Neobanks’ New Normal: Dissecting the Failures and Setbacks

- Afshan Dadan and Samridhi Singh

- 5 mins read

- Digital Finance, Insights

Table of Contents

The emergence, growth, and profitability of neobanks have always been a topic of discourse in the fintech sector. At WhiteSight, we’ve implored this curiosity by exploring the many themes around the neobanking ‘neo’velty. Whether it be climbing the hierarchy of their investment galore, following their SuperApp quest, or highlighting the exponential momentum in the space, the new battleground of neobanks has always kept us wondering about what’s cooking behind the scenes.2021 was a prolific year for neobanks. Several of them raised massive rounds of funding, became unicorns and decacorns, and expanded their global footprints. 2022 is proving to be a really challenging year for the sector. Intense scrutiny of regulators, a challenging economic environment, diminished funding & valuations, and growing fraud incidents have resulted in a sink or swim moment for neobanks. In this blog, we aim to analyse some of the past failures and setbacks in the sector to draw lessons from. We look at these incidents through the lens of four main perspectives:Shutdown: Cessation of operational activities due to fleeting measures to develop a sustainable revenue stream, inability to raise further funding, and M&A fallouts.Country Exit: Departure due to rising economic uncertainties (Brexit, Pandemic, economic slowdowns) in the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Kshitija Kaur

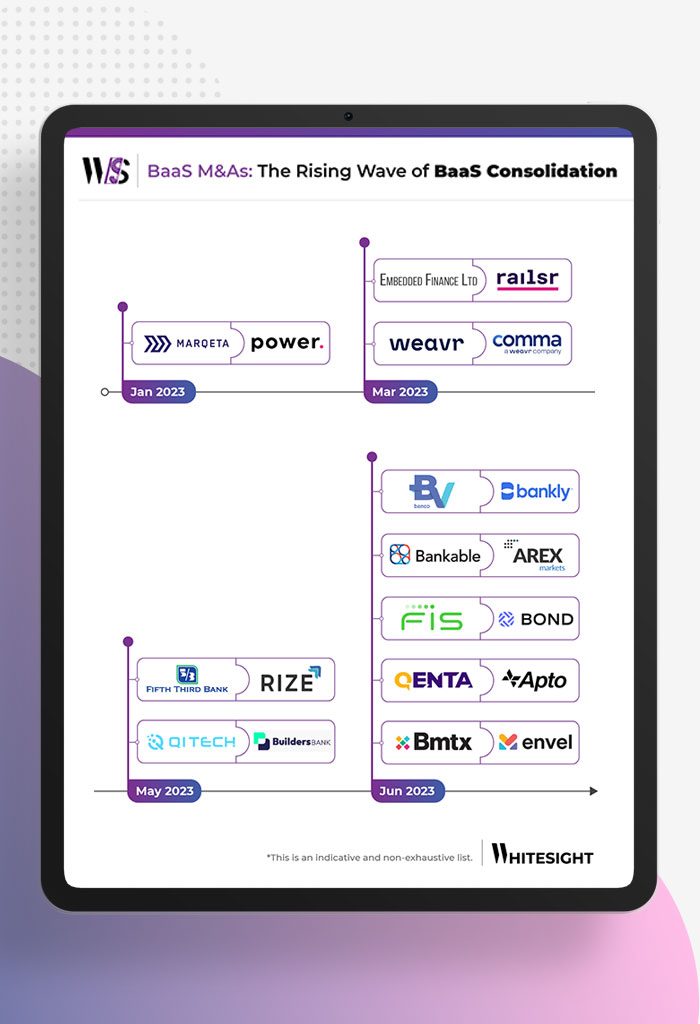

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

- Risav Chakraborty and Kshitija Kaur

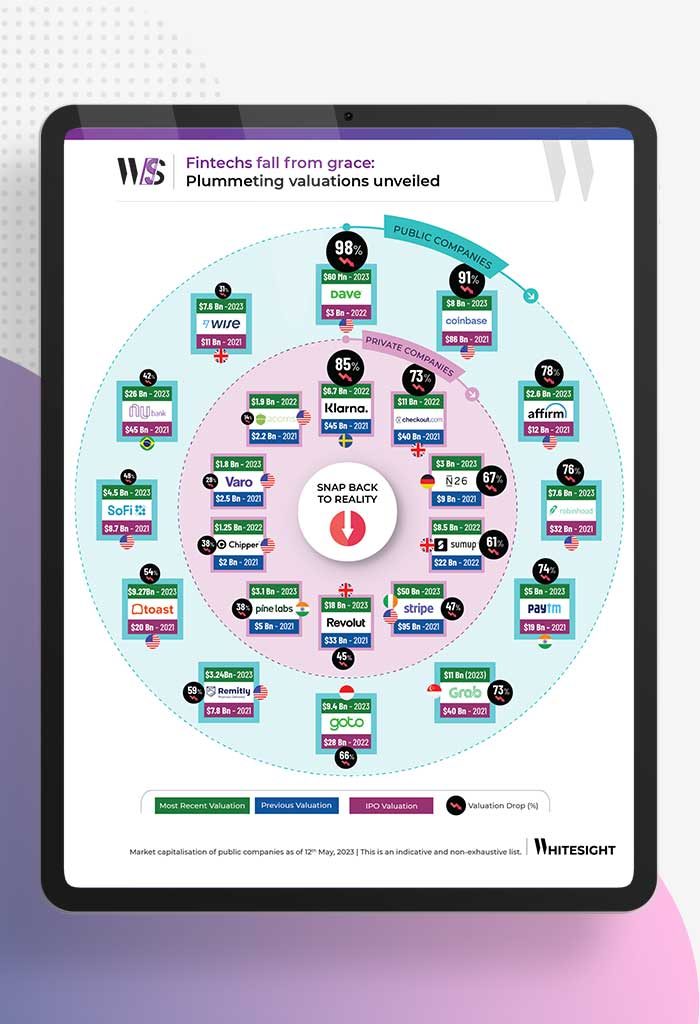

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

- Risav Chakraborty and Sanjeev Kumar

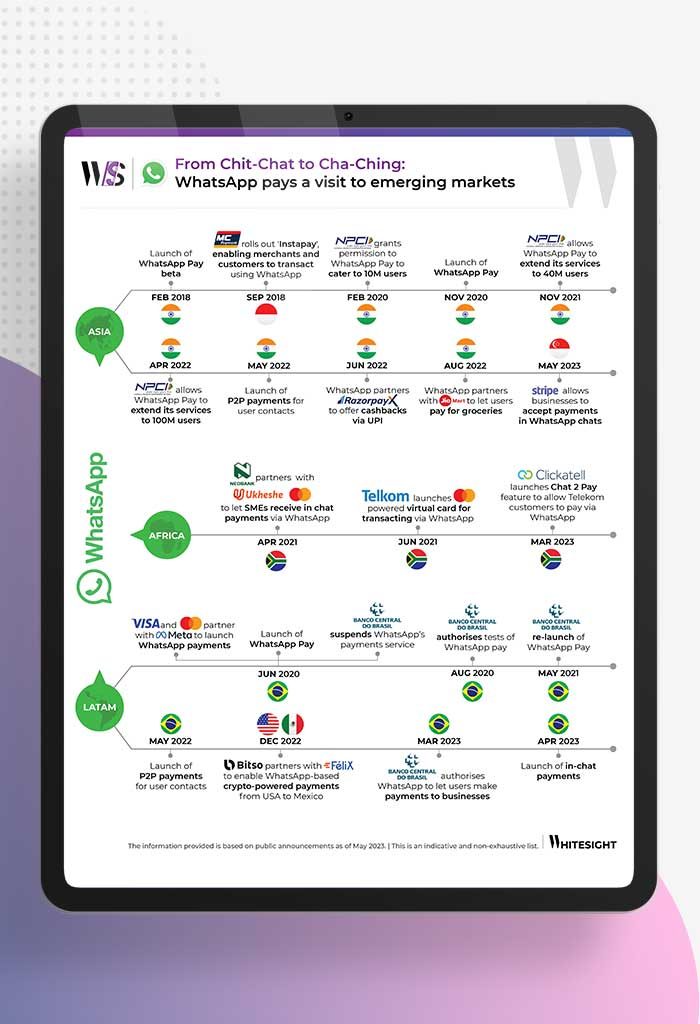

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

- Sanjeev Kumar and Samridhi Singh

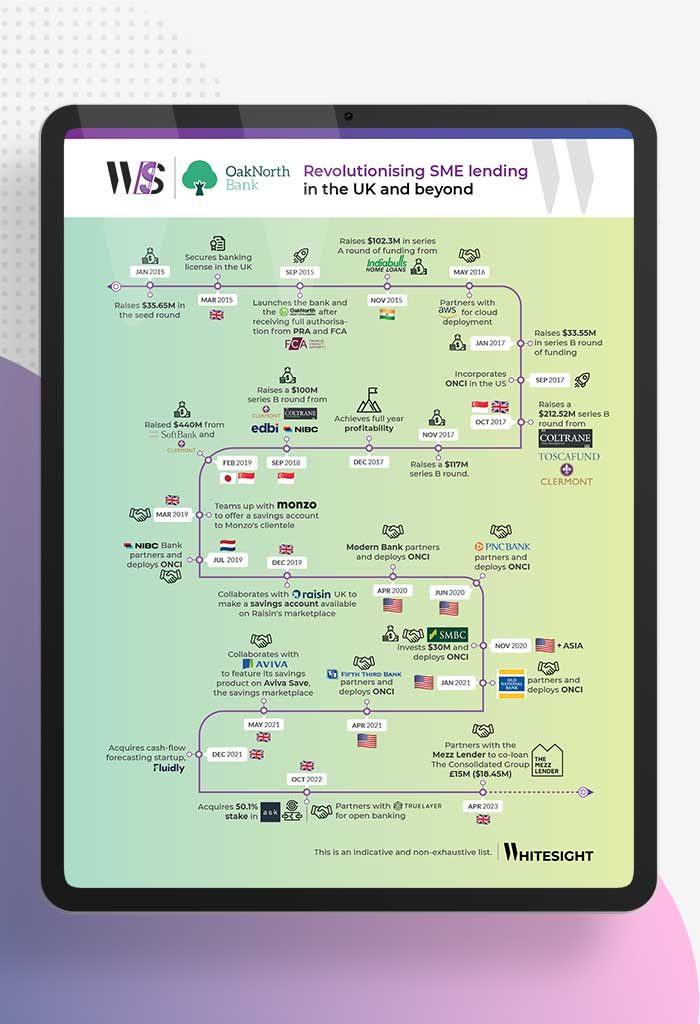

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

- Afshan Dadan and Ananya Shetty

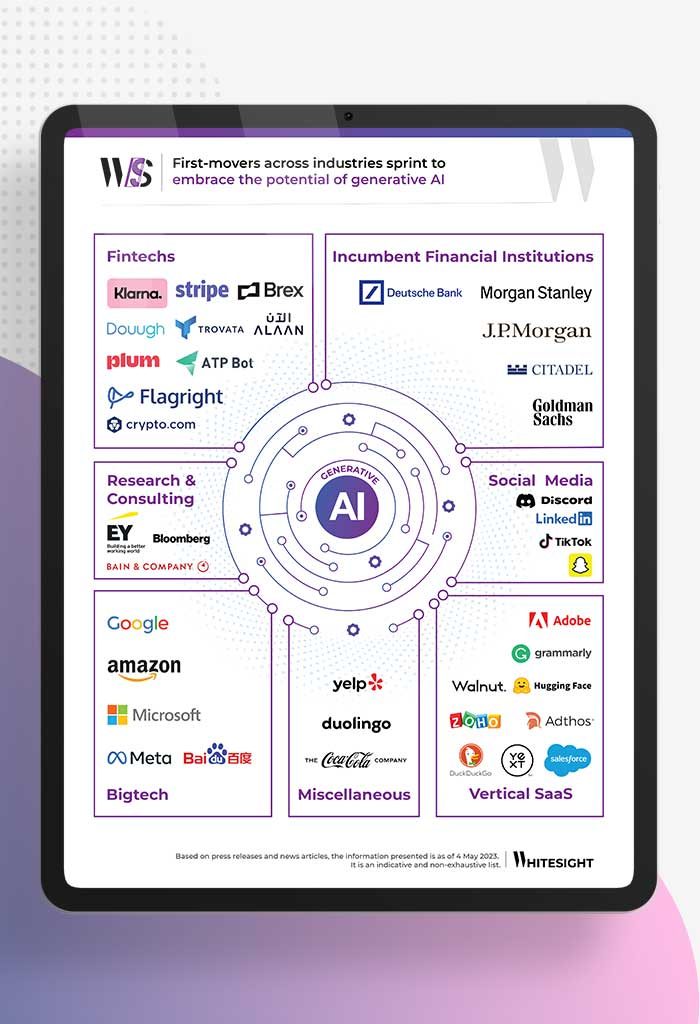

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...