Marcus: An Expedition from Wall Street to Main Street

- Sanjeev Kumar and Risav Chakraborty

- 5 mins read

- Digital Finance, Insights

Table of Contents

In 1869, a German immigrant named Marcus Goldman moved to New York City to launch a new business targeted at small businesses to help them secure short-term capital. Over the next few years, Marcus Goldman’s son, Henry Goldman, and son-in-law, Samuel Sachs, joined him, and the firm became a partnership with a new name: Goldman Sachs & Co.Over the next century and a half, the firm turned itself into a giant, announcing an annual revenue of $59.34B and annual net earnings of $21.64B in 2021. Approximately 98% of the annual revenues came from Investment Banking, Global Markets, Asset Management, and Wealth Management businesses.In this blog, we look at the digital bets Goldman has made on its diversification strategy towards building a consumer-centric digital finance business – Marcus by Goldman Sachs.Marcus, from the outside, may look like an innocuous neobank initiative aimed at unlocking retail banking opportunities for the global investment bank, but look deeper, and it seems like a riddle wrapped in a mystery inside an enigma.The firm’s evolutionary tale from ‘Goldman Sachs by Marcus’ to ‘Marcus by Goldman Sachs’ is an exciting one, especially given that the neobanking sector has faced a slew of failures and setbacks in recent […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

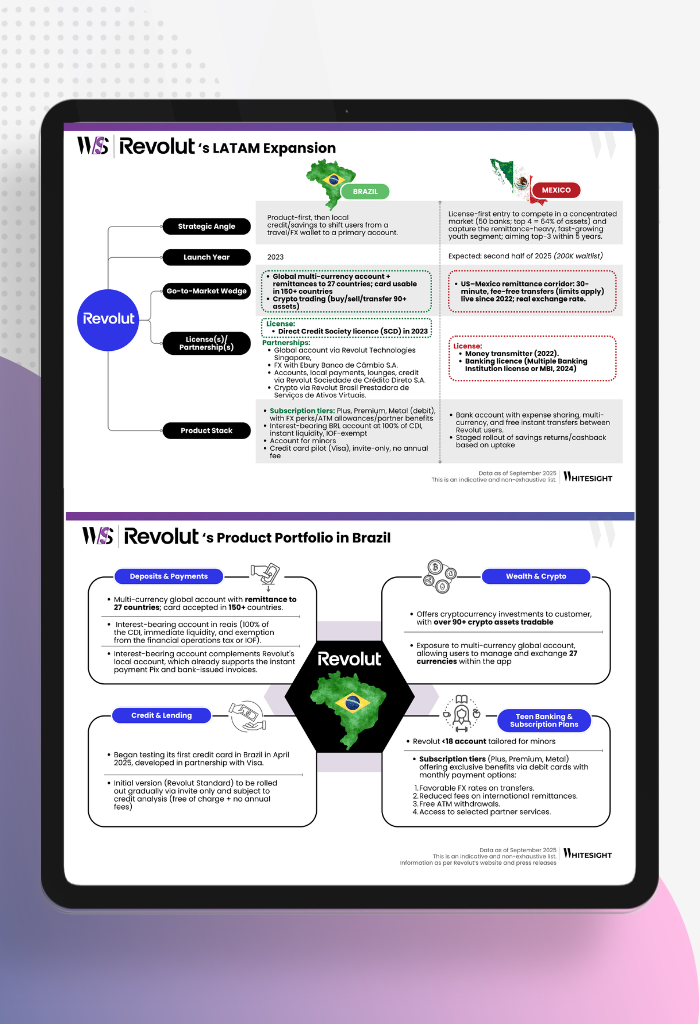

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

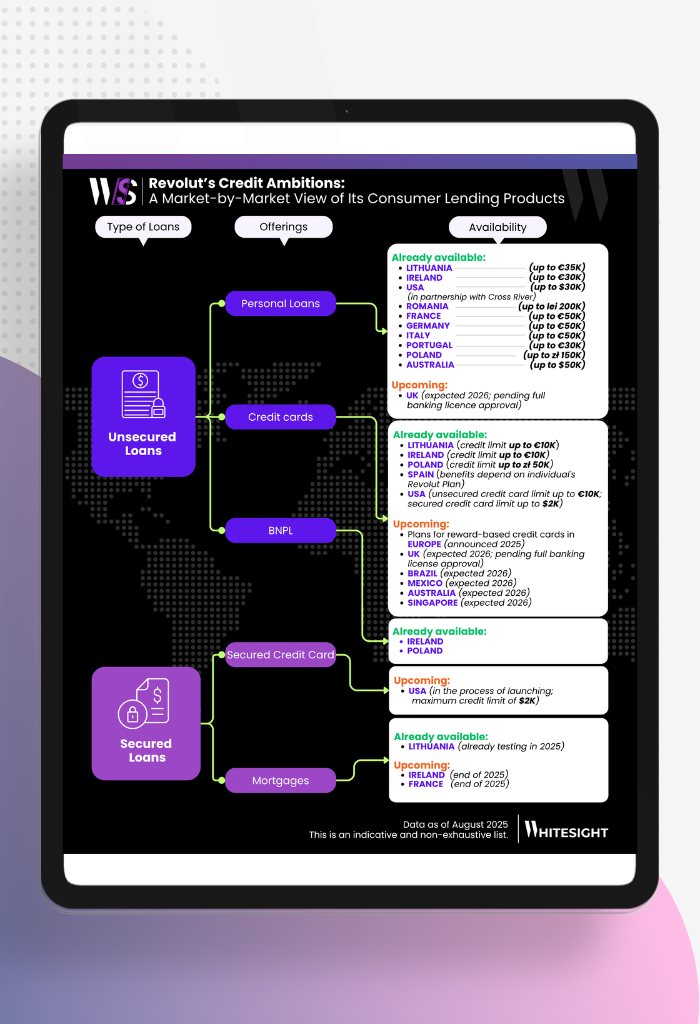

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

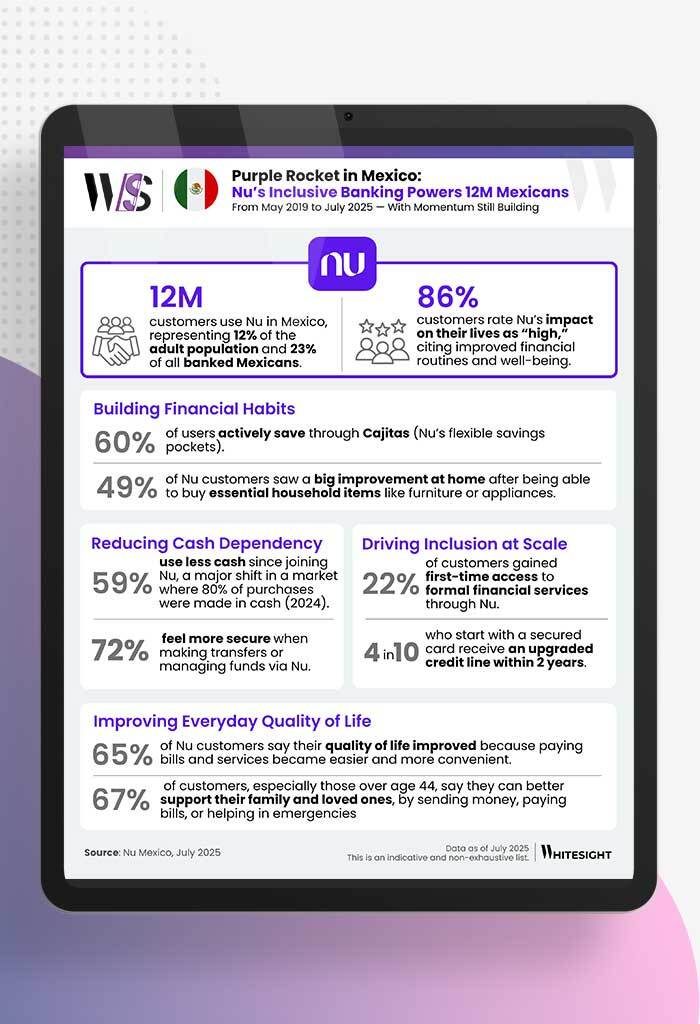

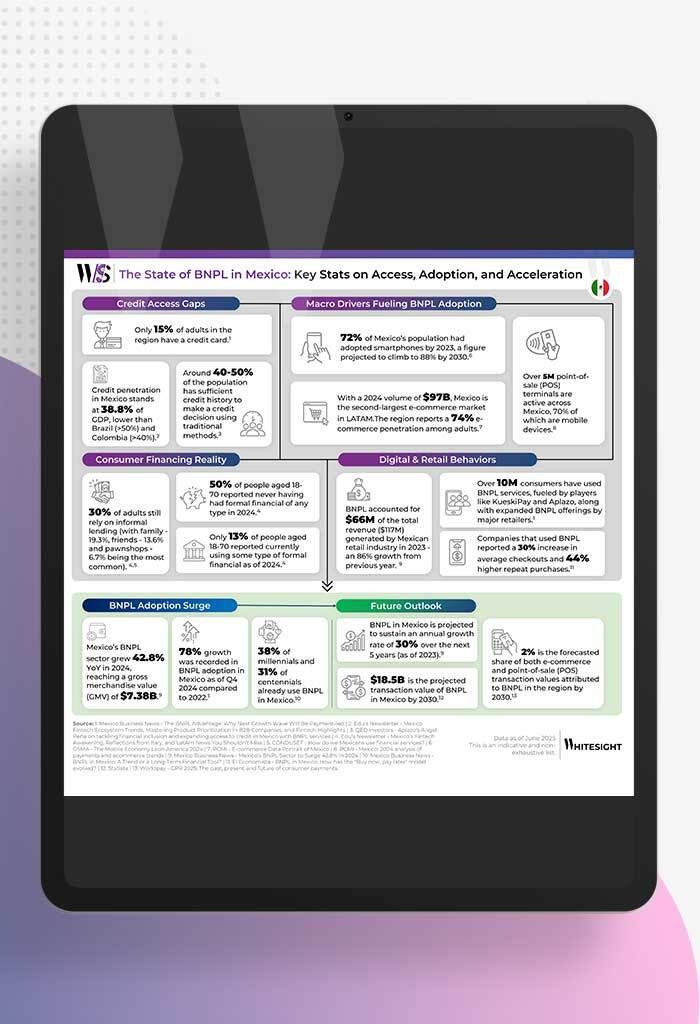

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar