Retail Darling to Business Powerhouse: Monzo’s Strategic Expansion Into SME Banking

- Sanjeev Kumar and Risav Chakraborty

- 9 mins read

- Digital Finance, Partnerships

Table of Contents

Digital Banks Have a New Target: Small Businesses

When digital banks first appeared, their pitch was simple – faster onboarding, smoother apps, and better design. But over time, they ended up changing much more than the user interface. They reshaped how people relate to their money and to their banks. Budgeting became intuitive, saving felt automated and more rewarding, and the overall experience started to feel personal, approachable, and even a little fun. From Nubank’s purple revolution in Brazil to Revolut’s borderless finance in Europe, the playbook was simple: win the customer’s heart first, and the balance sheet will follow.

But after revolutionising how individuals manage their money, a familiar hunger has returned: the search for the next frontier. Having captured the loyalty (and deposits) of millions of consumers, digital pioneers are now turning their gaze toward another massive yet underserved segment: small and medium-sized enterprises (SMEs). We unpack this broader industry shift in our collaborative report with Zazu, Reimagining Digital Banks for SMEs: Zazu 2025.

The UK’s SMEs Find their Moment

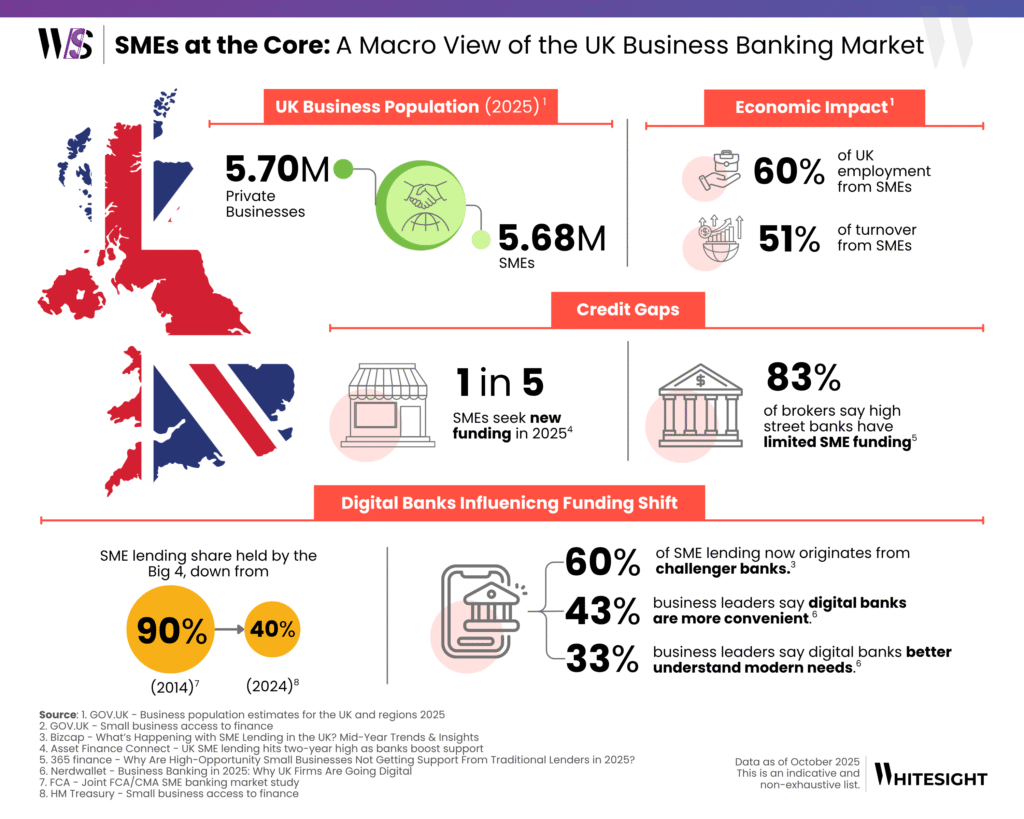

The UK has become ground zero for this shift. With 5.7 million private businesses, a digital-first culture, and progressive open banking regulations, it’s the ideal experimentation ground. SMEs represent 99% of the UK businesses, employing 60% of the private workforce and generating over half of the national turnover. Yet they face a £90B funding shortfall, a disconnect that reveals the failure of incumbents and a window for innovators.

For years after the 2008 financial crisis, the Big 4 banks (HSBC, Barclays, Lloyds, and NatWest) dominated SME credit, holding a 90% share. Today, that dominance has eroded, with their share dropping to around 40% as challenger banks and alternative lenders gain ground. The reasons are structural. Incumbents have struggled to adapt – their processes depend on paper-heavy applications, outdated risk scoring, and rigid lending models that fail to account for the day-to-day volatility of small businesses.

Challenger banks have stepped into that space by building faster, data-driven credit processes that align with how SMEs actually operate. Instead of relying solely on historical balance sheets, they assess affordability using real-time transaction data and cash-flow patterns from linked business accounts. Combined with instant approvals, integrated invoicing, and automated repayment tracking, this approach has reshaped access to working capital – with challengers now originating nearly 60% of annual SME lending.

In the UK’s “missing middle” (firms too complex for consumer workflows yet too small for bespoke corporate teams), loan cycles routinely stretch 90–100 days from application to disbursement. Frustration has fueled migration: 70% of UK business leaders would consider a branch-free bank, and 43% already find digital banks to be more convenient than incumbents.

This dissatisfaction sparked the initial wave of SME-focused players like Allica, OakNorth, and Tide emerging to fill the void, built specifically to offer tailored features for small business realities.

But in recent times, a second wave is cresting, one led by retail-born challengers like Monzo, Starling, and Revolut. We have already uncovered Starling’s journey to becoming an SME banking challenger and how it is living up to its promises for business banking in our Starling’s Challenger Bank Playbook. As for Monzo, the retail darling is now applying its design credibility, data discipline, and deep consumer trust muscle to workflows that power entrepreneurs as effortlessly as it once managed their personal budgets.

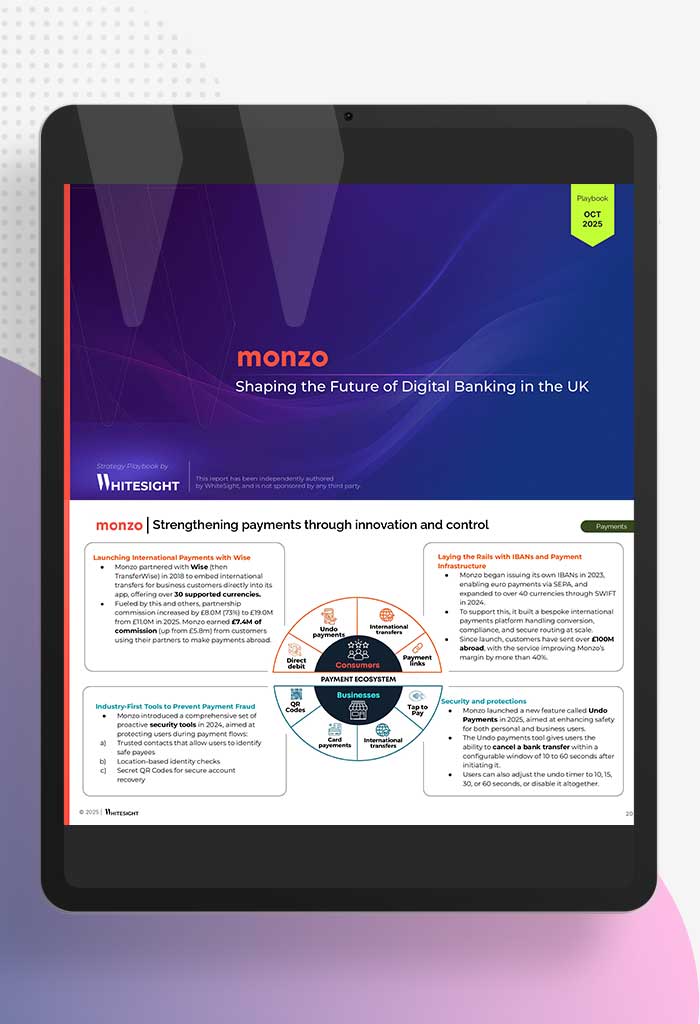

Want to discover how Monzo turned loyalty into recurring revenue? Learn from the best in class with our deep dive analysis on Monzo. Check out the report now!

Report

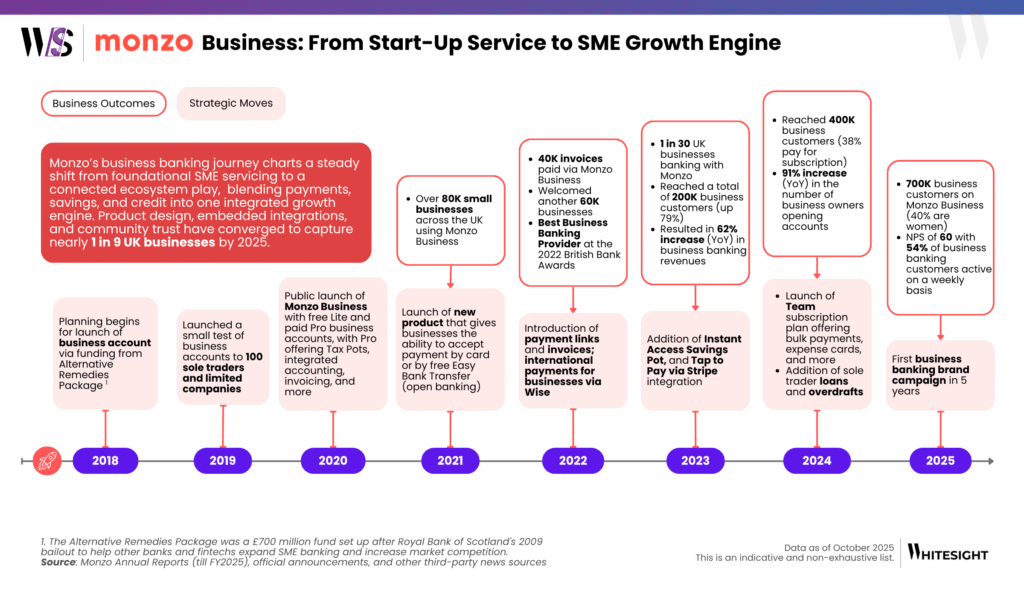

From 100 Alpha Accounts to 700K SME

Monzo’s entry into business banking began where most of its ideas do: with its customers. In 2018, its community forums revealed a clear pattern: thousands of users running side hustles or micro-businesses requesting a business account that worked like their personal Monzo – simple, mobile, and transparent. As Monzo wrote, “There are more than five million SMEs in the UK… lots of you have been asking us to build business bank accounts.” It was an early signal of product-market pull – strong user demand was clear with potential for a sustainable revenue stream that strengthened Monzo’s long-term economics.

Monzo also saw a cultural opportunity. Legacy banks still treated SMEs as smaller corporates, while digital-first peers like Starling and Tide were already serving them. But Monzo focused on a different niche: the freelancer and micro-SME segment. Co-founder Tom Blomfield explained: “We’re not trying to steal share from Starling or Tide. We’re targeting businesses that bank with legacy high-street banks.”

1. Learning from the Base

To test demand, Monzo launched a small alpha in early 2019, inviting 100 sole traders and limited companies to help shape what a truly digital business account should feel like. Blomfield’s Twitter poll confirmed it:

The answer was overwhelmingly clear: business accounts. Early testers identified pain points such as delayed payments, disjointed tools, and concerns about tax season. Instant notifications, web access, and faster reconciliation emerged as must-haves long before accountants caught up to them.

2. From Features to Foundations

After a year of co-design, Monzo officially launched Business Lite (free) and Pro (£5 a month) accounts in March 2020. While peers like Starling kept banking free, Monzo’s model reflected a bold principle: charge where value exists. As Blomfield put it, “Charging a small fee allows us to invest in power features including accounting integrations, multi-user access, and Tax Pots.” Those Tax Pots quickly became a fan favourite (especially for freelancers), automating set-asides for VAT and income tax. By FY2024, Tax Pots had helped businesses set aside more than £700M for their tax returns.

By 2021, Monzo identified the biggest SME pain point: getting paid faster. Internal research found 57% of businesses spent over an hour a week chasing payments. Monzo responded with a new product that enabled businesses to accept payment by card or Easy Bank Transfer via open banking, cutting that delay by 70%.

3. Building Financial Headroom

Partnerships became the next lever. The 2022 Wise integration allowed SMEs to send and receive money abroad seamlessly, see transparent FX fees, and manage international cash flow inside Monzo. Next came Instant Access Savings, offering 1.4% AER. This helped small businesses earn interest on idle balances, boosting both user value and Monzo’s deposit base.

4. Scaling Beyond the Solo Founder

By 2024, Monzo graduated to larger SMEs with its Team Plan (£25/month). It offers expense cards for overseeing employee spend, bulk payments for approving multiple payments in one go, and even accounting integrations with Xero, QuickBooks, and FreeAgent. For scaling firms, it replaced spreadsheets with real-time visibility. CEO TS Anil framed it: “Team is the next step in helping business owners focus on what really matters.”

Monzo’s next frontier was credit. After pilots in late 2024, it rolled out loans and overdrafts for sole traders and limited companies. This addressed a persistent gap: short-term liquidity that incumbents priced poorly. For Monzo, it unlocked a higher-margin product line and proved its model could scale responsibly. By 2025, Monzo Business surpassed 700K customers, 40% of them women-led, with 12% of company revenue now from business banking. What began as a community request has become a cornerstone of Monzo’s profitability story, a flywheel built on listening, iteration, and empathy for the modern entrepreneur.

How Business Banking Drove Monzo’s Financial Flywheel

Monzo’s business banking growth has been about building a self-sustaining engine for profitability. Each rollout turned engagement into revenue, and revenue into resilience.

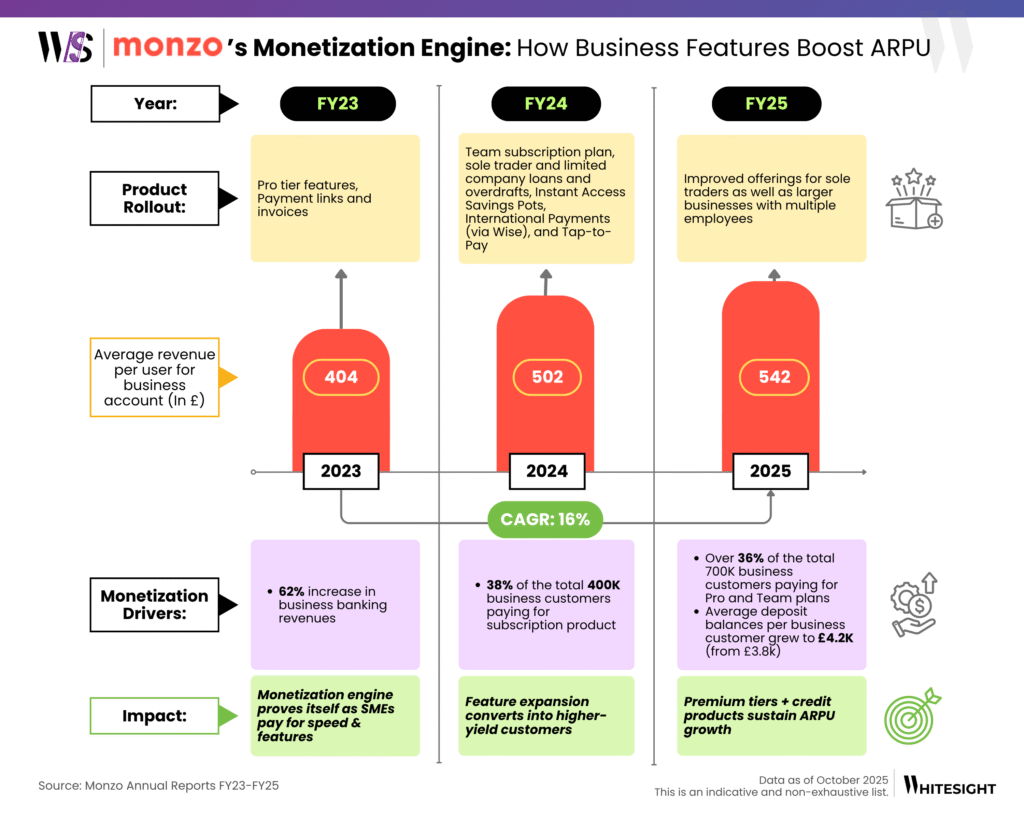

1. FY2023: From Adoption to Monetization

FY2023 was Monzo’s first true monetization test. Business accounts grew from 77K in FY21 to 200K, lifting SME revenues 62% and ARPU to £404.

Where many challengers pursued free tiers for growth, Monzo believed in charging where value exists. Usage-linked features like multi-user access, invoicing and accounting integrations resulted in converting trust into tangible economics. Business accounts played a role in doubling subscription income from £11M to £19.5M alongside Monzo Plus and Premium tiers. That decision validated two hypotheses: SMEs valued time-saving automation, and that revenue-driven pricing could coexist with customer love, a balance few fintechs achieve.

2. FY2024: Deepening Engagement, Expanding Yield

FY2024 marked a pivot from monetization to yield. Instant Access Savings boosted deposits by rewarding SMEs with 1.4% AER, creating a virtuous loop where Monzo gained cheap liquidity to fund future lending. Meanwhile, Wise-powered international payments and Tap-to-Pay increased high-frequency, fee-bearing activity inside the app.

As a result, ARPU jumped 24% to £502 and subscription revenue climbed 40% to £27.4M. These numbers reveal Monzo’s deeper design philosophy: monetization through usage intensity. Every new product deepened financial stickiness, transforming a current account into a working capital hub.

3. FY2025: Premiumization and Credit Economics

By FY2025, Monzo scaled upmarket, gradually moving customers from free to paid tiers through a layered product strategy, leveraging its Team Plan and credit products. 36% of business customers now pay for premium tiers, reflecting demand for expense cards, roles/approvals, and bulk payments. ARPU rose 16% to £542, and average deposits per business hit £4.2K, driven by trust and ecosystem dependency.

Loans and overdrafts added a new profit layer, introducing margin-rich lending while keeping risk low through granular, data-led underwriting. This is proof that Monzo’s unit economics now compound over time.

Across three years, each product expanded depth per customer, with business users delivering nearly 3x retail ARPU and business banking anchoring Monzo’s path to durable profitability.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

UK’s Top Challengers Are Redefining Business Banking

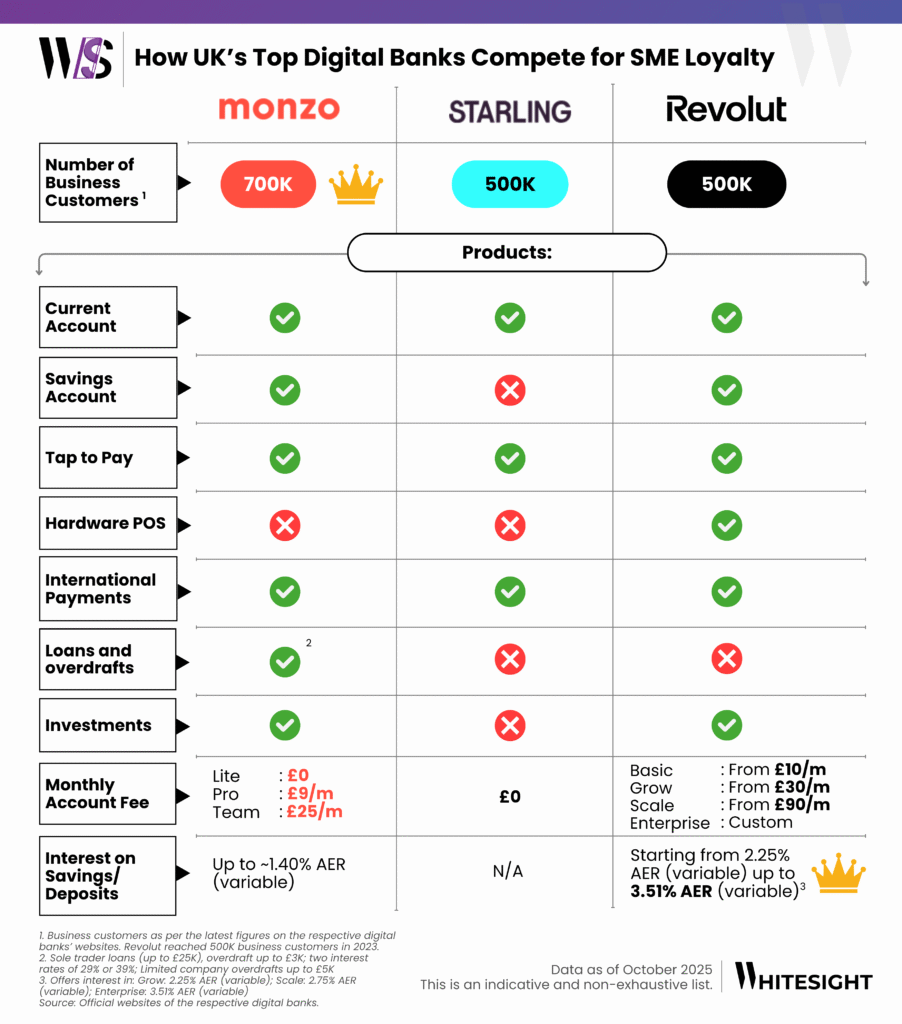

Digital business banking in the UK isn’t about who digitised faster, but rather who understands SMEs better. While Monzo, Starling, and Revolut operate in the same market, each has built a distinct playbook for what “business banking” means in a digital-first economy.

- Monzo’s SME strategy is rooted in empathy and iteration. Its niche lies with the creative, time-poor entrepreneur juggling invoices and taxes. From Tax Pots that automate earnings for HMRC to payment links that reduce late payments by 10 days, Monzo functions like a digital CFO. Its pricing structure – Lite (£0), Pro (£9/m), and Team (£25/m) – reflects a freemium-to-scale model. Unlike Starling’s zero fee, Monzo monetises productivity: businesses pay for time saved, not transactions made. With 700K business users, 36% on paid tiers, and 40% women-led firms, inclusivity has become its competitive moat.

- For SMEs, Starling Bank’s strength lies in traditional banking depth: integrated accounting, free UK transfers, and a business marketplace that connects SMEs with third-party services like insurance, accounting, and lending tools. Its early brand voice around supporting women entrepreneurs and financial literacy built an emotional moat. As growth steadies around 500K business users, Starling is leaning on its marketplace to drive engagement and revenue, earning commissions from select partner integrations. This partnership-driven approach allows it to monetise via curated partnerships, strengthening loyalty without overextending its product stack. Our upcoming Starling Deep Dive Report will explore this evolution in greater detail. Subscribe to Radar to stay in the loop when it drops and never miss out on key insights.

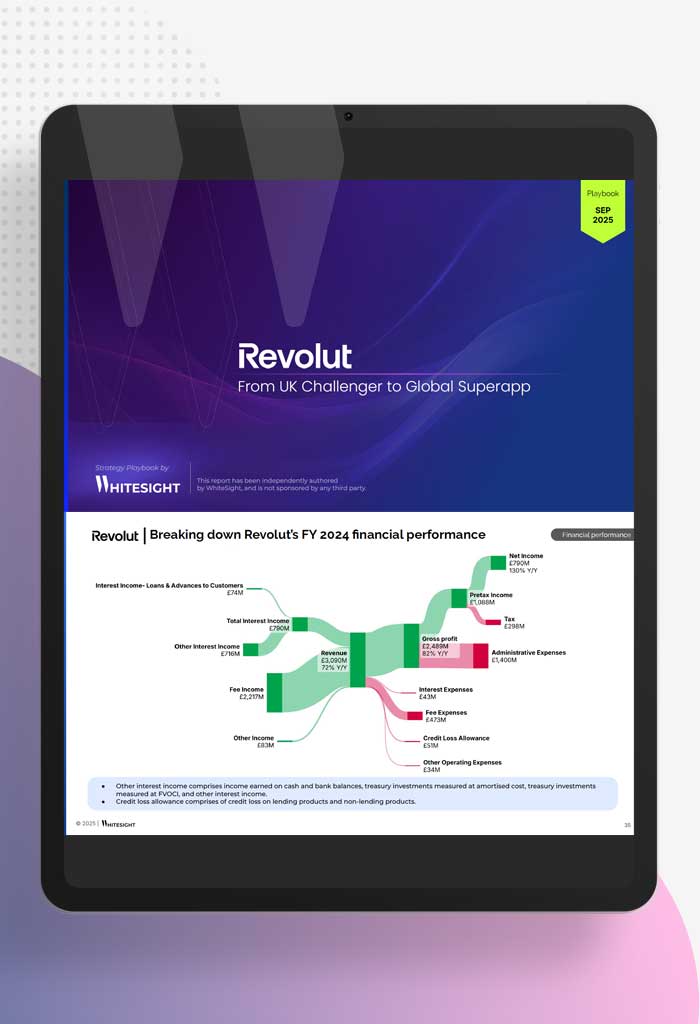

- Revolut’s SME offering is an extension of its global ambition. Its plans, Basic (£10/m) to Enterprise (custom), mirror its global DNA. It offers features like multi-currency account, Revolut Pay, and POS integrations, catering to startups and large corporates alike. Its edge lies in ecosystem thinking: embedded payroll, expense management, and advanced analytics – the makings of a full financial operating system. Revolut’s strategy of combining global transfer capabilities with payment hardware reflects its larger vision of becoming a truly borderless digital bank, a journey we explore in depth in Revolut: From UK Challenger to Global Superapp.

Three challengers, three theses of SME banking’s future. Together, they prove that “business banking” is a multi-segment frontier where brand ethos matters as much as balance sheets.

The Evolution Continues as Monzo Scales Beyond BordersAdd Your Heading Text Here

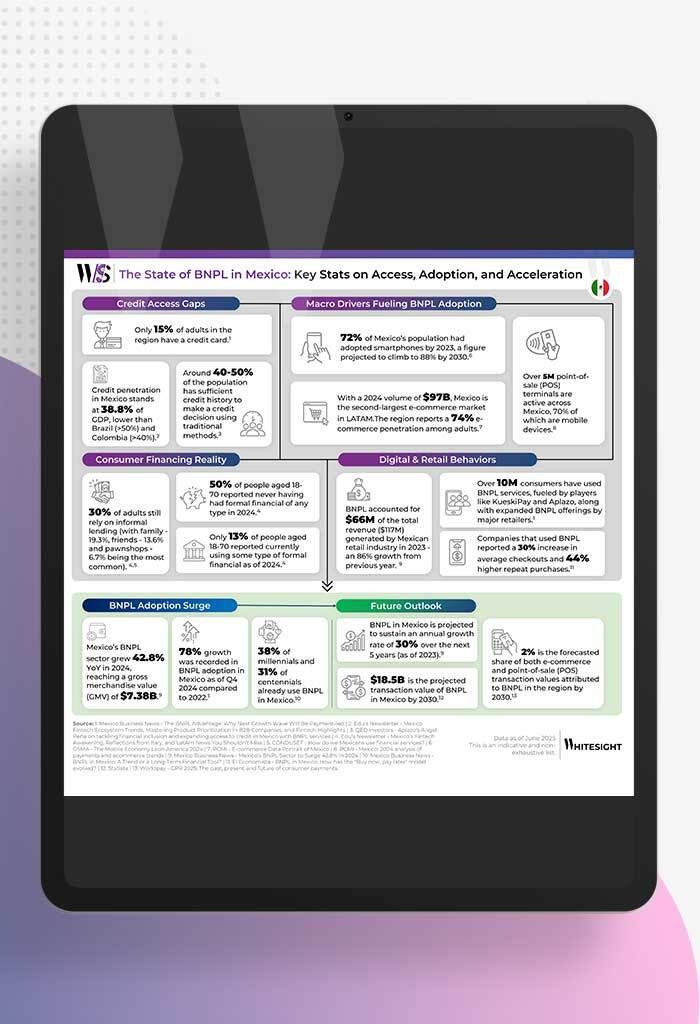

Monzo’s business-banking push signals a broader shift: challengers evolving into multi-product SME banks. And it’s not a trend confined to the UK. We’re seeing digital banks worldwide chart different courses to serve SMEs. Across LATAM, players like Nubank and Banco Inter are similarly expanding from retail to SME services, blending credit, payments, and ecosystem partnerships to capture underserved business owners. While UK challengers focus more on tools for investments and tax, LATAM counterparts are deepening credit access for underserved entrepreneurs. In our Nubank Deep Dive Report, we have decoded how the digital bank’s strategy to build a scalable, multi-layered model for SME banking with its no-fee credit card and working capital loans. Meanwhile, its Brazilian peer, Banco Inter, has positioned itself as the ultimate superapp via its working capital and receivables anticipation solutions, as we have explored in our Banco Inter Strategy Playbook.

Looking ahead, Monzo has made it clear that supporting small and medium-sized companies is now a strategic priority. The bank plans to bring new and innovative services to this segment, mirroring the same simplicity and transparency that made its retail offering a success. Its current aim is to deepen features across business accounts in the UK itself, strengthening utility and engagement by helping SMEs manage, borrow, and grow.

What began as a community-driven experiment may now evolve into Monzo’s most strategic export: a challenger-bank model built for the entrepreneurs powering modern economies.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Authors

Sanjeev is a fintech aficionado who loves to explore the depths of the industry as much as he loves to explore the depths of the ocean in his scuba gear. He is the founder and CEO at WhiteSight, bringing a wealth of research and advisory experience to the fintech world.

Senior Research Associate

Risav is a senior research associate at WhiteSight, where he spends his days navigating the complex fintech landscape and poring over market trends. When he's not decoding the world of fintech, you'll find this sports fanatic decoding the perfect curveball on the football field.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar