Banking-as-a-Membership: Subscription Playbook of Monzo and Revolut

- Sanjeev Kumar and Risav Chakraborty

- 5 mins read

- Digital Finance, Partnerships

Table of Contents

Subscriptions as the Business Model of Banking

For years, neobanks thrived on a single metric: customer growth. They were judged by how many millions of sign-ups they could rack up. But when venture funding started cooling due to macroeconomic headwinds, investors pressed for sustainable paths that deliver real returns on their capital. The focus shifted from growth at all costs to sustainable and robust revenue streams. Now, investors began asking harder questions: where’s the profit?

For digital banks, this meant finding new routes to profitable revenues. Lending was the obvious path, but it carried risk and capital intensity. Another, more organic lever soon emerged in the form of subscriptions.

The wider economy has already embraced them, and many drivers are leading to their increased adoption:

- The Subscription Economy Index 2025 shows that companies in the Index experienced a 25% increase in unique subscribers over two years.

- Meanwhile, 84% of consumers say they’re still getting equal (50%) or greater (34%) value from their subscriptions despite uncertainty.

- In the UK alone, the subscription market is projected to grow 19% annually, hitting £1.8B by end-2024.

- And Gen Z is powering the surge. According to a recent Visa research, 9 in 10 are subscribed to at least one service, spending £305 a month on average (more than triple Gen X).

But subscriptions aren’t immune to headwinds.

- According to GlobalData, 22% of UK consumers switched brands in 2024 based on lower pricing due to cost-of-living pressures.

- In fact, almost 28% have reviewed their subscriptions to ensure they pay for what they use. Of these, 20% have already cancelled or plan to cancel because of rising costs.

Subscriptions, then, are a double-edged sword: sticky and scalable, but also exposed to economic mood swings.

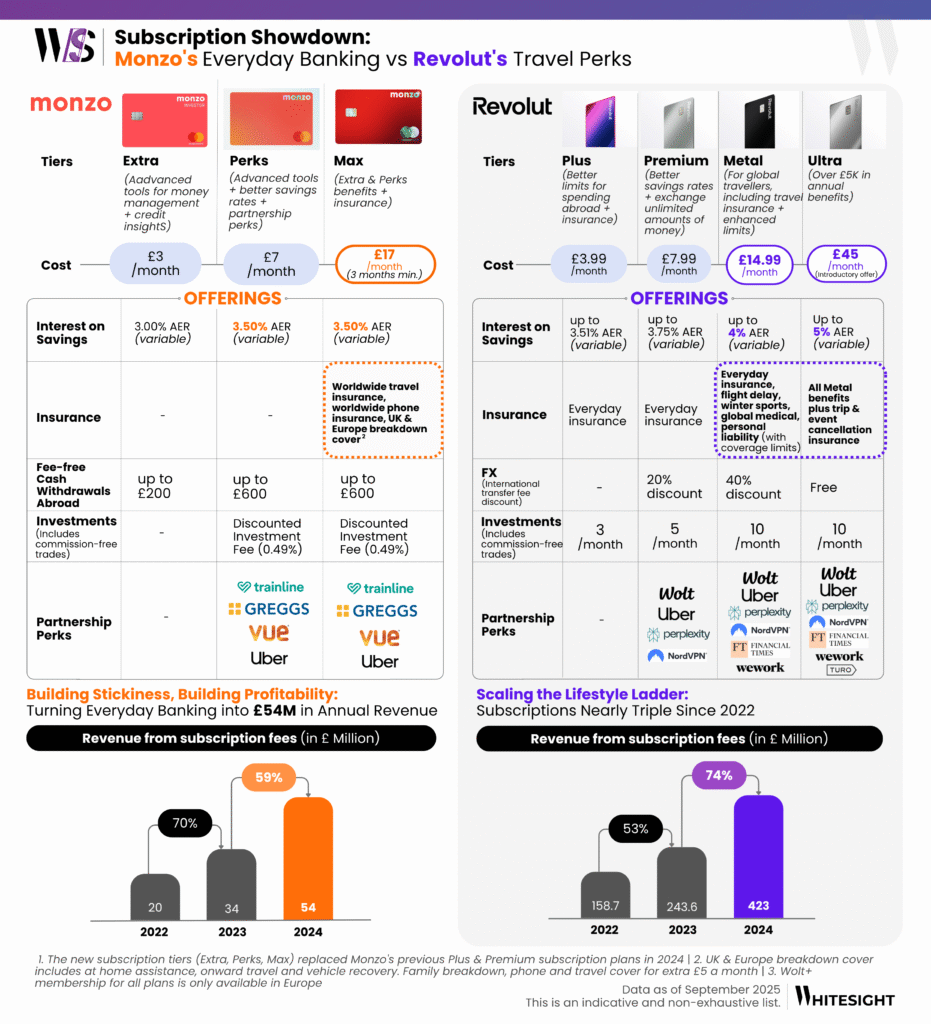

It’s no surprise then that Europe’s fintech giants are racing to perfect the formula. Revolut, N26, and others raced ahead with premium tiers, selling travel benefits, lifestyle perks, and higher-yield savings as part of a monthly package. Revolut paved the way with Premium (2017), Metal (2018), and Plus (2020) tiers, adding Ultra in 2023 and hiking fees to reflect richer perks. Monzo, by contrast, stumbled out of the gate, shelving its first Plus plan in 2019 after a lukewarm reception. But the challenger regrouped, and in 2024 it relaunched with three polished tiers (Extra, Perks, Max) just as Revolut hiked its own fees to as much as £14.99.

Looking to understand the formula behind a profitable digital bank? Learn from the best in class with our deep dive analysis on Revolut. Check out the report now!

Report

With both now scaling fast, the real test is how their subscription strategies compare, in offerings, economics, and the ultimate playbook for profitability.

The Subscription Learning Curve of Digital Banks

Monzo and Revolut started from different places, stumbled, adapted, and are now using subscriptions as a lever for profitability and loyalty.

1. Monzo’s Subscription Journey

Monzo’s first foray into subscriptions came in 2019 with Monzo Plus, a £6/month plan offering colored cards and a handful of extras. But customers weren’t sold, and after facing a smattering of complaints, the plan was scrapped within months.

Undeterred, Monzo returned in 2020 with a revamped Plus at £5/month. This time, it included 1% interest on balances up to £2K, £400 fee-free foreign withdrawals, and digital perks like virtual cards and credit insights. Later that same year, Monzo introduced Premium at £15/month, adding higher interest, bundled phone insurance, and a sleek metal card. This tier resonated with Monzo’s power users: within the first year, 134K customers subscribed to Plus and Premium. By FY2022, subscriptions had scaled to over 360K users across Plus, Premium, and paid business accounts, with fees accounting for 25% of Monzo’s revenue, proof that subscriptions could be more than an experiment.

By 2023, Monzo broadened access by making some budgeting tools free for all, while simultaneously enhancing paid tiers to keep them attractive. The real breakthrough arrived in 2024 with Extra (£3), Perks (£7), and Max (£17), new tiers designed after surveying 45K customers. Focused on daily value, they bundled perks like free Greggs snacks (where 2.3M customers spent £70M in 2023) and discounted Trainline Railcards (with 13M transactions worth £244M in 2023), alongside higher savings rates, discounted investing fees, and insurance.

The result: by FY2025, Monzo had 1M+ subscribers, with subscription income up 50% YoY.

Want to discover how Monzo turned loyalty into recurring revenue? Learn from the best in class with our deep dive analysis on Monzo. Check out the report now!

Report

2. Revolut in Contrast

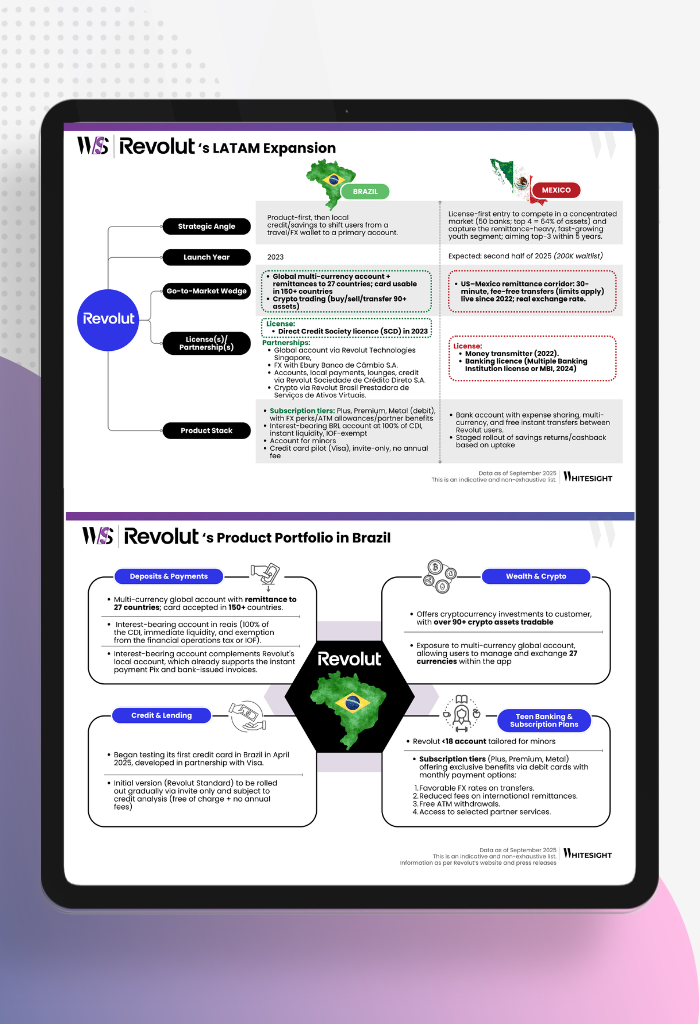

Revolut offers four tiers — Plus, Premium, Metal, and Ultra — structured more like a lifestyle membership than a banking bundle. Metal, at £14.99/month, undercuts Monzo’s top-end Max in price but tilts towards international perks like higher FX allowances, travel insurance, and cashback. Its Ultra plan pushes savings rates up to 5% (vs Monzo’s 3.5% variable), with broader insurance coverage and global lifestyle perks like WeWork and Financial Times access. Revolut has also leaned into scale, boasting 6.6M paying users by 2024 and quadrupling subscription revenues since 2021.

At their core, the two models reflect different ambitions. Revolut’s subscriptions are built for mobility, catering to people who travel often, swap currencies, and want lifestyle extras on top. It’s a compelling value prop for the globally mobile, but less so as a “home bank,” where daily utility is limited. Monzo flips that script. Its subscriptions are designed to make the current account stickier. It does so by layering savings rates, investing discounts, insurance, and perks onto everyday money management. This makes Monzo far more embedded in a customer’s financial life, giving it the chance to convert subscriptions into deposits, investments, and lending revenues.

For Monzo, the prize is everyday financial primacy; for Revolut, it’s global lifestyle ubiquity. In 2025, Monzo is actively tuning its tiers, recently adding an Uber One subscription as a partner perk. It is also exploring mobile services – a potential step into bundles that could include telco/eSIMs and even family packs, deepening its role as a daily-life utility. Revolut is marching in parallel, having already introduced eSIMs and signalling its intent to launch full mobile plans with unlimited calls, texts, and data, extending its lifestyle bundle beyond finance into connectivity. Both are betting on a future that feels more like “banking-as-a-membership”.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Senior Research Associate

Risav is a senior research associate at WhiteSight, where he spends his days navigating the complex fintech landscape and poring over market trends. When he's not decoding the world of fintech, you'll find this sports fanatic decoding the perfect curveball on the football field.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...