Walmart’s FinTech Waltz: A Digital Wonderland

- Sanjeev Kumar and Risav Chakraborty

- 3 mins read

- Fintech Strategy, Insights

Table of Contents

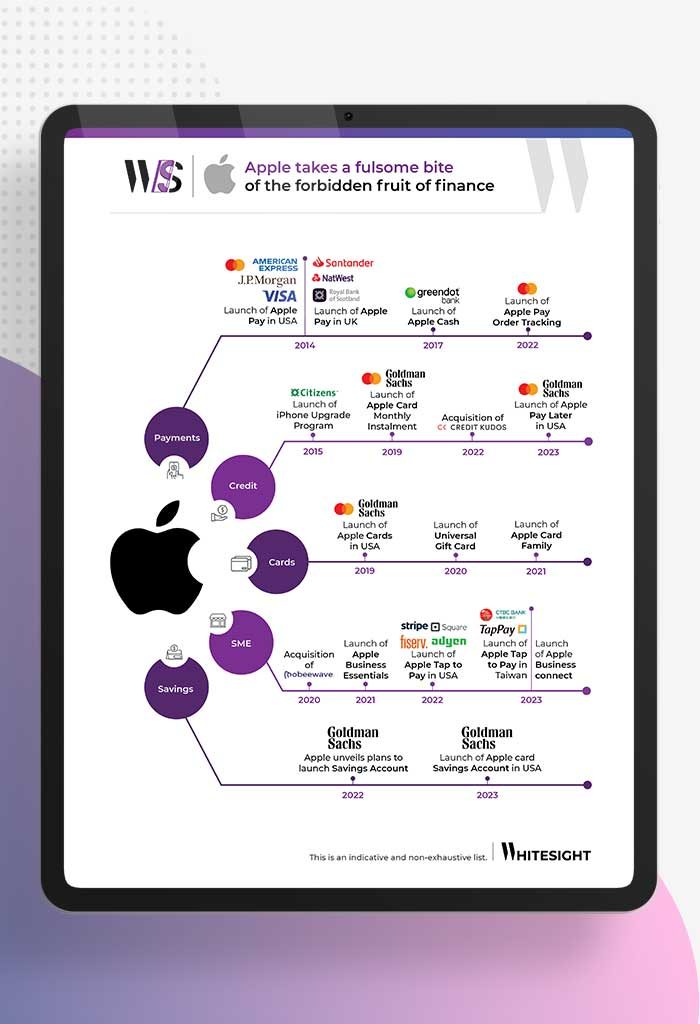

Walmart, one of the world’s largest retailers by revenue, has always strived for a customer-first mindset. It is also one of the earliest non-banking stalwarts to bring contextual financial products to aid customers’ shopping experiences – a trend which we now call embedded finance. Since the 1990s, this has reflected in Walmart’s investments, partnerships, internal innovations, and acquisitions as the company has continued to deliver a broad omnichannel commerce experience to its customers. Walmart has upped the ante on its SuperApp ambitions, with its recent acquisitions of two FinTechs – Ever Responsible Finance and ONE Finance. We look at Walmart’s flirtations with financial products that spread well beyond 2 decades. Initial Bets in FinanceWalmart’s attempts to diversify its offerings date back to early 2005—when the retail giant in partnership with GE Consumer Finance and Discover Financial Services—announced plans to launch a credit card that can be used both inside and outside Walmart stores. Soon after, it applied for a banking license as an industrial loan company (ILC) with the Department of Financial Institutions in Utah. However, given the pressure from the banking fraternity against Walmart’s advances in the sector, it withdrew its bank charter application within two years of filing. […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Kshitija Kaur

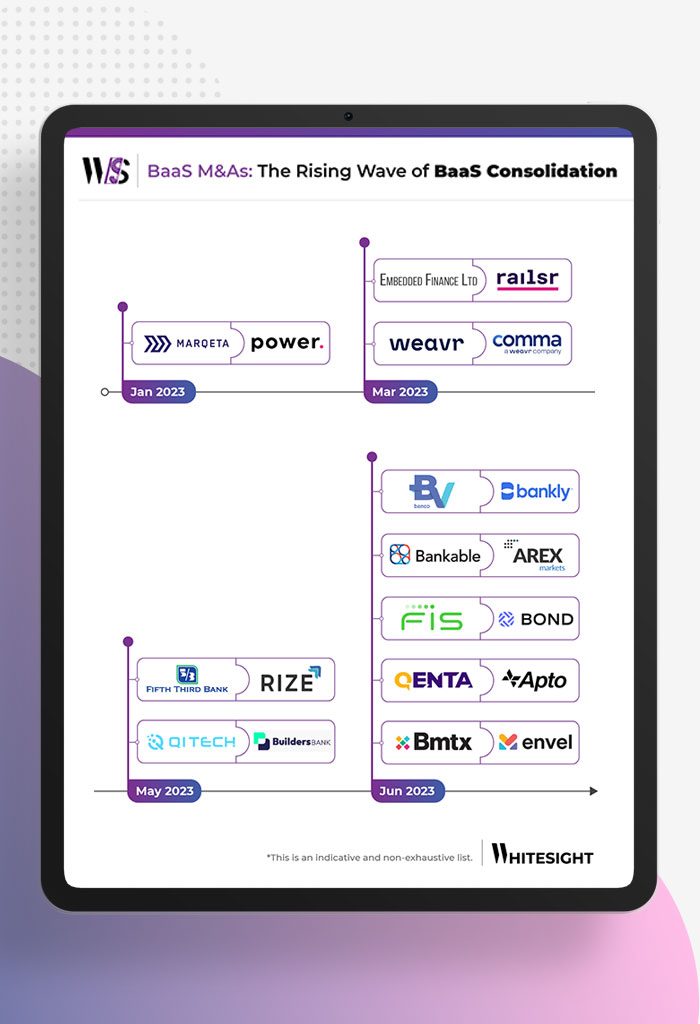

Grab, merge, or unite – 2023 is fast becoming the year of consolidation in the Banking-as-a-Service (BaaS) realm. It’s no...

- Risav Chakraborty and Kshitija Kaur

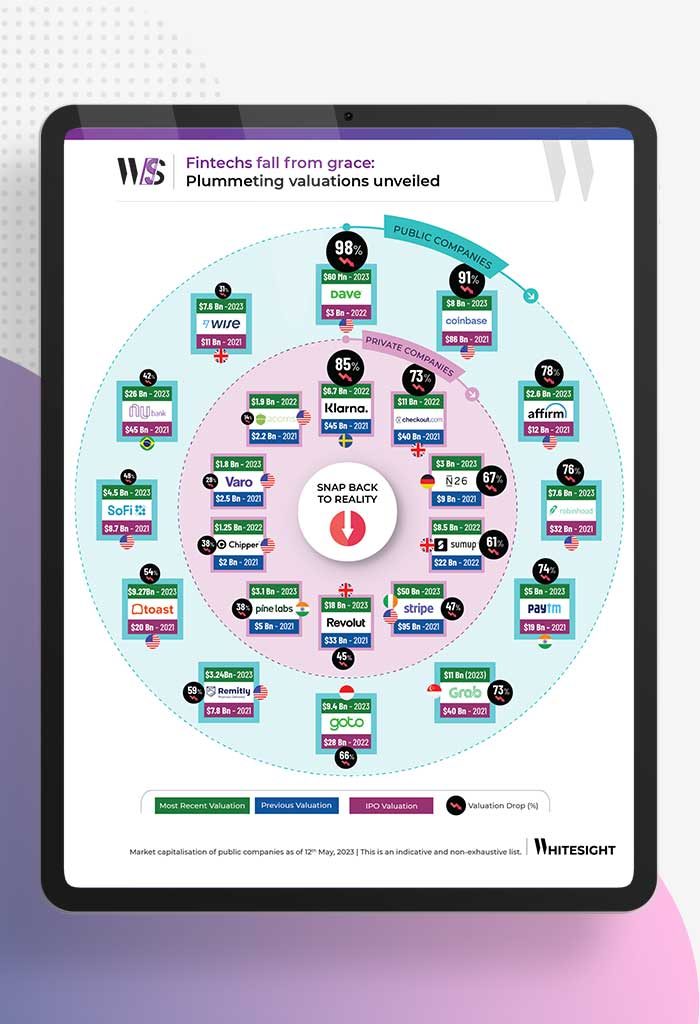

Over the past year and a half, the fintech sector has witnessed a massive slowdown, marked by stagnant growth, reduced...

- Risav Chakraborty and Sanjeev Kumar

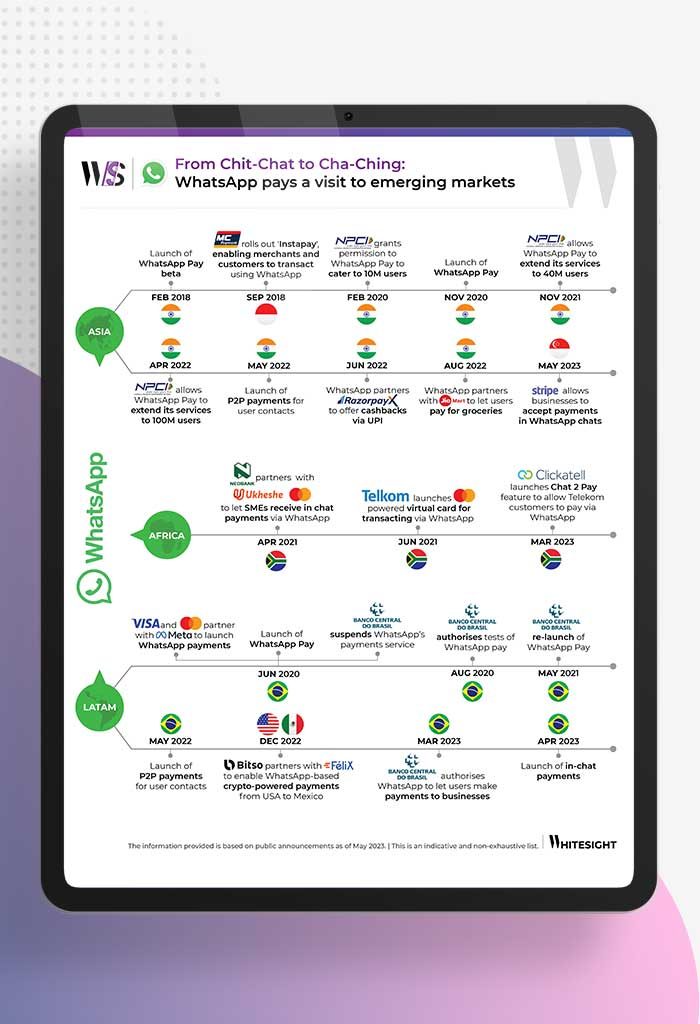

As digital payments and mobile wallets gain traction with growing internet access, tech biggies like WhatsApp are stepping in to...

- Sanjeev Kumar and Samridhi Singh

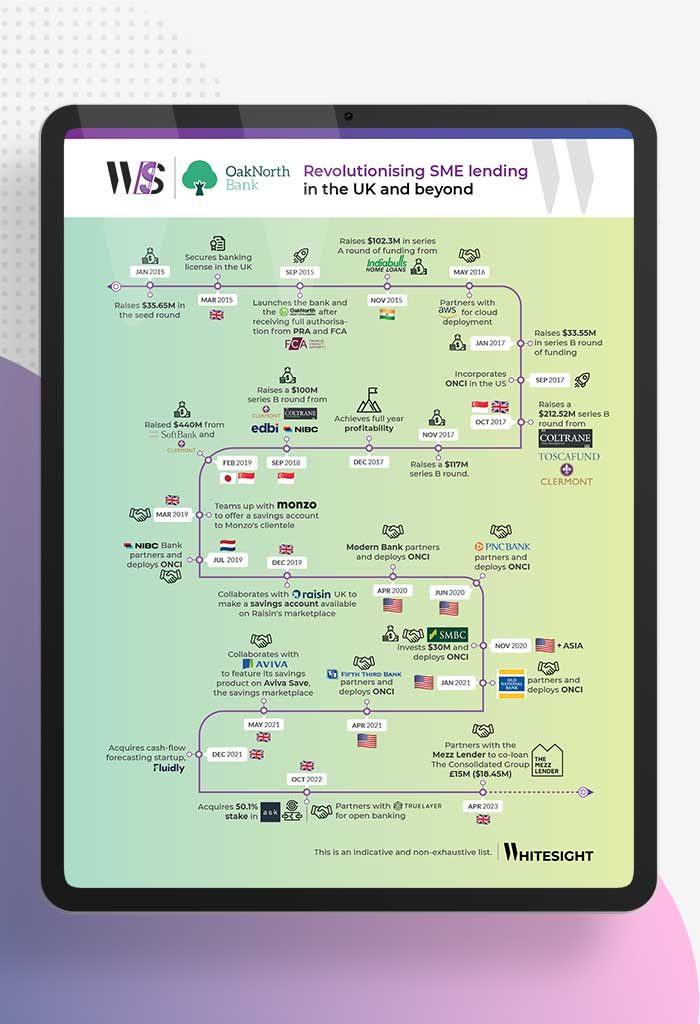

OakNorth has emerged as a standout in the fintech realm thanks to its exceptional business model that not only ensures...

- Sanjeev Kumar and Risav Chakraborty

Think about the biggest brands in the world – you’ve probably got a few names popping up in your mind....

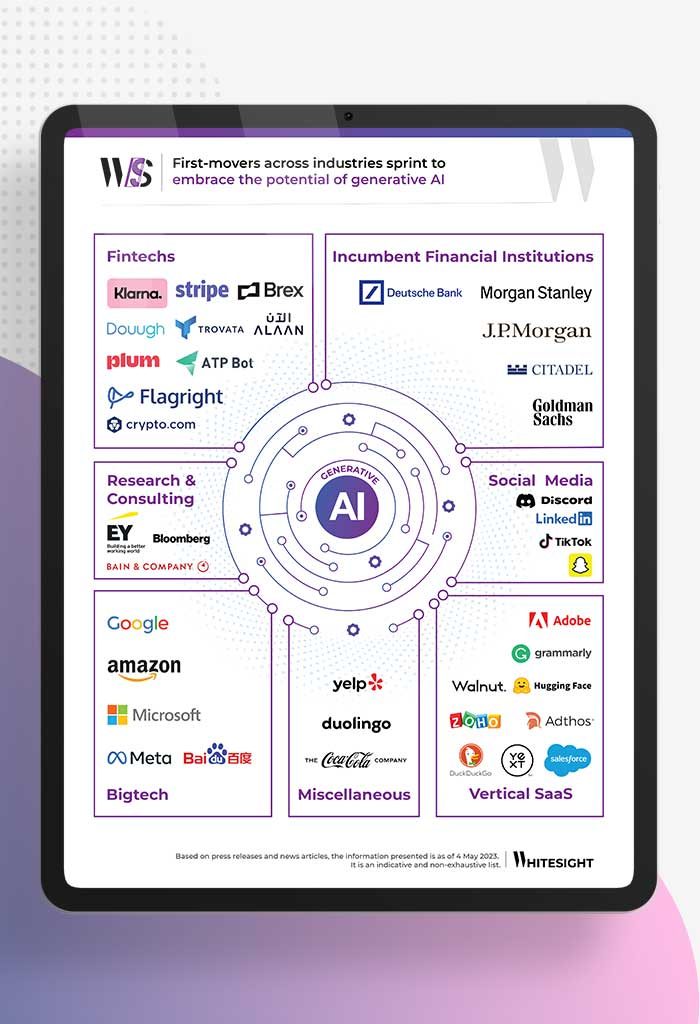

- Afshan Dadan and Ananya Shetty

Generative artificial intelligence (AI) describes algorithms (such as ChatGPT by Open AI, StyleGAN by NVDIA, DeepDream by Google) that can...