#WIN: Women in Neobanking

- Team WhiteSight

- 2 mins read

- Insights, Sustainable Finance

Table of Contents

When women master technology they tend to rise to the top very quickly because they have greater empathy. Wise words by none other than Anne Boden of Starling Bank.One Small Step for Anne Boden, One Giant Leap for StarlingBefittingly on the International Women’s Day, Starling Bank achieved the much awaited Unicorn status. After achieving the monthly profitability in October 2020, and Unicorn status in March 2021, IPO remains the next milestone for Starling to gallop towards. Fintech has historically been hard pressed with the double whammy of diversity challenge, as both the technology and financial industry happens to be male-dominated at the leadership levels. Regardless, incredible female founders and leaders continue to create and lead next-gen fintech businesses, and especially the challenger banking.Women-led neobanks in our Top 20 list represent 5 fintech unicorns serving more than 50 million customers and have cumulatively raised over $5.2 billion in funding.Starling Bank & Judo Bank, the oh-so-rare profitable neobanks, are lead by some fierce female entrepreneurs like Anne Boden & Jacqui Colwell.The two neobanks also count a significant number of women in leadership roles across the organisations.Are the Challenger Banks Challenging the leadership diversity Status Quo? The leadership positions analyses gave us a […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Samridhi Singh

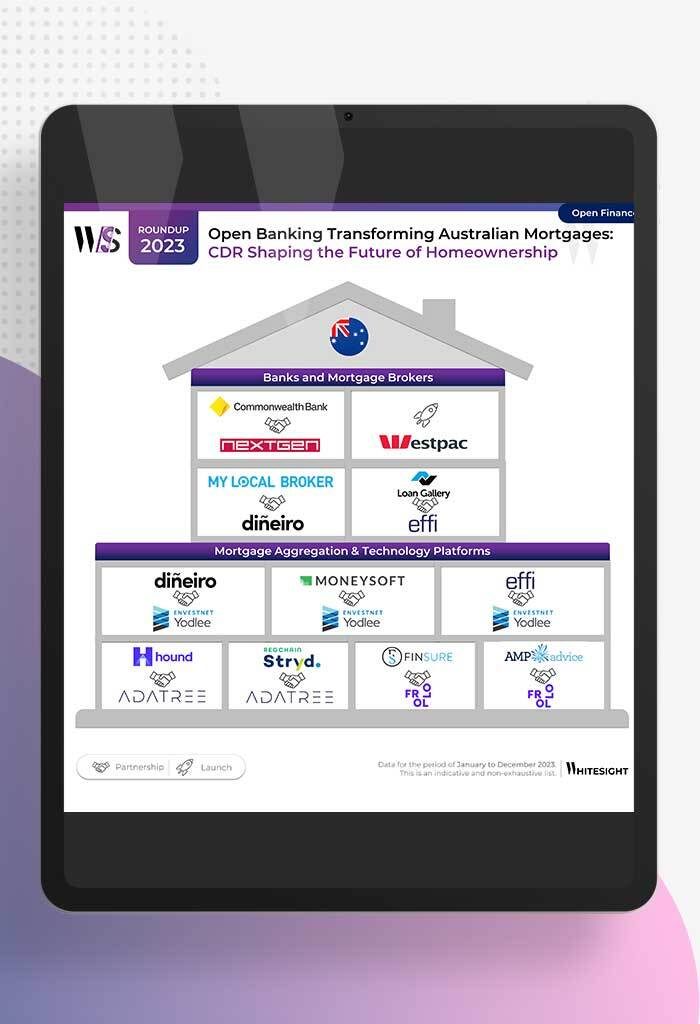

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

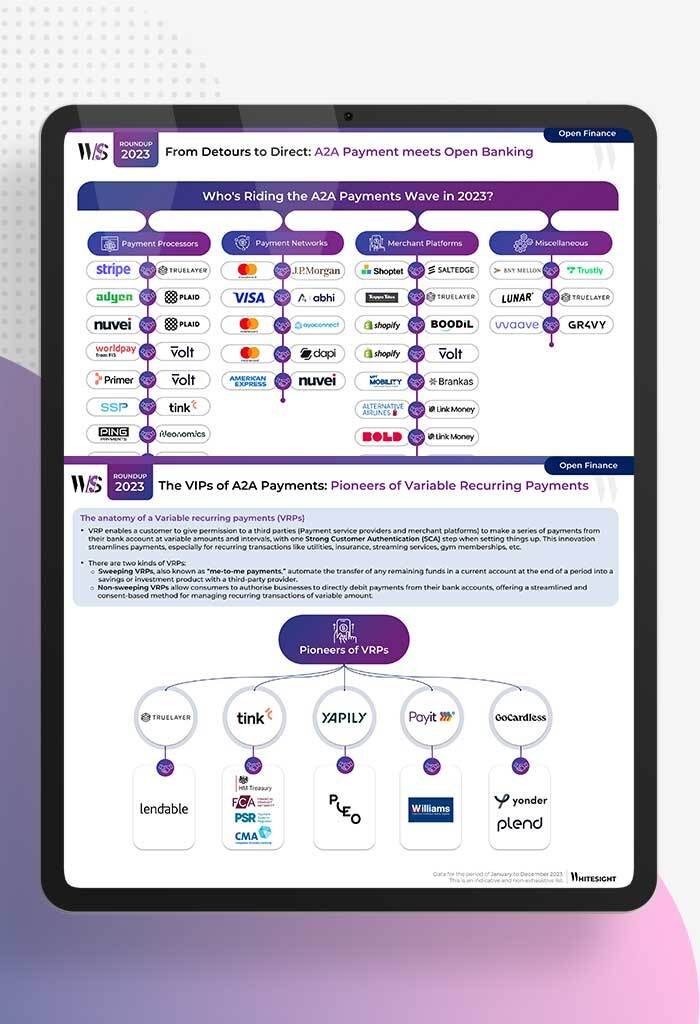

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

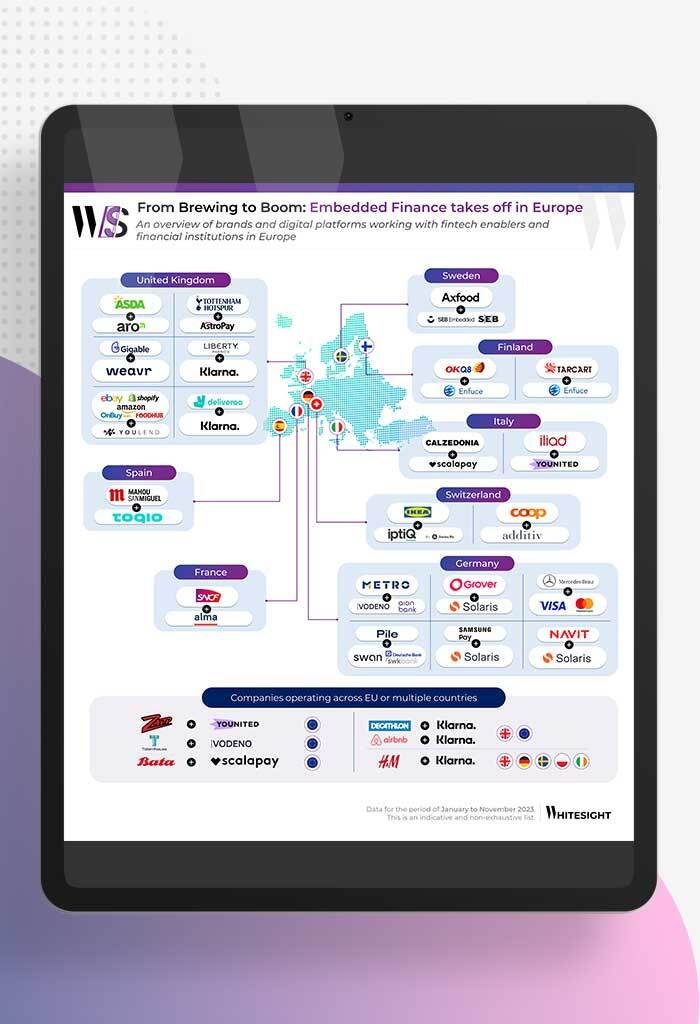

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

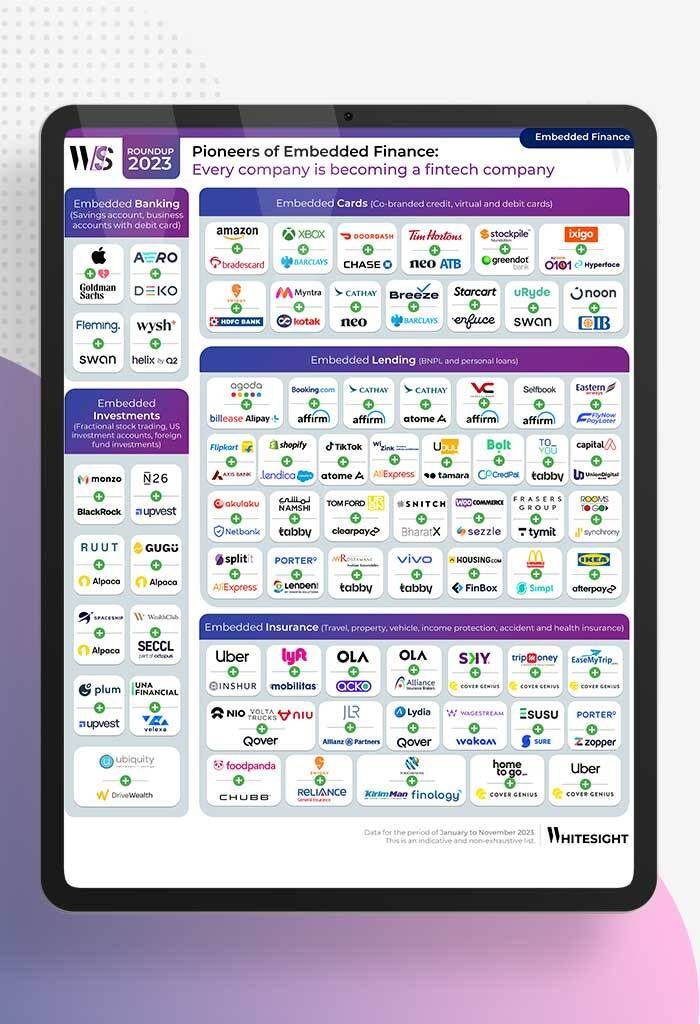

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...