The UK Big Banks’ Bet on FinTech

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Bank-Fintech Collaboration, Insights

Table of Contents

The dawn of the digital age in the financial sector has paved the way for increased alliances between incumbents and FinTechs. In an attempt to bolster the UK’s FinTech sector, FinTech Pledge, developed by the Fintech Delivery Panel with support from HM Treasury (HMT) as an initiative aimed towards creating a financial ecosystem by enabling enhanced collaboration between banks and leading FinTech firms, was launched in 2020. In 2022, the Big 4 UK banks – Natwest, Barclays, Lloyds and HSBC – have been busy walking the talk through their ecosystem-focused initiatives and are moving the needle on the Bank-FinTech collaboration mandate. Going after isolated partnerships seems to be a thing of the past for the UK High Street banks. The Big 4 have instead resorted to forming an ecosystem of FinTechs with an array of carefully curated alliances that help them unlock ecosystem orchestration at scale. The symbiotic collaboration mainly revolves around a few key ecosystem orchestration themes, including:i) Platform-as-a-Service, a utility-based model that allows clients to develop, run and manage banking applications in the cloud,ii) Banking-as-a-Service, the provisioning of banking products and services through third-party distributors,iii) Innovation Sandbox, brings a variety of FinTech collaboration opportunities through an efficient design […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

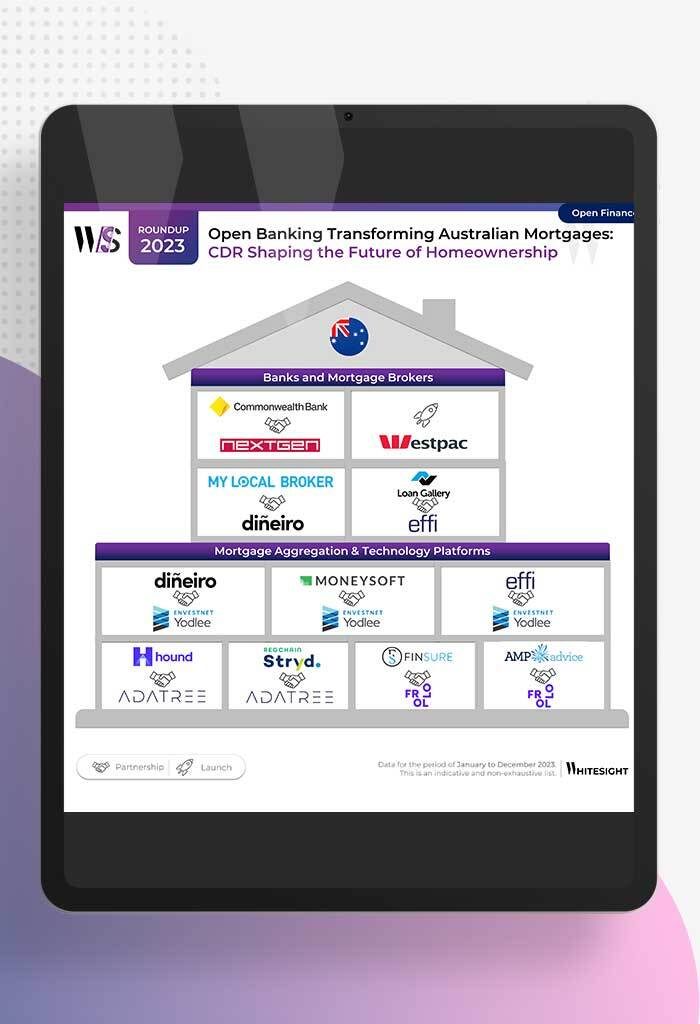

- Sanjeev Kumar and Samridhi Singh

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

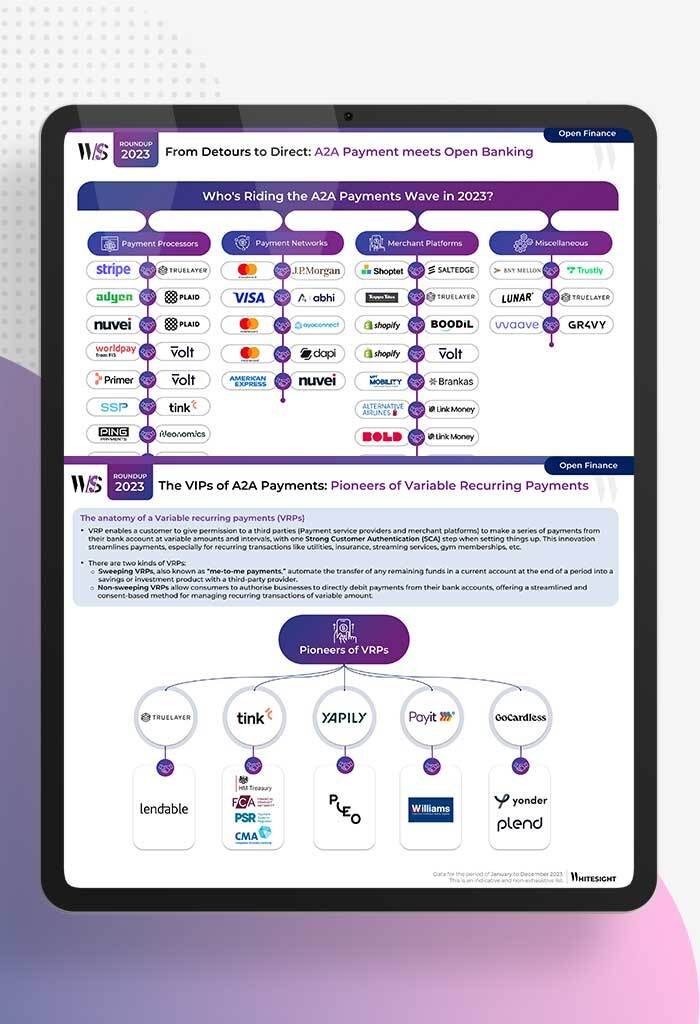

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

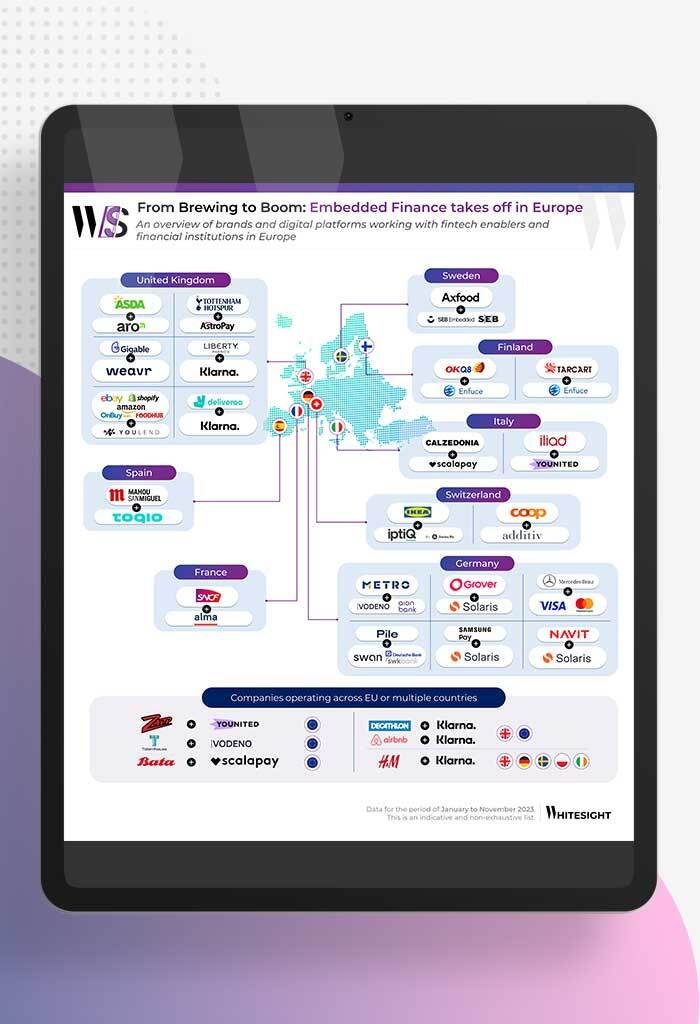

- Afshan Dadan and Sanjeev Kumar

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

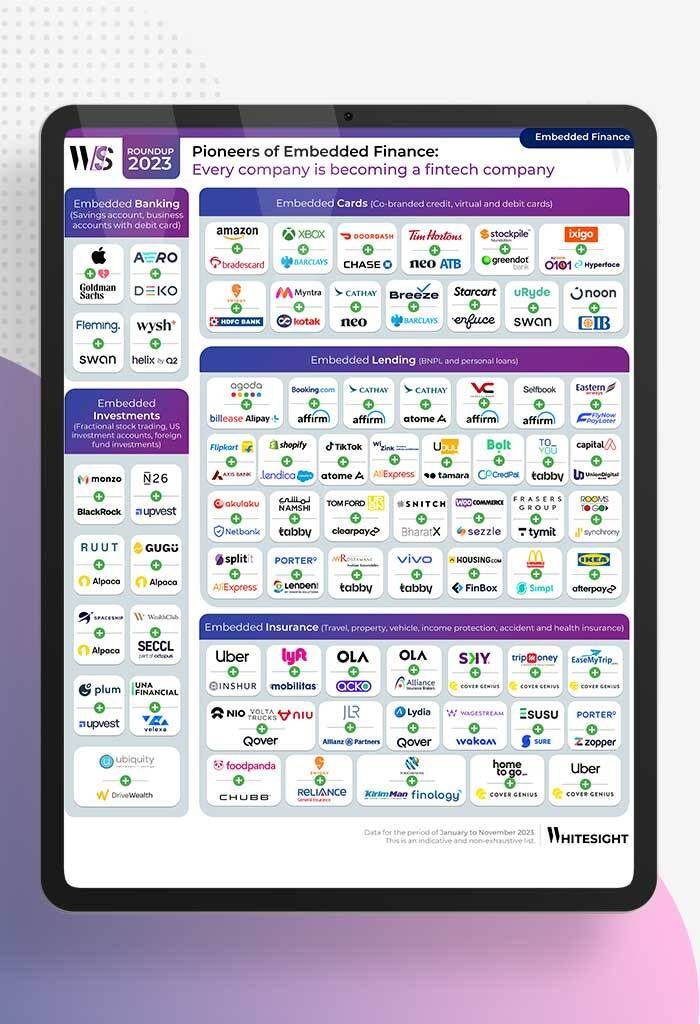

- Sanjeev Kumar and Samridhi Singh

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...