Behind the Synergy: Unearthing the Indian FinTech DNA

- Afshan Dadan

- 6 mins read

- Fintech Strategy, Insights

Table of Contents

India, as a market for financial services, is ripe with untapped potential. With a population of over 1.3 billion, 80% of which is banked, the financial literacy rates remain low at 27%. Micro, small and medium enterprises (MSMEs) that contribute 30% to the GDP of the country, represent a credit gap of USD 397 billion. These factors present opportunities for reform and more open financial services enabled by technology and digital infrastructure.The country’s fintech landscape has witnessed a flourishing symbiotic relationship between regulatory initiatives and infrastructure blocks, which have resulted in the perfect breeding ground for incumbents and insurgents to innovate upon. Over the last two decades, India’s zealous determination in bringing a paradigm shift in its vision for financial inclusion has led to the development of the India Stack, an initiative that aims to decode the country’s monetary problems through paperless, cashless, and presence-less API systems. The four distinct technology layers, covering areas of digital identity, digital records, consent, and a democratised payments interface, lay the holistic foundation for synchrony between infrastructure and norms. The hybrid open finance model which doesn’t mandate participation but definitely incentivises it, creates healthy market competition for collaboration between the most established to the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

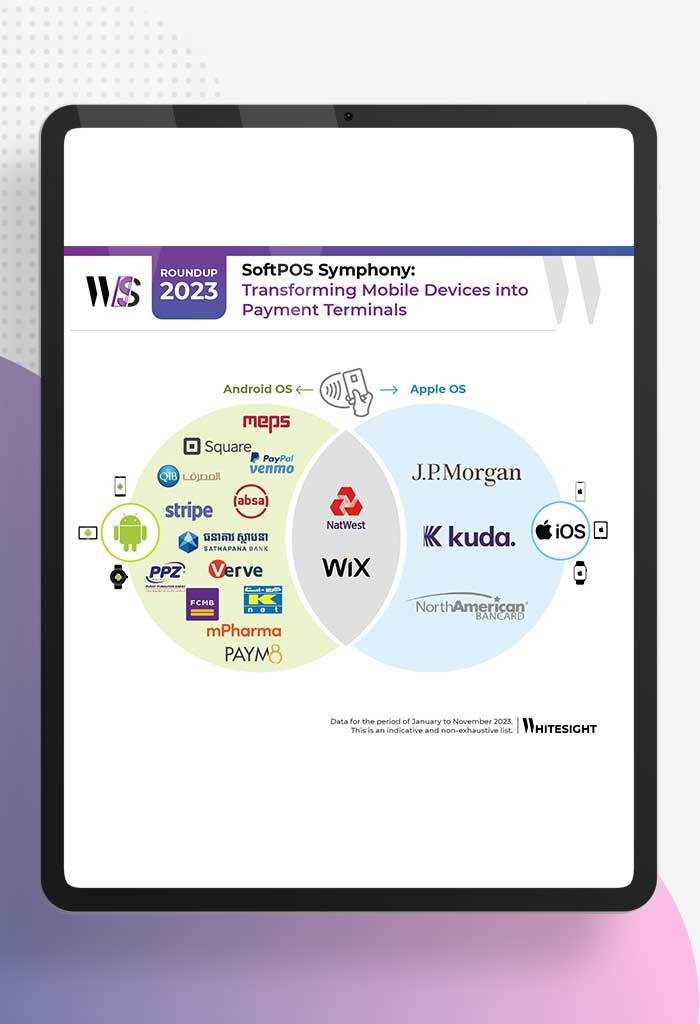

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

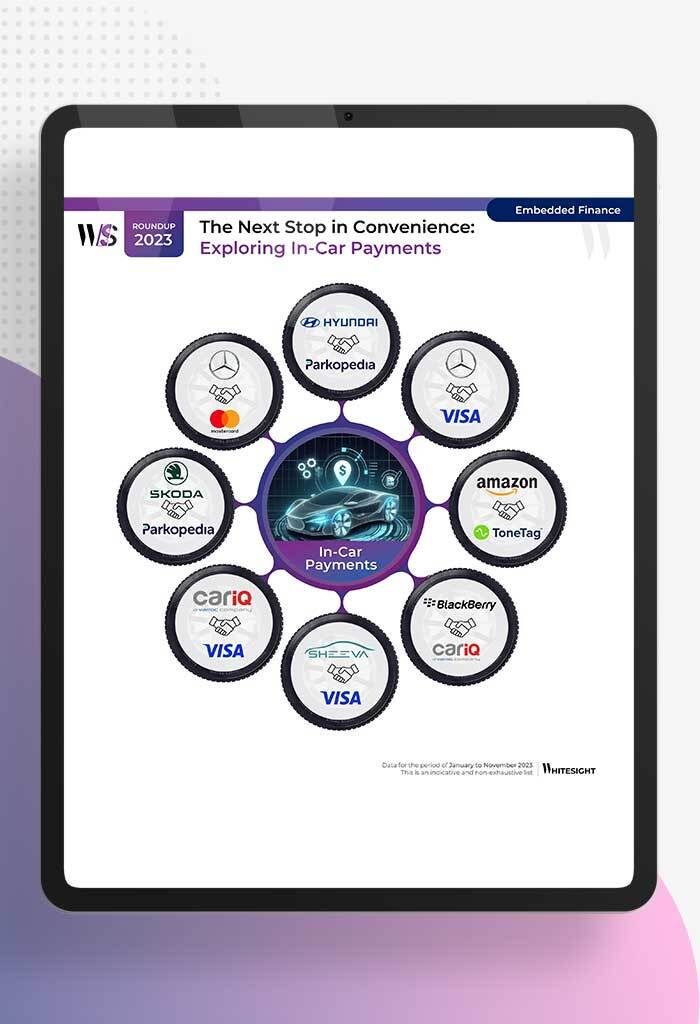

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

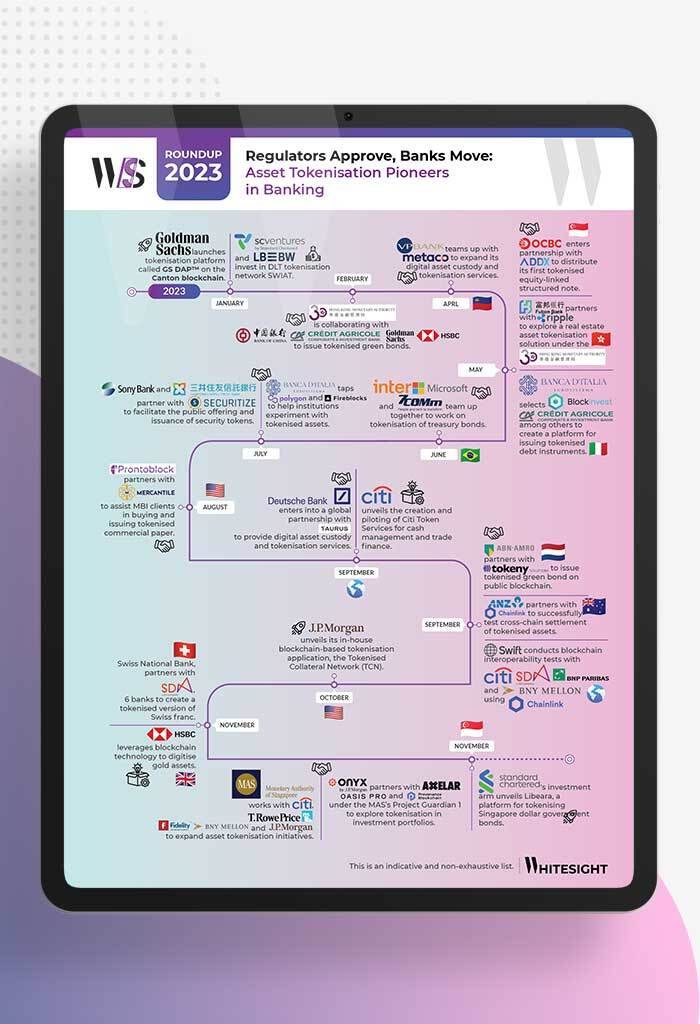

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

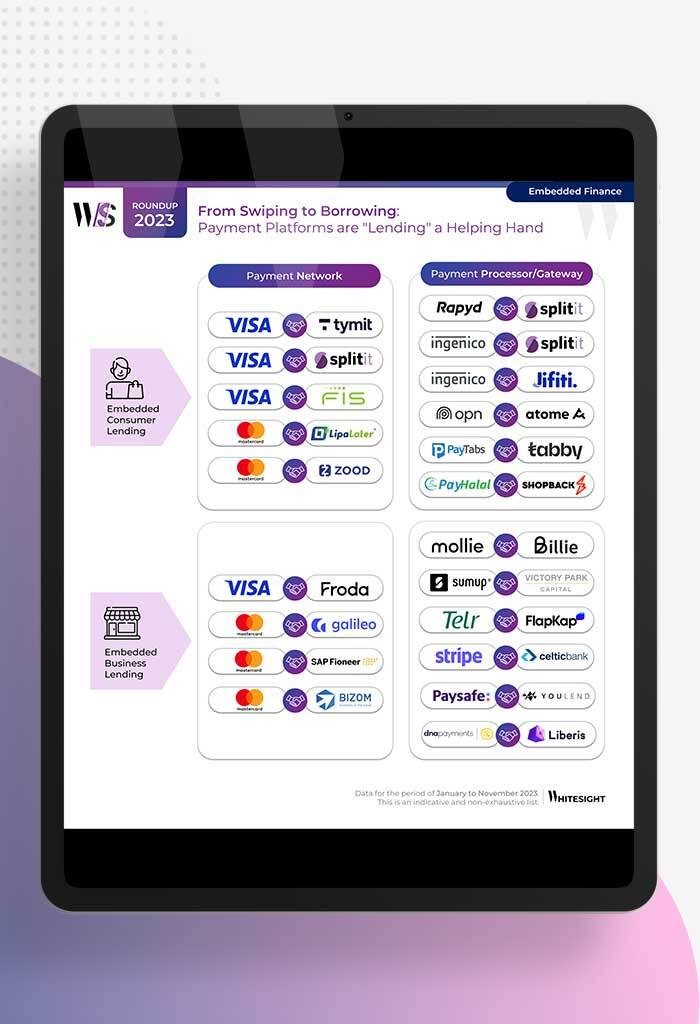

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

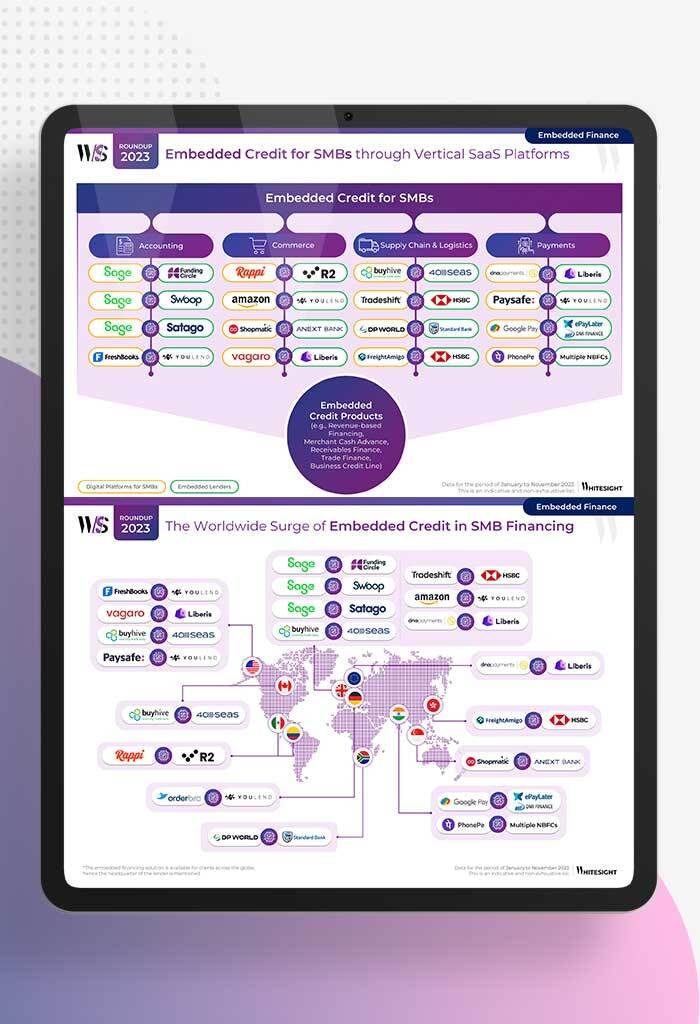

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...