How Saudi Arabia Engineered a Digital Payments Boom

- Sanjeev Kumar

- 5 mins read

- Digital Finance, Partnerships

Table of Contents

Behind Saudi Arabia's Digital Payments Surge

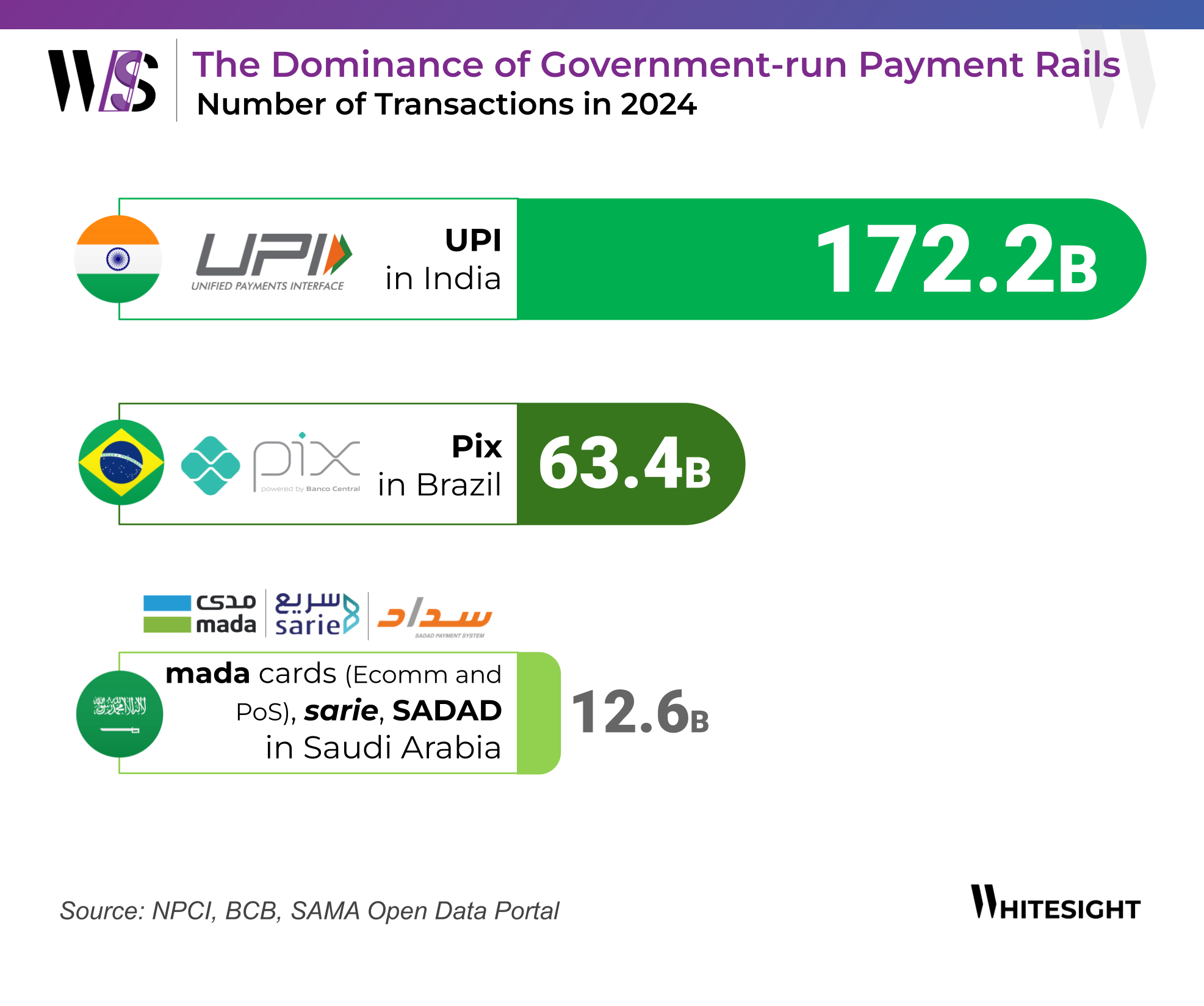

Everyone’s heard about Pix in Brazil and UPI in India – the poster children of digital payments. In 2024, Pix processed over 63 billion transactions, making it central to how Brazil moves money. UPI? It handled 172 billion transactions last year, up 46% from 2023.

These government-led platforms are loud, fast, and headline-grabbing. They get the global spotlight. But while the world watched Brazil and India rewrite digital payments playbooks, Saudi Arabia has been building something just as ambitious. The country is undergoing a significant transformation in its payments landscape, driven by Vision 2030’s ambitious goal of achieving 80% cashless transactions.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

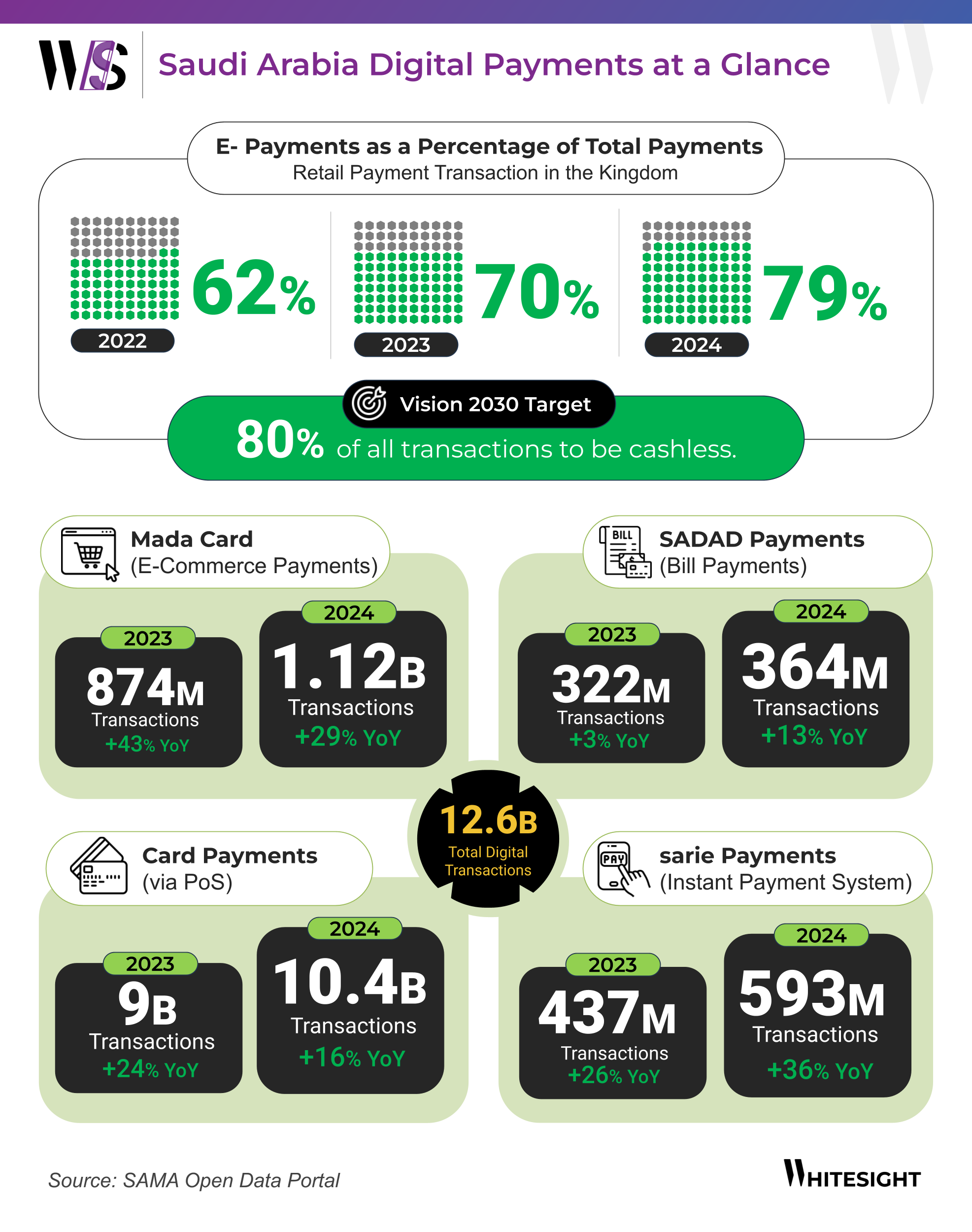

Saudi redesigned its payment rails with precision—from e-commerce cards to real-time bank transfers—until, almost suddenly, digital payments became the default. In 2024, 79% of all retail transactions in Saudi were electronic, up from 70% in 2023. Back in 2019, the number of cashless transactions was a measly 36% of total transactions. A leap that didn’t just happen, it was architected—from the top down(by government and regulators) and from the ground up (by fintechs, banks and tech platforms).

Mada: From Domestic Card Network to E-Commerce Default

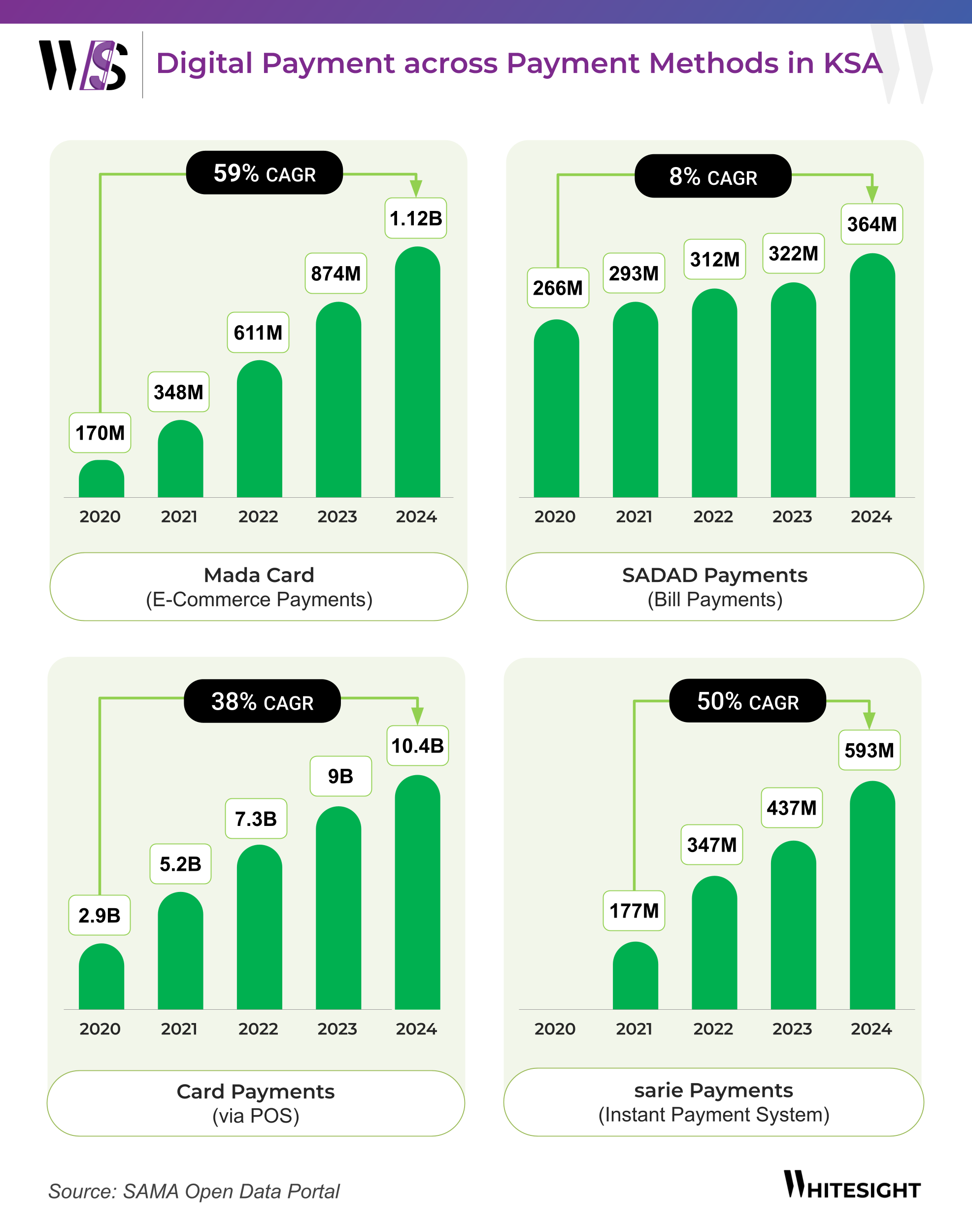

Mada started as a local card network – introduced in 2015 by Saudi Payments under SAMA to rebrand the older SPAN system. It was designed to be cost-effective than the global card networks and easier for banks to integrate. But its e-commerce play took longer. For years, online merchants defaulted to global rails. That changed fast. Between 2020 and 2024, Mada’s e-commerce transactions grew from 170 million to 1.12 billion. That’s a 59% CAGR.

The Central Bank pushed tokenization and biometric security measures for contactless Mada payments. That meant consumers could shop online—or in-store—with a fingerprint or face ID and zero friction.

Point-of-Sale: Contactless Payments Scaling Steadily

While e-commerce and instant payments steal the spotlight, PoS card payments in Saudi Arabia have been quietly stacking up impressive numbers. In 2020, Saudis swiped or tapped their cards at physical terminals 2.9 billion times. By 2024, that number more than tripled to 10.4 billion transactions, clocking a solid 38% CAGR.

What’s driving it? For starters, widespread rollout of contactless PoS terminals, especially since COVID. Apple Pay’s launch in 2019 and Samsung Pay’s rollout in 2024—both with native Mada support—gave mobile wallets serious traction. With Google Pay set to go live this year, the momentum is only picking up speed. SAMA has also issued new licenses to merchant acquirers, opened the gates for QR code acceptance, and incentivised PoS adoption in Tier 2 cities.

SADAD: The Bill Payment Infrastructure

Launched in 2004, SADAD was one of Saudi’s earliest payments experiments: a centralised platform for paying bills—utilities, telecom, traffic fines, and more. SADAD currently has over 300 billers, including both government organisations and non-government ones.

SADAD has been steadily scaling. In 2020, it handled 266 million transactions. By 2024, that number reached 364 million, growing at a modest but stable 8% CAGR. But SADAD’s real impact isn’t just in volume—it’s in invisibility. Over the last few years, SADAD has been embedded into major mobile banking apps, fintech wallets, and utility portals. From electricity bills to traffic fines, users now settle payments with a few taps, often without even realising they’re using a government rail.

sarie: The Crown Jewel of Instant Payments

In early 2021, Saudi launched sarie, a real-time payments system designed to move money between banks instantly—24/7, 365 days a year. It was a joint project between Saudi Payments, IBM, and Mastercard, with government backing and API-first architecture.

sarie started with 177 million transactions in its first year. Fast forward to 2024, and that number has surged to 593 million—marking a 50% CAGR in just three years. Behind the scenes, sarie has become a default layer for everyday transfers—from peer-to-peer payments and salary disbursements to small business payouts and bill splits. For users, sarie means no waiting and no delays. For businesses, it unlocks faster liquidity, real-time reconciliations, and a gateway to smarter financial flows. It’s real-time infrastructure for a real-time economy.

Payments as Saudi Fintech’s Launchpad

This surge in digital payments is as much a story of policy or infrastructure as it is of the success of Saudi Arabia’s fintech ecosystem. According to Fintech Saudi’s 2023 annual report, more than 72 fintech companies were actively operating in the payments space. That’s one-third of all fintechs in the country—a clear signal that payments are not just the entry point, but the engine of Saudi’s financial innovation.

And the next wave of fintech is already being built on the rails Saudi laid itself. As Mada expands, sarie accelerates, SADAD deepens —fintech players are expected to building new layers on top: from embedded payments and cross-border flows to pay-by-bank checkouts. ____

2025 feels like Saudi’s breakout year.

Mada scaling. sarie humming. SADAD embedded. Fintechs building on top.

Not a surprise—just years of groundwork paying off.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

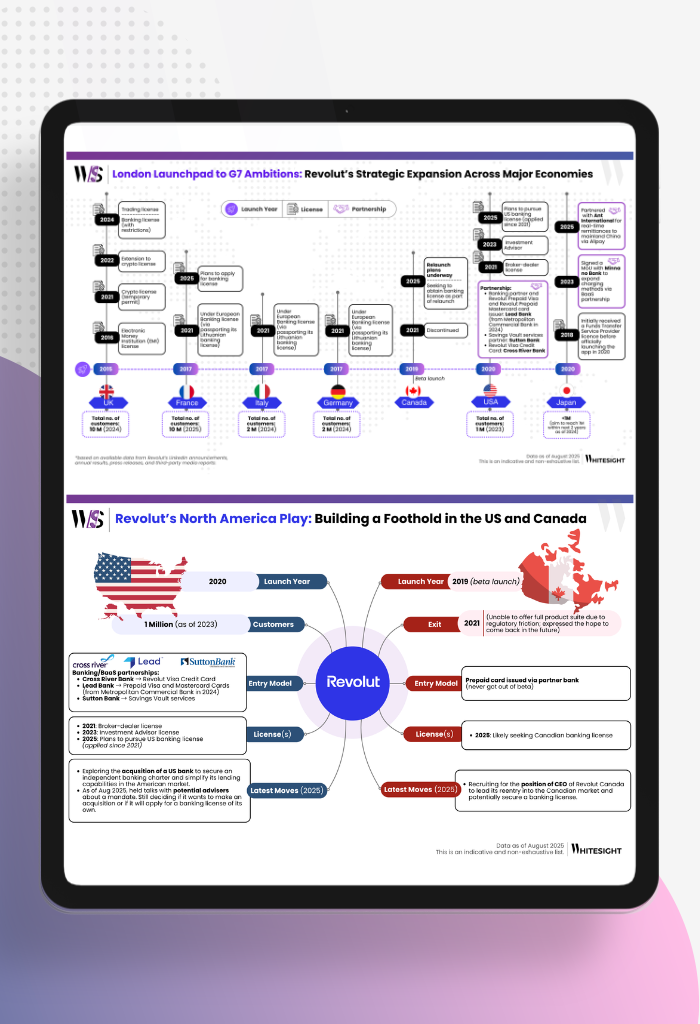

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty