Amazon’s Payments Adventures

- Sanjeev Kumar and Risav Chakraborty

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

Amazon’s Payments AdventuresFrom payments to lending to insurance to checking accounts – Amazon has been attempting a multi-pronged onslaught in financial services. The internet company has been supremely focused on building financial services that supports its core business objective of increasing participation in the Amazon ecosystem, and payments is an extremely important piece of this ecosystem participation puzzle. Digital and closed-loop payments solutions help Amazon to offer frictionless transactions to consumers and reduce cost of transactions that it pays to payment processing firms. Most importantly it helps Amazon unlock the value of financial data to aid its personalization objective. This quest to own a bigger piece of the Payments value chain has resulted in several run-ins with the incumbents and partnerships with the fintech disruptors. We look at Amazon’s Payment adventures during the last 30 months. The e-commerce giant and payment solutions provider Visa are back in the limelight this year, as in a recent turn of events, Amazon has decided to temporarily halt the ban on Visa credit cards in the UK – a decision taken by the online retailer in November 2021. We take a look at some of the key events that shaped the retail platform’s payments […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

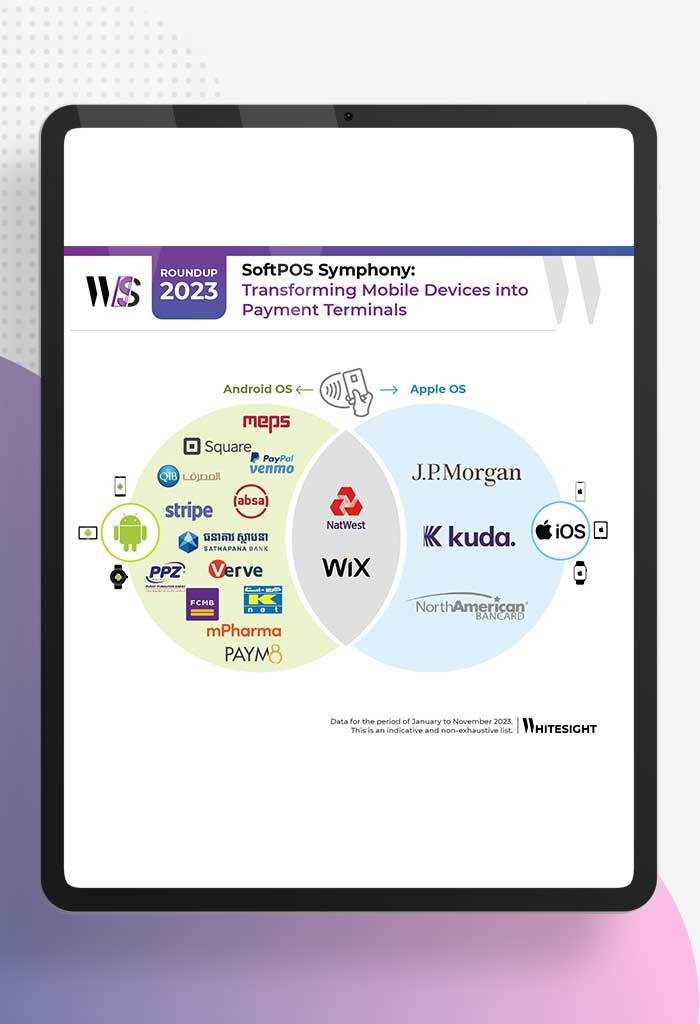

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

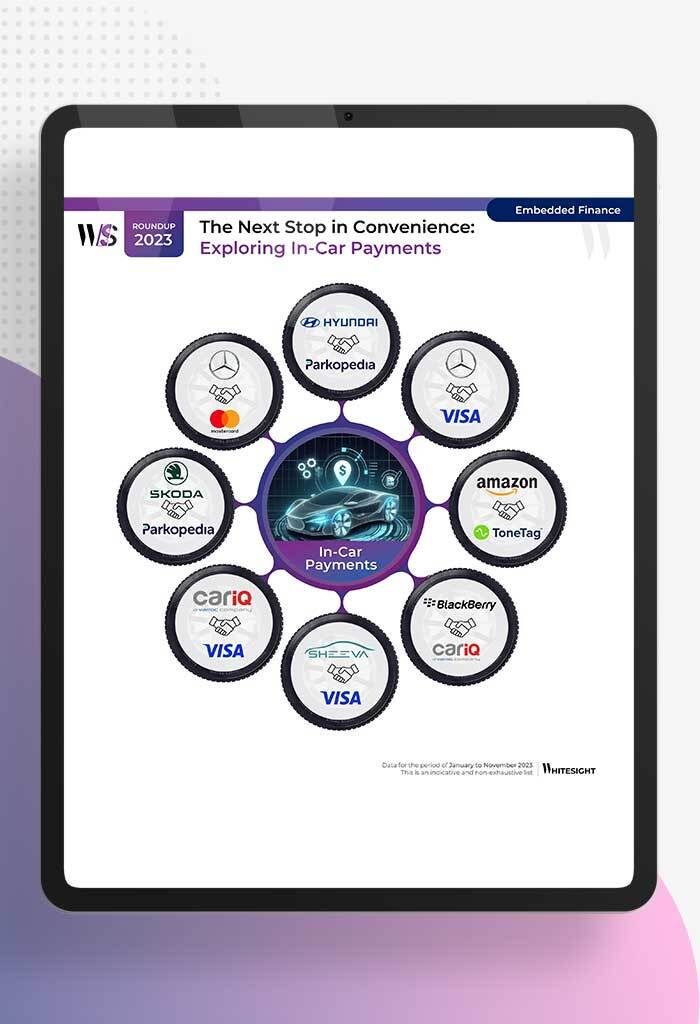

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

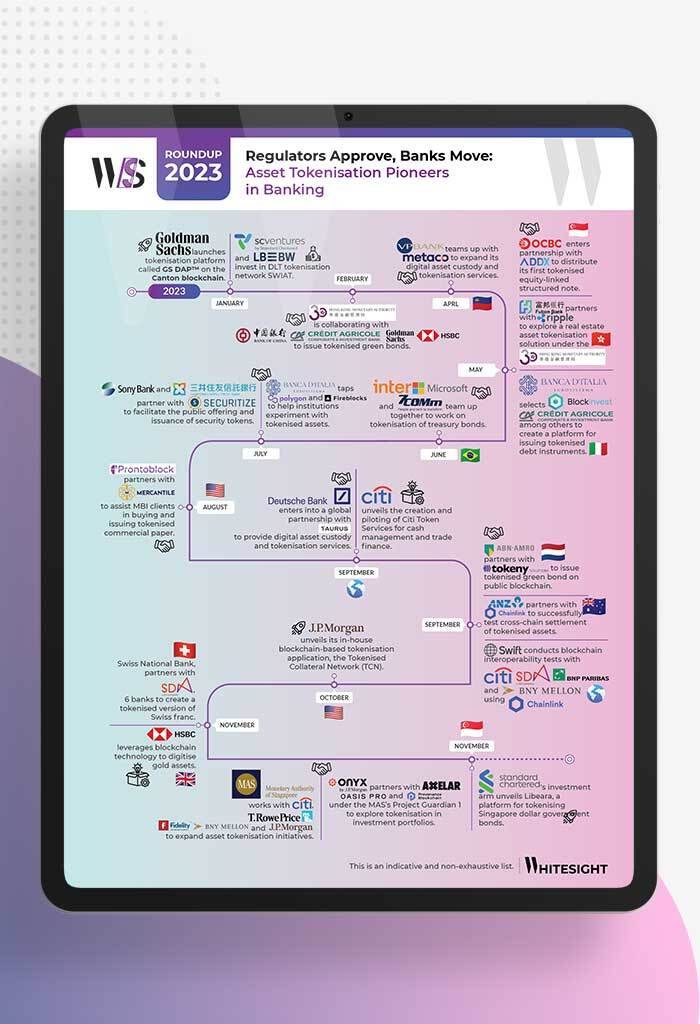

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

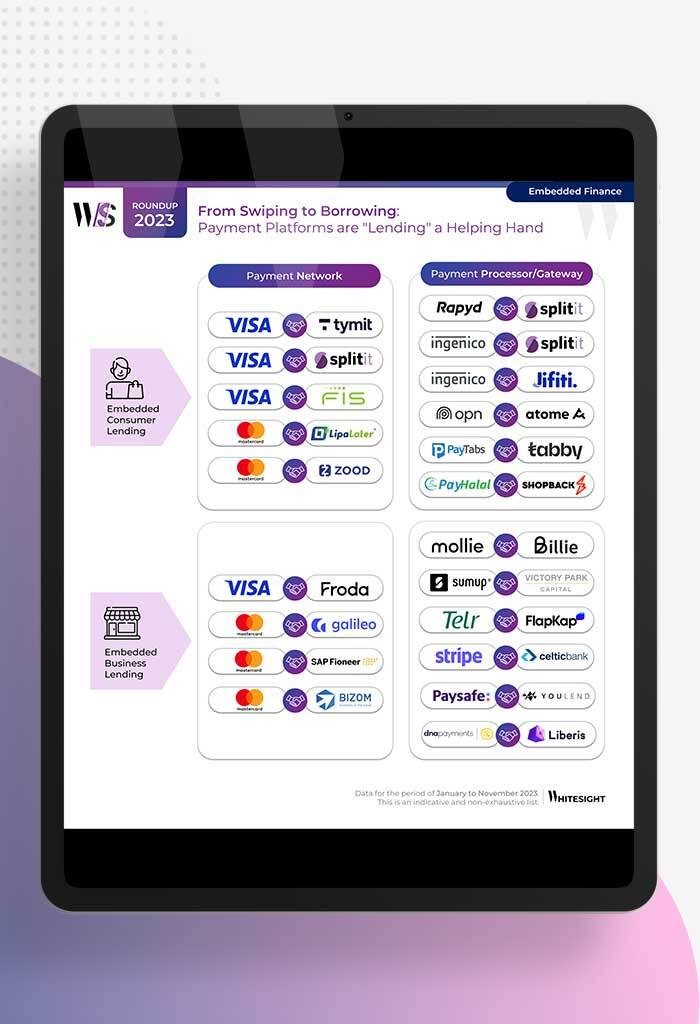

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

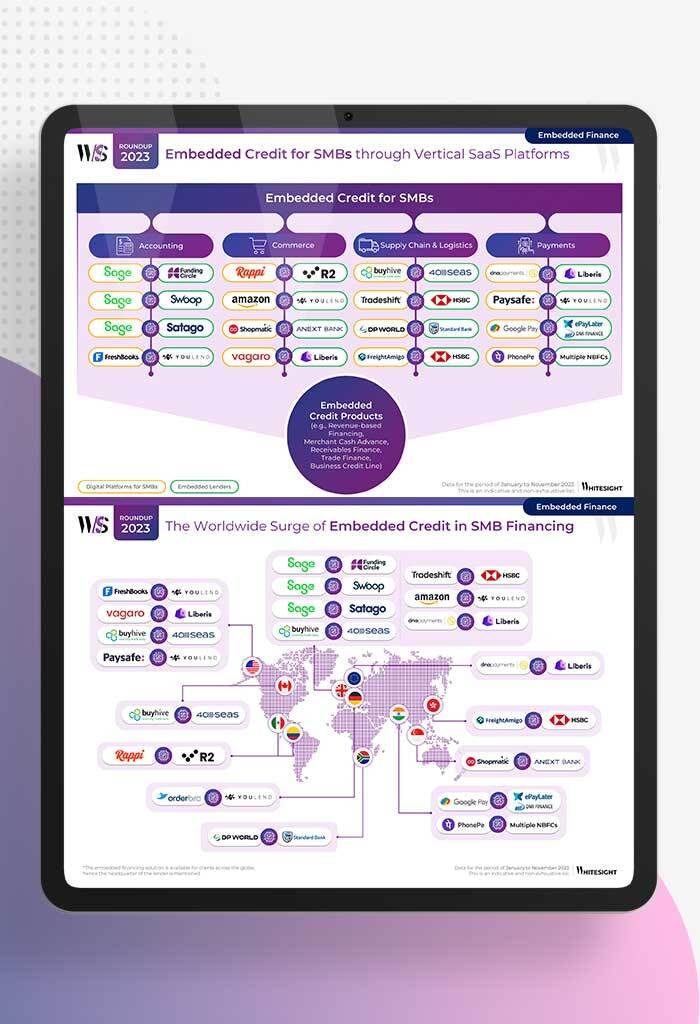

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...