Promoting Reliability In Diverse Ecosystems: Financial Institutions As Allies

- Kshitija Kaur and Risav Chakraborty

- 5 mins read

- Insights, Sustainable Finance

Table of Contents

Our identity is a mirror of our self-image, reflecting our behavior and interactions with the world around us. With each layer of individual thoughts, beliefs, and actions, we build our way up to establish a sturdy foundation of belonging and security. We then seek the same values in our environment, investing in communities and causes that resonate with our true selves.Amongst the things that define our idea of the self, financial services encompass a myriad of traits that contribute to our individuality. With personal data being a key ingredient in accessing economic resources, personalization should be at the heart of fabricating offerings with an inclusive mindset. The freedom of being one’s authentic self is a critical element in cementing the many bricks of financial well-being.Nevertheless, several communities face barriers to a seamless financial journey. On average, the LGBTQ+ population faces more discrimination that impacts their financial wellness, with challenges in areas of work, health, and even family planning. About 40% of LGBTQ+ borrowers have been denied help from a financial professional due to their sexual orientation. Add people of color and transgender individuals to the mix, and we have figures that fair significantly worse.Despite such results, financial firms have made […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

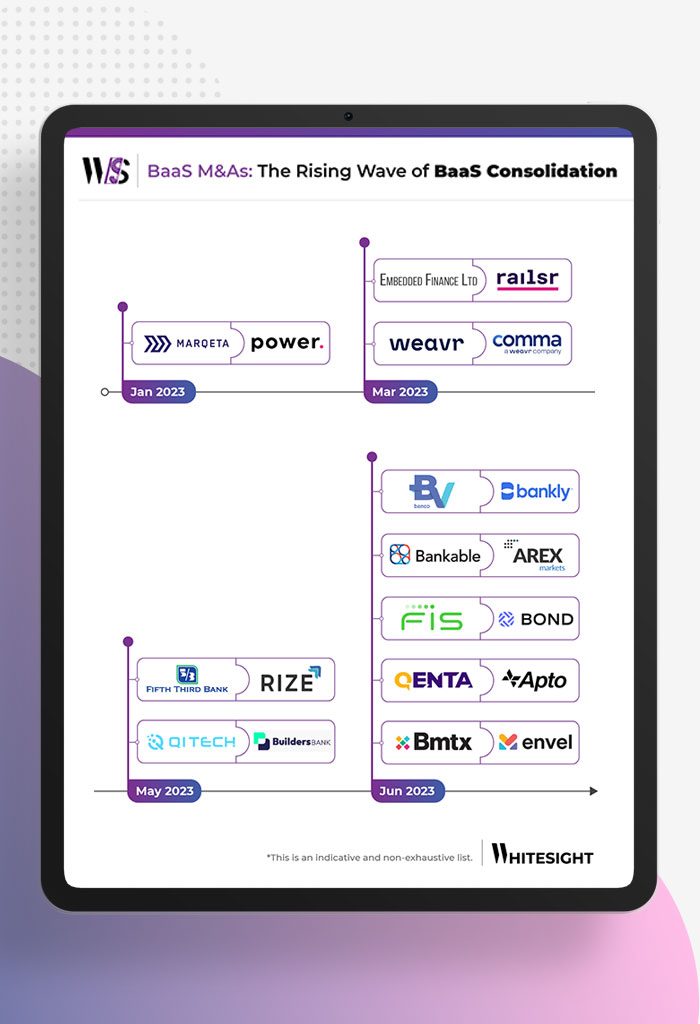

- Sanjeev Kumar and Kshitija Kaur

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

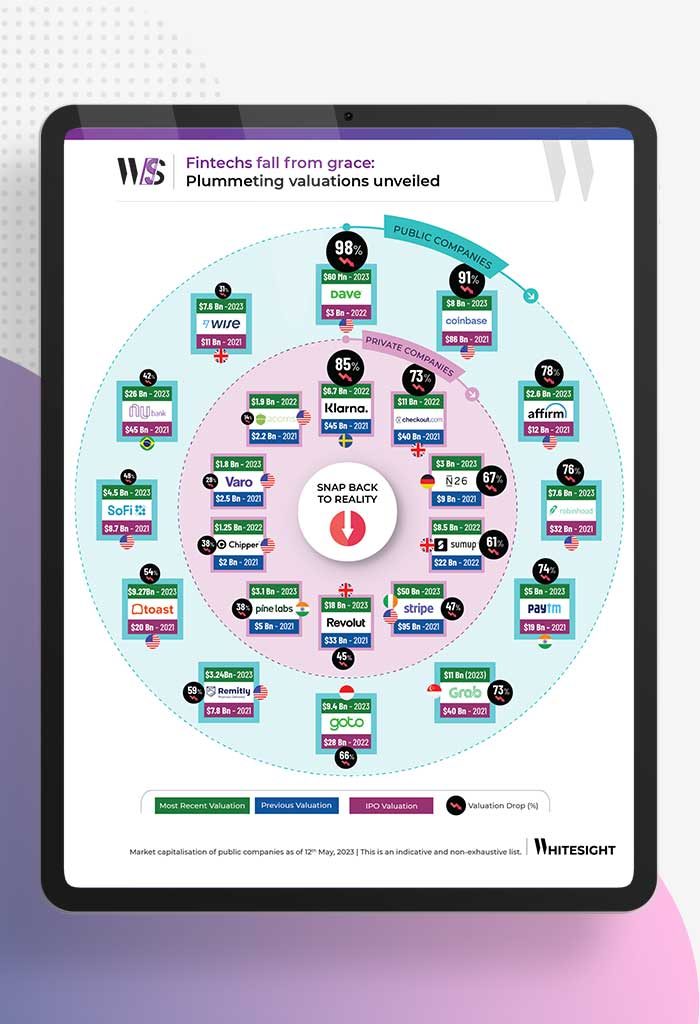

- Risav Chakraborty and Kshitija Kaur

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

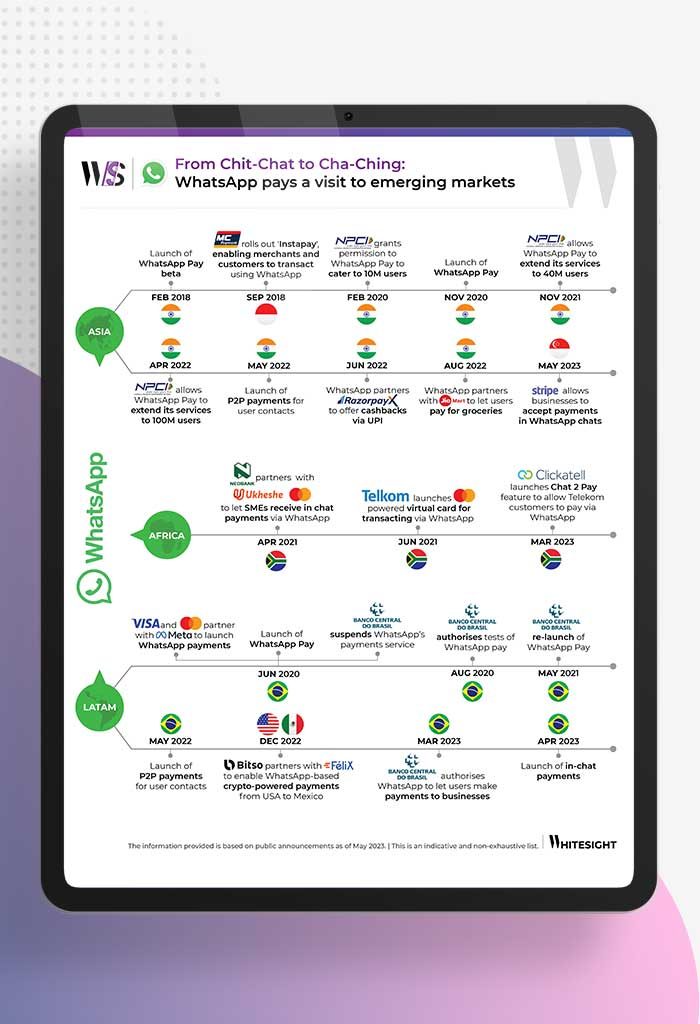

- Risav Chakraborty and Sanjeev Kumar

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

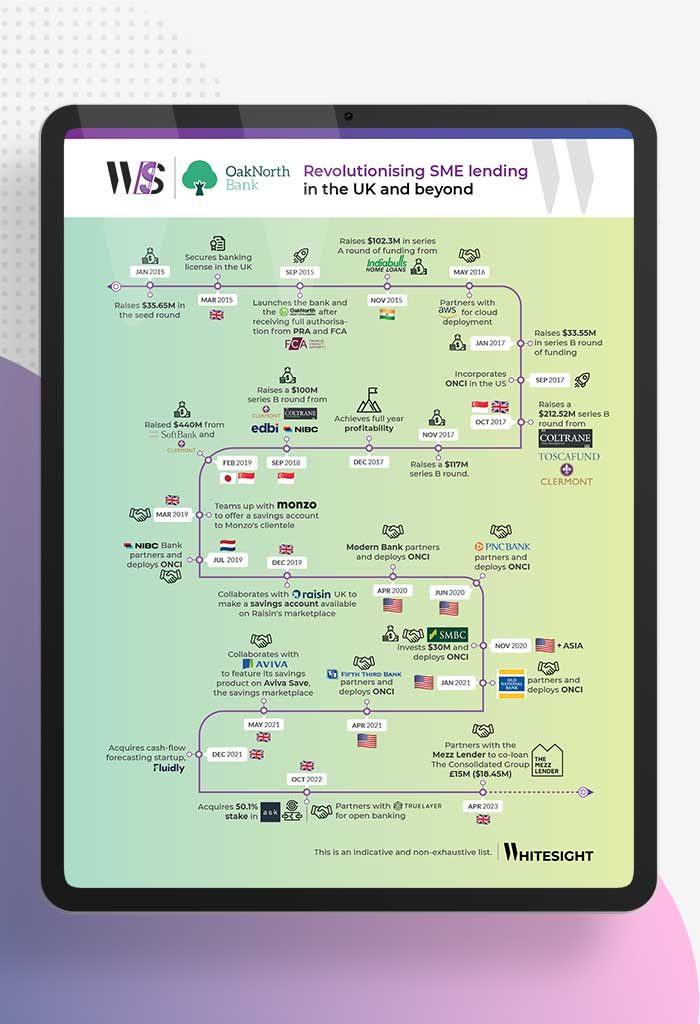

- Sanjeev Kumar and Samridhi Singh

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

- Afshan Dadan and Ananya Shetty

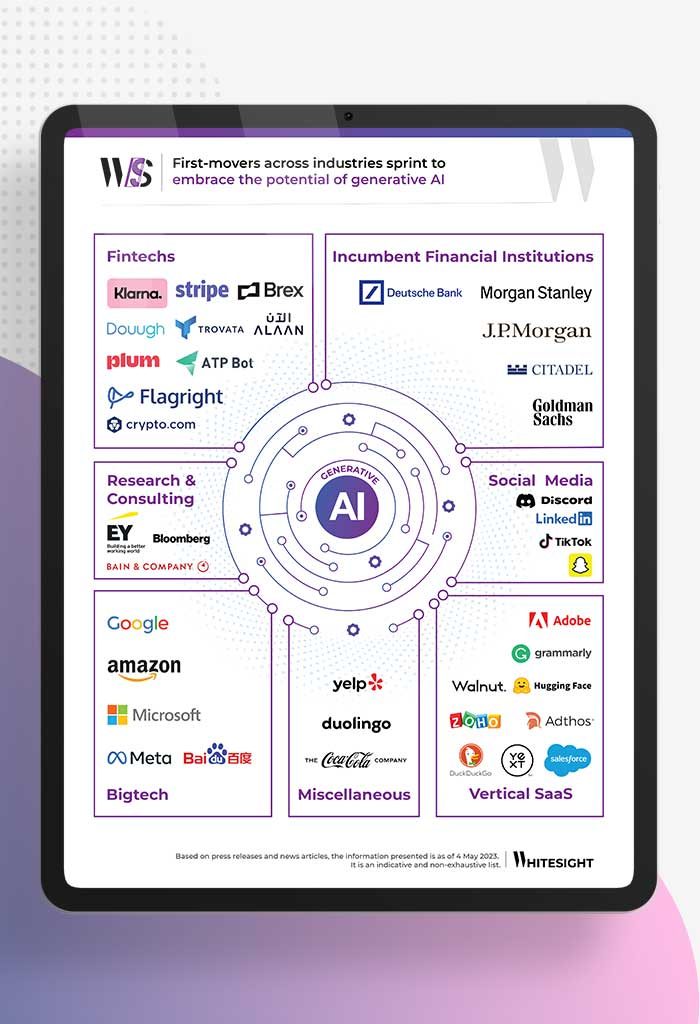

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...