Behind the Synergy: Unearthing the Indian FinTech DNA

- Afshan Dadan

- 6 mins read

- Fintech Strategy, Insights

Table of Contents

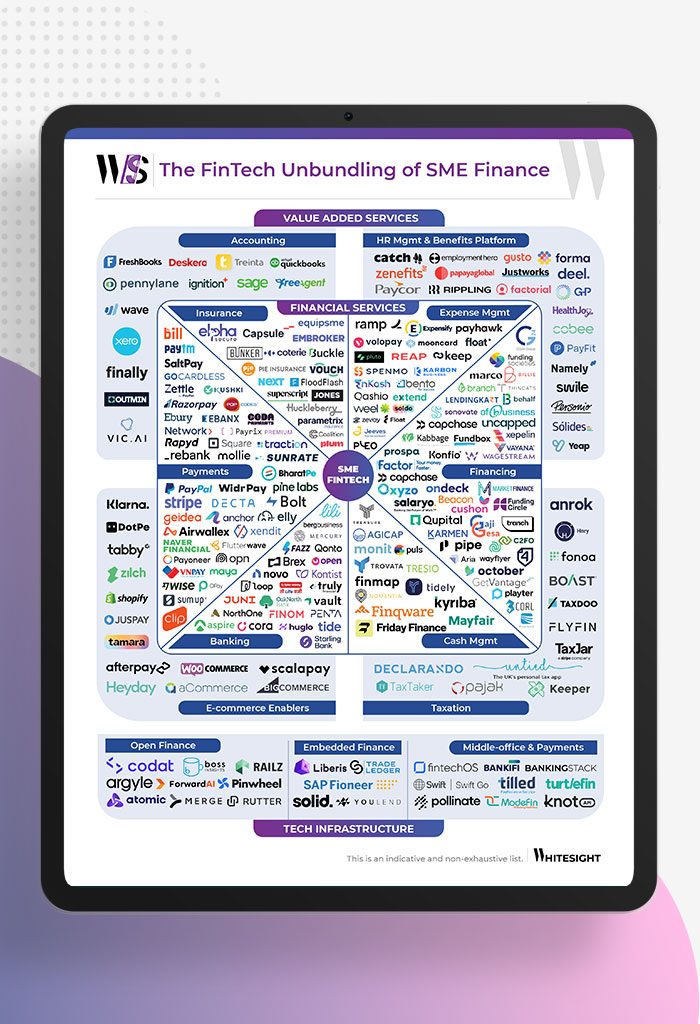

India, as a market for financial services, is ripe with untapped potential. With a population of over 1.3 billion, 80% of which is banked, the financial literacy rates remain low at 27%. Micro, small and medium enterprises (MSMEs) that contribute 30% to the GDP of the country, represent a credit gap of USD 397 billion. These factors present opportunities for reform and more open financial services enabled by technology and digital infrastructure.The country’s fintech landscape has witnessed a flourishing symbiotic relationship between regulatory initiatives and infrastructure blocks, which have resulted in the perfect breeding ground for incumbents and insurgents to innovate upon. Over the last two decades, India’s zealous determination in bringing a paradigm shift in its vision for financial inclusion has led to the development of the India Stack, an initiative that aims to decode the country’s monetary problems through paperless, cashless, and presence-less API systems. The four distinct technology layers, covering areas of digital identity, digital records, consent, and a democratised payments interface, lay the holistic foundation for synchrony between infrastructure and norms. The hybrid open finance model which doesn’t mandate participation but definitely incentivises it, creates healthy market competition for collaboration between the most established to the […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Kshitija Kaur

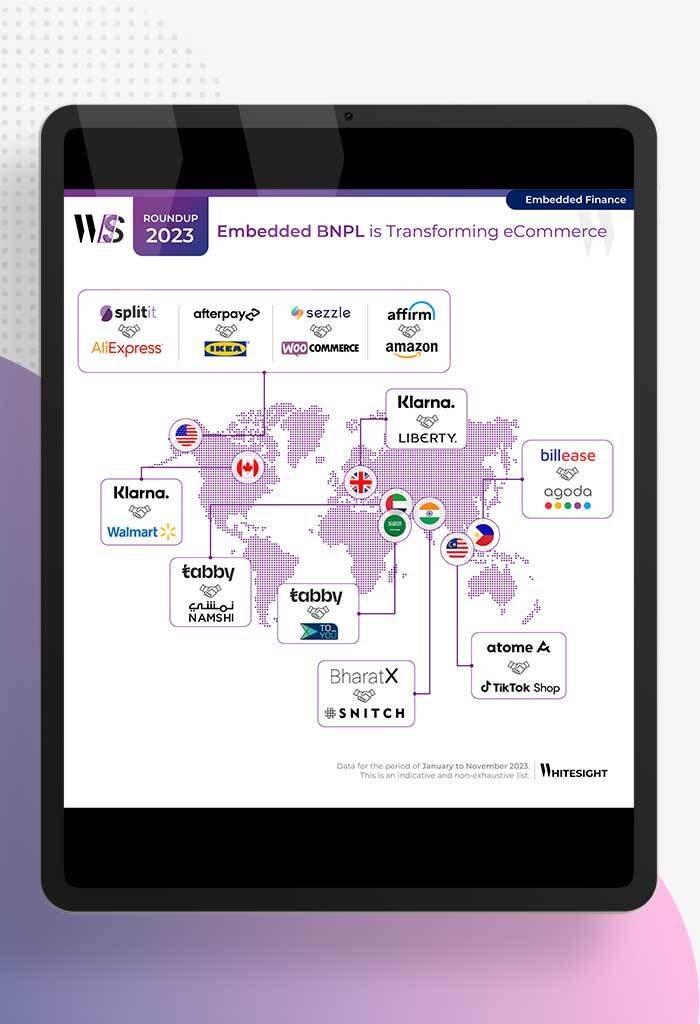

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...

- Risav Chakraborty and Kshitija Kaur

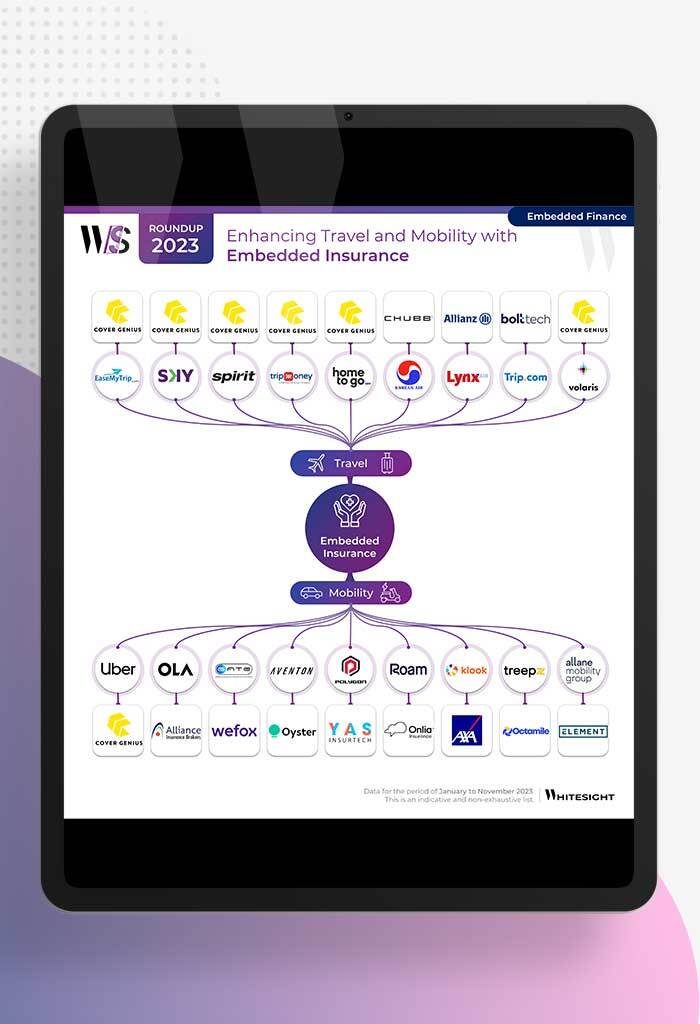

Drive Safe, Fly Secure: Embedded Insurance Escapade The travel and mobility sectors are roaring back to life now that the...

- Kshitija Kaur and Risav Chakraborty

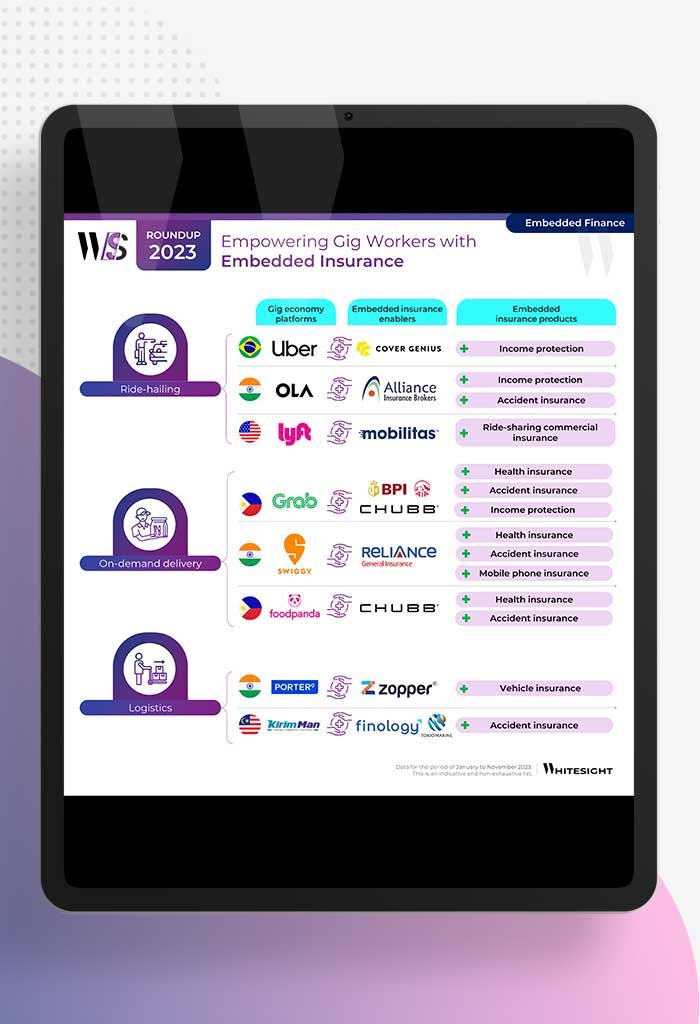

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the...

- Afshan Dadan and Sanjeev Kumar

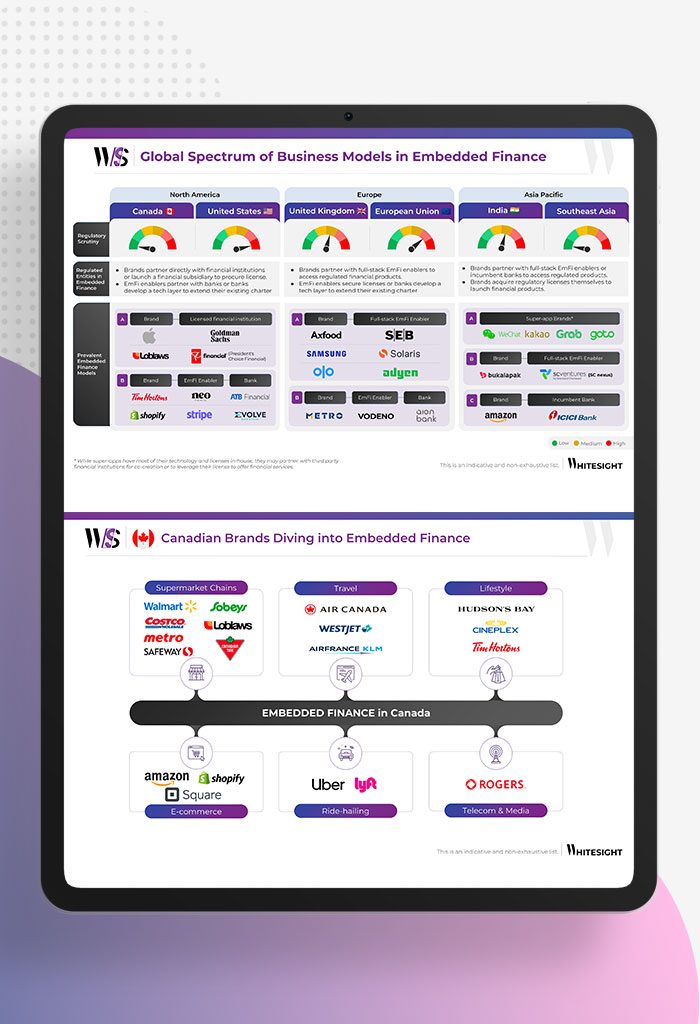

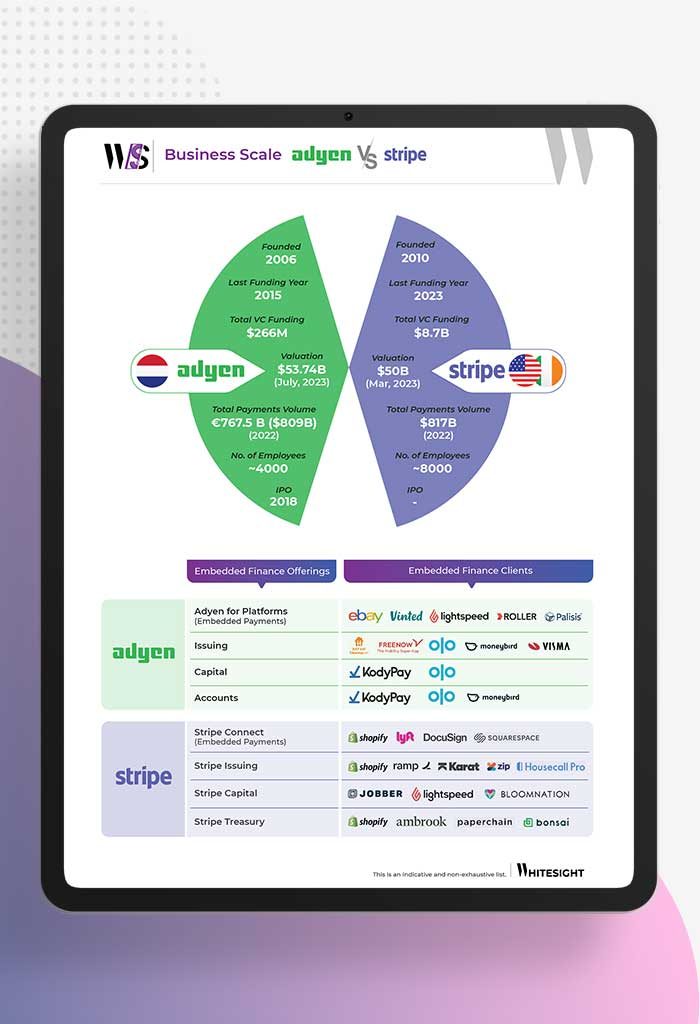

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend...

- Sanjeev Kumar and Afshan Dadan

In the ever-evolving world of finance, fintech has emerged as a game-changer, particularly for small and medium enterprises (SMEs). As...

- Kshitija Kaur and Sanjeev Kumar

Payment processors had an incredible run during the pandemic, riding the wave of increased adoption of digital payments among merchants...