Open Banking in Canada: Better Late Than Never?

- Kshitija Kaur and Sanjeev Kumar

- 7 mins read

- Insights, Open Finance

Table of Contents

Canada Open Banking: Glacial Pace or Strategic Patience? Canada, a nation renowned for its politeness and measured approach, has finally entered the open banking arena. While other developed countries like the UK, EU, Singapore, and Australia have embraced open banking with the zeal of an Olympic sprint, Canada has taken a more “politely patient” route. Much like the gradual melting of Canadian snow in the spring, the nation’s open banking journey has been characterised by deliberation and cautious optimism. This so-called “made-in-Canada” approach, often described as slow and methodical, has sparked debate – is it a case of better late than never, or a missed opportunity for innovation and competition?In 2023, regulators in North America made significant strides in implementing open banking, with key developments occurring in the United States and Canada. In October 2023, the United States laid the foundation for open banking when the Consumer Financial Protection Bureau (CFPB) introduced the Personal Financial Data Rights rule. Following this, on 21 November 2023, the Canadian Government announced its plans to create an open banking framework in its 2023 Fall Economic Statement. Just as Europe uses the term “PSD2” and Australia calls it “Consumer Data Rights,” Canada employs the term […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

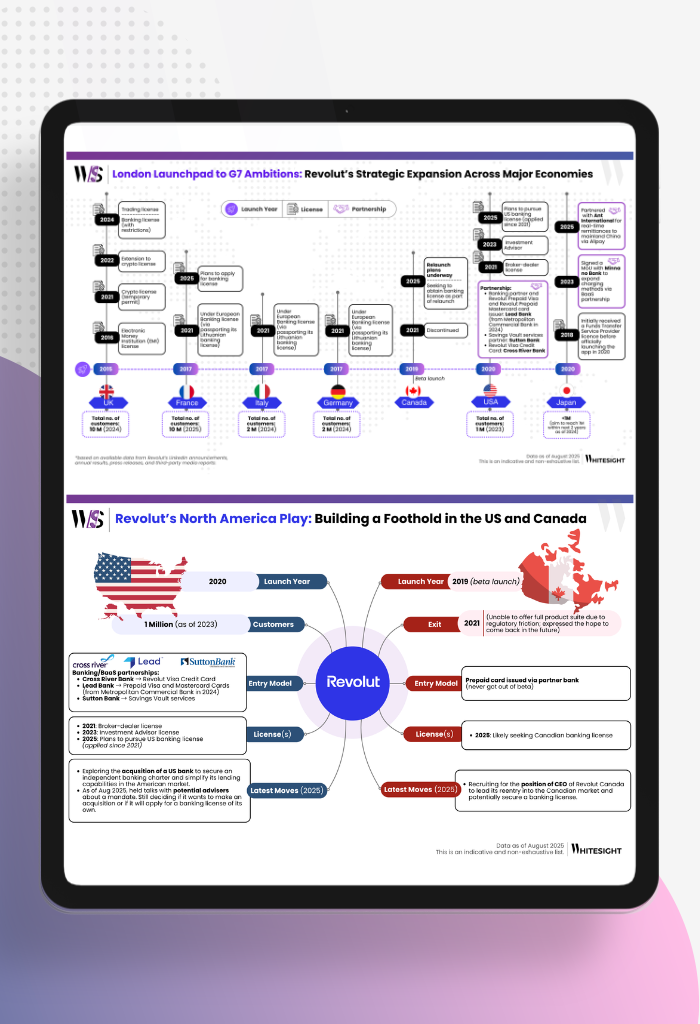

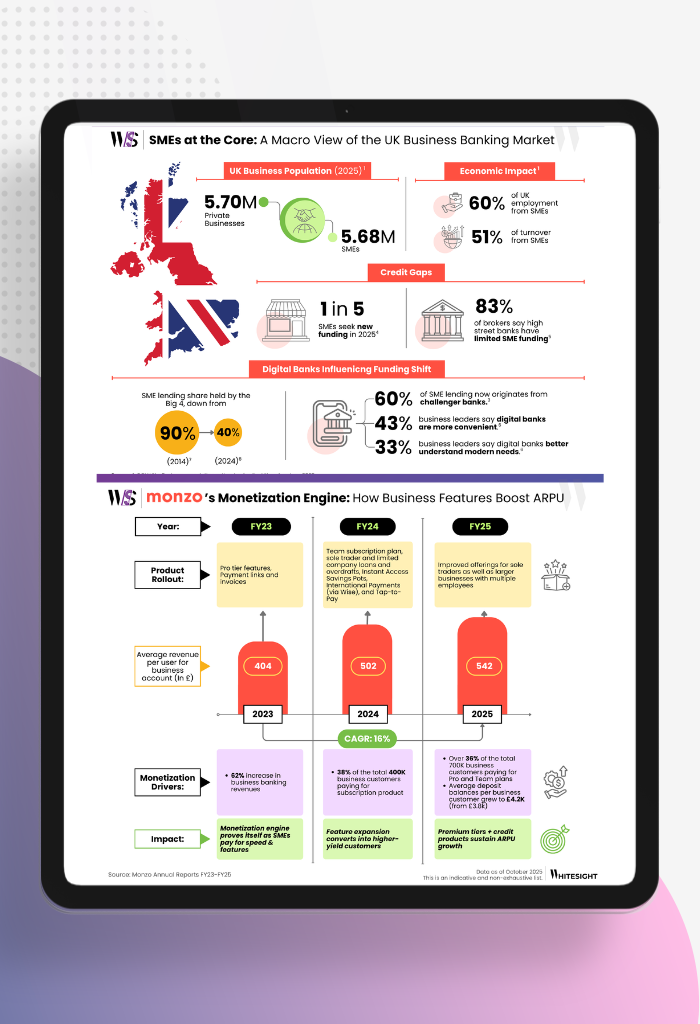

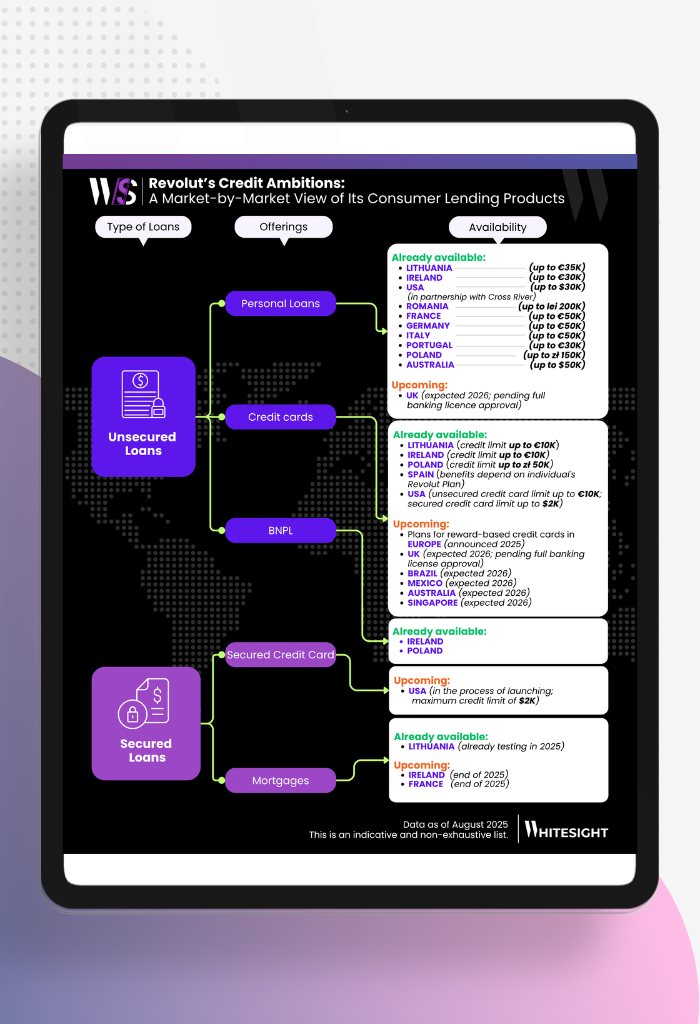

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

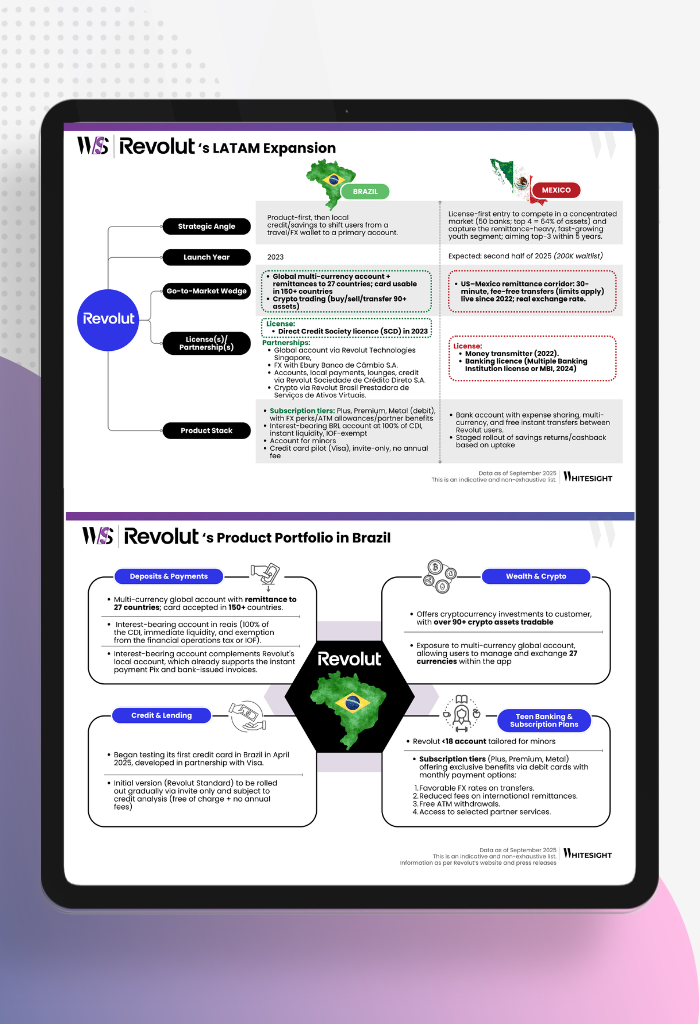

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...