Neobanks’ New Normal: Dissecting the Failures and Setbacks

- Afshan Dadan and Samridhi Singh

- 5 mins read

- Digital Finance, Insights

Table of Contents

The emergence, growth, and profitability of neobanks have always been a topic of discourse in the fintech sector. At WhiteSight, we’ve implored this curiosity by exploring the many themes around the neobanking ‘neo’velty. Whether it be climbing the hierarchy of their investment galore, following their SuperApp quest, or highlighting the exponential momentum in the space, the new battleground of neobanks has always kept us wondering about what’s cooking behind the scenes.2021 was a prolific year for neobanks. Several of them raised massive rounds of funding, became unicorns and decacorns, and expanded their global footprints. 2022 is proving to be a really challenging year for the sector. Intense scrutiny of regulators, a challenging economic environment, diminished funding & valuations, and growing fraud incidents have resulted in a sink or swim moment for neobanks. In this blog, we aim to analyse some of the past failures and setbacks in the sector to draw lessons from. We look at these incidents through the lens of four main perspectives:Shutdown: Cessation of operational activities due to fleeting measures to develop a sustainable revenue stream, inability to raise further funding, and M&A fallouts.Country Exit: Departure due to rising economic uncertainties (Brexit, Pandemic, economic slowdowns) in the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

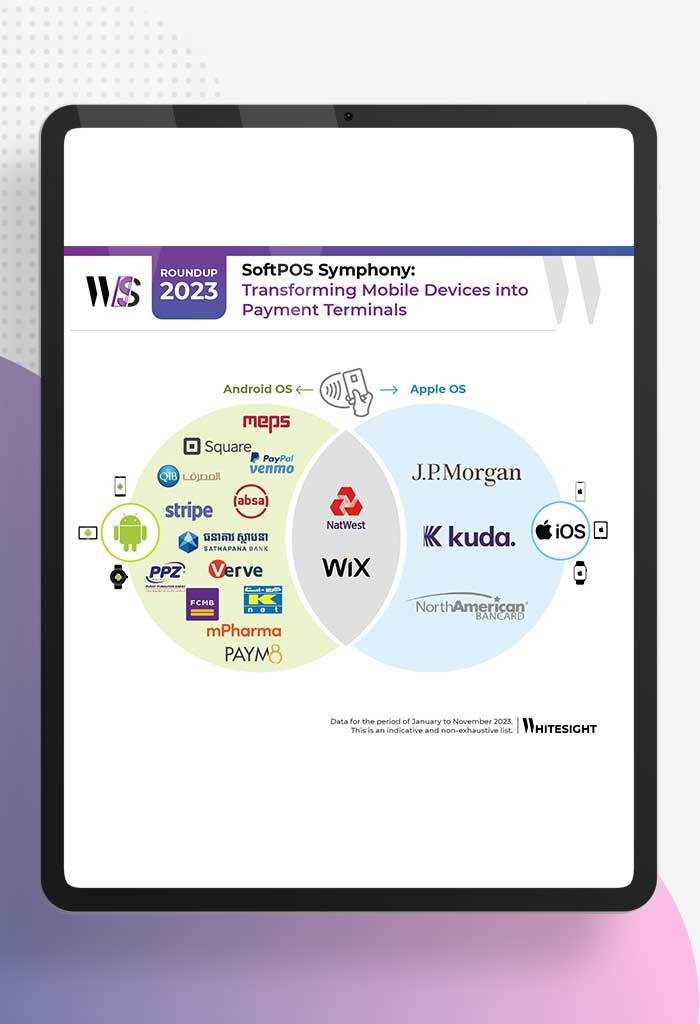

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

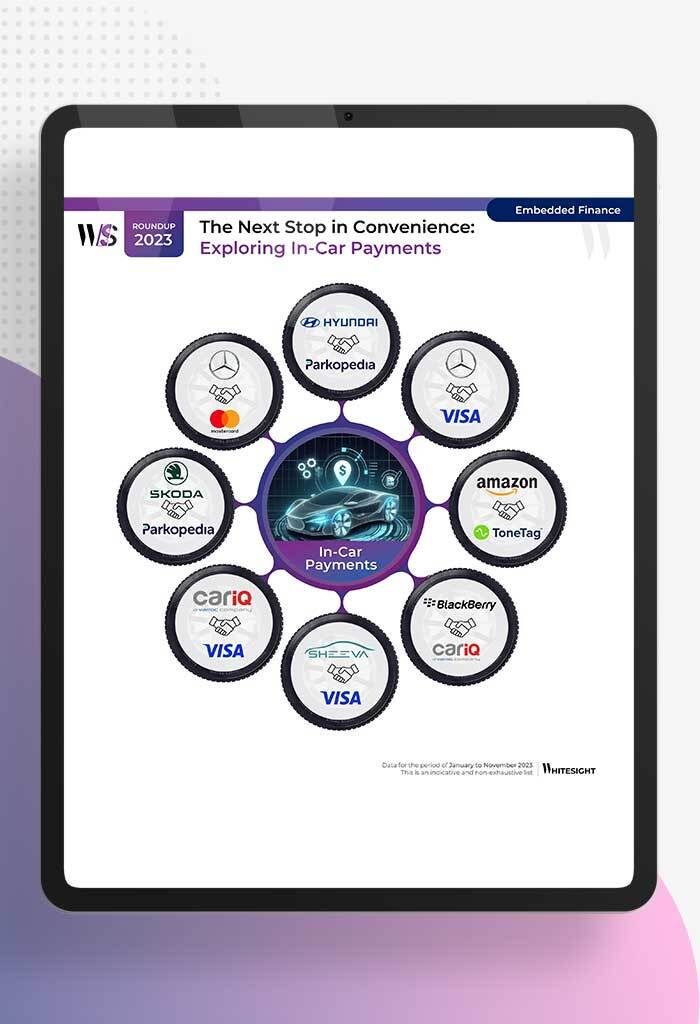

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

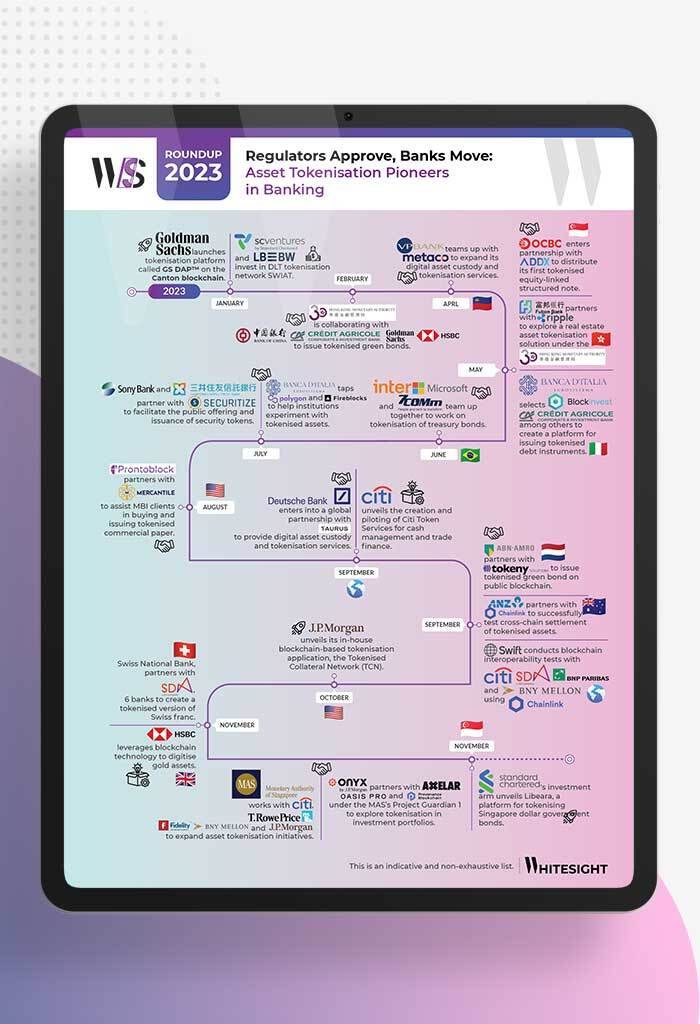

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

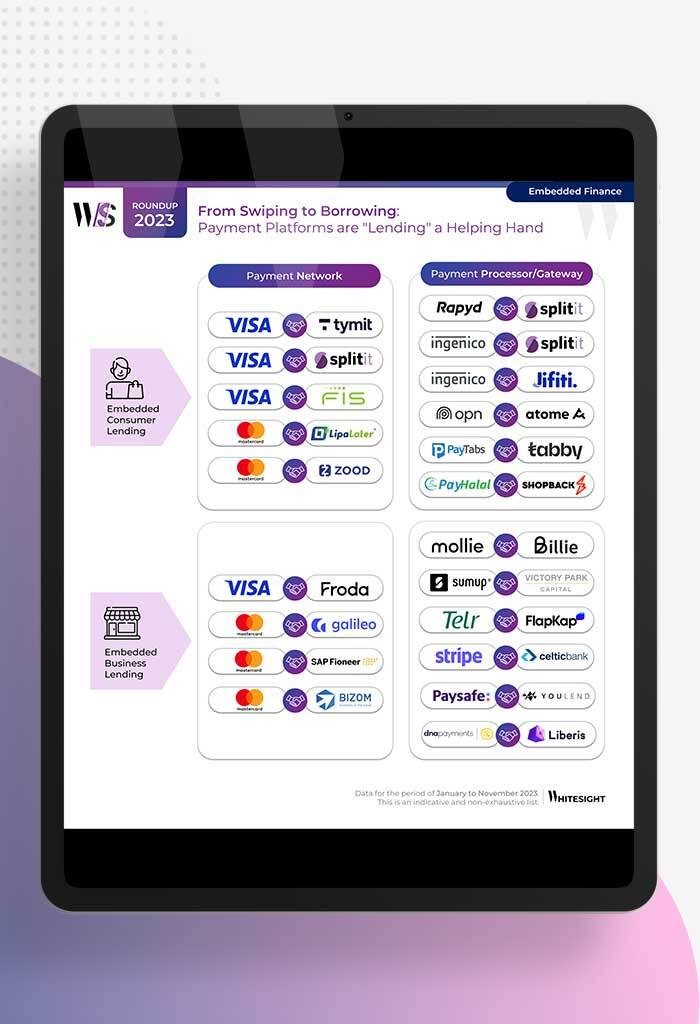

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

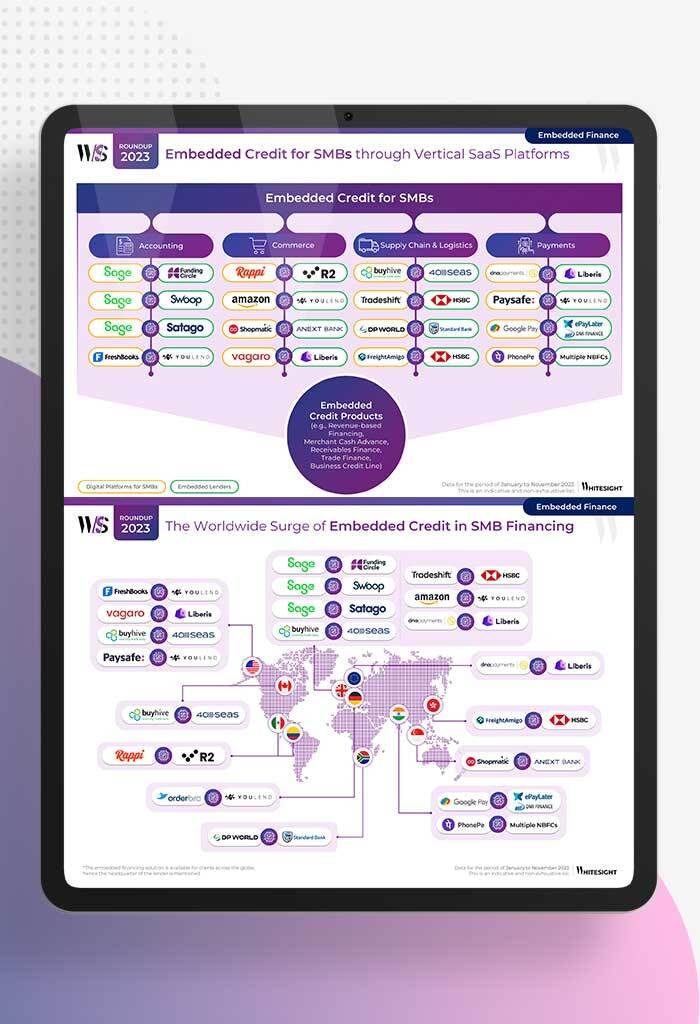

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...