Promoting Reliability In Diverse Ecosystems: Financial Institutions As Allies

- Kshitija Kaur and Risav Chakraborty

- 5 mins read

- Insights, Sustainable Finance

Table of Contents

Our identity is a mirror of our self-image, reflecting our behavior and interactions with the world around us. With each layer of individual thoughts, beliefs, and actions, we build our way up to establish a sturdy foundation of belonging and security. We then seek the same values in our environment, investing in communities and causes that resonate with our true selves.Amongst the things that define our idea of the self, financial services encompass a myriad of traits that contribute to our individuality. With personal data being a key ingredient in accessing economic resources, personalization should be at the heart of fabricating offerings with an inclusive mindset. The freedom of being one’s authentic self is a critical element in cementing the many bricks of financial well-being.Nevertheless, several communities face barriers to a seamless financial journey. On average, the LGBTQ+ population faces more discrimination that impacts their financial wellness, with challenges in areas of work, health, and even family planning. About 40% of LGBTQ+ borrowers have been denied help from a financial professional due to their sexual orientation. Add people of color and transgender individuals to the mix, and we have figures that fair significantly worse.Despite such results, financial firms have made […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

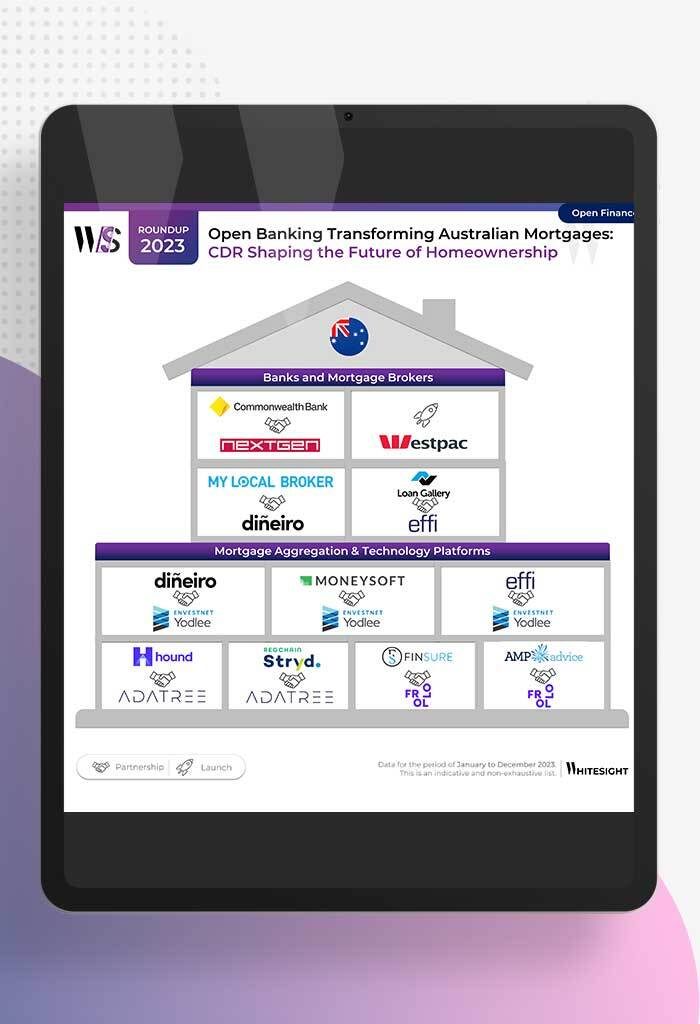

- Sanjeev Kumar and Samridhi Singh

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

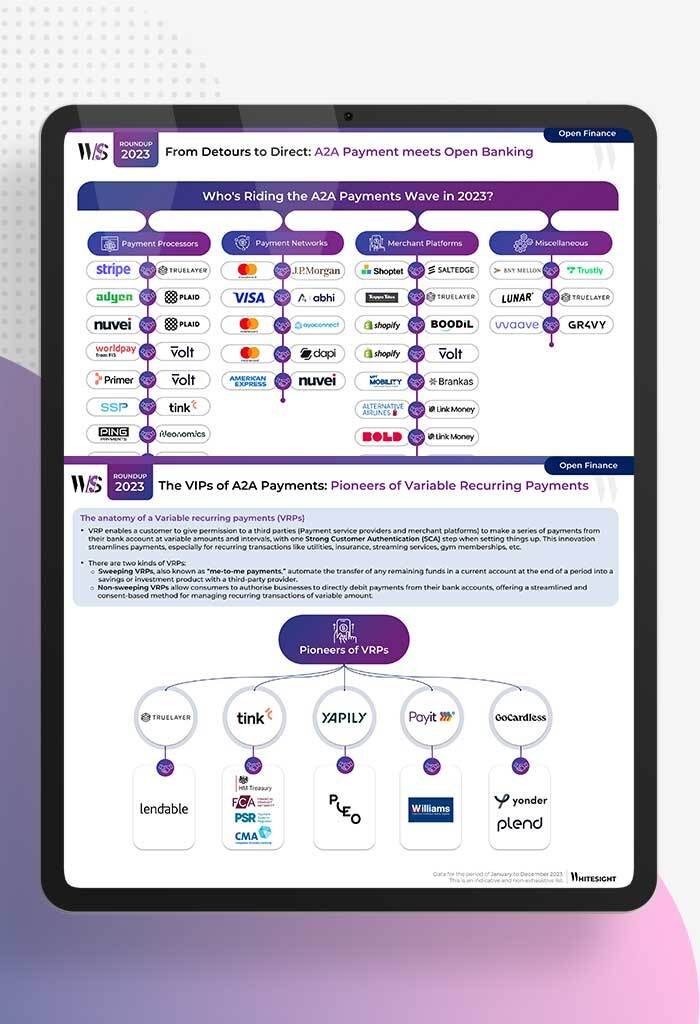

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

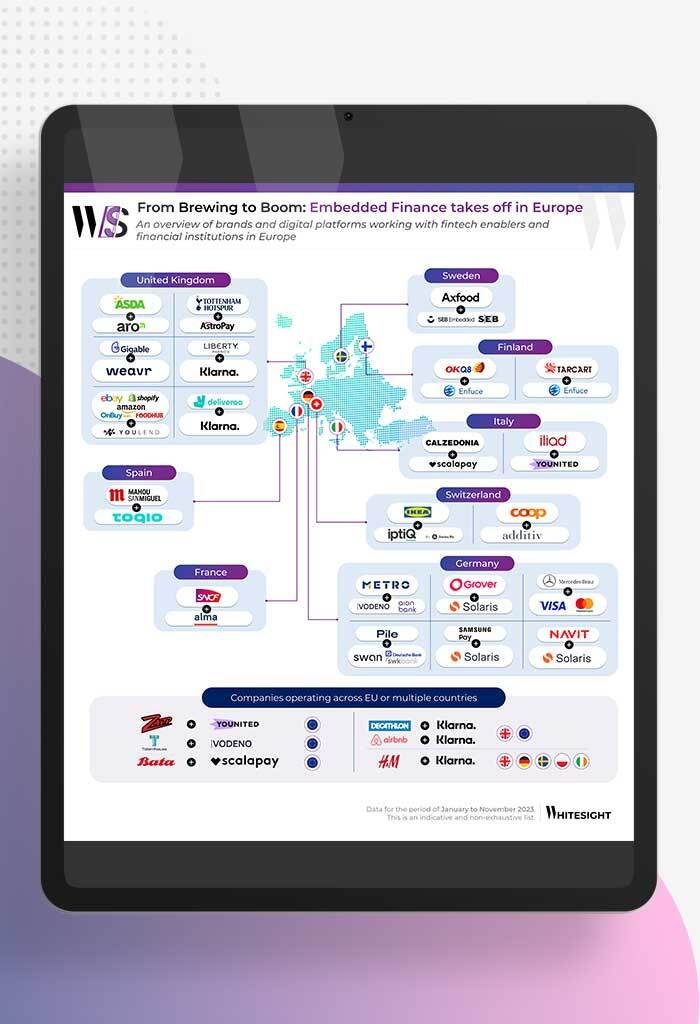

- Afshan Dadan and Sanjeev Kumar

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

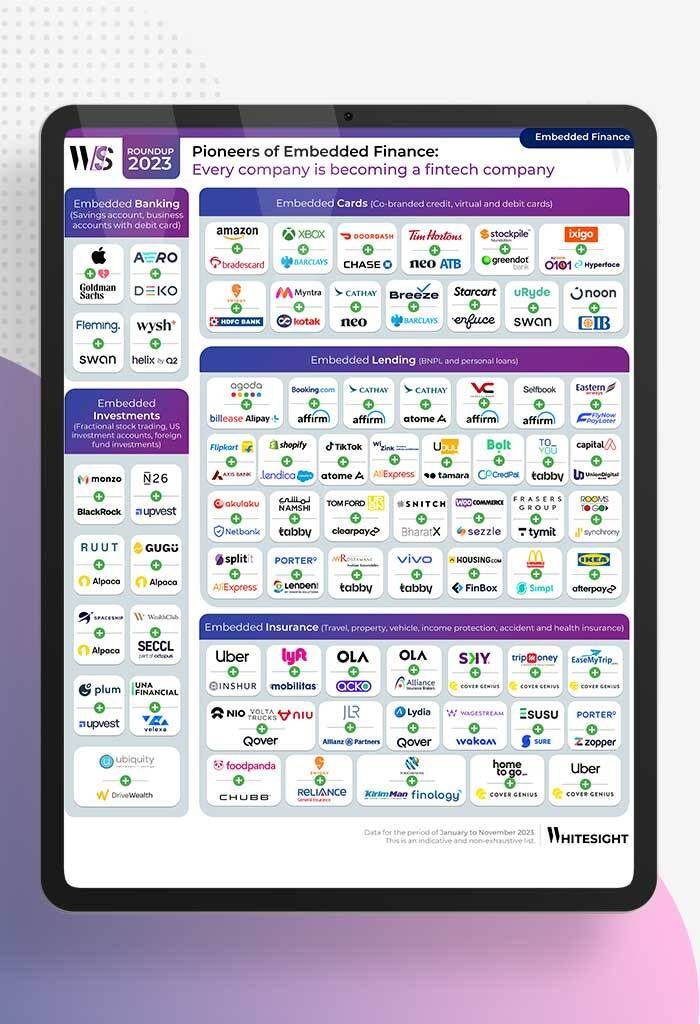

- Sanjeev Kumar and Samridhi Singh

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...