A SEA of Transformation: Southeast Asia’s Digital Banking Landscape

- Kshitija Kaur and Risav Chakraborty

- 11 mins read

- Digital Finance, Insights

Table of Contents

Transformation stems from the need for innovation – to unlock novel ways of generating value. Just like the tides in a sea cause ripples of rising and falling changes through the influence of gravity, global economies experience waves of metamorphosis thanks to the impact of soaring and shifting demands from consumers and businesses in the digital era. The financial industry across the world is going through the pangs of transformation by embracing digitalisation, business model transformation, and product innovation.The financial industry transformation wave has cascaded its way to the shores of Southeast Asia (SEA) – in the form of the digital banking swell that is triggering the push for economic growth. Home to a population of more than 675 million (of which ,60% remain unbanked) and more than ,71 million micro, small and medium-sized enterprises (MSMEs), SEA is emerging as a breeding ground for digital-first business models. 100 million additional internet users have joined the digital economy in the last three years since the pandemic broke out in 2019. The current number of internet users in SEA stands at a mighty 460 million, with 20 million new users getting added in 2022 alone.This is where digital banks came in – […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

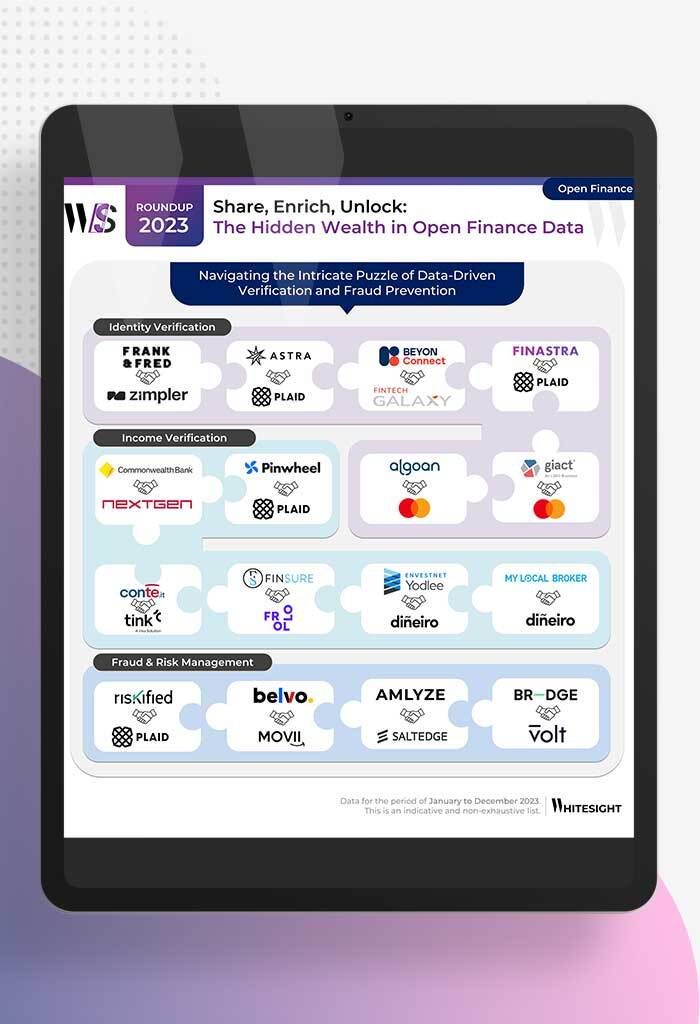

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

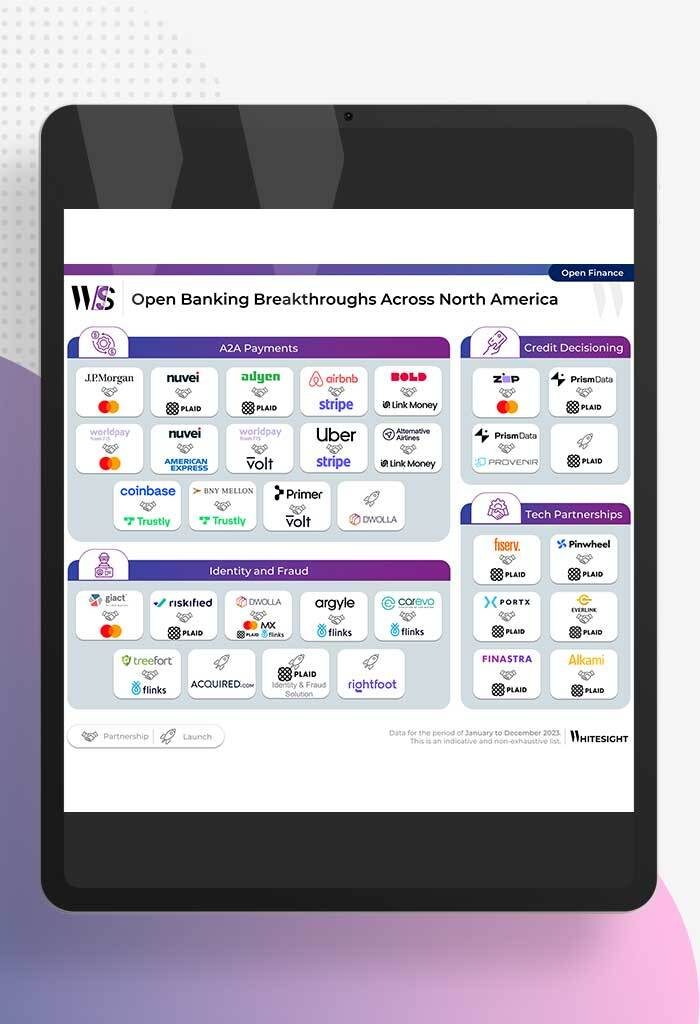

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

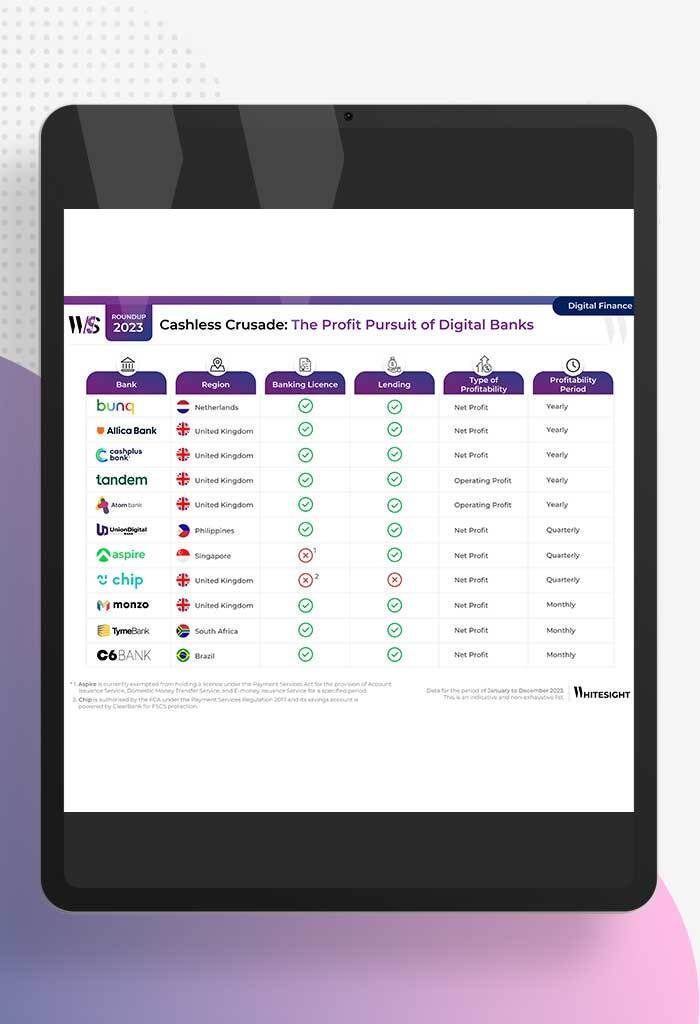

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

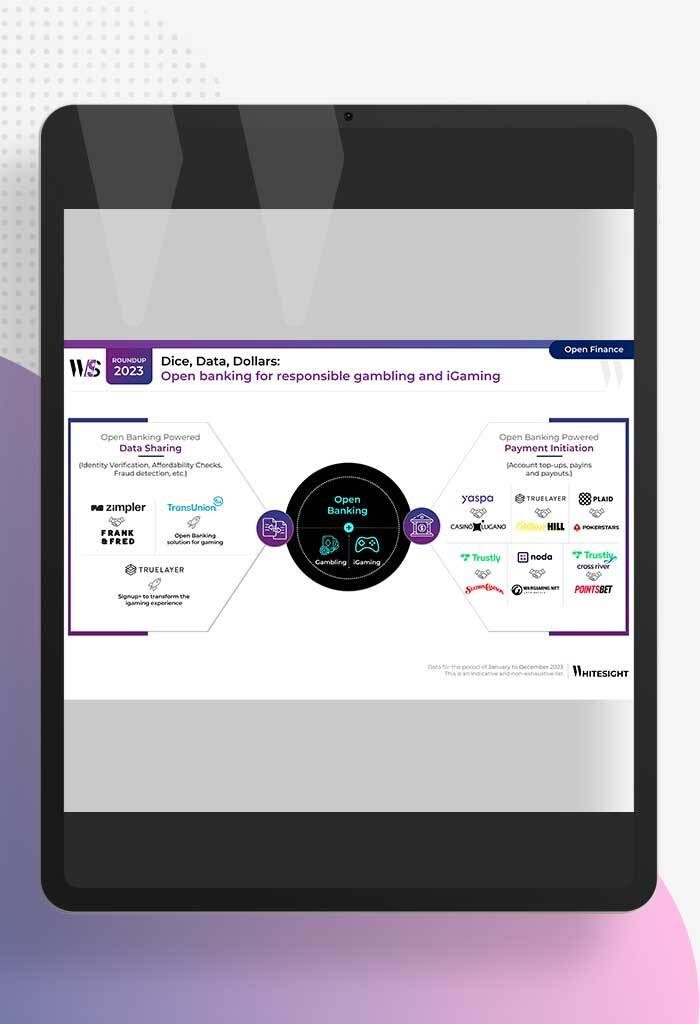

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

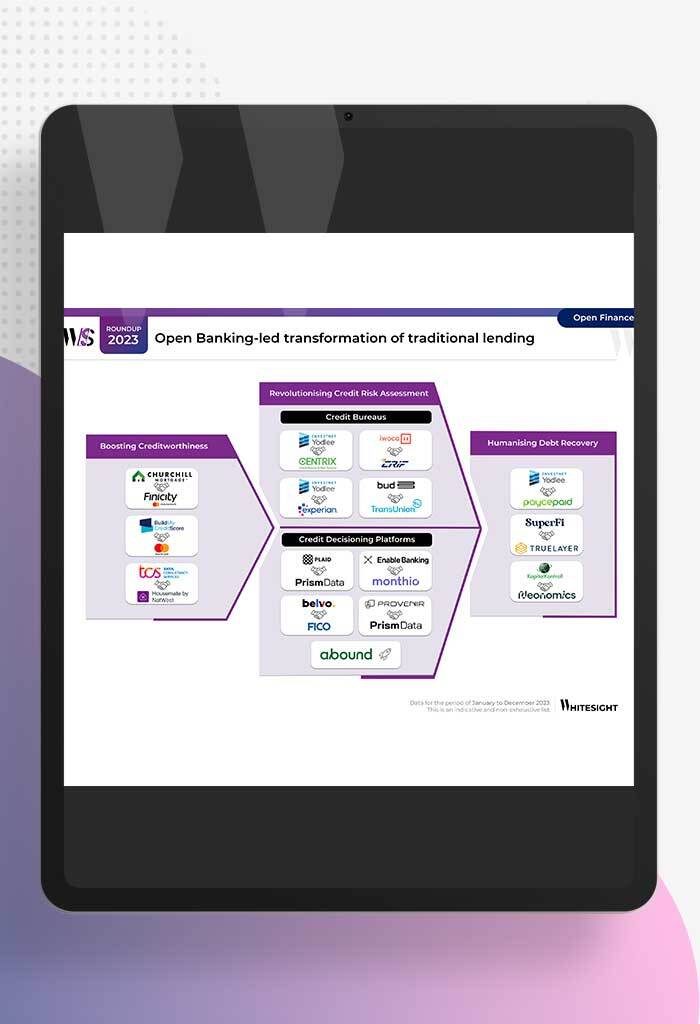

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

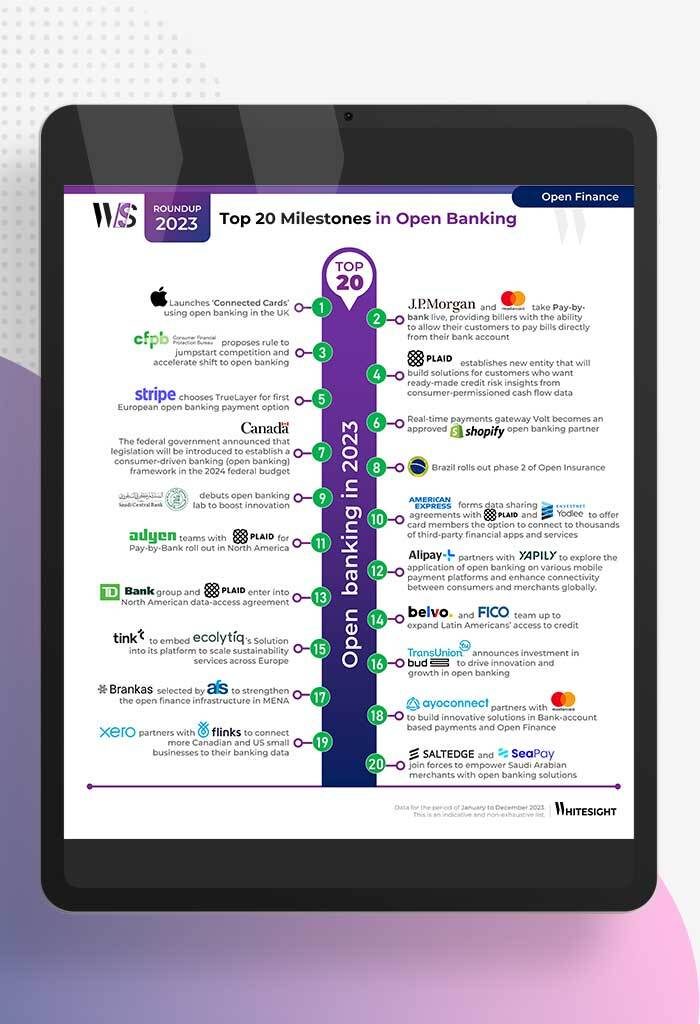

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...