Cloud-native Cores and Digital Banking Revolution

- Sanjeev Kumar and Risav Chakraborty

- 2 mins read

- Digital Finance, Insights

Table of Contents

Cloud-native Cores and Digital Banking RevolutionOne small step towards cloud-native cores, one giant leap towards digital finance! — That’s how the financial industry has been moving in 2022.Legacy infrastructure in banking has long been the elephant in the room, preventing financial institutions from personalising their services at scale. According to a report by Celent and Mambu, banks worldwide can save up to $246B by switching to a cloud-native architecture, including a 76% decrease in core spending and a 15% reduction in total IT costs over a five-year period.In 2022, we witnessed a massive influx of banks and FinTechs embracing cloud-native architectures by forging strategic alliances with modern core banking providers. The legacy systems that large financial institutions often rely on have left them marooned in technological quicksand. 80% of top bank executives believe that if they do not upgrade their technology to be more flexible and capable of supporting rapid innovation, the very existence of their company may be in jeopardy. With cloud-native core banking platforms, banks can personalise their services at scale as well as rapidly design, test, and deliver engaging experiences to customers.Incumbents across the globe are waking up to this notion of evolving dynamics as constant technological […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

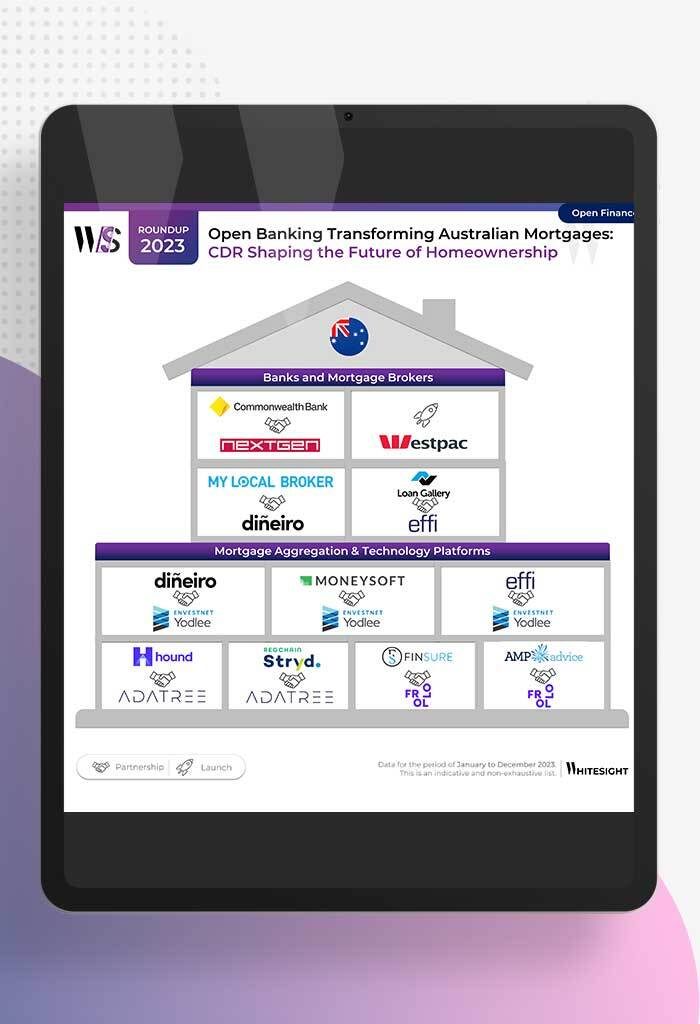

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

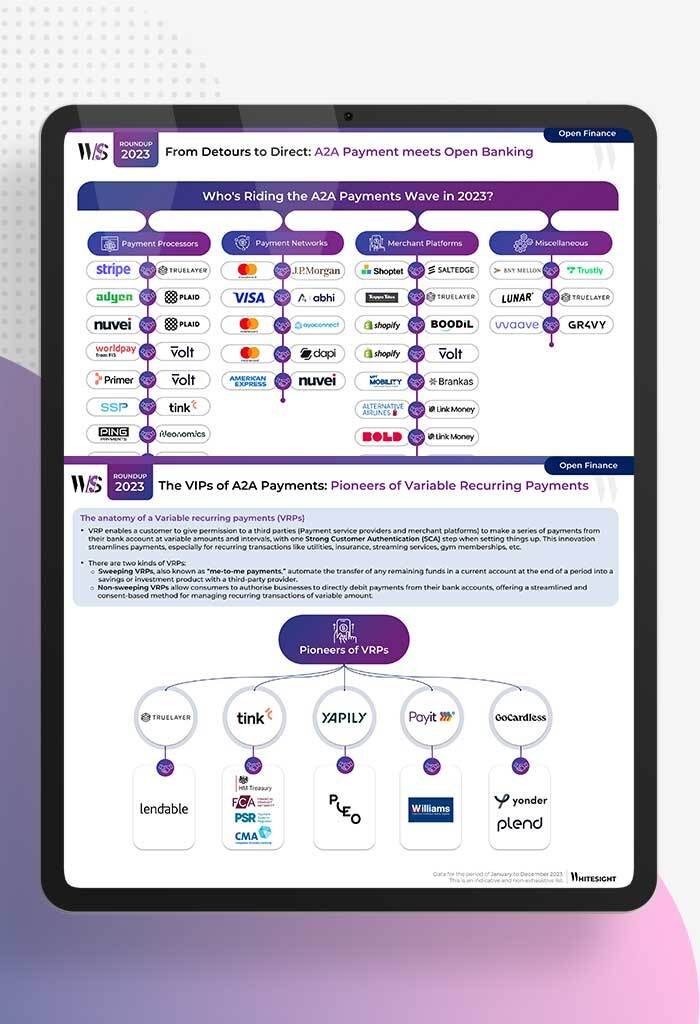

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

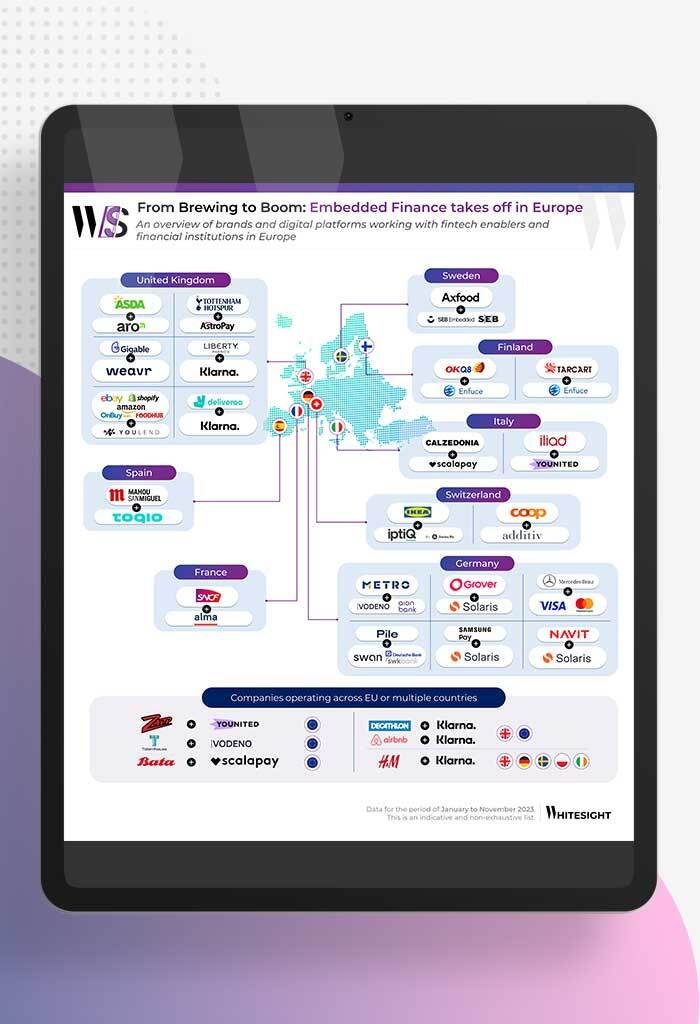

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

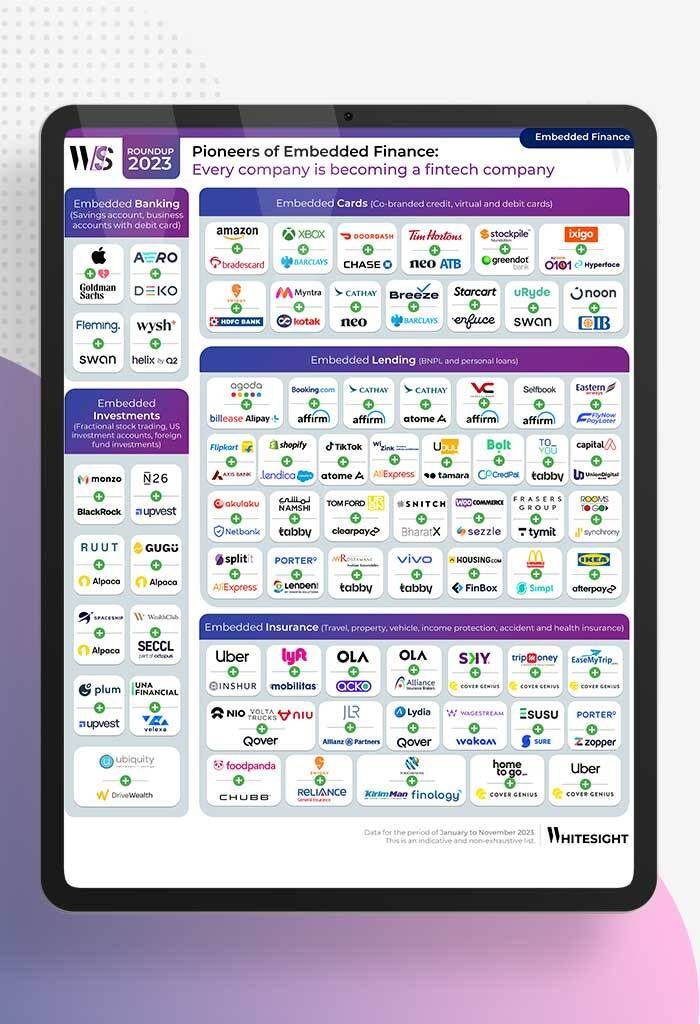

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...