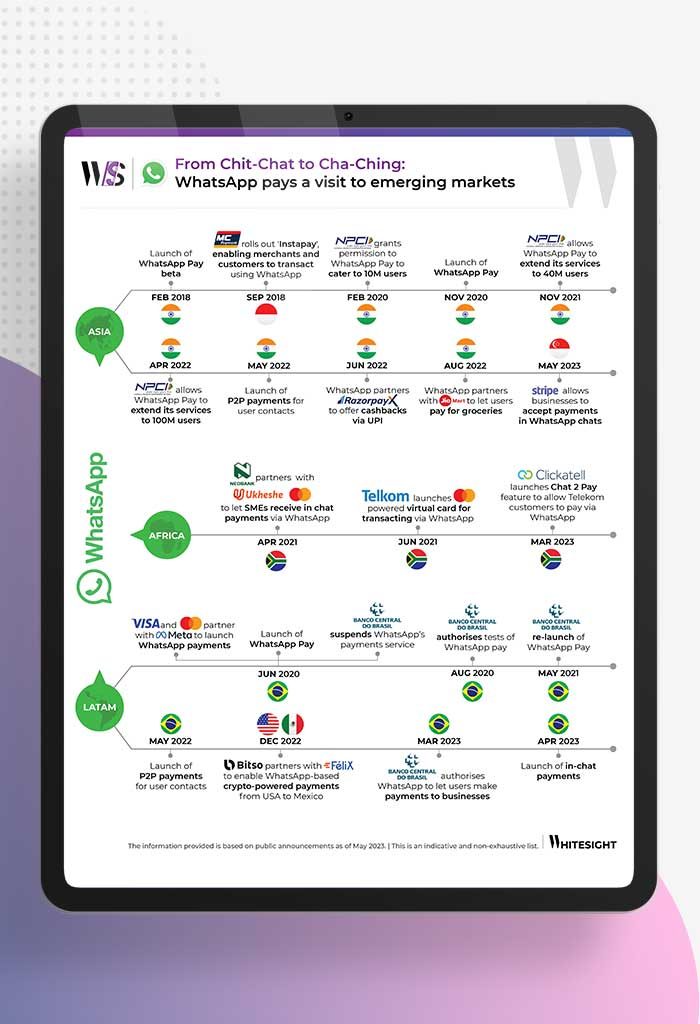

- Risav Chakraborty and Sanjeev Kumar

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

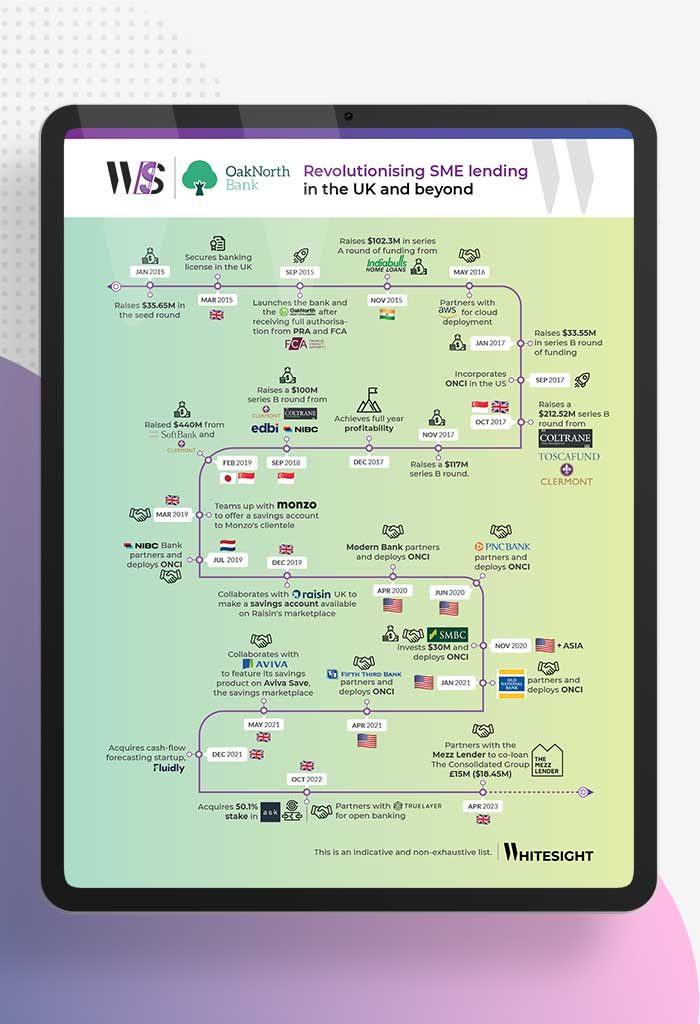

- Sanjeev Kumar and Samridhi Singh

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

- Afshan Dadan and Ananya Shetty

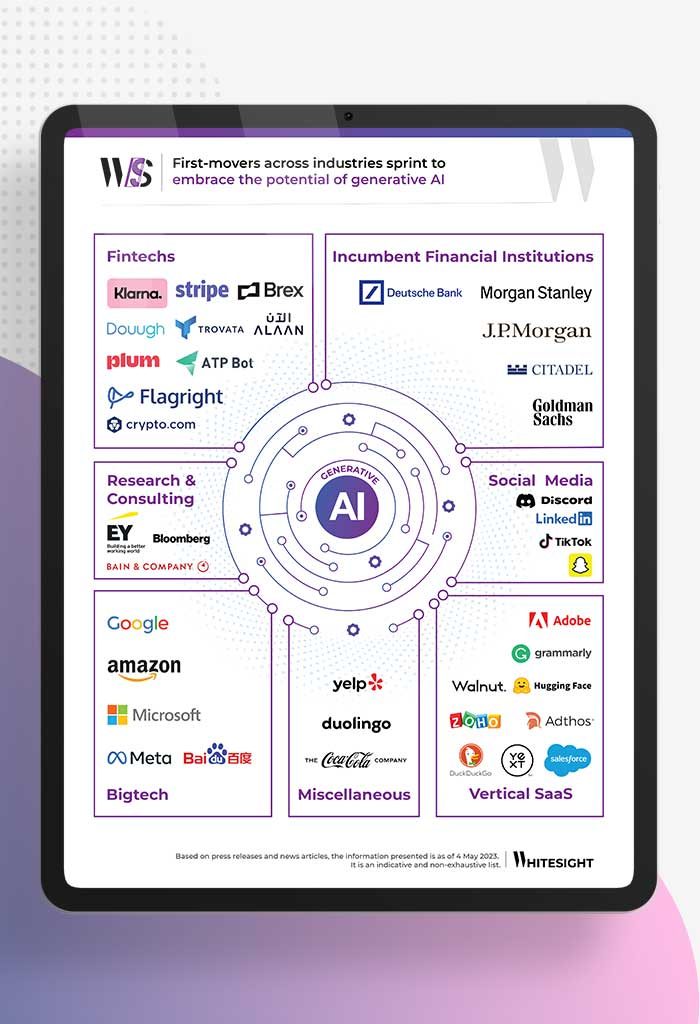

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...