Cloud-native Cores and Digital Banking Revolution

- Sanjeev Kumar and Risav Chakraborty

- 2 mins read

- Digital Finance, Insights

Table of Contents

Cloud-native Cores and Digital Banking RevolutionOne small step towards cloud-native cores, one giant leap towards digital finance! — That’s how the financial industry has been moving in 2022.Legacy infrastructure in banking has long been the elephant in the room, preventing financial institutions from personalising their services at scale. According to a report by Celent and Mambu, banks worldwide can save up to $246B by switching to a cloud-native architecture, including a 76% decrease in core spending and a 15% reduction in total IT costs over a five-year period.In 2022, we witnessed a massive influx of banks and FinTechs embracing cloud-native architectures by forging strategic alliances with modern core banking providers. The legacy systems that large financial institutions often rely on have left them marooned in technological quicksand. 80% of top bank executives believe that if they do not upgrade their technology to be more flexible and capable of supporting rapid innovation, the very existence of their company may be in jeopardy. With cloud-native core banking platforms, banks can personalise their services at scale as well as rapidly design, test, and deliver engaging experiences to customers.Incumbents across the globe are waking up to this notion of evolving dynamics as constant technological […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

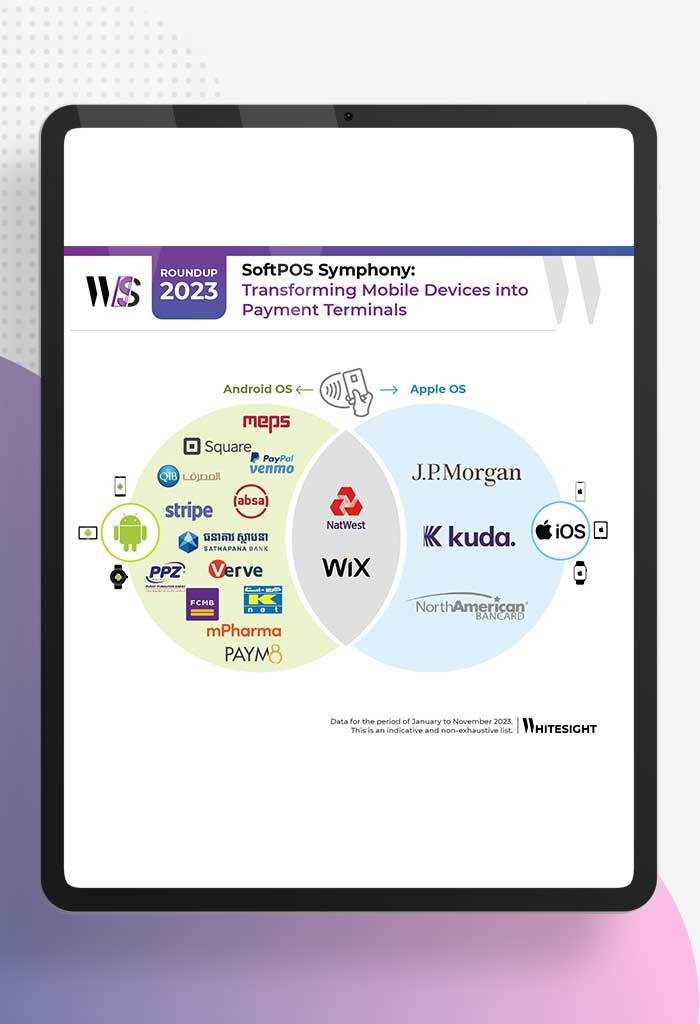

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

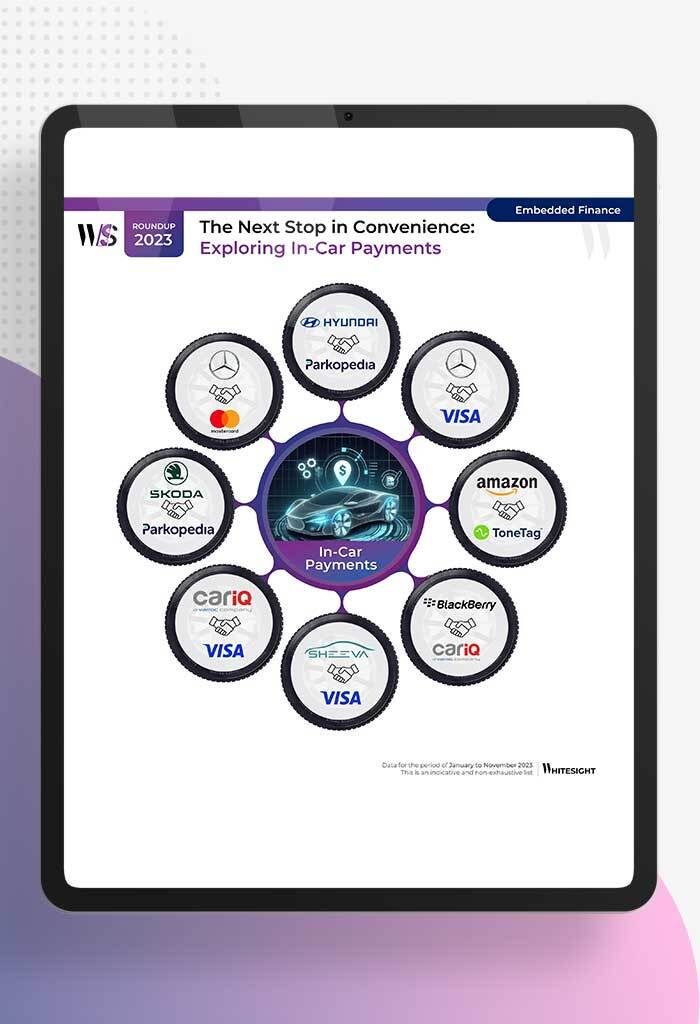

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

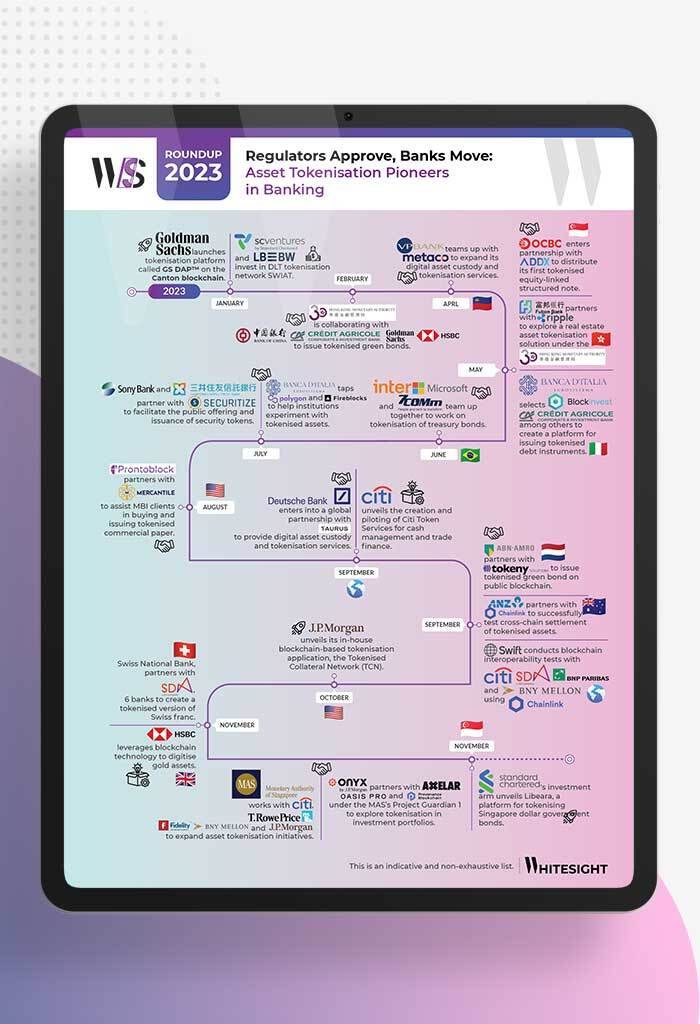

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

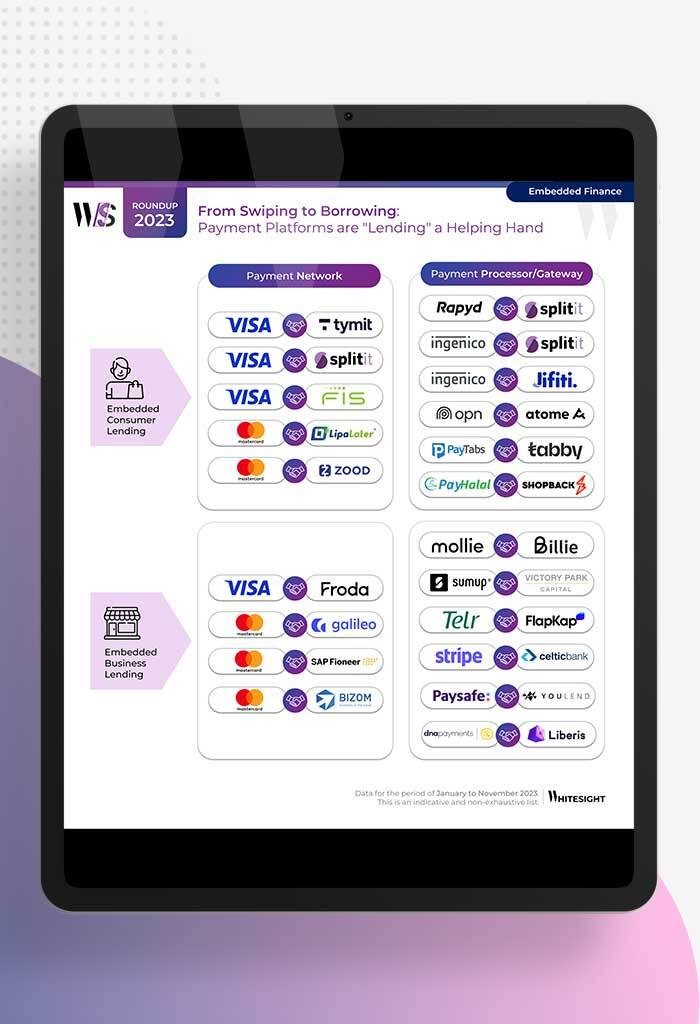

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

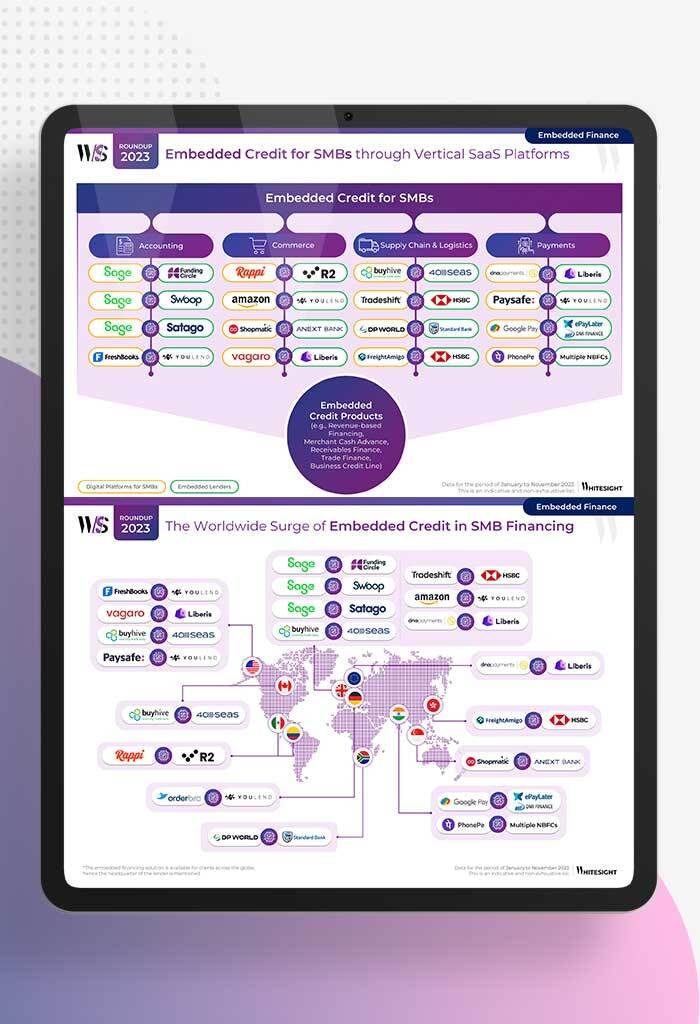

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...