Monzo’s Wealth Playbook: Turning Gen Z Savers into Tomorrow’s Investors

- Sanjeev Kumar and Risav Chakraborty

- 7 mins read

- Digital Finance, Partnerships

Table of Contents

What Nubank Did with Credit, Monzo Wants to Do with Wealth

What do Brazilians with purple credit cards and Brits with coral debit cards have in common? Both signal a banking revolution that started with one bold, counterintuitive move.

In Brazil, Nubank revolutionised the credit landscape. For decades, big banks dominated a market where half the population lacked access to credit, with interest rates north of 400%. Credit access was either nonexistent or prohibitively expensive for most Brazilians, until Nubank stepped in. By offering no-fee, app-based credit that arrived in days, it unlocked credit access and became the financial gateway for an underserved generation. It continued to expand its portfolio with discipline, further building a secured lending portfolio where repayment was automatic, predictable, and often backed by collateral. Our Nubank’s Secured Lending Portfolio blog unpacks how this approach redefined inclusion by turning credit into a confidence-building tool for millions. Credit was the wedge; scale followed.

Nubank cracked the code to scale and profitability, in one of the toughest markets in the world. With 114M+ users and a model built for cost-efficiency, it’s setting new standards for fintech success.

WhiteSight’s latest deep dive analyses the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

Report

In the UK, access isn’t the issue, guidance is. Most people already have current accounts and healthy savings balances. Yet for years, traditional banks have made building wealth feel like a puzzle with missing pieces: no clear path from saving to investing, limited education on where to start, and fragmented tools that don’t integrate across savings, spending, and investments. Savings accounts offer safety but minimal growth, with returns often barely covering inflation. Investments feel complicated and intimidating. They are full of jargon, lengthy onboarding forms, and high minimum investment amounts that make entry feel out of reach for younger or first-time investors. Platforms rarely explain risk in plain language, and most people don’t know how much to start with or what to expect. Pensions feel distant and opaque because they’re scattered across multiple employers, hard to access digitally, and buried under technical paperwork and unclear fee structures. This is the wedge that Monzo is going after. The challenge isn’t access to several siloed accounts and financial instruments, it’s to bridge the gap between saving and growing customers’ money confidently.

- Households sit on more than £1.9T in cash savings (Bank of England, Sep 2025). However, much of it is languishing in low-yield accounts.

- At the same time, consumer confidence is rising. According to Moneybox, 41% Brits now feel ‘very confident’ managing their finances, up from 32% in 2024, and 84% feel confident in their ability to save.

- Younger generations, often drawn to higher-risk, high-reward opportunities, are leading the charge. In the UK, 68% Gen Z and 65% Millennials have invested at some point in their lives.

- Yet, only 21% feel very confident with their retirement planning. Nearly 17% UK adults still have no private pension, especially among the young, low-income, and self-employed (FCA, 2024).

- Still, the figure has doubled from 11% in 2024. Moreover, data from FCAshowed that 75% of UK adults had some private pension provision in 2024.

Here, Monzo spotted a first-mover opportunity just like Nubank, but instead of credit, its proposition is wealth. If the future of finance is digital, then helping people start small, build habits, and grow their money over time within the same app they already budget, spend, and save in could be a game-changer. Its pitch? Start with a Savings Pot, graduate to an Exchange Traded Fund (ETF), and one day consolidate your pension. The strategy is simply about being a financial control center: the place where customers grow not just their money, but their financial confidence, step by step.

The Path from First Pot to Future Pension

Monzo’s wealth play can be understood as a ladder that customers climb step by step: starting with short-term savings, moving into medium-term investments, and eventually planning for retirement. Each stage lowers barriers for Gen Z and Millennials while deepening their trust in Monzo, turning everyday savers into long-term wealth builders.

Stage 1 | Short-term: turning small pots into sticky habits

The first rung was deceptively simple: the humble Pots. These were goal-based piggy banks that gave first-time savers a simple way to ring-fence money for goals (from holidays to rent buffers), and in doing so, turned intention into habit. They quickly caught on, with over 300K created each month by 2021–22. A year later, Savings Pots arrived, paying 1% interest in partnership with Investec, showing young users that even small balances could grow. By 2023, the feature matured into Instant Access Savings Pots, with up to 3.5% AER and instant withdrawals. For Gen Z and Millennials, this was their first taste of seeing money grow rather than just sit idle, a crucial step in building short-term wealth and financial confidence. By passing on Bank of England rate hikes, Monzo turned saving into a habit with tangible rewards.

Within a year, 1.3M customers saved £7.7B, earning £130M interest, helping Monzo scale deposits to £16.6B and cement loyalty on its path to profitability.

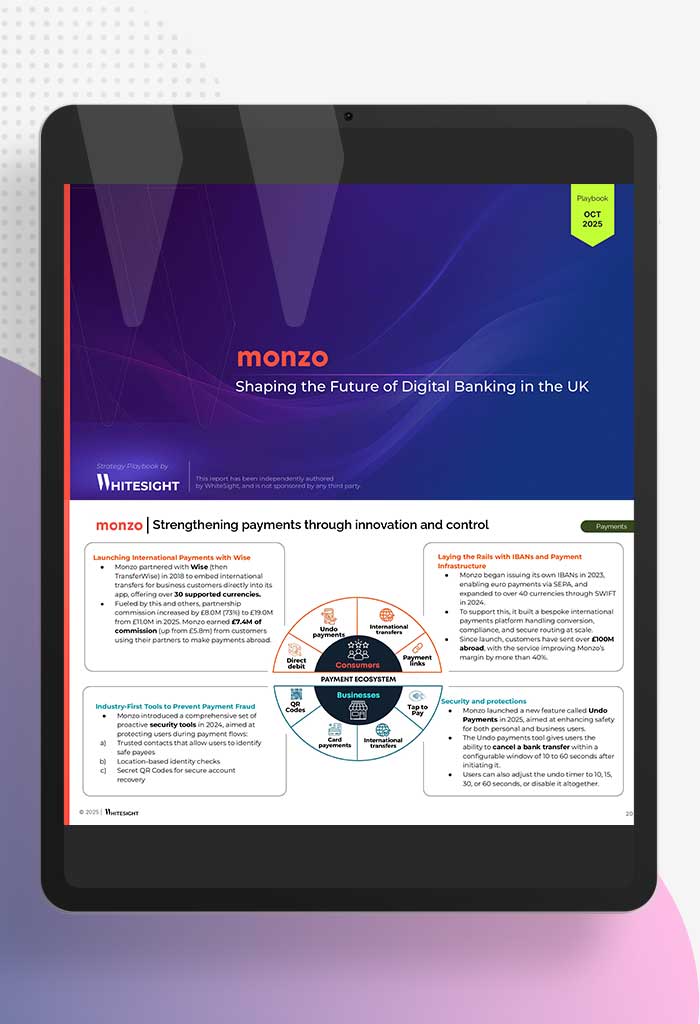

Want to discover how Monzo turned loyalty into recurring revenue? Learn from the best in class with our deep dive analysis on Monzo. Check out the report now!

Report

Stage 2 | Medium-term: moving from fixed returns to market upside.

As savers grew more confident, Monzo gave them tools to grow wealth beyond day-to-day balances. Its Fixed Savings Pots, launched with OakNorth and later partners like Paragon and Charter, offered market-leading rates. It began at 1.35% AER on 3-month terms in 2019 and rose to 4.55% AER on 12-month deposits in 2025, allowing customers to lock in certainty against the UK’s cost-of-living inflation.

The real leap came with Monzo Investments in 2023, aimed squarely at its Gen Z and Millennial base (that year, 52% of its customers were Gen Z, while two-thirds were under 30). The feature lowered barriers: invest from £1, pick between three BlackRock funds: Careful, Balanced, Adventurous, and get in-app guidance to banish complexity. For a generation where fewer than 1 in 4 held investments, this opened the door to long-term wealth building. For Monzo, it boosted stickiness, diversified income, and offered a pathway to profitability beyond lending.

Stage 3 | Long-term: simplifying pensions and long-term wealth

The final rung is also the most intimidating: pensions. Research in 2024 showed 51% of UK adults didn’t know their total retirement savings, and 77% felt anxious about pensions. Monzo’s answer was the Monzo Pension, built with pension-finding specialist Raindrop. It consolidates scattered pensions into a single self-invested personal pension (SIPP) managed by BlackRock, charges a transparent 0.63% annual fee (lower for subscribers), and makes retirement balances as easy to check as your Friday night takeaway bill.

By solving complexity and offering visibility, Monzo extends its role in savings from a money management app to a lifelong financial partner. Customers who once logged in to split a dinner bill can now track their path to retirement under the same Coral banner.

Charting the Next Horizon to Becoming a Lifelong Wealth Partner

Monzo’s next chapter signals its ambition to move from a savings-led fintech to a full-spectrum wealth manager. In 2025, it introduced Build Your Own portfolios, letting customers invest from just £1 across 11 ETFs managed by BlackRock, tailored to personal themes and interests, solving the paradox of choice that holds millions back from investing.

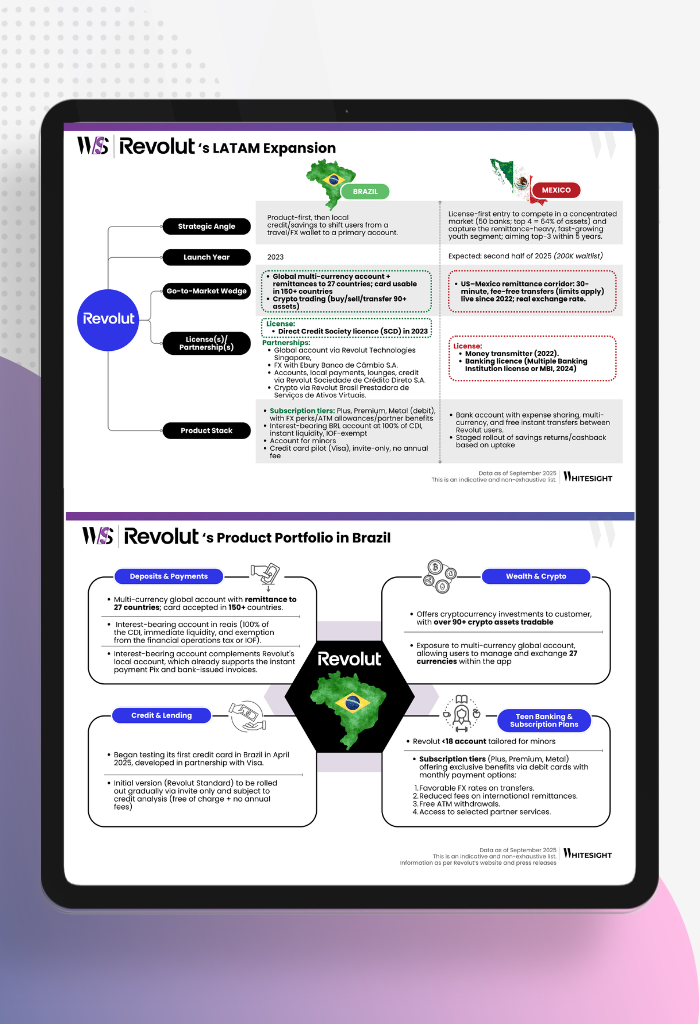

Since September 2023, Monzo customers have been able to open investment accounts and access a range of multi-asset funds directly within the app. Now, with over 300K customers already on its investment platform, Monzo is migrating to Seccl, an embedded investment tech firm, equipping it with institutional-grade infrastructure to scale custody, trading, and soon fully digital accumulation SIPPs. The move reflects a broader trend among UK challengers expanding into wealth management. Revolut, for instance, has taken a parallel route – using crypto as its bridge into investing. Its journey from simple retail trading to a full-spectrum crypto platform shows how digital banks are reimagining asset ownership for a generation raised on accessibility and autonomy. This recent play by Revolut is something we’ve analysed in Revolut’s Crypto Strategy: From Utility and Exchange to Expansion.

Together, these steps position Monzo as a “financial control center”, where it’s helping customers set money aside, and guiding them from their first £1 investment to long-term retirement planning. For Monzo, it’s the blueprint to deepen trust, diversify revenues, and cement relevance across every stage of its customers’ financial lives.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Senior Research Associate

Risav is a senior research associate at WhiteSight, where he spends his days navigating the complex fintech landscape and poring over market trends. When he's not decoding the world of fintech, you'll find this sports fanatic decoding the perfect curveball on the football field.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

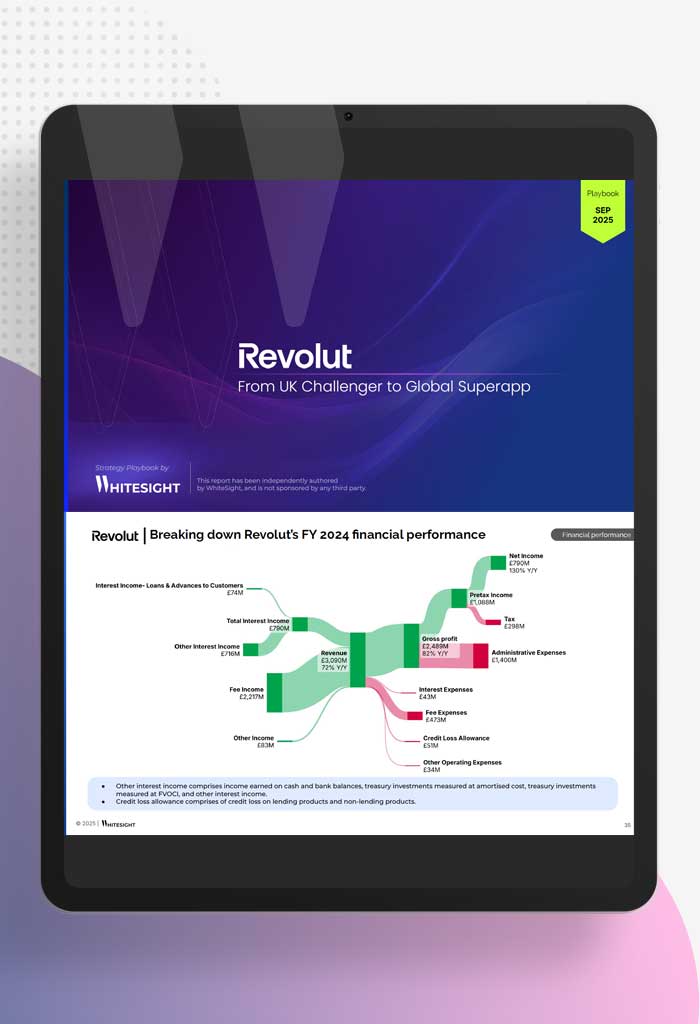

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...