The Unbundling of Finance for SMEs : A Fintech Revolution

- Sanjeev Kumar and Afshan Dadan

- 3 mins read

- Insights, SME Finance

Table of Contents

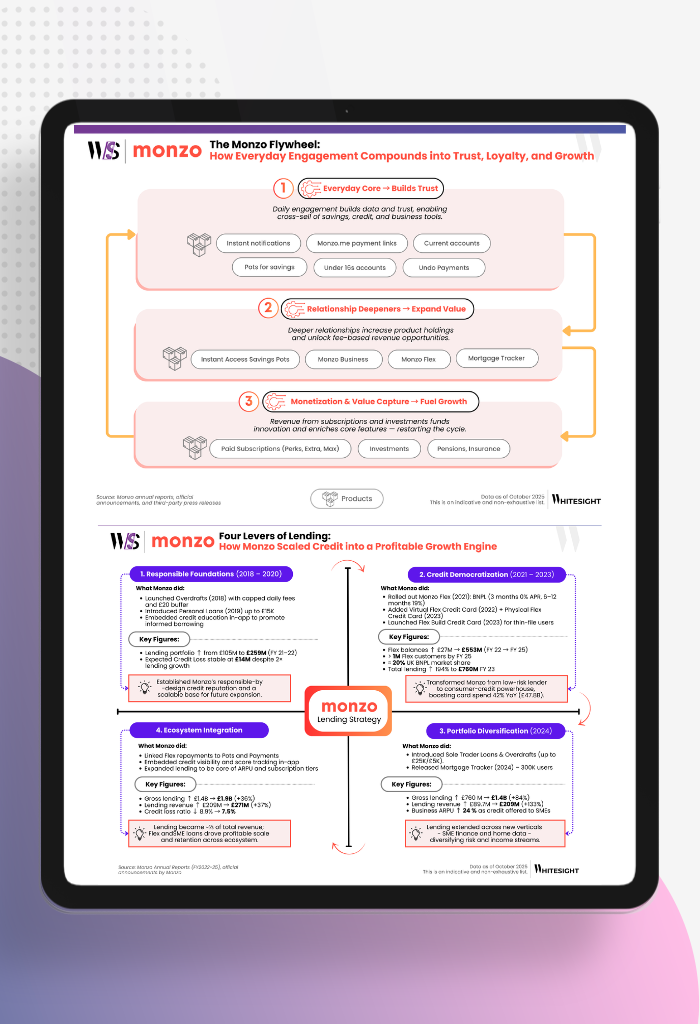

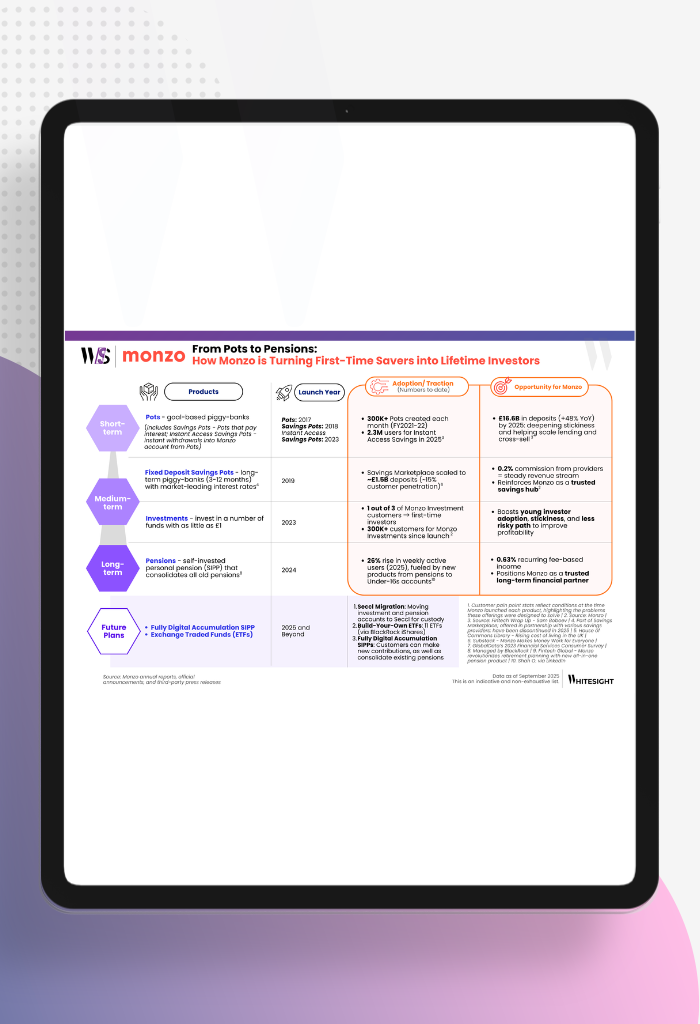

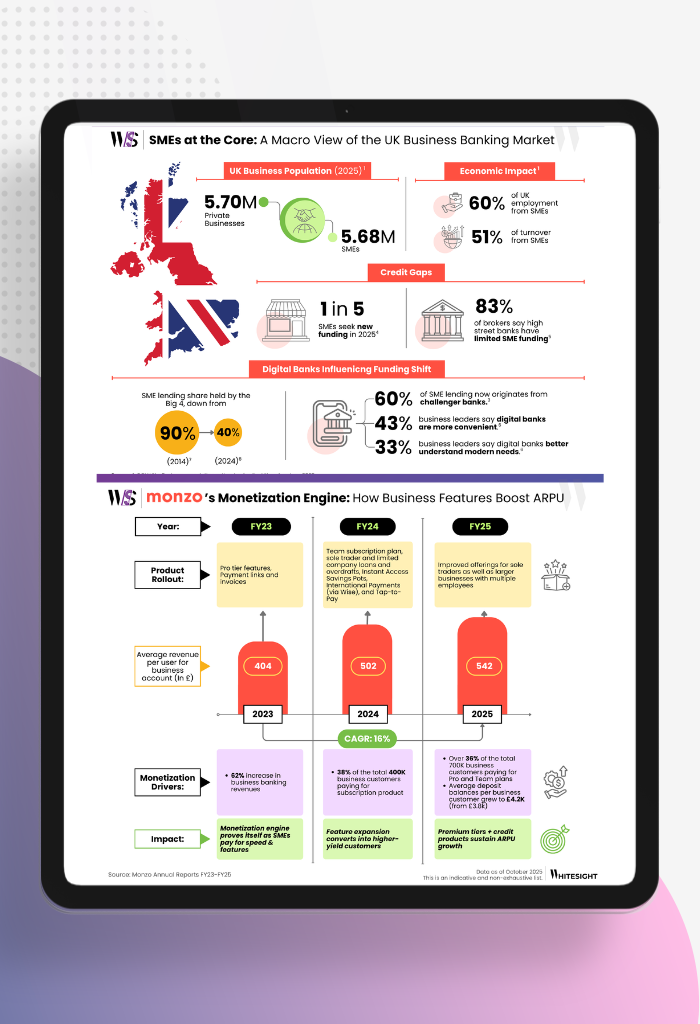

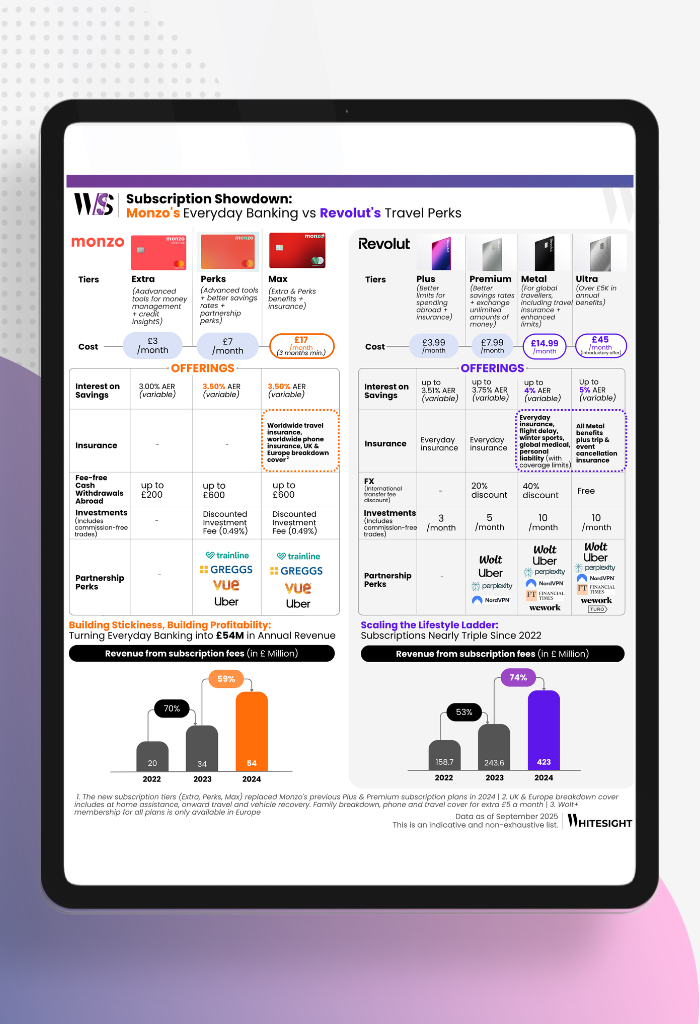

In the ever-evolving world of finance, fintech has emerged as a game-changer, particularly for small and medium enterprises (SMEs). As a follow-up to our previous article, we delve deeper into how Fintech is unbundling finance for SMEs, offering a plethora of services that were once the sole domain of traditional banks. We’ve incorporated a section on Cash Management, spotlighting key players that are empowering SMEs to leverage high-interest rates and gain access to instant credit lines. Furthermore, we’ve emphasized crucial sub-categories within the tech platforms segment, including data infrastructure and embedded finance platforms. These platforms are serving a crucial role in facilitating SMEs’ access to contextual financial products through their frequently used channels and at significantly improved rates. The Fintech Advantage for SMEs Fintech companies are offering a range of financial services to SMEs, from payments and banking to financing and insurance. They are also providing value-added services such as accounting, taxation, human resources management (HRM), and e-commerce operations. This unbundling of services is enabling SMEs to choose the best solutions for their specific needs rather than relying on a one-size-fits-all approach from traditional banks. To access the underlying data, reach out to us at hello@whitesight.net Cash Management Platforms One […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

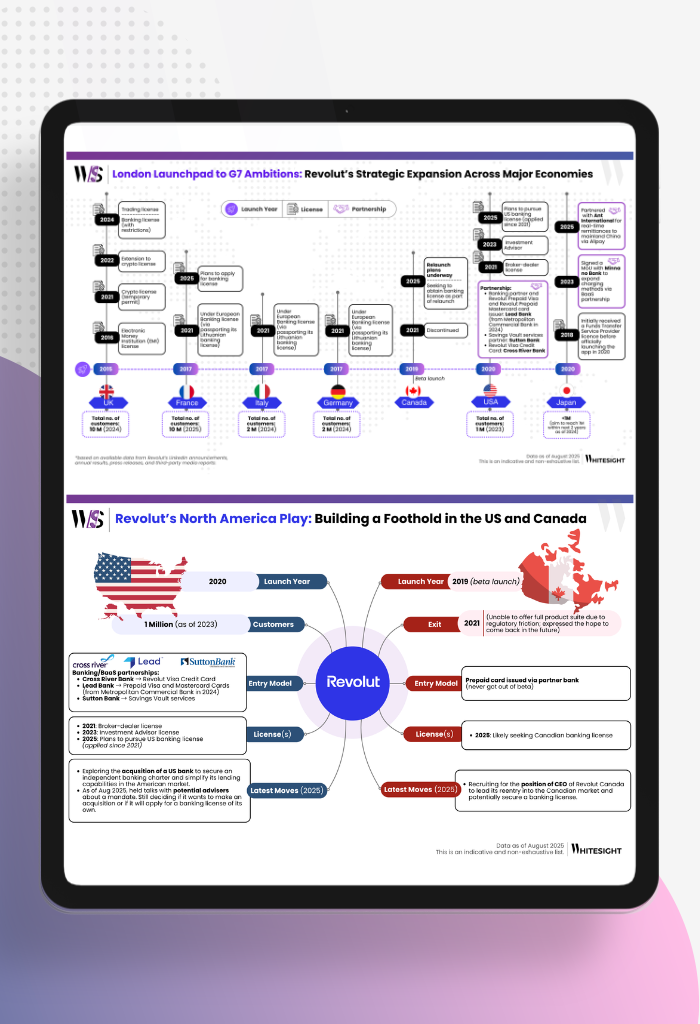

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty