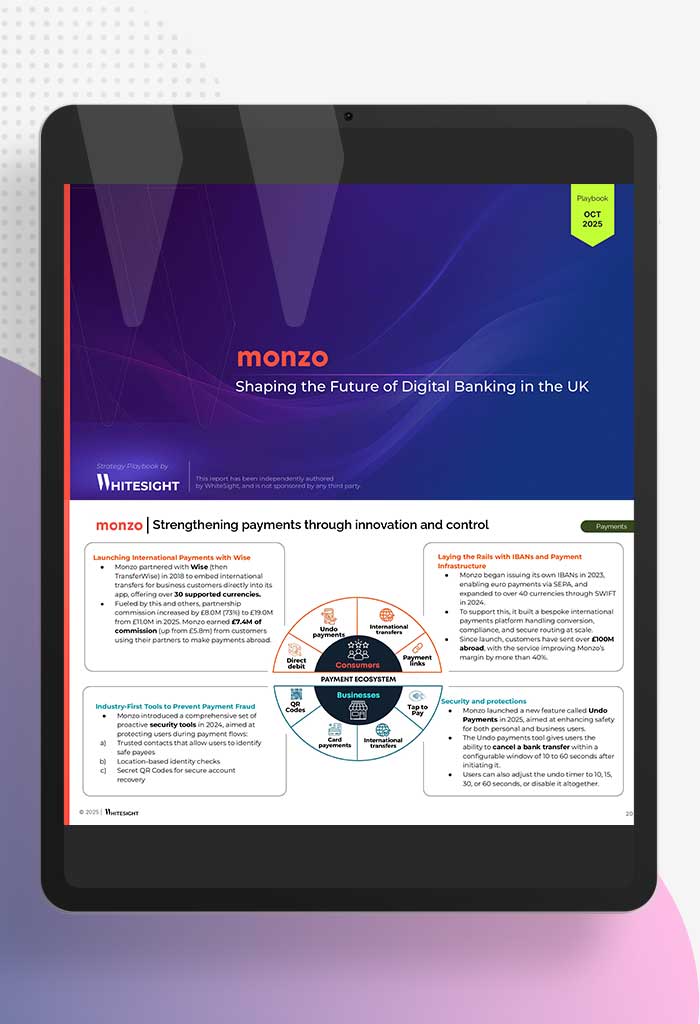

Monzo went from challenger bank to a £1.2B-revenue machine, without losing its inimitable Hot Coral halo. What actually powered the step-up: Flex’s shift from BNPL to full-stack credit, paid plans with real stickiness, and SME monetisation at scale. Grab the deep dive for hard numbers, product moves, and the playbook behind 12.2M customers and counting.

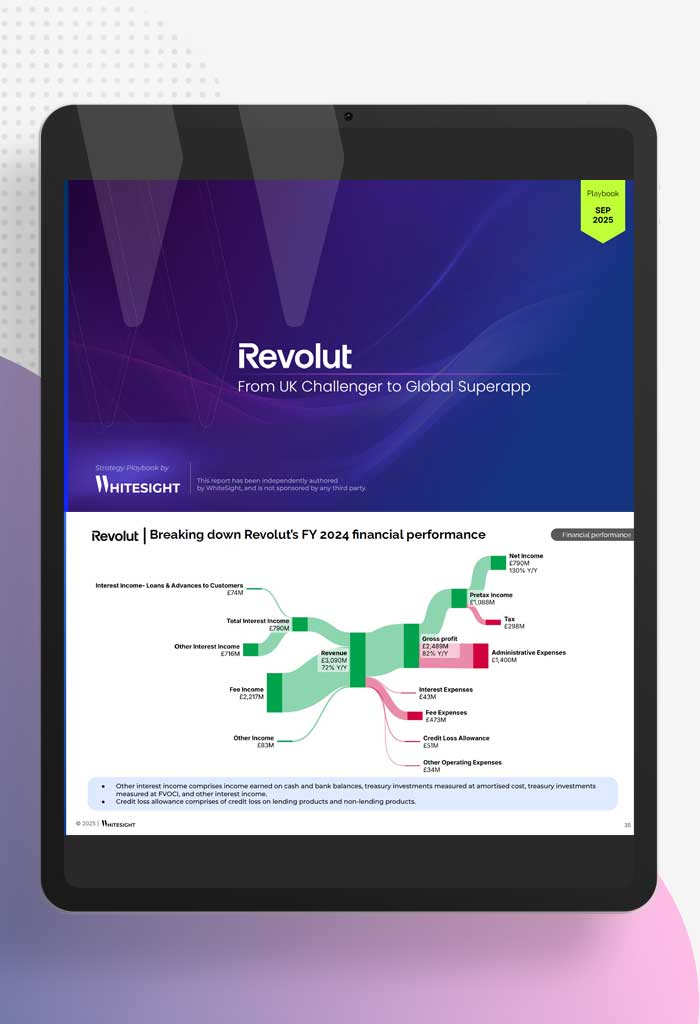

From disrupting cross-border money movement to building a 60M+ customer base across 48 countries, Revolut has consistently stretched the boundaries of what a digital bank can be. Now, CEO Nik Storonsky has set a new ambition: to make Revolut the first truly global bank – serving 100M customers, in 100 countries, and generating $100B in revenues. With investors projecting a $242B valuation by 2030, Revolut’s journey is now about becoming An Everything Bank for Everyone.

At WhiteSight, we’ve unpacked the strategy behind this vision, uncovering how Revolut is shaping its model, products, and market moves to turn ambitious goals into a global reality.

At WhiteSight, we’ve unpacked the strategy behind this vision, uncovering how Revolut is shaping its model, products, and market moves to turn ambitious goals into a global reality.

BNPL shifted deeper into retail and banking infrastructure, while tokenisation gained serious ground in real estate and assets. Licensing activity heated up across the UAE, Saudi Arabia, and Egypt, reshaping virtual assets, digital wallets, and e-KYC. Meanwhile, fintechs are scaling across borders, tapping into high-demand markets and underserved segments with sharper models. WhiteSight’s latest report unpacks the moves, the capital, and the momentum that are setting the course for MENA’s fintech future.

CBDC pilots ramped up in India, Korea, and Thailand. Regulators rolled out clearer digital asset rules. And across Singapore, Hong Kong, Japan, and China, tokenised ESG bonds, money market funds, and digital bonds started hitting production. Meanwhile, SME banking kept pace with mobile-first credit tools, invoice-backed lending, and even Shariah-compliant BaaS making waves. WhiteSight’s latest report breaks it all down – how fintechs, regulators, and financial institutions across APAC are syncing up to rebuild finance from the ground up, one use case at a time.

Latin America’s fintech pulse beat louder in Q1 2025. From cross-border scale-ups to QR-powered payments and licensing-led land grabs, LATAM’s fintechs are maturing and branching out. Real-time payments hit new heights – Brazil’s PIX reached record adoption, and Colombia rolled out Bre-B as its own real-time payment rail. Meanwhile, fintechs embedded themselves deeper into people’s daily lives — powering payments at fast-food chains, streamlining checkout in ecommerce, and becoming the go-to wallet for gig workers. And regulators? They remained proactive as ever, greenlighting licences that gave crypto players and payment startups a serious leg up. WhiteSight’s latest report explores the most telling patterns shaping LATAM’s fintech future — one expansion, partnership, and product launch at a time.

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net income, and metrics that legacy and challenger banks would kill for, Nu is proof that fintechs can scale and stay profitable.

In a region where high cost-to-serve and low credit access are the norm, Nubank built a lean, digital-first platform that’s low-cost, hyper-scalable, and sticky. Whether it’s cracking payroll loans, embedding telecom into its superapp, or using Open Finance to find low-risk borrowers at scale—Nu’s model is what sustainable fintech looks like in emerging markets. WhiteSight’s latest deep dive distills the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

From BNPL baked into payment rails to co-branded cards reshaping loyalty—Q1 2025 was a turning point for embedded finance going deeper and broader across industries. Payments are becoming optimised at checkout, layered with loyalty, and embedded across physical and digital channels. BNPL is being natively built into payment rails, marketplaces, and even operating systems. Meanwhile, modular infrastructure models like BaaS, CaaS, and IaaS are letting platforms embed cards, savings, insurance, and wealth tools with minimal overhead. WhiteSight’s latest report dissects the quarter’s most defining developments—across embedded payments, lending, insurance, and infrastructure—exploring how businesses across sectors are building financial products into the fabric of user experiences.

From credit cards in developing markets to crypto custody for institutions, Q1 2025 saw digital banks get serious about product depth and global reach. Across the quarter, digital banks doubled down on lending to the underserved, scaled stock trading and tax filing into everyday banking, and tightened security amid rising scam threats. Meanwhile, regulators greenlit new players in emerging markets—signalling a regulatory shift that’s actively enabling digital challengers. WhiteSight’s latest report unpacks the specific moves, market entries, and product plays defining digital finance in early 2025. Explore the most critical trends that are setting the pace for digital finance this year.

As 2025 kicks off, embedded and digital finance continue to deepen their foothold across industries. Embedded finance saw a surge in strategic alliances, with BaaS providers fueling cross-border banking expansion, and embedded payments reshaping checkout experiences across commerce, travel, and entertainment. Meanwhile, digital banks pivoted towards diversified lending, flexible credit, and embedded wealth solutions, reflecting an accelerated push toward personalized, frictionless financial experiences. From identity-powered payments to regulatory-driven digital banking expansion, explore the most critical trends that are setting the pace for embedded and digital finance in 2025.

Q4 2024 marked a defining period in digital finance, characterized by regulatory greenlights fueling global digital bank expansions and a surge in SME-focused banking solutions. Incumbents accelerated digital subsidiary launches, while challenger banks diversified their offerings beyond traditional banking—venturing into crypto, wealth management, and even telecommunications. Mergers and acquisitions intensified as financial players sought strategic positioning in an increasingly competitive market. Our latest report unpacks the most significant trends that shaped the digital finance landscape in the final quarter of 2024.

The embedded finance landscape in 2024 has been shaped by deeper industry verticalization, cross-border scalability, and strategic consolidation. The developments highlight the rise of embedded lending solutions for SMBs, the growing role of B2B BNPL in corporate liquidity management, and the expansion of embedded payments into non-traditional sectors like gaming, healthcare, and travel. Meanwhile, regulatory frameworks are tightening around BaaS, impacting partnerships and compliance requirements. Our report distils the most pivotal moves shaping the sector, tracking where capital flowed, which sectors saw the biggest shifts, and how embedded finance providers adjusted their strategies in response to changing regulatory and customer expectations.

Banco C6 has rapidly carved its place as one of Brazil’s formidable digital banks, leveraging its robust superapp framework to integrate banking, credit, insurance, and investment services under one roof. Anchored by its focus on secured lending, the bank has created a resilient, low-risk growth model. Beyond financial services, Banco C6’s ESG commitment shines through initiatives like the Rainbow Card for inclusivity and its eco-efficient carbon tracking tools, cementing the bank’s role in sustainable and socially conscious banking. Our Banco C6 Strategy Playbook unveils the strategic levers behind its growth—from credit portfolio structuring and risk management to revenue diversification and cost efficiency.

Monzo went from challenger bank to a £1.2B-revenue machine, without losing its inimitable Hot Coral halo. What actually…

From disrupting cross-border money movement to building a 60M+ customer base across 48 countries, Revolut has consistently stretched…

BNPL shifted deeper into retail and banking infrastructure, while tokenisation gained serious ground in real estate and assets….

CBDC pilots ramped up in India, Korea, and Thailand. Regulators rolled out clearer digital asset rules. And across…

Latin America’s fintech pulse beat louder in Q1 2025. From cross-border scale-ups to QR-powered payments and licensing-led land…

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net…