Amazon’s Payments Adventures

- Sanjeev Kumar and Risav Chakraborty

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

Amazon’s Payments AdventuresFrom payments to lending to insurance to checking accounts – Amazon has been attempting a multi-pronged onslaught in financial services. The internet company has been supremely focused on building financial services that supports its core business objective of increasing participation in the Amazon ecosystem, and payments is an extremely important piece of this ecosystem participation puzzle. Digital and closed-loop payments solutions help Amazon to offer frictionless transactions to consumers and reduce cost of transactions that it pays to payment processing firms. Most importantly it helps Amazon unlock the value of financial data to aid its personalization objective. This quest to own a bigger piece of the Payments value chain has resulted in several run-ins with the incumbents and partnerships with the fintech disruptors. We look at Amazon’s Payment adventures during the last 30 months. The e-commerce giant and payment solutions provider Visa are back in the limelight this year, as in a recent turn of events, Amazon has decided to temporarily halt the ban on Visa credit cards in the UK – a decision taken by the online retailer in November 2021. We take a look at some of the key events that shaped the retail platform’s payments […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

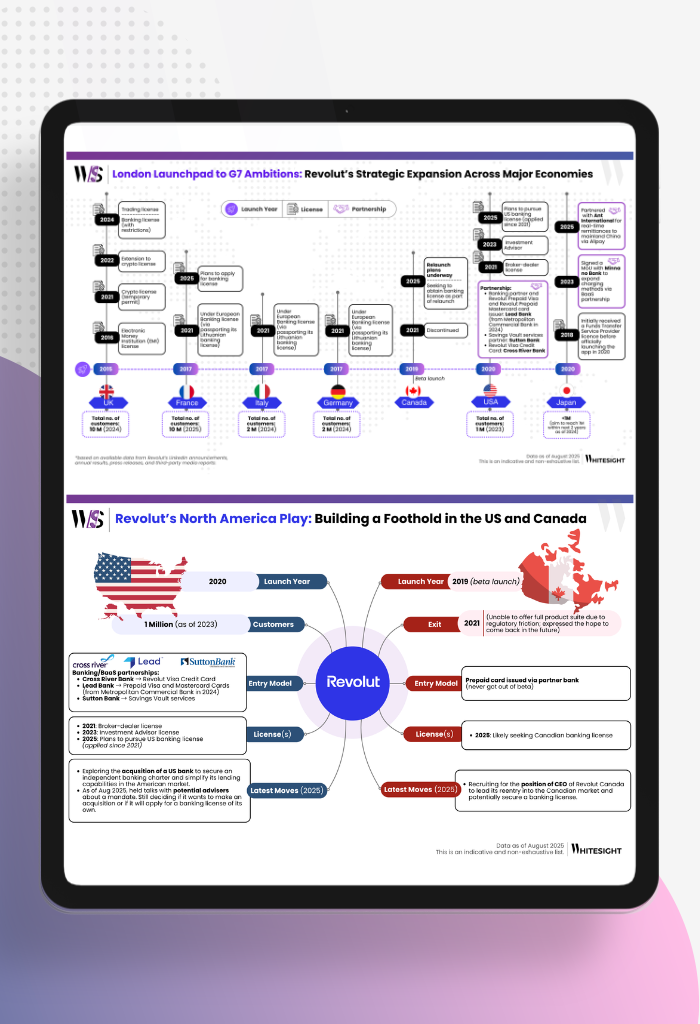

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty