An Apple A Day With FinTech In Play

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

An Apple A Day With FinTech In PlayIn Aug 2018, Apple became the first company in the world to hit a $1T market capitalization, followed by a $2T valuation just two years later and briefly crossed the $3T mark in the month of Jan, 2022. The tech giant had its genesis in the dreams of Stephen G Wozniak, who planned to develop his own computer. In 1976, Apple was co-founded by Steve Jobs, Stephen Wozniak and Ronald Wayne in the Jobs’ family garage – a story that resonates with everyone’s favorite start-up fairytale of a few close friends, a garage, and humble beginnings. Though the release of Macintosh in 1984 was a major milestone for the company, the tech goliath’s leap into prominence can be majorly credited to Steve Jobs’ second stint as the CEO starting 1997. Since the launch of the first iMac in 1998, Apple has always strived for innovation which has reflected in their investment and acquisition strategies. Their partnership with Walmart to launch voice activated grocery shopping via Siri and with Salesforce to facilitate developers build their own native applications are the perfect examples of Apple’s ambitions to actively expand its presence across industries, and also […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

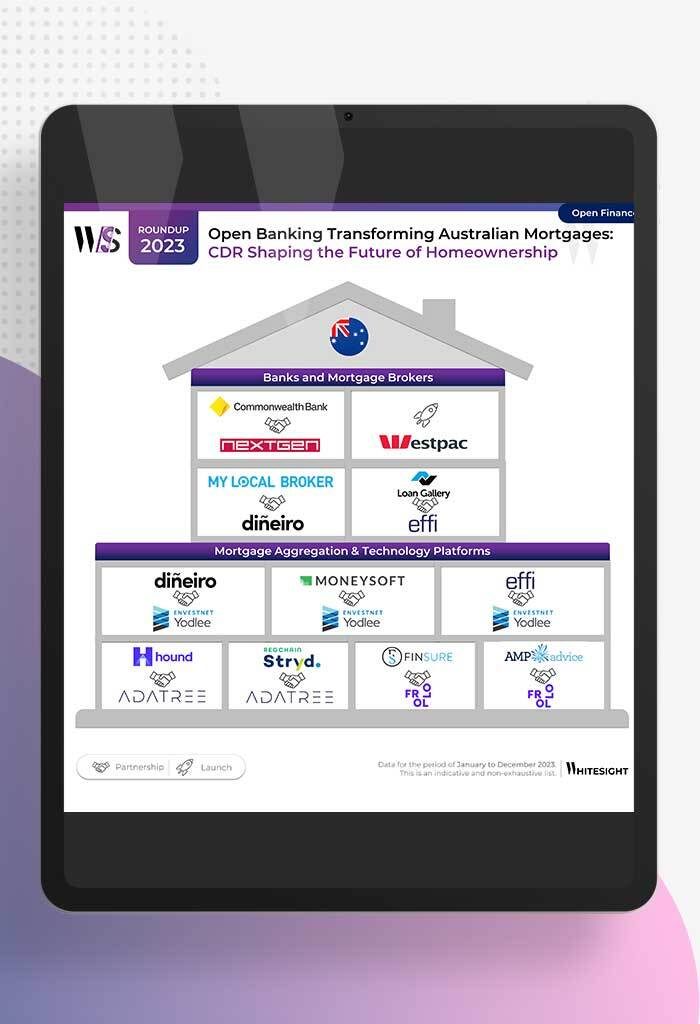

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

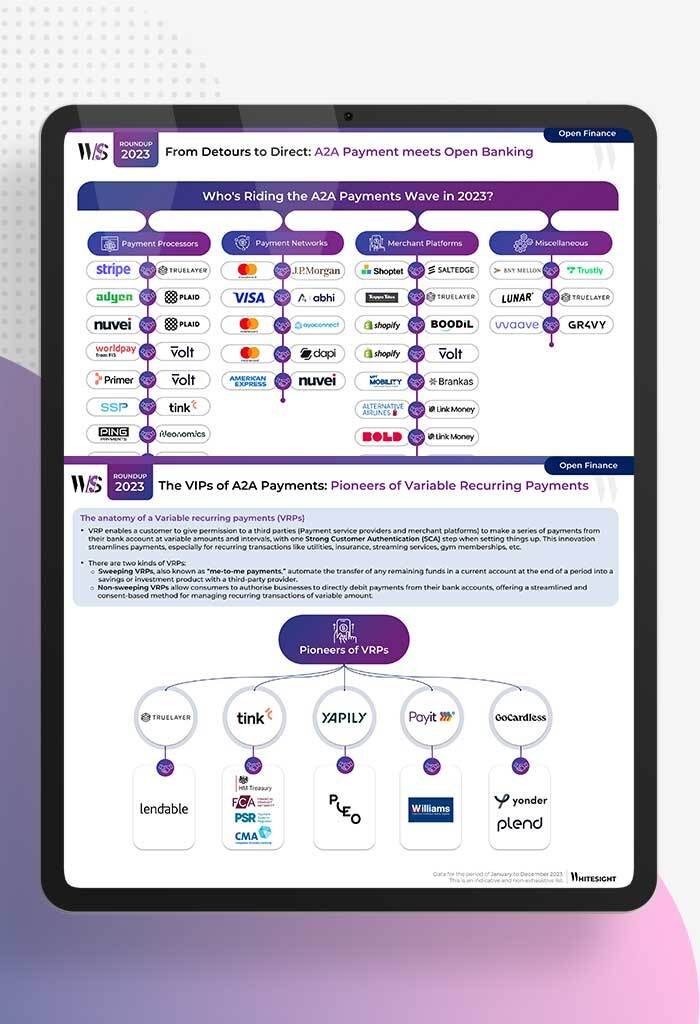

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

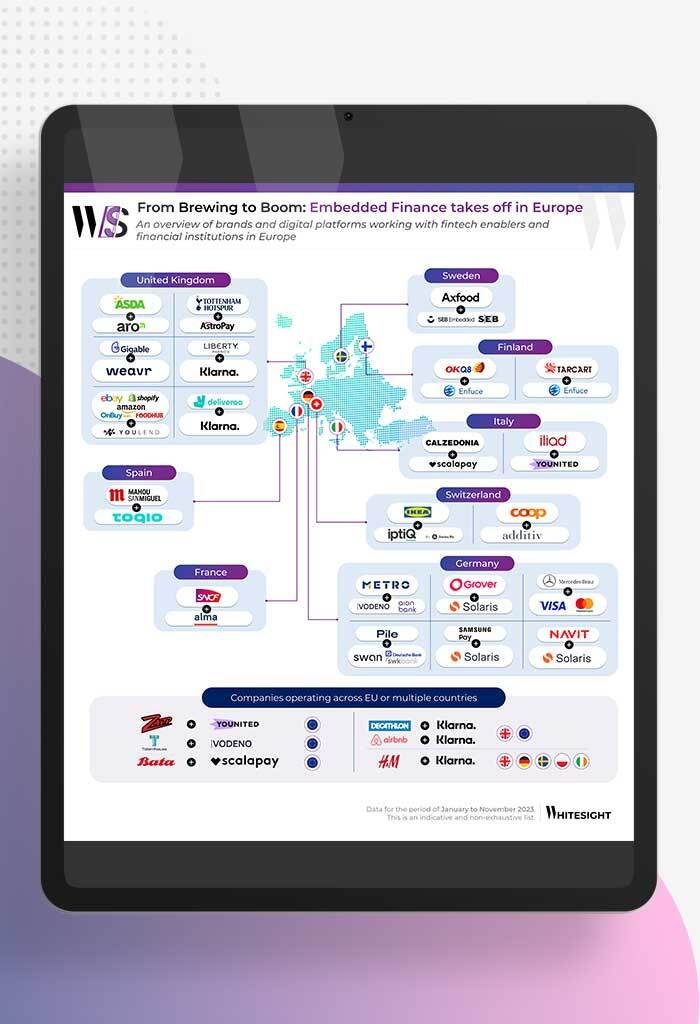

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

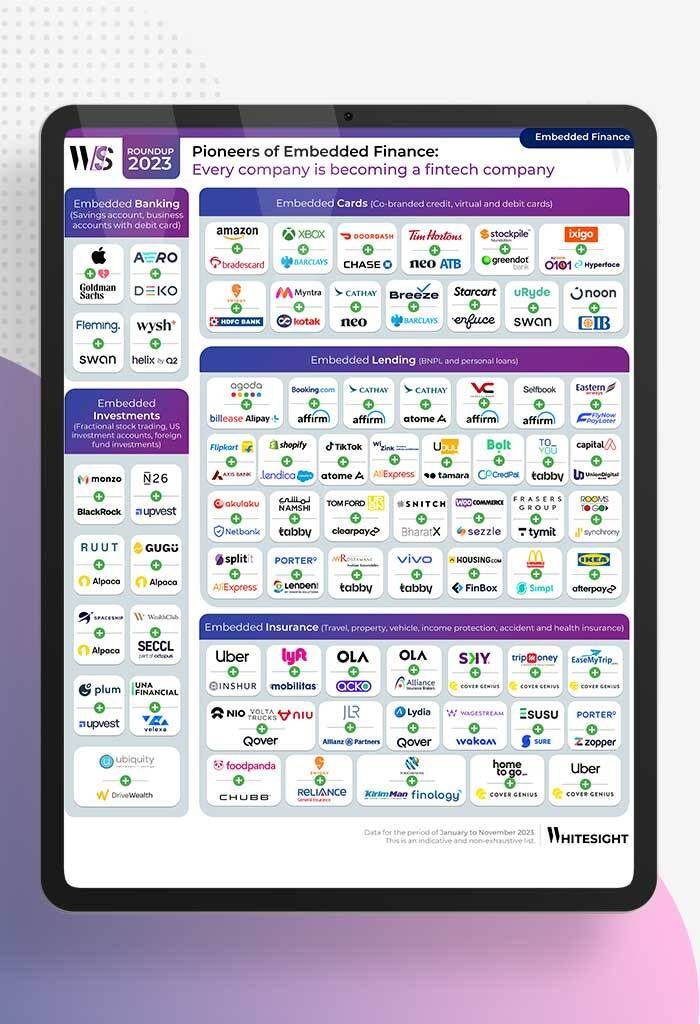

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...