Opening Doors for Open Banking in the GCC

- Sanjeev Kumar and Risav Chakraborty

- 3 mins read

- Insights, Open Finance

Table of Contents

The emergence of Open Banking, a paradigm allowing consumers to consent to third parties to get access to financial data through standardised APIs, is playing a pivotal role in forging the future of finance worldwide. In the Gulf Cooperation Council (GCC), the Open Banking phenomenon is evolving at a rapid pace, with certain countries embracing the imperative far more aggressively. As we analysed in our report published earlier this year in partnership with Spire, Open Banking in the GCC region has the potential to unlock a broader range of open finance use cases – personal finance management, payments initiation, wealth management, BNPL, and alternative credit scoring for consumers and automated accounting, payments acceptance, cash flow forecasting, alternative SME financing, and automated tax planning for MSMEs. GCC Regulators Drive Open Banking Initiatives in the RegionIn the GCC, regulators have been quick to acknowledge the potential of Open Banking to drastically transform traditional banking services in the region. The watchdogs have undertaken a structured approach by carefully examining the already existing legislative frameworks for Open Banking in the UK, Europe, Australia and parts of the world. The growth of FinTech ecosystems in the GCC has been a major driver behind the establishment […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

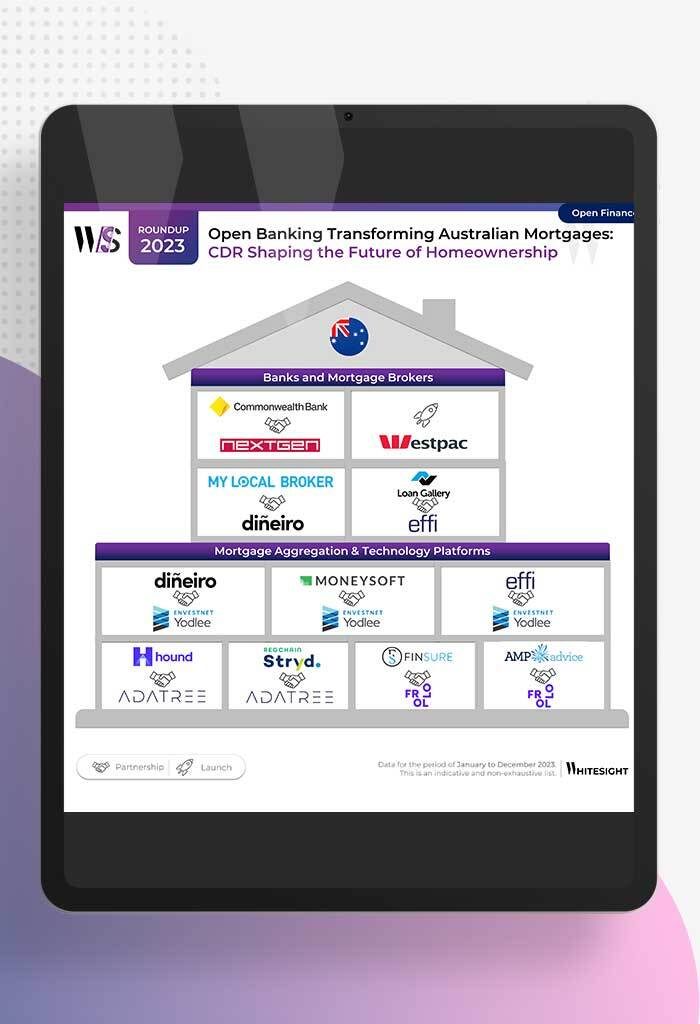

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

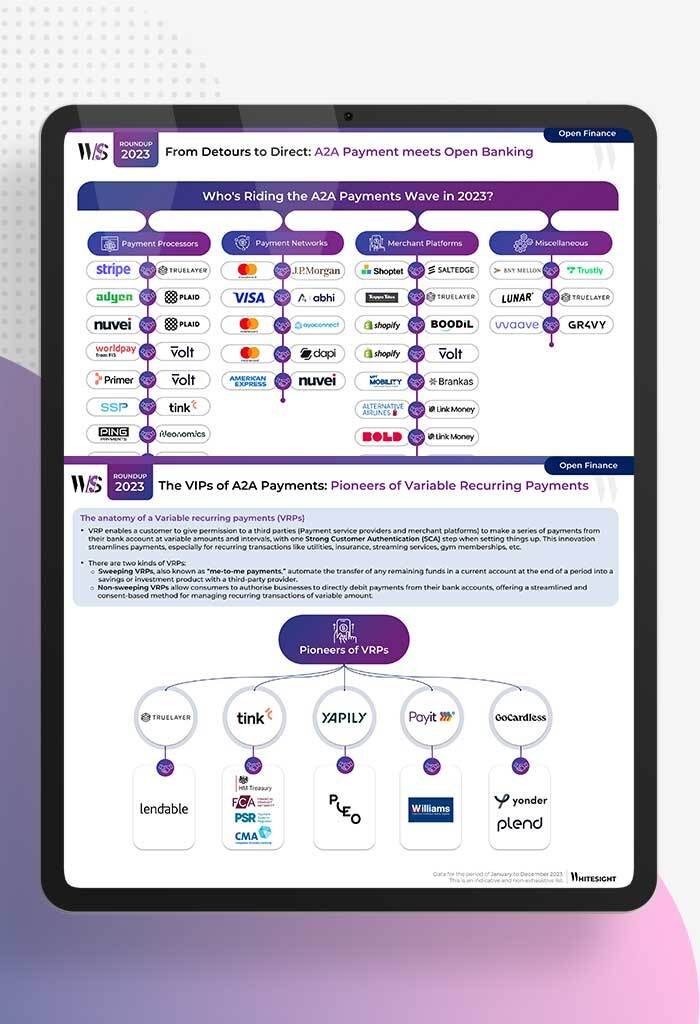

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

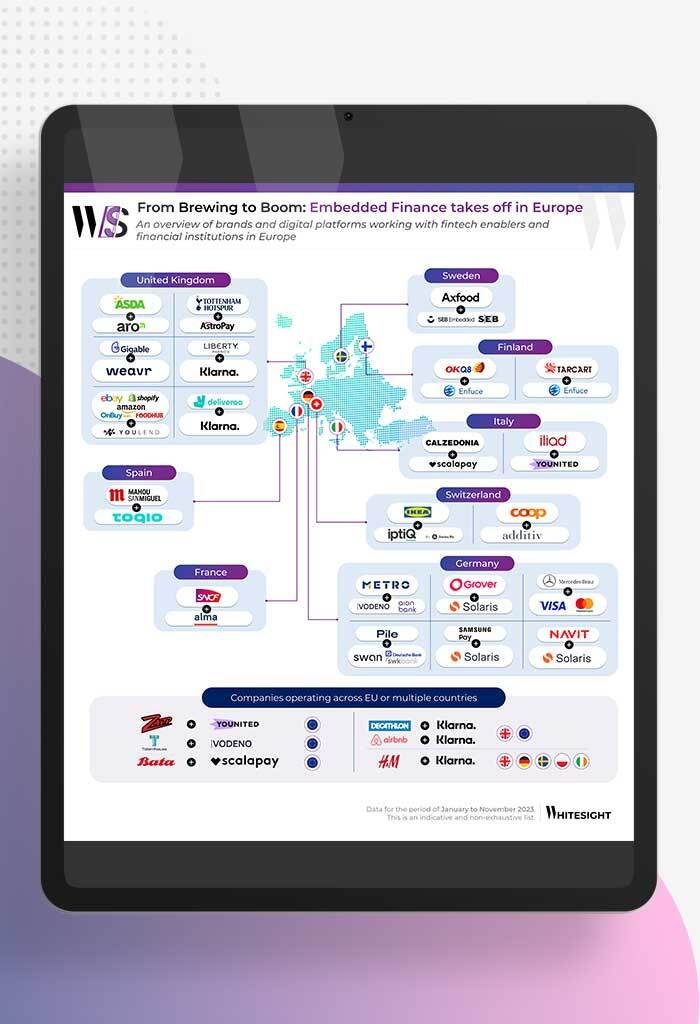

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

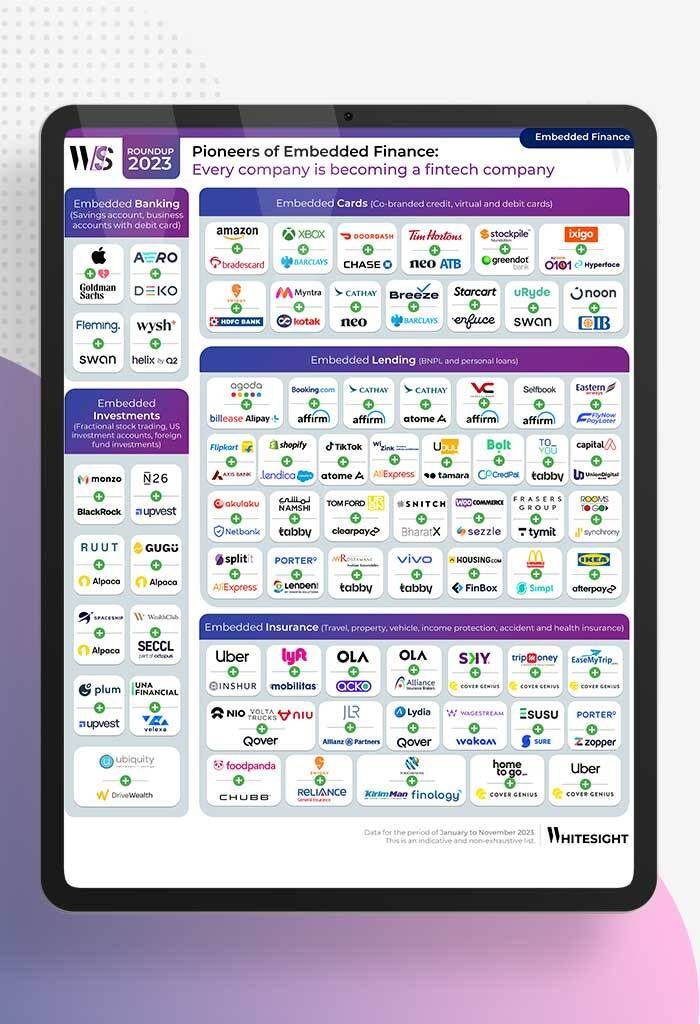

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...