The Monzo Model: Product Evolution Fueling Customer Growth and Sustainability

- Sanjeev Kumar and Risav Chakraborty

- 10 mins read

- Digital Finance, Insights

Table of Contents

Building Ecosystems That Bank on Engagement

When digital banks first emerged around 2010–2015, their goal was simple: make banking fast, fair, and frustration-free. Slick onboarding, transparent fees, and human-centred design turned finance from a chore into a choice. Yet as user bases scaled, expectations evolved. Today’s digital banks no longer stop at current accounts, savings, or loans. They’re building multi-product platforms that extend into insurance, investments, e-commerce, and even lifestyle utilities like travel perks and e-SIM connectivity.

The logic is clear. 57% of consumers prefer super apps for the convenience of unified services on one platform. Digital banks sit at the centre of that appeal, with users showing the strongest interest in integrating mobile purchases (54%), money transfers (53%), and bill payments (51%) within the same app. What’s more, PYMNTS Intelligence finds that 79% of banks are preparing for a “deeply embedded” future, with 70% viewing this integration as core to their digital strategy.

The transformation is taking visible shape across markets. In Asia, super apps like WeChat, Alipay, and Gojek have created ecosystems where payments, shopping, and social experiences coexist seamlessly. In Brazil, Banco C6 exemplifies this shift with a full-stack superapp that unifies banking, credit, insurance, and investments. It has targeted the upmarket segment by offering curated investment products in partnership with JPMorgan Chase for high-net-worth clients, a strategy we’ve uncovered in our Banco C6 Strategy Playbook. Meanwhile, Nubank’s no-fee credit card, paired with features like PIX transfers, remittances, and embedded telecom services, shows how digital banks can unlock inclusion and profitability at scale, as explored in our Nubank Deep Dive report.

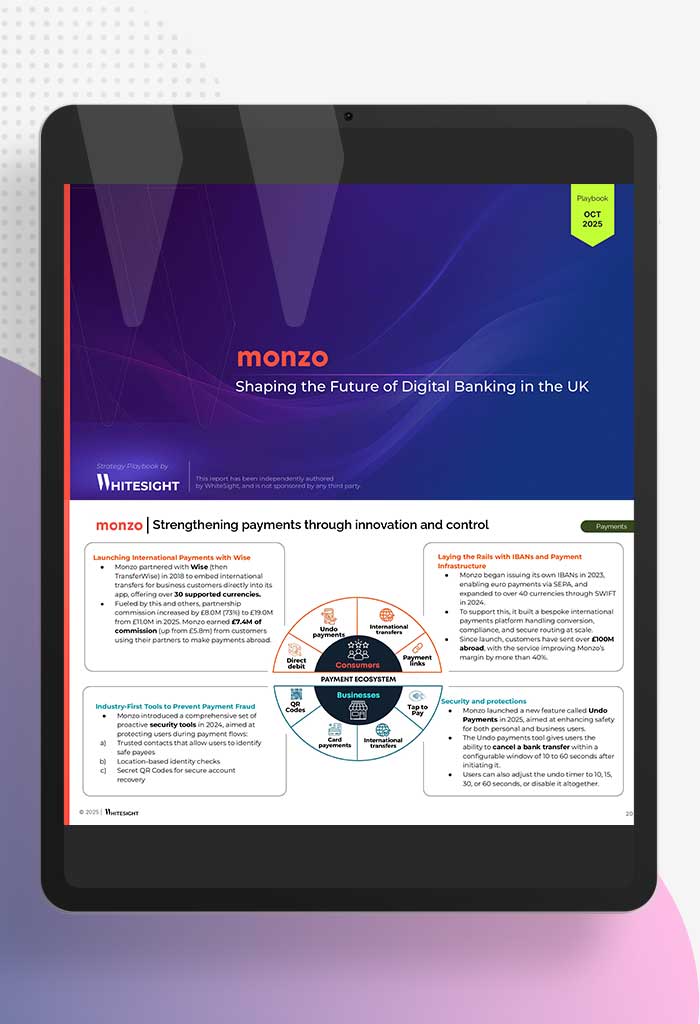

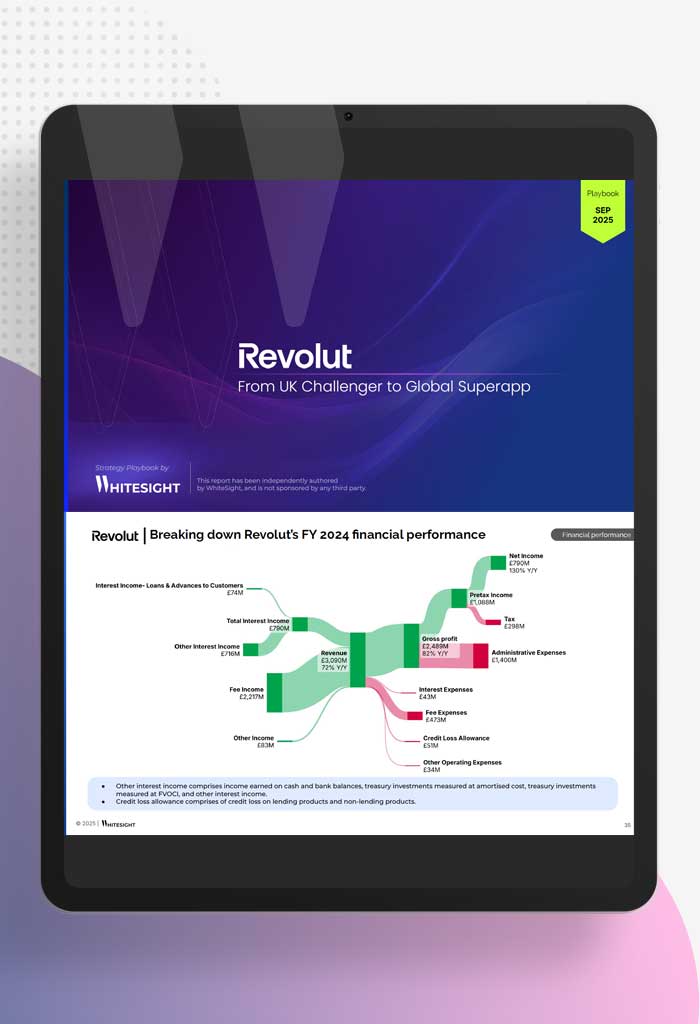

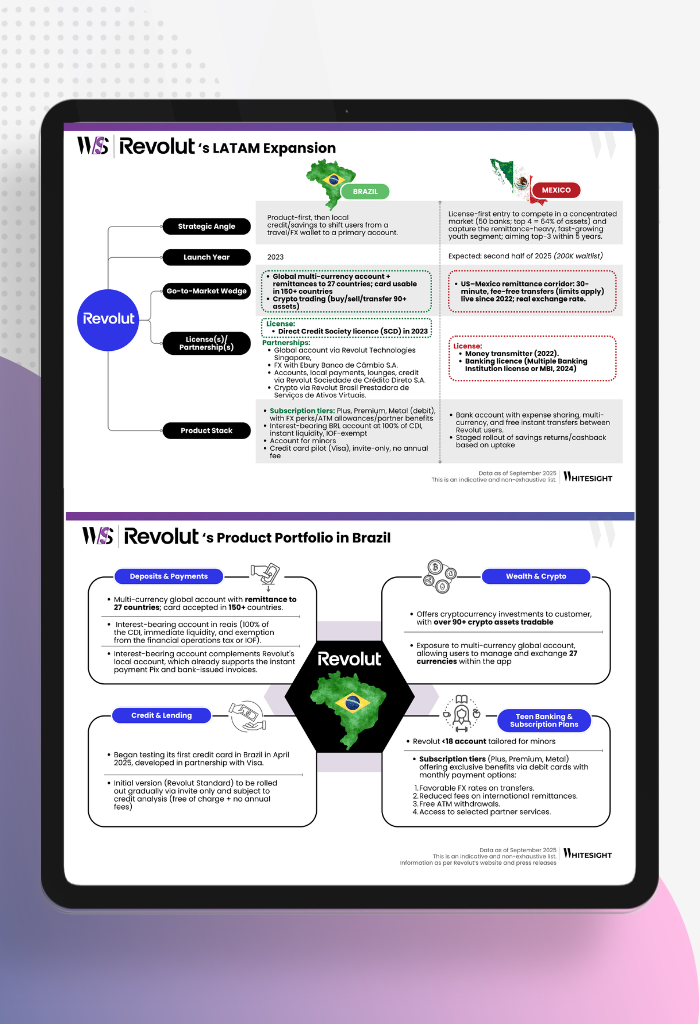

The UK is seeing the same wave. In fact, 57% of UK consumers say they would trust their bank to deliver such an integrated financial super app. Revolut, with 65M+ customers worldwide, has taken this ecosystem vision global. It has turned its borderless finance model into a global super app, from cross-border transfers to travel, crypto, and lifestyle subscriptions. Our Revolut: From UK Challenger to Global Superapp playbook covers its transformative path in detail. Monzo, meanwhile, is pursuing depth over breadth, positioning itself as a “financial control center” where consumers can manage their financial lives.

What’s emerging is a deliberate layering of value, built for retention, monetisation, and scale. And it’s this philosophy that frames Monzo’s evolution across three arcs: product evolution, business growth, and financial growth.

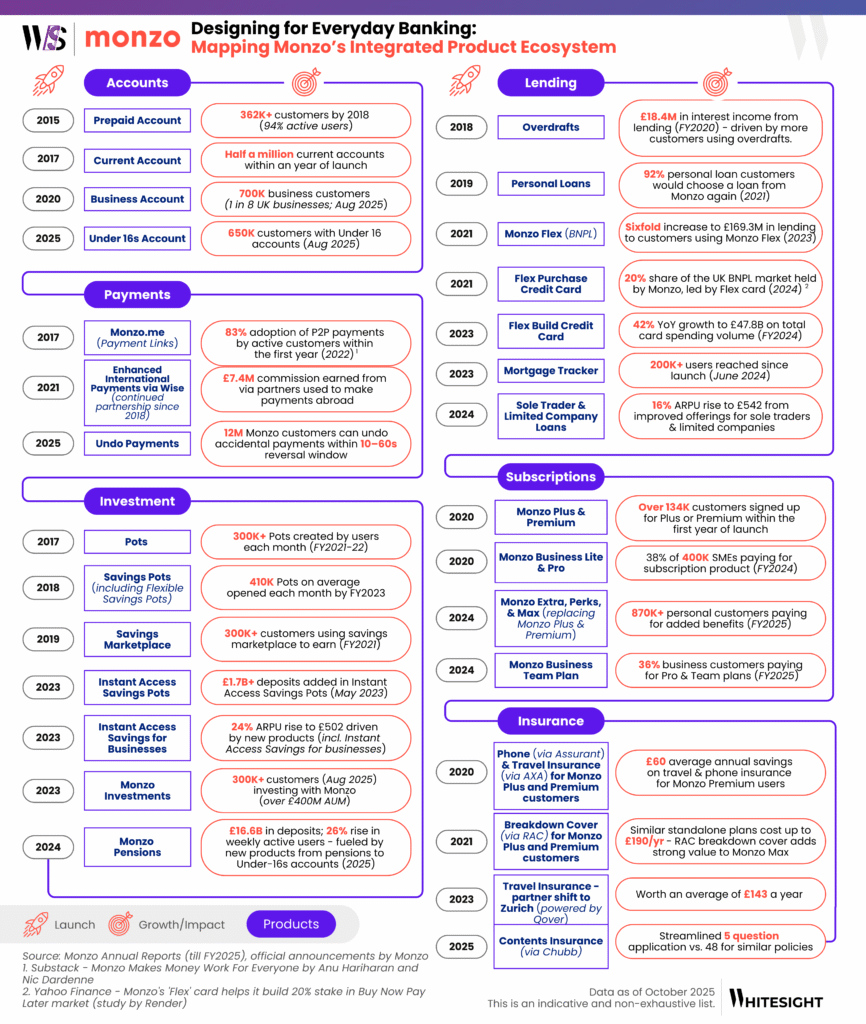

How Monzo Engineered Its Product Evolution

Monzo’s story began with a prepaid card rolled out to 500 early adopters. It was both a prototype and a statement: real-time notifications, instant freezing, and spending insights that could make people feel in control of their money again.

Within two years, this experiment evolved into a full current account with FSCS protection and faster payments. From thereon, Monzo followed a simple loop to build more features: listen, remove friction, turn utility into a habit, and monetise habits that deliver daily value.

Monzo understood that adoption depended on the frequency of use. Features like Pots turned banking into behavioural design. By letting users “earmark” money for goals, Monzo bridged emotion with disciplined saving. By FY22, over 300K Pots were being created each month.

Yet Monzo’s true inflection point came when it moved beyond managing money to making money work. Instant Access Savings Pots, launched in 2020, were the catalyst. By offering up to 3% AER via partner banks, Monzo built a dual engine of trust and deposits. Within a year of launch, Instant Access balances exceeded £7.7B, turning idle funds into a low-cost funding source for future lending.

Want to discover how Monzo turned loyalty into recurring revenue? Learn from the best in class with our deep dive analysis on Monzo. Check out the report now!

Report

From Savings to Subscriptions

Subscriptions followed in 2020, the foundation of recurring revenue. After early missteps, Monzo relaunched Plus (and later Premium) to package higher interest, travel and phone insurance, credit insights, and power budgeting under one price. “This software has the potential to really meaningfully change people’s relationship with their finances…it’s a package of value… we can provide fairly uniquely.” — Mike Hudack, CPO. Within a year, 134K users signed up for Plus and Premium. By FY22, 25% of revenue came from subscriptions, validating the model. Monzo learned fast from its 2019 stumble, refining its tiers into Extra, Perks, and Max by 2024. As uncovered in our Banking-as-a-Membership: Subscription Playbook of Monzo and Revolut blog, it’s now counting over 1M paid users, having transformed subscriptions into a scalable, loyalty-driven revenue engine.

From Overdrafts to On-Demand Credit

Next came loans, and while Monzo started its lending journey with overdrafts, it was Flex – the BNPL feature – that rewired short-term credit around transparency and control. Unlike competitors chasing checkout integrations, Monzo embedded Flex directly into its app, available wherever customers spend. By FY25, Flex users surpassed 1M, representing nearly 20% of the UK BNPL market.

From Transactions to Investments

That same philosophy drove Monzo Investments (2023), managed by BlackRock and powered by Seccl, aimed at the bank’s majority Gen Z consumer base. CEO TS Anil described its aim as “banishing the barriers to investing, affordability, complexity, and lack of personalisation.” Starting from £1, users could invest in simple, risk-based portfolios. It positioned Monzo as a first-mover among licensed neobanks for offering investments, with peers like Starling and Zopa not offering investing in 2023. The move reflects a broader mission: to make Monzo a financial control centre where customers can grow their money and confidence step by step, something we’ve explored in detail in our Monzo’s Wealth Playbook: Turning Gen Z Savers into Tomorrow’s Investors (insert hyperlink here) blog. Combined with insurance, Monzo Pensions, business banking, and even Under-16 accounts, Monzo now serves every stage of financial life, from pocket money to payroll.

Two patterns emerge from here:

- Go from money control to money growth and then money protection. Lending, savings yield, and insurance map cleanly to those jobs.

- Monetize through time saved and anxiety removed. Subscriptions (Perks/Extra/Max) and recent features like Undo Payments to reverse mistaken transfers monetise peace of mind and reduce admin, benefits consumers feel daily.

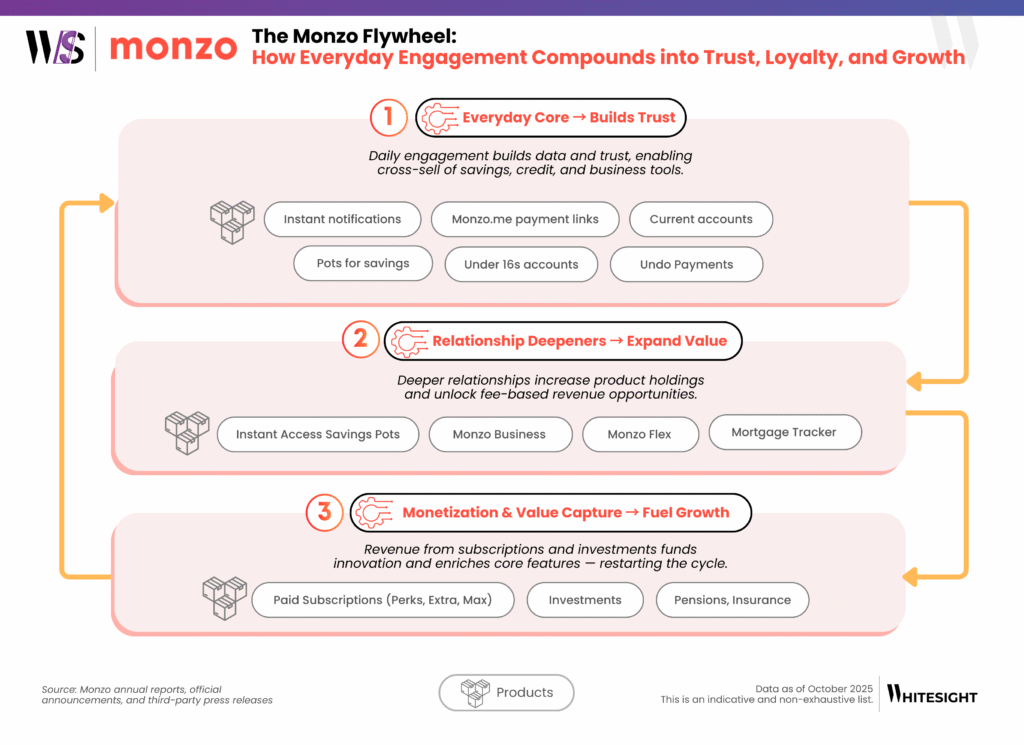

This is the logic behind Monzo’s value stack:

Each layer strengthens the next. The Everyday Core builds trust and engagement through daily utility. Once users rely on Monzo for instant notifications, Pots, and payments, they naturally graduate to deeper financial use cases like Flex or Business accounts. These deeper relationships create richer data and engagement patterns, enabling Monzo to cross-sell high-value, fee-generating services, i.e. subscriptions, investments, and pensions. The bottom monetization layer acts as a cash cow and funds innovation and product development that enrich the Everyday Core. For example, subscription revenue supports new UX features or free core tools and paid subscription plans also create halo effects in a way that satisfied premium users become advocates who drive adoption of free, habit-forming features (e.g., Pots, payment links).

This flywheel of cross-sell and engagement explains Monzo’s exceptionally low churn and rising Average Revenue Per User from £163 to £187 in retail and £542 in business banking.Every launch, from emergency loans to embedded insurance, built a deeper relationship with users who once just wanted a Coral card that worked. Today, Monzo’s 12M users and 700K business accounts are a living ecosystem built on the belief that trust compounds faster than interest.

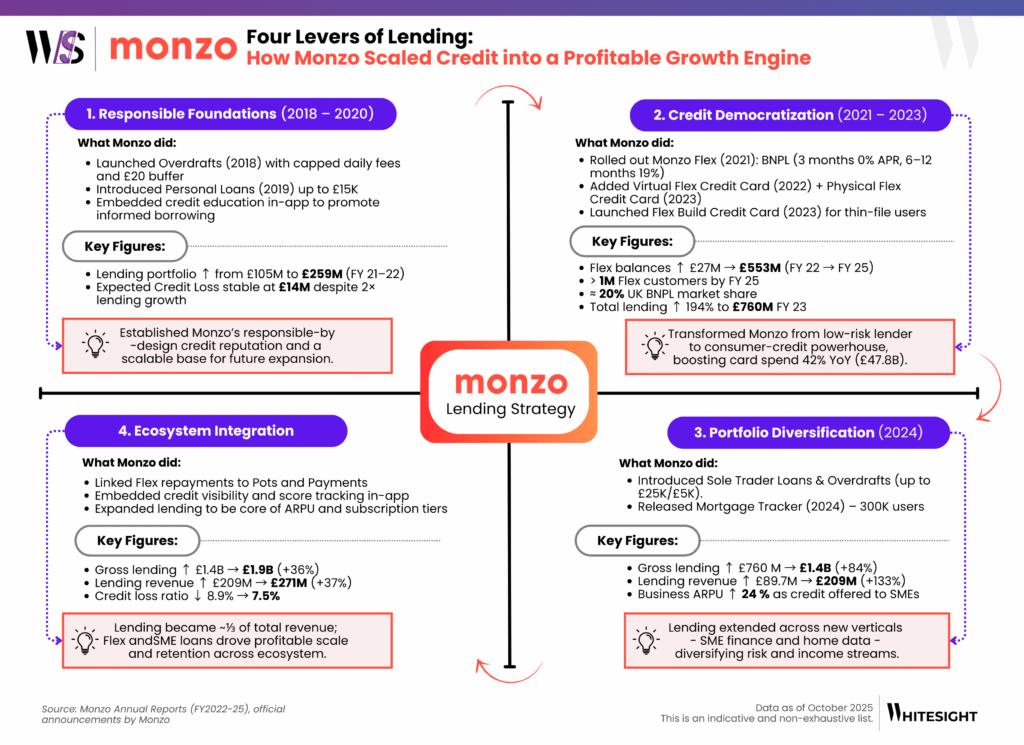

Credit as the Catalyst of Monzo’s Compounding Growth

While the first phase of Monzo’s journey was about earning trust, the second was about monetizing it responsibly. Lending became the ultimate proof that a design-first challenger could compete where incumbents once held the advantage: credit.

The 2018 overdraft launch established Monzo’s principle of responsible-by-design credit. A capped daily fee, transparent in-app breakdowns, and a £20 safety buffer differentiated it from legacy lenders who profited from opacity. Personal loans followed in 2019, starting from just £200 and underwritten on affordability rather than risk tiers. As co-founder Tom Blomfield described it, “You shouldn’t force people to borrow thousands when they only need two hundred… it’s a flexible tool, not a trap.” This principle of lending as empowerment and not entrapment became Monzo’s credit DNA.

The turning point arrived in 2021 with Monzo Flex. Users could retroactively split purchases into three, six, or twelve instalments, all managed within the app. The approach worked: lending via Flex surged sixfold to £169M by FY23, representing over one-fifth of Monzo’s total credit book.

By 2023, Flex matured into a credit-card ecosystem. The Flex Physical Card offered limits up to £10K and 0% APR for short-term purchases, while Flex Build targeted thin-file customers, starting at £350 limits with incremental increases. TS Anil described it as “a way to give people the same flexibility we built our brand on, now applied to credit.” These upgrades deepened inclusion and unlocked scale: by FY24, total card spending grew 42% YoY to £47.8B.

Monzo’s next move took lending beyond consumers. In 2024, it launched sole-trader and limited company loans, up to £25K, and business overdrafts of £5K, a logical progression as Monzo’s SME banking base grew past 500K accounts in 2024. By embedding the same design principles – real-time repayment tracking, transparent interest, and instant approvals – Monzo translated its retail strengths into the SME arena. For small-business owners long underserved by incumbents, this meant credit that was immediate and integrated. It’s a continuation of how Monzo applies its design credibility, data discipline, and deep consumer trust to empower entrepreneurs as effortlessly as it once managed personal budgets – which we have explored in our Retail Darling to Business Powerhouse: Monzo’s Strategic Expansion Into SME Banking blog.

The bank also introduced a Mortgage Tracker, helping 300K users monitor repayments and rate changes. While mortgage lending itself isn’t on the cards anytime soon for Monzo, this product still deepens engagement in one of life’s biggest financial commitments.

In a market crowded with volume chasers, Monzo’s lending model stands out for precision. Instead of disrupting credit, it redesigned it: smaller, fairer, data-driven, and seamlessly integrated into an ecosystem where every repayment strengthens the relationship.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

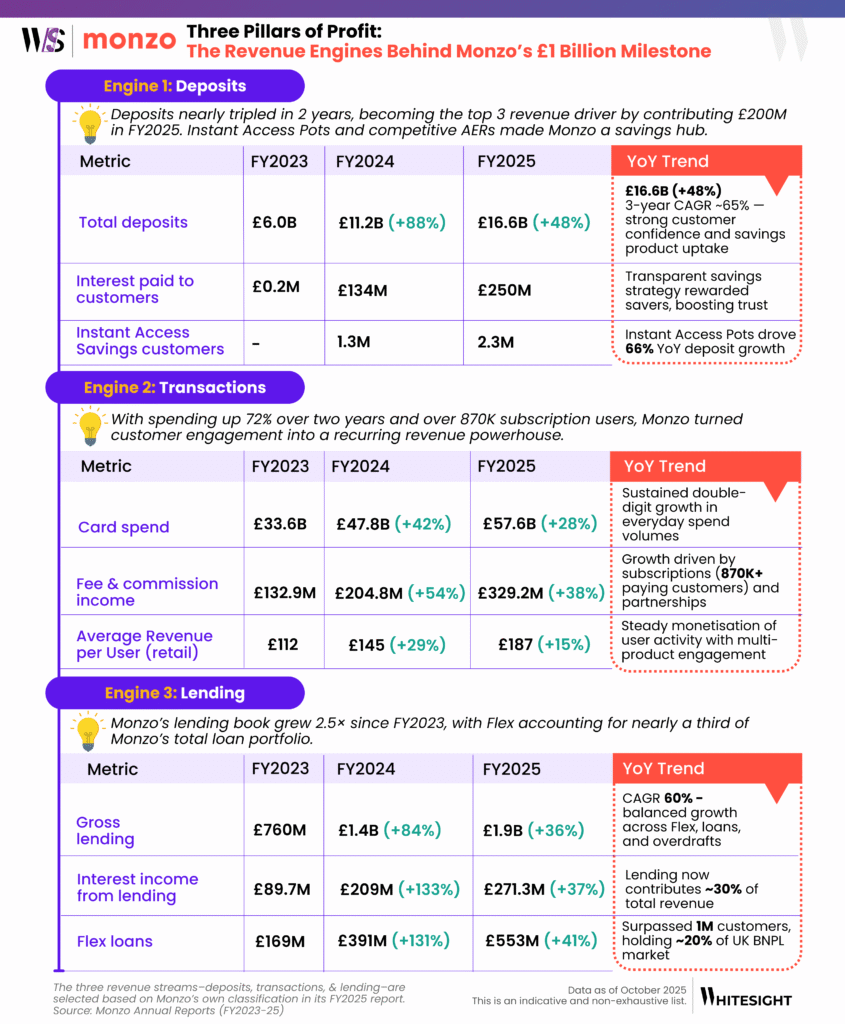

Designing Profitability Through Deposits, Spend, and Credit

Monzo’s leap from a £116M loss in FY23 to a £95M profit in FY25 was a result of its robust design system. After years of refining product-market fit, Monzo learned that sustainable growth lies in three engines that power one another: savings, transactions, and lending. Each reinforces trust, deepens engagement, and funds the next layer of growth.

1. Savings: Liquidity That Builds Loyalty

Monzo’s savings journey evolved from behavioural engagement to financial muscle. In FY23, viral features like Roundups and Pots built savings habits, pushing deposits to £6B, while Instant Access Pots added £1.7B within months. By FY24, habits matured into trust: 1.3M users deposited £5.4B, earning £134M in interest as Monzo proved fair returns drive loyalty. In FY25, it surged to £16.6B, including £8.9B in Instant Access balances, as 2.3M savers earned £259M in interest. Alongside, Monzo Investments attracted 300K users and £400M AUM, while the bank retired third-party Pots to focus on its own spreads. The outcome is a self-funded growth loop where customer trust generates low-cost liquidity, powering Monzo’s lending and turning savings from a passive liability into a compounding, profitable asset.

2. Transactions: Engagement into Recurrence

Monzo’s transaction engine turned everyday payments into a steady yield, driven by two levers: card spend and subscriptions. In FY23, card spend rose 38% to £33.6B, while subscription fees jumped 77% as 350K customers paid for Plus and Premium, proving that users would pay for convenience. By FY24, spend climbed to £47.8B, and subscription revenue rose 53% as Monzo leaned into behavioural monetisation: customers paying for convenience, cashback, and travel perks. FY25 cemented the loop: £57.6B flowed through cards, transaction income hit £235M, and subscriptions surged 64% to 870K after launching Extra, Perks, and Max. The playbook is simple: price the time you save, own more of the rail where it matters, and let subscriptions convert daily utility into annual recurring revenue-like cash flows. For customers, it means premium perks and smoother cross-border flows; for Monzo, it’s more predictable, higher-margin unit economics.

3. Lending: Yield with Discipline at Scale

Monzo’s lending story is one of precision and maturity. In FY23, its loan book nearly tripled to £759M, proving customers now trusted Monzo to lend and not just hold money. Overdrafts, unsecured loans, and Flex built a diversified portfolio that drove interest income up 190%. By FY24, the playbook matured. Lending revenue climbed 133% to £209M, representing a quarter of total income. However, credit loss provisions rose sevenfold, signalling the cost of rapid acceleration. Rising arrears and portfolio seasoning were offset by better risk modelling and diversified exposure across overdrafts, loans, and Flex. In FY25, that refinement paid off. While the loan book rose 36% to £1.9B, credit losses declined 10%, proving underwriting precision and recovery strength. Lending now contributes ~30% of total revenue, proving that enhanced credit tools, tighter risk decisioning, and early forbearance build a flywheel of sustainable credit.

As of FY2025, each engine, savings, transactions, and lending independently generate £200M+ annually. The edge is their synergy: savings fund lending; transactions drive deposits and subscriptions; lending monetises the trust earned. That flywheel pushed revenue past £1B and flipped a £116M FY2023 loss into a £95M FY2025 profit. It also raised ARPU (retail £187, business £542) as customers hold more products (2.1 per weekly-active retail user; 3.9 per active business).

Monzo’s Next Frontier of Scale and Connectivity

Monzo’s profitability lift, £1.2B in revenue and over £90M net income in FY25, gives it the momentum to turn scale into global impact. Its next chapters are clear: expanding into Europe via a Dublin hub in 2025, and reopening its US ambitions with a US banking licence in view. On the home front, Monzo is also preparing to enter the UK mobile market as an Mobile Virtual Network Operator, a bold move to deepen engagement, bundle connectivity with banking, and cross-sell to its 13M+ customers. These initiatives flow from its core playbook: trust, engagement, monetisation. From savings to spend to credit, Monzo has built the architecture. Now it’s about global reach, ecosystem breadth and making “banking + life” ubiquitous.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Senior Research Associate

Risav is a senior research associate at WhiteSight, where he spends his days navigating the complex fintech landscape and poring over market trends. When he's not decoding the world of fintech, you'll find this sports fanatic decoding the perfect curveball on the football field.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...